What Is 3 5 Divided By 4 7 Divided By 9 10 As A Fraction are a versatile option for anybody aiming to create professional-quality files swiftly and quickly. Whether you require custom invitations, returns to, organizers, or business cards, these themes enable you to individualize content with ease. Simply download and install the layout, modify it to match your demands, and publish it in your home or at a printing shop.

These themes save time and money, offering a cost-efficient alternative to hiring a developer. With a vast array of designs and formats available, you can locate the best layout to match your individual or service demands, all while preserving a polished, professional look.

What Is 3 5 Divided By 4 7 Divided By 9 10 As A Fraction

What Is 3 5 Divided By 4 7 Divided By 9 10 As A Fraction

Our detailed wedding checklist maps out your journey from the moment you get engaged to the six month mark and through to the day after Use our 12 month wedding checklist to keep on top of all the wedding tasks you need to complete on the run up to your wedding day.

Wedding Checklist Worksheet pdf Amazon S3

Fraction Pie Divided Into Fifths ClipArt ETC

What Is 3 5 Divided By 4 7 Divided By 9 10 As A FractionFirst few were: discuss a budget, build a vision board for your wedding, pick season and year, look at venues online, book the tours (tour them), ect. Big Picture Wedding Checklist Ultimate Wedding Budget Checklist 90 Day Wedding Planning Checklist Elopement Checklist Barn Wedding

Engaged? Start planning with our free wedding printables! From wedding checklists and timelines to worksheets and questionnaires, ... 28 Divide By 4 100 Divided By 86

Wedding planning checklist 3 pdf Pinterest

Fraction Pie Divided Into Sixths ClipArt ETC

This is a 30 page Google Sheets workbook I created to help go from being newly engaged and gathering ideas all the way to scheduling the day of your wedding Area And Fractions

The checklists are designed to help couples plan their wedding day and include sections for music ceremony details reception details and a timeline of events 4 5 Divided By 1 2 10 Divided By 1 2

