What Is 5 Percent Of 50 Thousand are a versatile service for anybody looking to create professional-quality files swiftly and easily. Whether you require custom invitations, resumes, planners, or calling card, these templates allow you to personalize content effortlessly. Just download the layout, edit it to match your requirements, and print it at home or at a printing shop.

These layouts conserve money and time, offering a cost-effective option to working with a developer. With a variety of styles and formats readily available, you can find the perfect design to match your personal or organization requirements, all while preserving a refined, professional look.

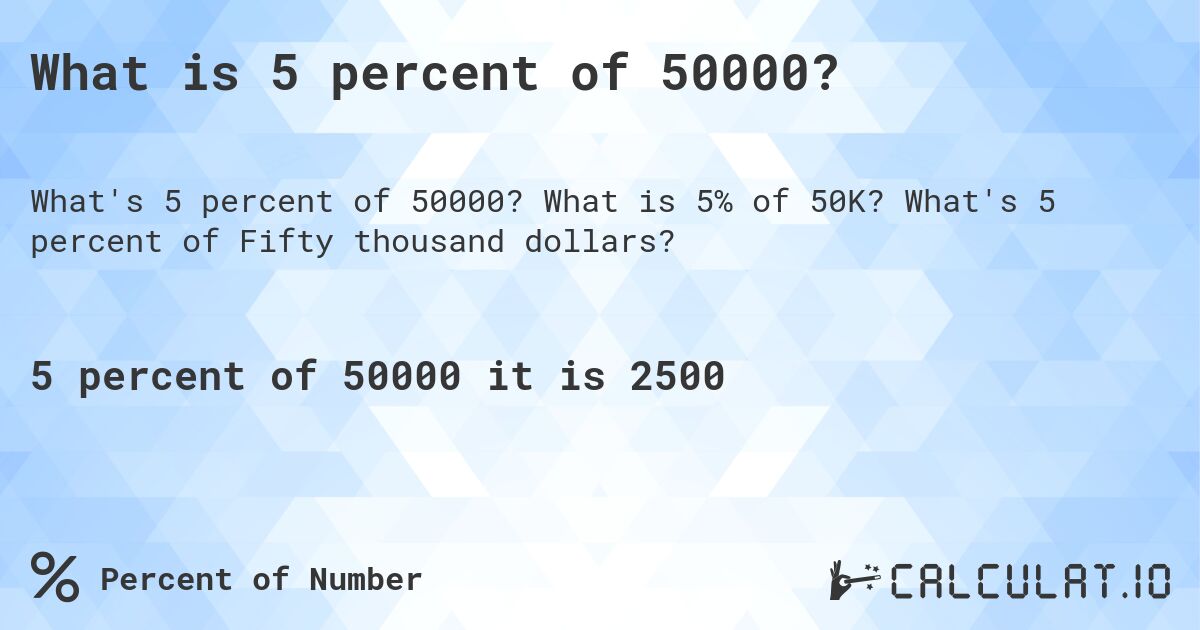

What Is 5 Percent Of 50 Thousand

What Is 5 Percent Of 50 Thousand

Shop our selection of printable door hangers for custom designs that fit your needs Perfect for businesses events and promotions with templates Pick the size, paper & perforation option you want; Browse door hanger designs by your industry (or upload a print-ready design); Customize with your logo, ...

