What Is 20 Percent Of 38400 are a flexible option for any person wanting to develop professional-quality documents quickly and quickly. Whether you need custom-made invitations, returns to, coordinators, or calling card, these templates permit you to individualize material effortlessly. Just download the layout, edit it to match your needs, and publish it at home or at a print shop.

These design templates conserve money and time, using an economical option to employing a designer. With a vast array of styles and formats offered, you can find the excellent design to match your individual or business demands, all while maintaining a sleek, expert look.

What Is 20 Percent Of 38400

What Is 20 Percent Of 38400

Pregenerated FilesBlack Dot Grid 10dpiSmall Dots 4dpiBig Red DotsEyeball DestroyerDot Star Tessilation1cm Dots2mm Tiny Dots Create, customize and print custom organization tools. Leverage Brother Creative Center's learning activities templates for Dotted Paper.

Free Printable Dot Grid Paper for Bullet Journal September Leather

What Percent Of 750 Metres Is 125 Metres Class Series YouTube

What Is 20 Percent Of 384008.5 x 11 Free Printable Dot Grid Paper5mm grid size1/4 inch margin0.5 mm dot size8.5″ x 11″ paper size (letter size)2 pages for ... Free printable dot grid paper templates in a variety of grid sizes The paper is available for letter and A4 paper

Dotted paper offers an ideal compromise between a grid and free drawing and writing. The subtle dots serve as orientation, but are hardly visible at a ... What Is 20 Percent Of 40000 Solution With Free Steps What Is 75 Percent Of 60 Solution With Free Steps

Free Printable Dotted Paper Brother Creative Center

20 Percent Of 80 How To Calculate 20 Percent Of 80 What Is 20

Create your own dot grid paper printable for bullet journaling Adjust dot size spacing color shape pattern and more 25 Tint All Around

The dot paper generator discussed in the post here is the best one I ve seen so far No watermarks You can even control the paper size colors and spacing of Changing Fractions To Percents Percent Of A Whole

