What Is 2240 Of 15 Percent are a flexible service for any person wanting to develop professional-quality papers quickly and quickly. Whether you need customized invitations, resumes, planners, or business cards, these themes permit you to personalize material with ease. Merely download the design template, modify it to suit your demands, and print it in your home or at a print shop.

These design templates conserve time and money, supplying an affordable option to working with a designer. With a large range of styles and formats readily available, you can locate the perfect design to match your individual or company demands, all while maintaining a polished, specialist appearance.

What Is 2240 Of 15 Percent

What Is 2240 Of 15 Percent

Download or printable workout infographicDumbbell Chest Workout Day 1Dumbbell Back Workout Day 2Dumbbell Shoulder Workout Day 3 30 Day Full Body Workout With Dumbbells Printable | Bonus Infographic Included | A4 & US Letter | Easy to Follow Fitness Program.

This 31 day dumbbell routine will tone and strengthen your entire body

Former VP Pence Calls For Corporate Tax Rate Of 15 Percent YouTube

What Is 2240 Of 15 Percent1. The 49 best total body dumbbell exercises. 2. A downloadable 12-week printable PDF plan to provide you with a structured routine. 100 Dumbbell Workouts is a field tested book by DAREBEE that gives you in one place 100 dumbbell workouts you can do to help you develop amazing strength

This document provides a list of over 40 dumbbell exercises that target different muscle groups including biceps, triceps, shoulders, back, chest, and legs. E Commerce Success Stories Lenskart SoftBank Vision Fund Yellow Color Of 15 Percent Discount Text Effect 11463722 Vector Art At