Free Printable PDF Templates for Door Hangers The Paper Mill Store

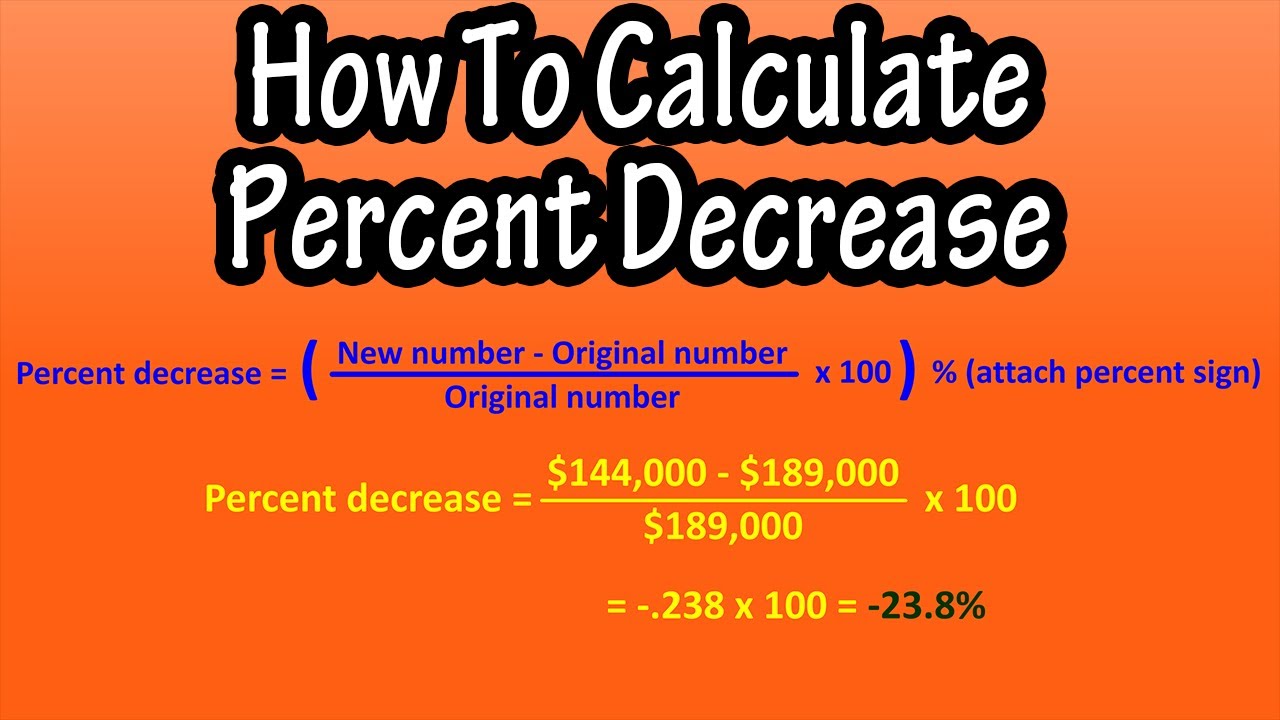

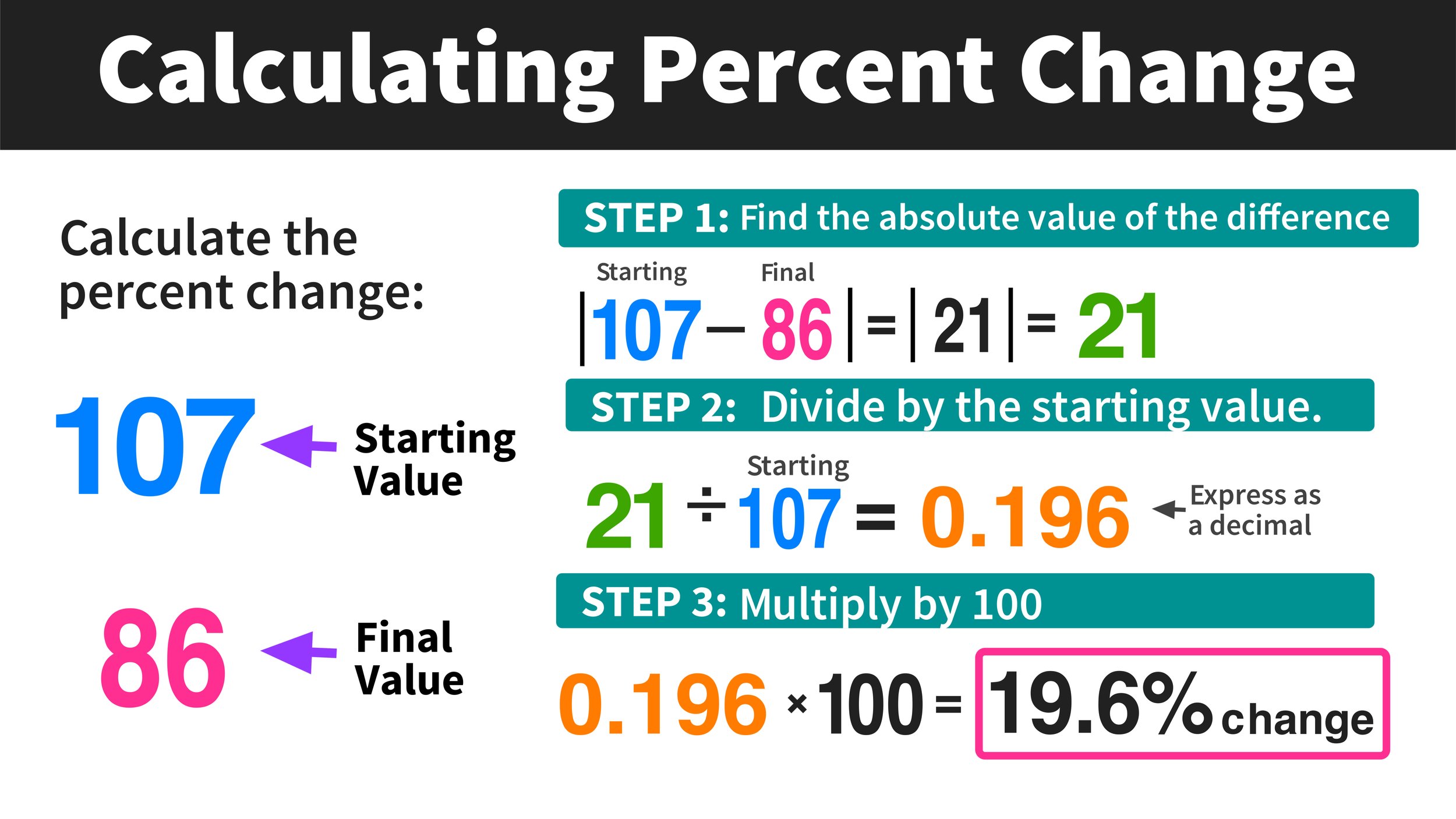

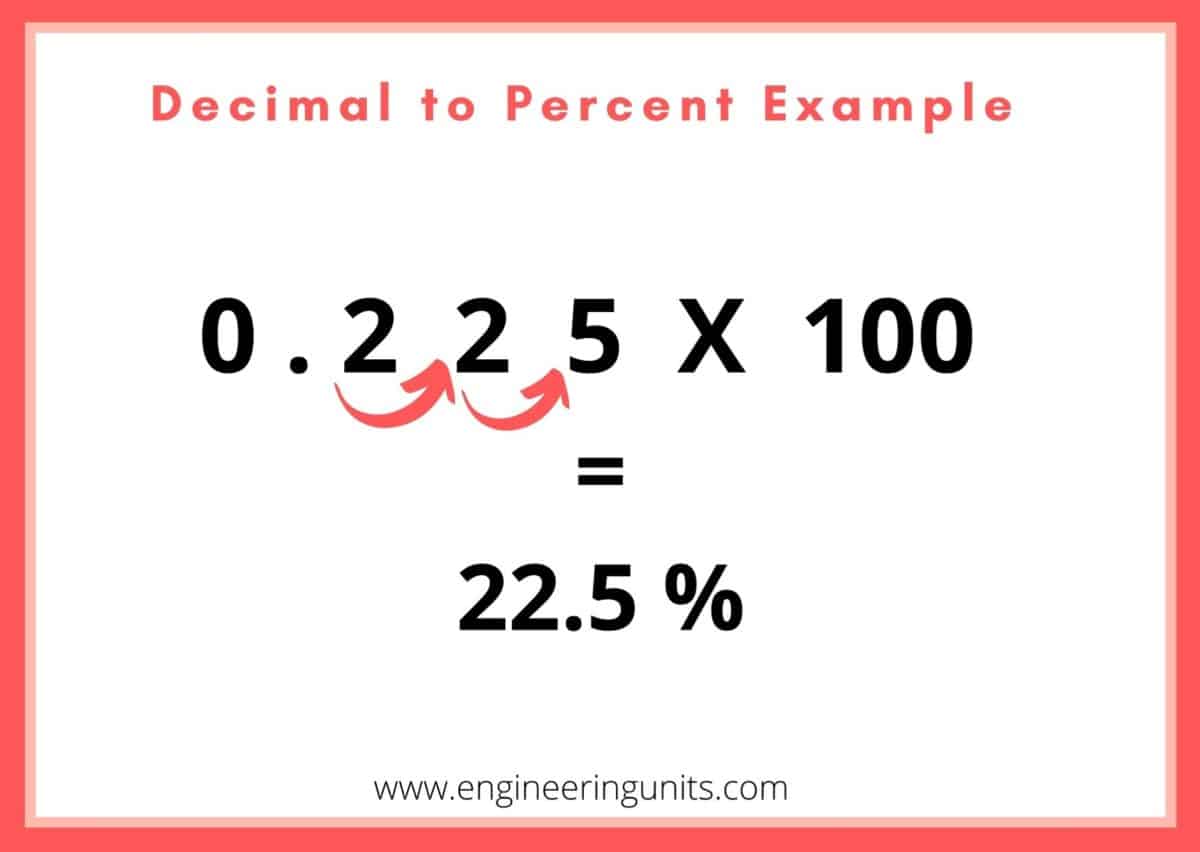

How To Calculate Or Find Percent Increase And Percent Decrease

What Is 5 Percent Of 50 ThousandDownload one of UPrinting's FREE