What Is 4 952 Rounded To The Nearest Hundred Calculator are a versatile remedy for any person wanting to develop professional-quality files quickly and conveniently. Whether you need customized invites, returns to, planners, or calling card, these templates allow you to individualize web content effortlessly. Merely download and install the layout, modify it to fit your needs, and print it in the house or at a printing shop.

These layouts save time and money, using a cost-effective choice to working with a designer. With a vast array of designs and layouts offered, you can locate the ideal style to match your individual or company needs, all while maintaining a refined, expert look.

What Is 4 952 Rounded To The Nearest Hundred Calculator

What Is 4 952 Rounded To The Nearest Hundred Calculator

The 2024 NFL Weekly Schedule shows matchups and scores for each game of the week Use the printer icon to download a printable version We provide free weekly NFL Pick'em sheets and college pick'em sheets for you to print. You can access the full NFL schedule or college football schedule for ...

NFL Schedule Week 2 Dec 17 Dec 17 2024 ESPN

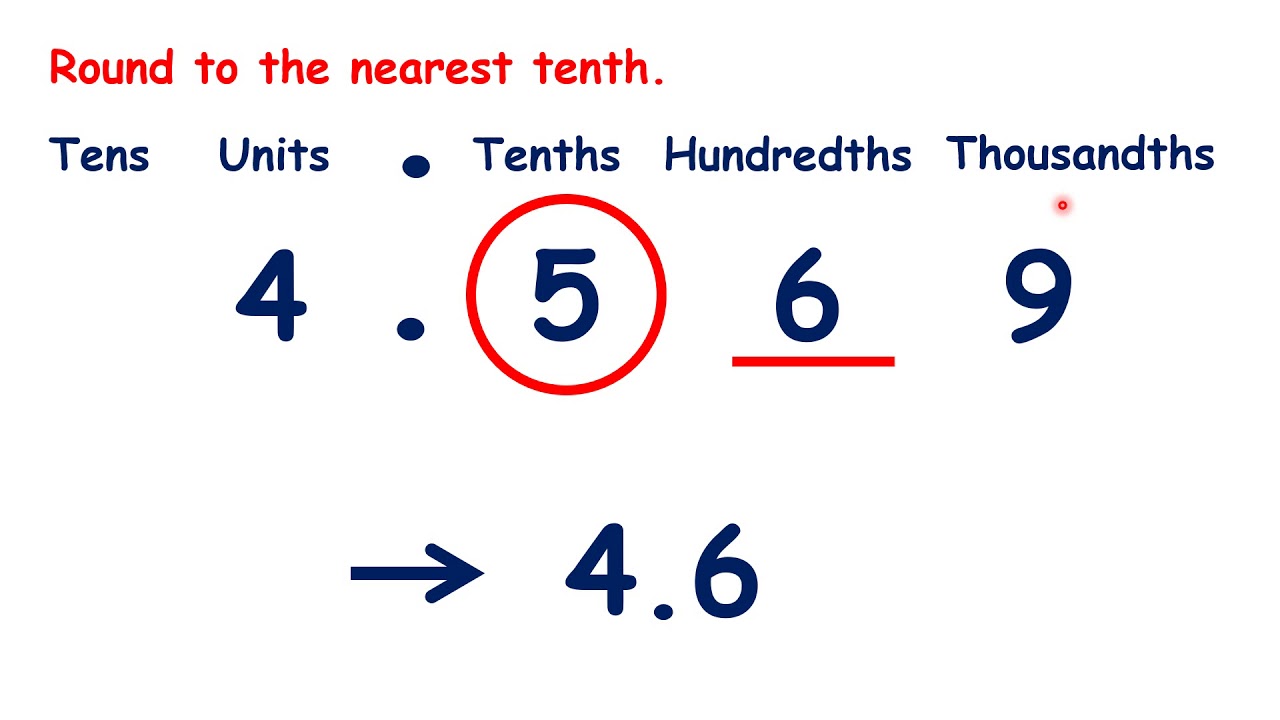

Rounding To Nearest Thousandth Calculator

What Is 4 952 Rounded To The Nearest Hundred CalculatorPrint Week 2 NFL Pick'em Office Pool Sheets in .PDF Format. NFL Football Week Two Picks and Schedules. National Football League Match ups. Thursday Sep 12 TIME ET Buffalo at Miami 8 15 pm Sunday Sep 15 Las Vegas at Baltimore 1 00 pm LA Chargers at Carolina 1 00 pm