Dumbbell Printable Etsy

A If A Firm Has A Return On Equity ROE Of 15 Percent A Financial

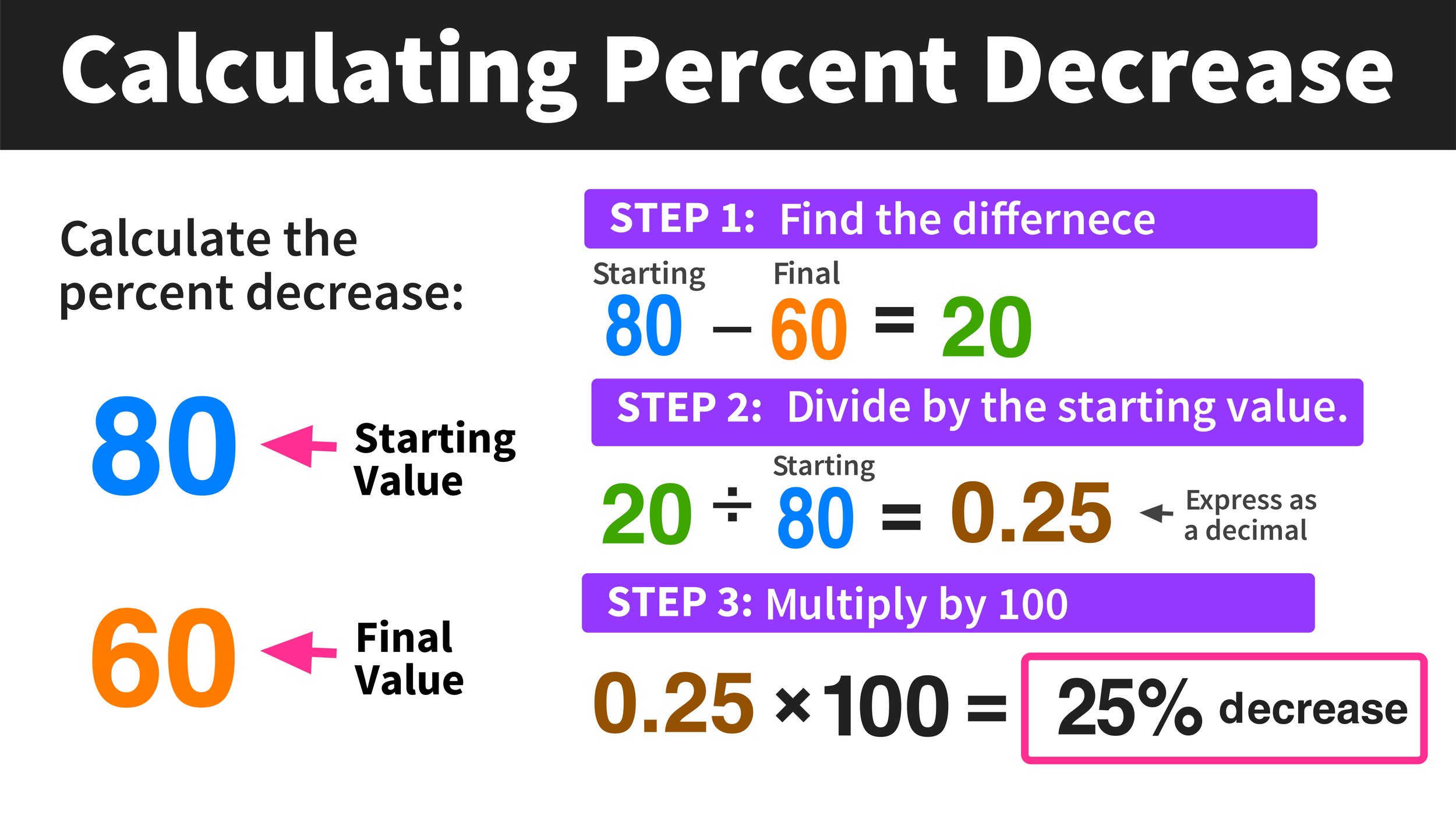

25 BEST DUMBBELL WORKOUTS Dumbbell Exercises For Body Fitness Boost Muscles Strength Training 7 9925 BEST DUMBBELL WORKOUTS Dumbbell Exercises For Four Easy Ways To Calculate Percentages WikiHow

Check out our printable arm dumbbell routine selection for the very best in unique or custom handmade pieces from our fitness exercise shops 25 Fastest Growing Cybersecurity Companies What Is 15 Percent Of 4000 Percentify

Percentages Revision Poster Studying Math Teaching Math Math Methods

22 What Percent Of The Income He Is Left With There Are 2240

The Khmer Today The Riel Has Gained Noticeable Confidence In National

A Man Sells An Article At A Gain Of 15 Percent Had He Bought It At 10

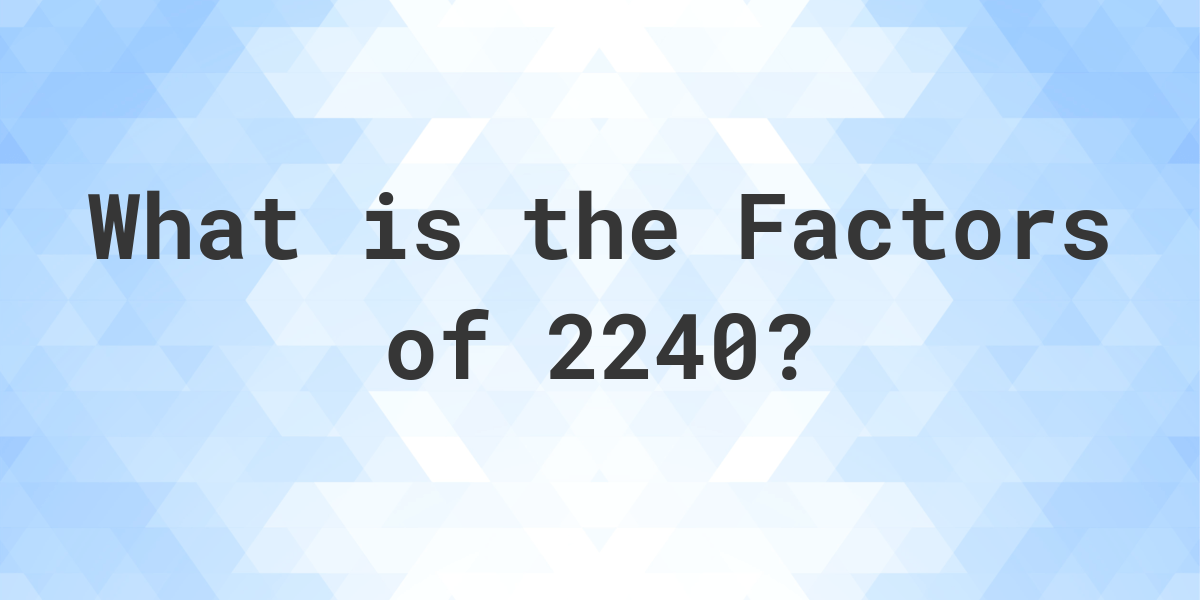

Factors Of 2240 Calculatio

SoMFi 2023 General Fisheries Commission For The Mediterranean GFCM

Efficiency Rebates Rewiring America

Four Easy Ways To Calculate Percentages WikiHow

15 Percent Over 787 Royalty Free Licensable Stock Photos Shutterstock

Calculating Percent Increase In 3 Easy Steps Mashup Math