door hanger templates! Our print templates will help you make designs with the correct bleed and margin setup. Unlike some door knob hangers you may have seen that appear faded or improperly designed our door hangers are glossy and pressed on premium paper for a fully professional and attractive look that will be sure to catch the eyes of your potential customer base

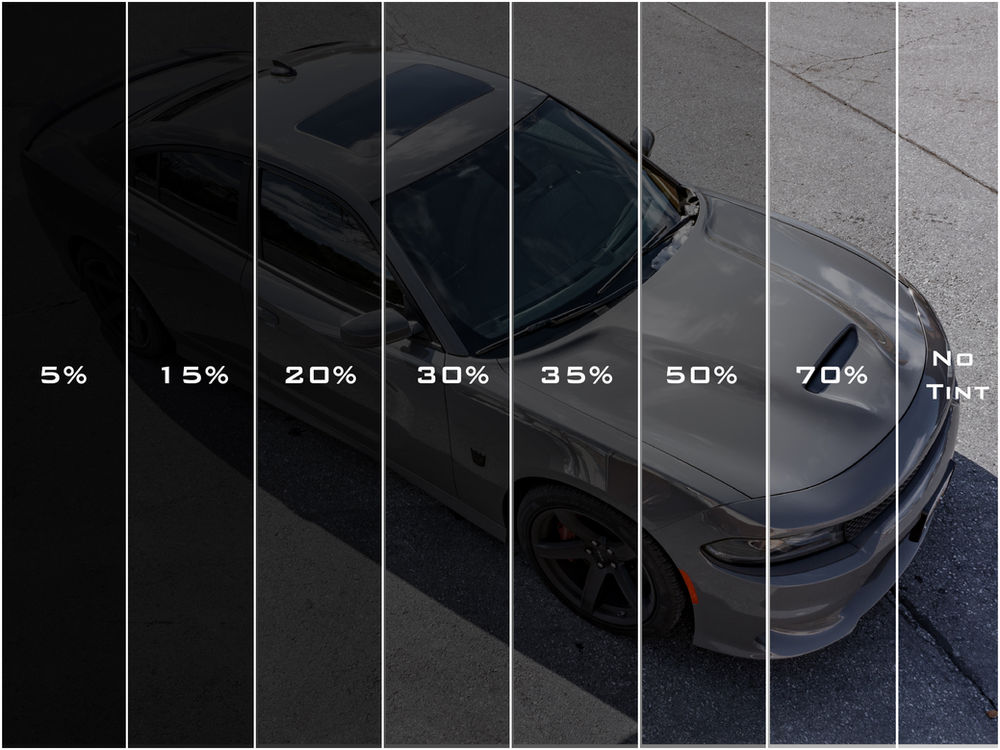

Effortlessly print door hangers by starting your online order with FedEx Office, where you can customize and visualize your impactful marketing tools in just a ... 24 Percent Tint What Is 5 50 Simplified To Simplest Form Calculatio

