What Is 4 Percent Of 450 000 are a flexible option for any person aiming to create professional-quality records rapidly and quickly. Whether you require custom-made invitations, returns to, organizers, or business cards, these templates permit you to individualize web content effortlessly. Just download and install the template, modify it to match your demands, and publish it in your home or at a printing shop.

These design templates conserve money and time, supplying a cost-effective option to employing a designer. With a large range of designs and formats offered, you can locate the excellent style to match your individual or service needs, all while maintaining a sleek, specialist look.

What Is 4 Percent Of 450 000

What Is 4 Percent Of 450 000

Print connect the dots worksheets for free At the Oh My Dots printouts gallery you can print unlimited dot to dot games for free Free, printable animal dot-to-dot activity worksheet PDFs for preschool or kindergarten (ages 2-5) children. These dot-to-dots count by ones.

Free Printable Dot to Dot Pages All Kids Network

What Is 4 Percent Of 250000 Calculatio

What Is 4 Percent Of 450 000Mar 28, 2024 - Explore Don Hendricks's board "Dot to dot" on Pinterest. See more ideas about dot to dot printables, connect the dots, dots. Click on the puzzles below to download printable sample puzzles Scroll to the bottom of the page to purchase We will match any competitor price

Connect the dots and printable dot to dot worksheet. Percent Yield Worksheets What Is The LCM Of 4 And 15 Calculatio

Easy Free Printable Animal Dot to dot Worksheets

What Is 4 Percent Of 3000000 Calculatio

These dot to dot Dinosaur graphics will help strengthen a child s number skills fine motor skills focus on the task at hand tracing What Is 4 90 Simplified To Simplest Form Calculatio

40 Extreme Dot to Dot Oceans 254 253 211 260 269 268 261 259 267 208 262 210 209 258 255 263 Extreme Dot to Dot Oceans39 What Is 4 40 Simplified To Simplest Form Calculatio What Is 4 Percent Of 2000

What Is 4 Percent Of 150000 Calculatio

What Is 4 Percent Of 120000 Calculatio

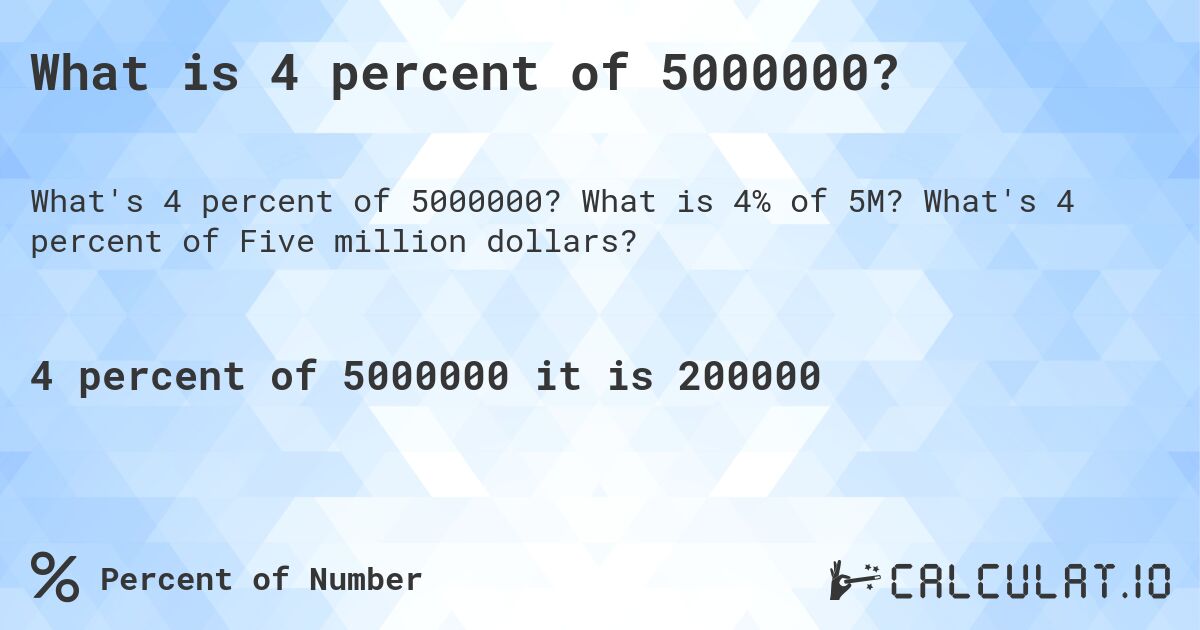

What Is 4 Percent Of 5000000 Calculatio

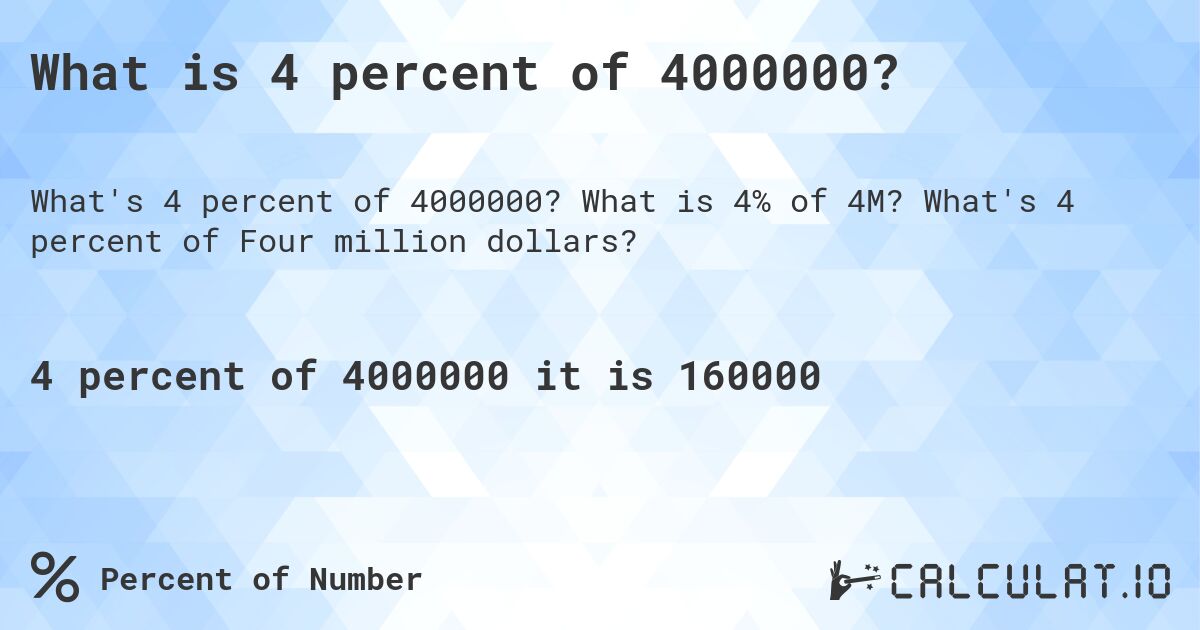

What Is 4 Percent Of 4000000 Calculatio

What Is 4 Percent Of 1000 Percentify

2 3 In Percent

What Is 4 20 Simplified To Simplest Form Calculatio

What Is 4 90 Simplified To Simplest Form Calculatio

What Is 4 5 Simplified To Simplest Form Calculatio

What Is The LCM Of 4 And 5 Calculatio