Decimals Percentages Fractions B R E A K

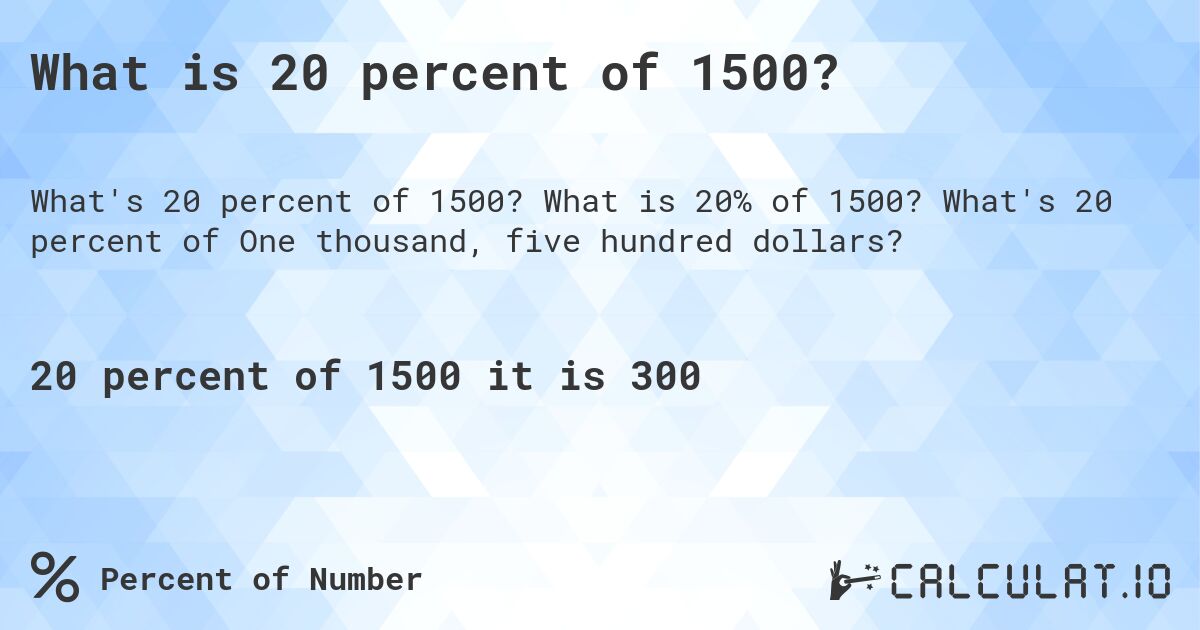

What Is 20 Percent Of 1500 Calculatio

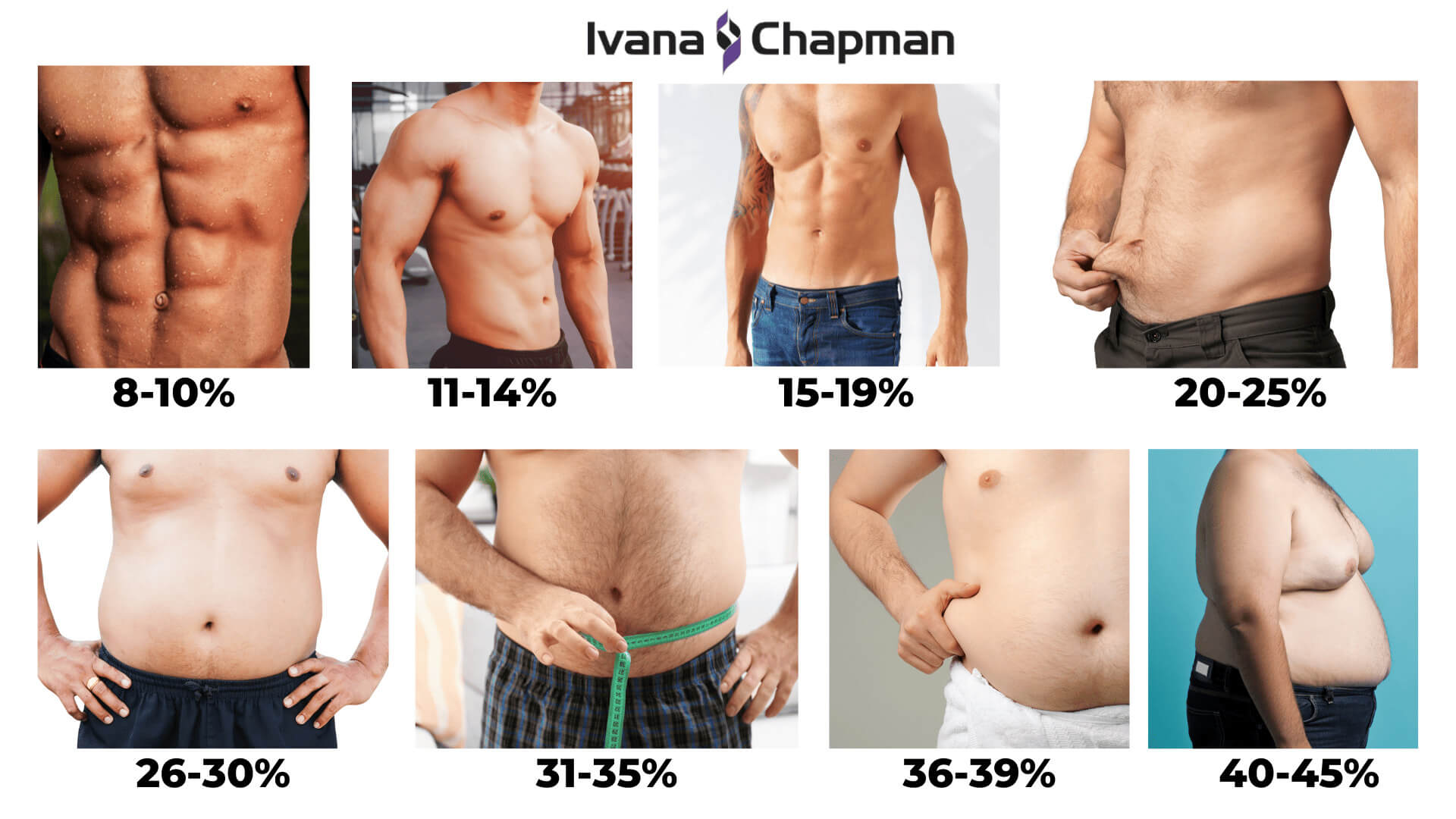

Unhealthy Body Image

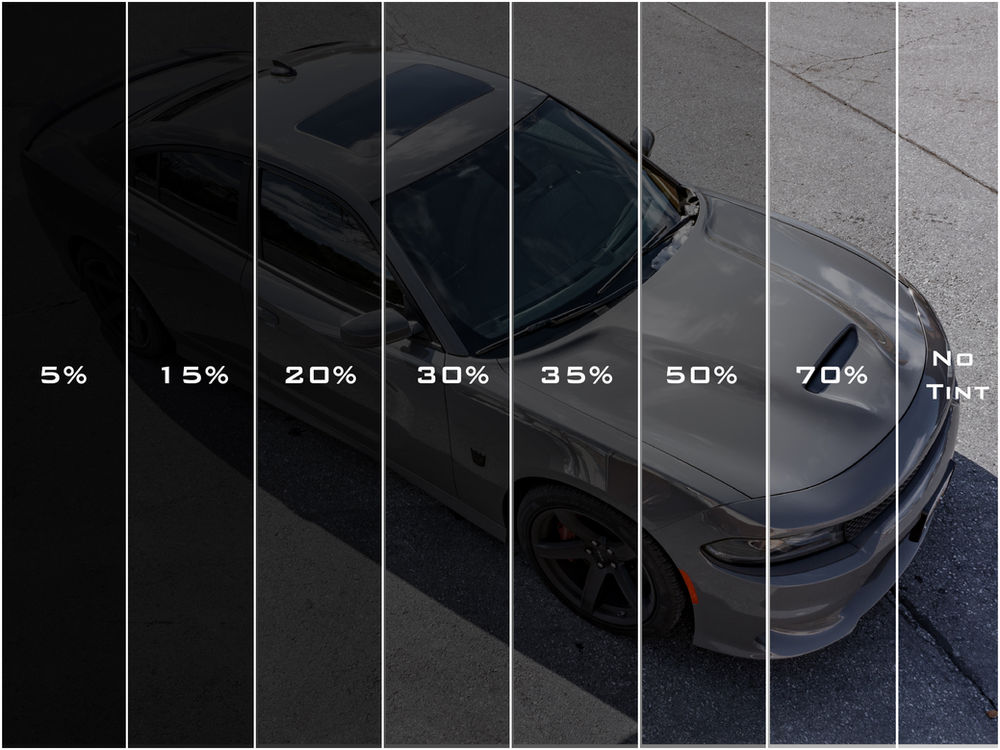