Get the 2024 Monday Night Football Schedule. See which teams are playing this Monday or plan your Football Mondays for the entire NFL season. [img_title-17] [img_title-16]

Printable Weekly FOOTBALL Pick em Sheets OfficePoolStop

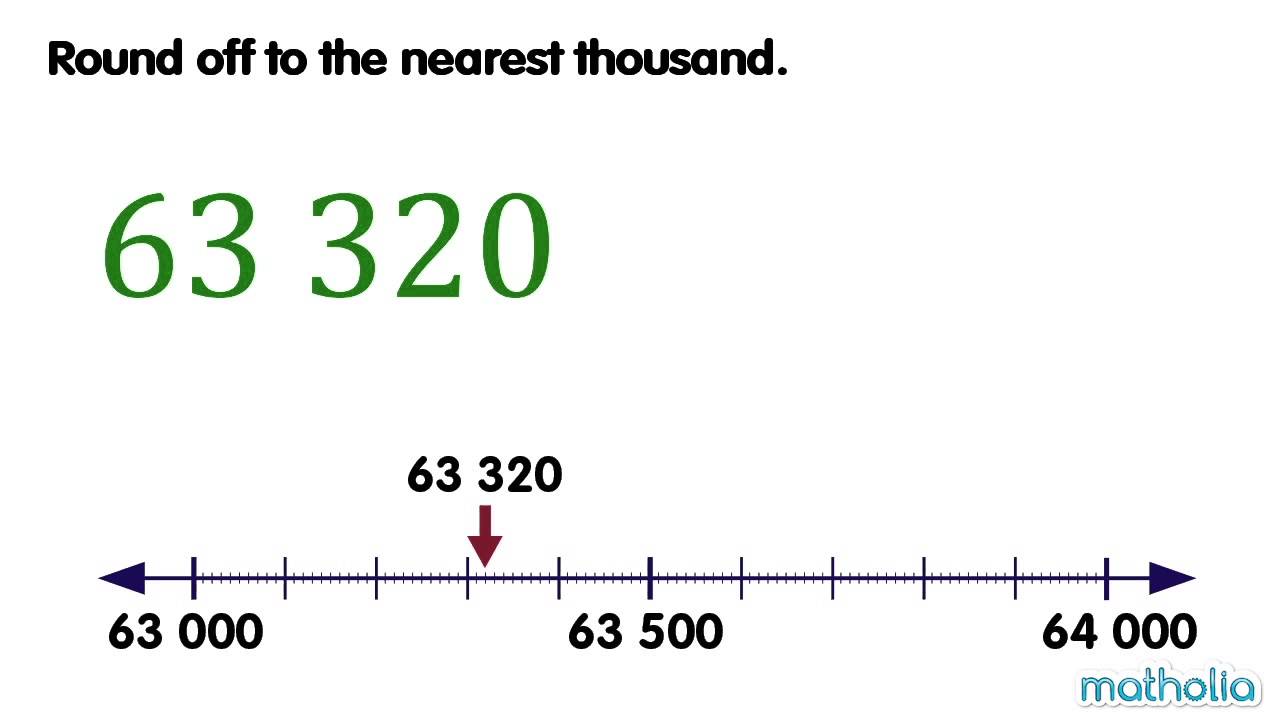

Rounding To The Thousands

Includes every weekly NFL matchup game times and TV networks Space to write in game projections and results Prints on letter size paper [img_title-11]

Sunday September 15th Raiders logo LV Raiders 2 11 Ravens logo Chargers logo LAC Chargers 8 5 Panthers logo Saints logo NO Saints 5 8 Cowboys [img_title-12] [img_title-13]