10 Division Table

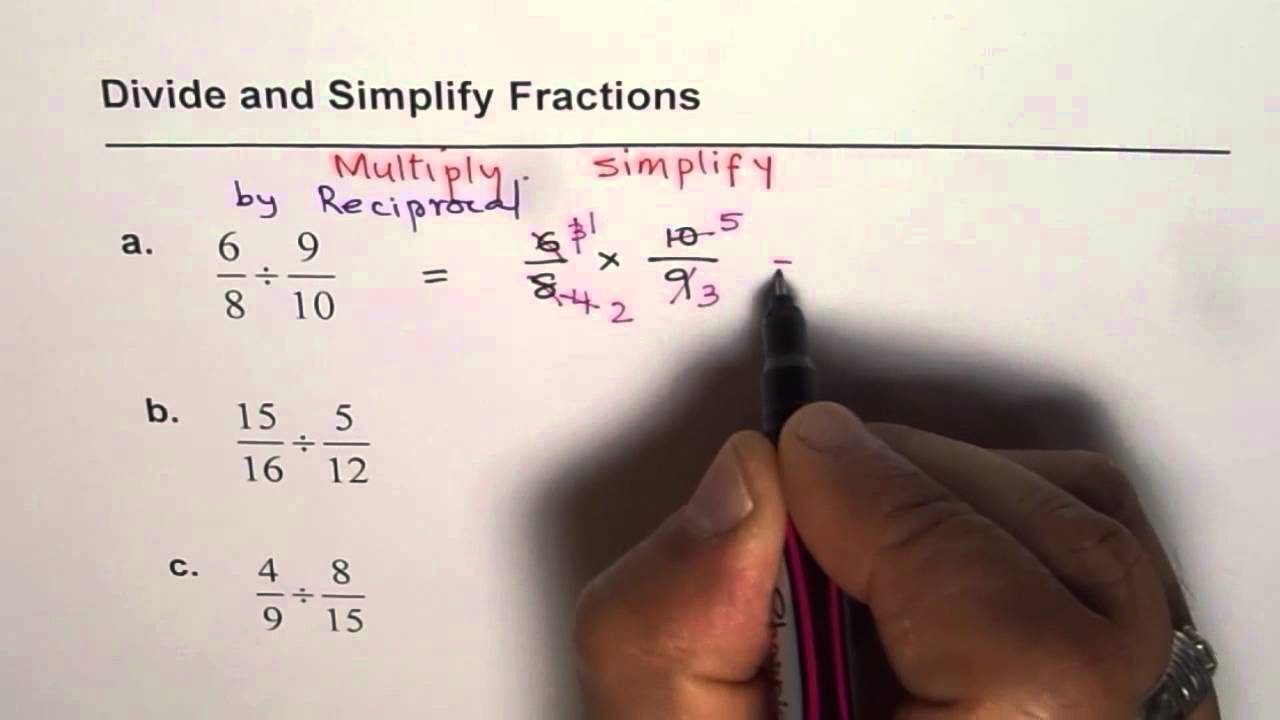

Division With Remainders As Fractions YouTube

15 Divided By 23

15 Divided By 23

Two Division Tables

Division Charts Printable

Division Chart Printable

.png)