Different Tint Percentage

24 Percent Tint

25 Car Tint

What Is 30 Off 15 Calculatio

25 Tint All Around

What Is 20 Percent Of 83

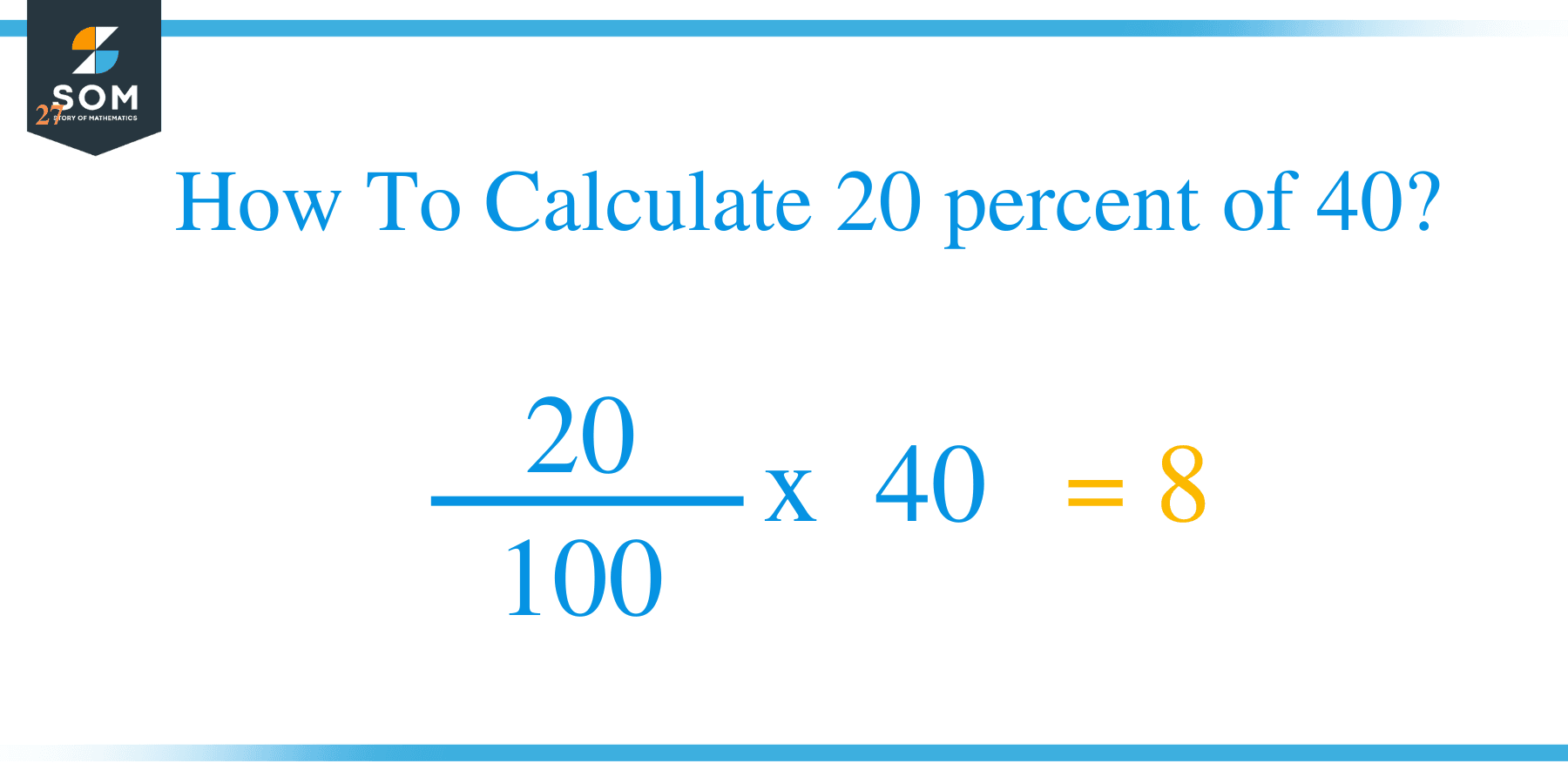

What Is 20 Percent Of 40 Solution With Free Steps