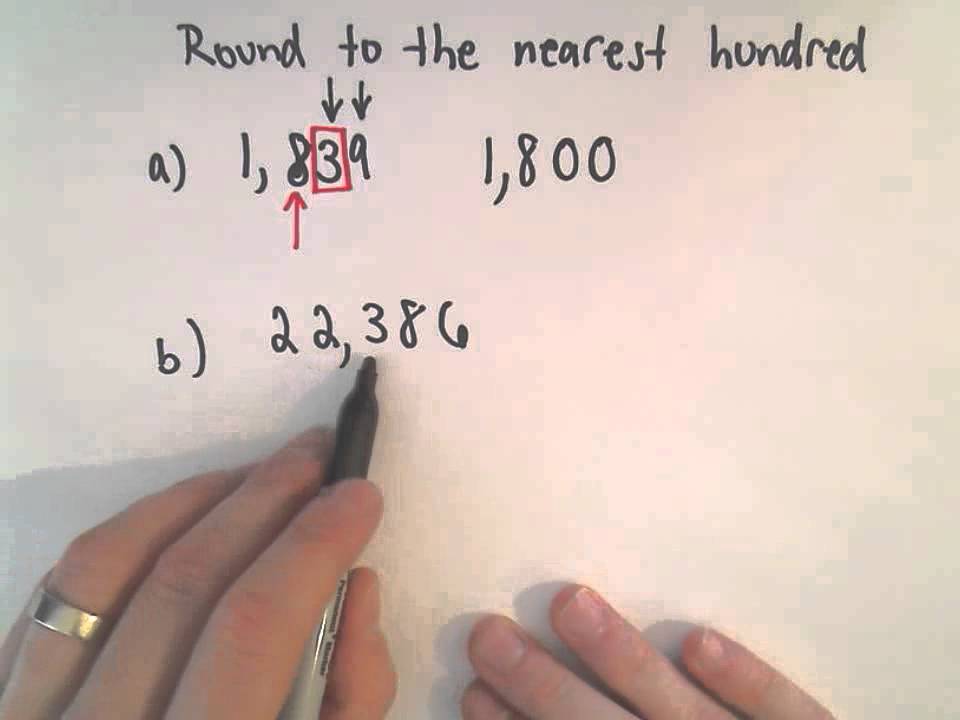

Rounding To The Hundred

Rounding To Hundreds Place

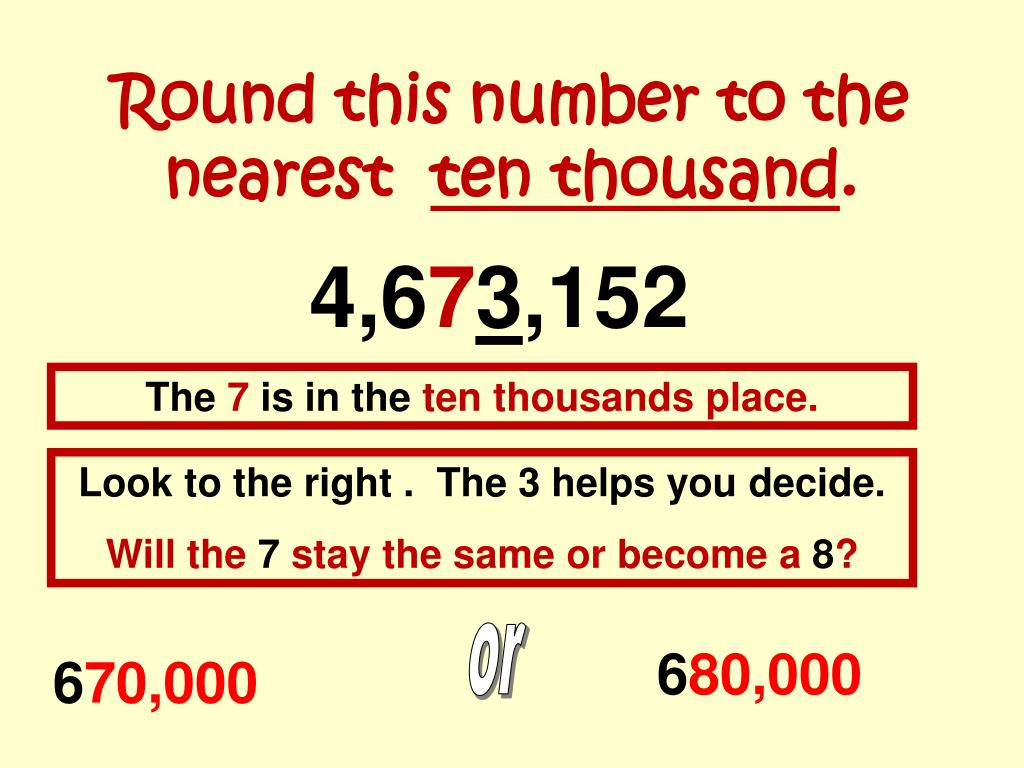

Rounding To Ten Thousands

Rounding To The Nearest Tenths Calculator

Rounding To Hundredth Place

499 Rounding To The Nearest Tenth

[img_title-10]

[img_title-11]

[img_title-14]

[img_title-15]