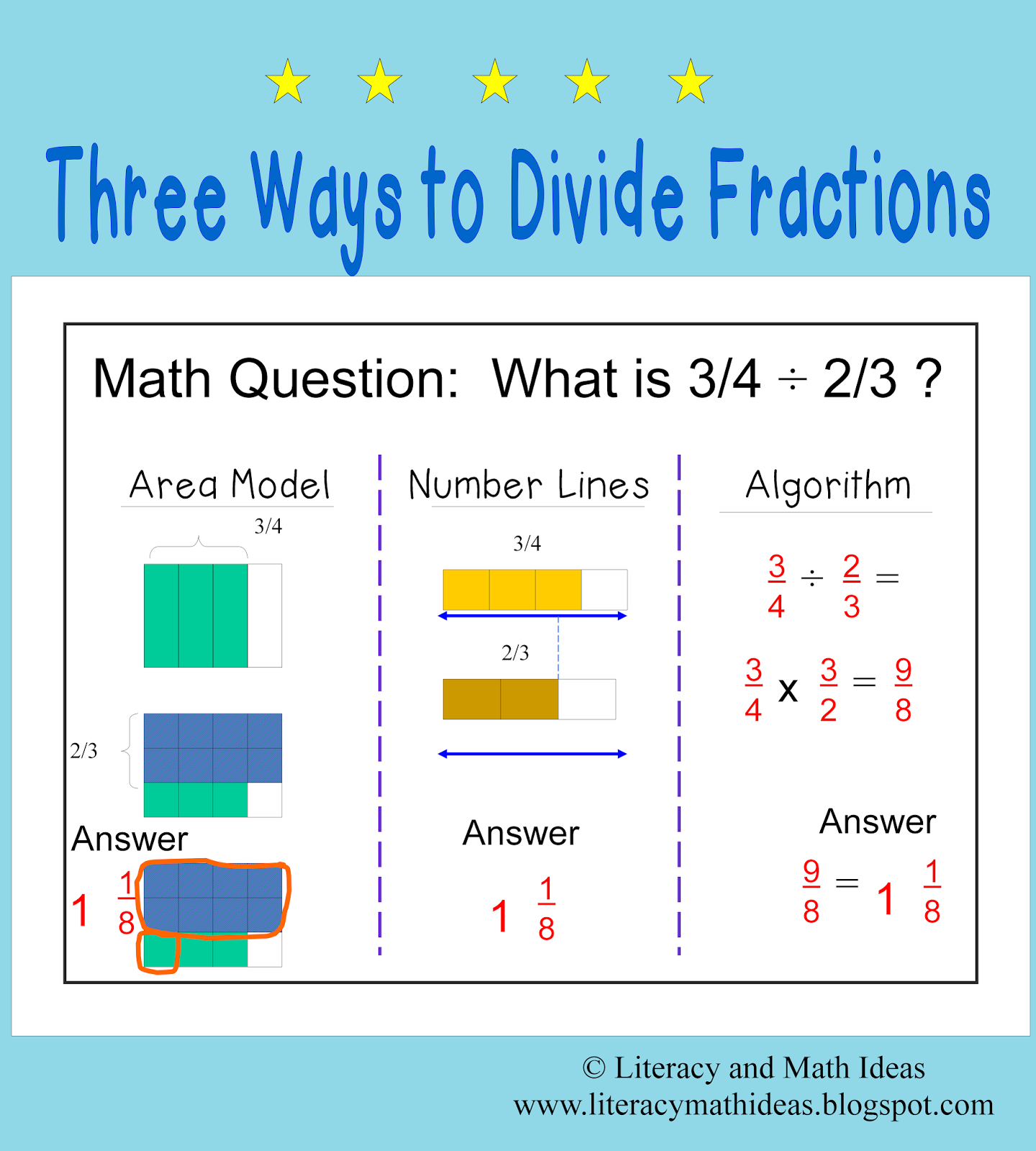

Area And Fractions

6 Divided By 100

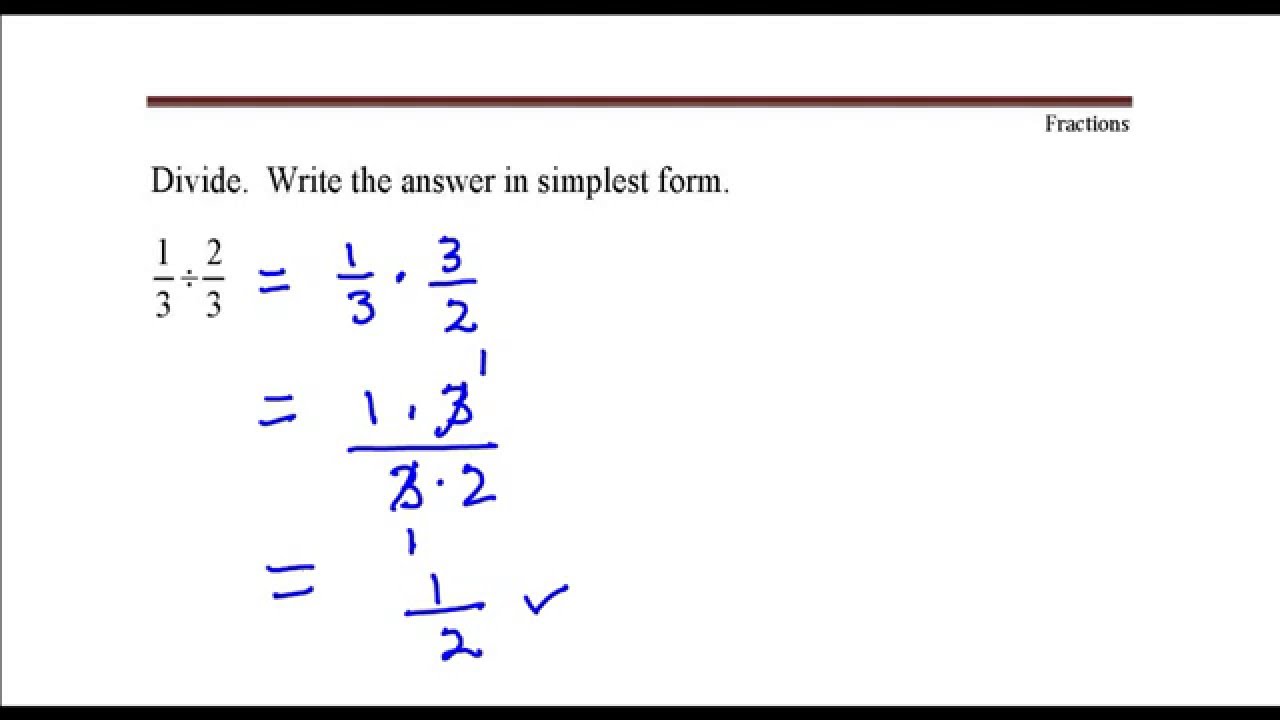

1 4 Divided By 3