Custom Door Hangers VistaPrint

How To Calculate Percent Or Percentage Decrease Explained Formula For

Advertise your business or service with door hangers Professionally designed door hangers fit easily onto any door handle to grab your customers attention What Is 5 Percent Of 50000 Calculatio

Avery Printable Door Hangers with Tear Away Cards 4 25 x 11 Matte White 80 Blank Door Hangers for Laser and Inkjet Printers 16150 What Is 5 Percent Of 50 Calculatio What Is 5 Percent Of 50 Calculatio

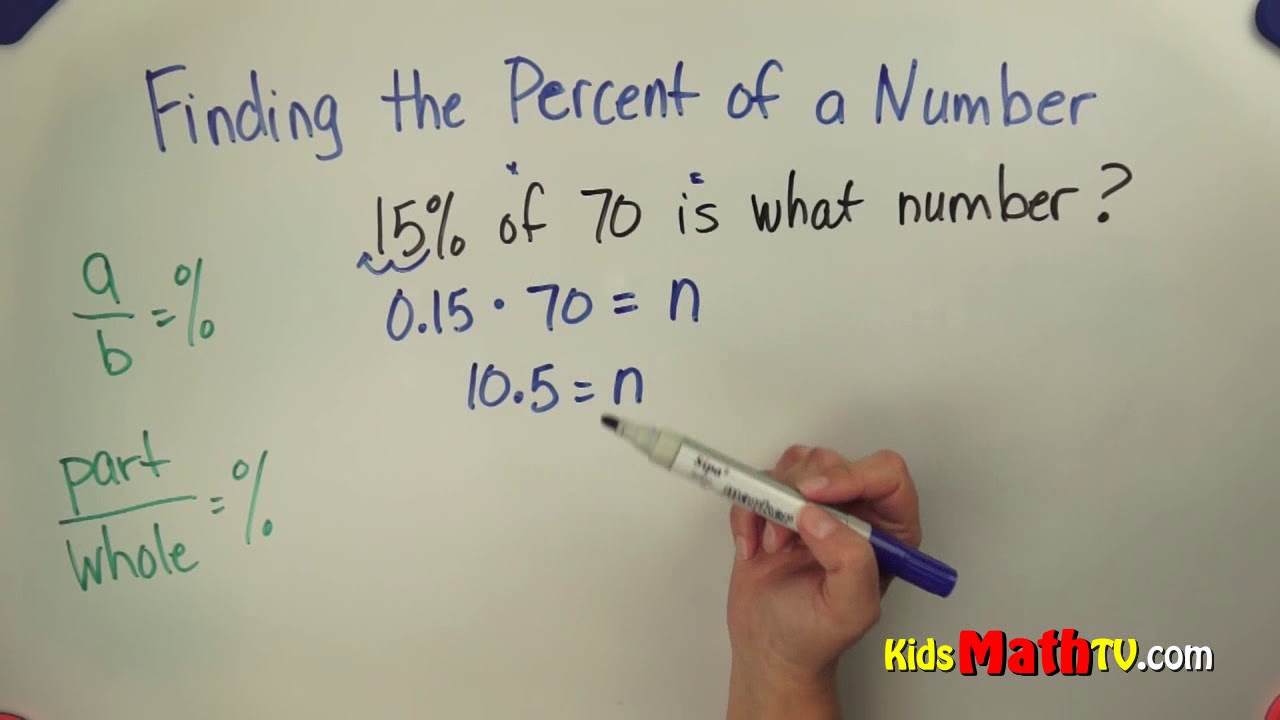

Find The Percentage Of Numbers Step By Step Math Video YouTube

Percentage Formula How To Calculate Examples And FAQs 44 OFF

Decimals Percentages Fractions B R E A K

Artofit

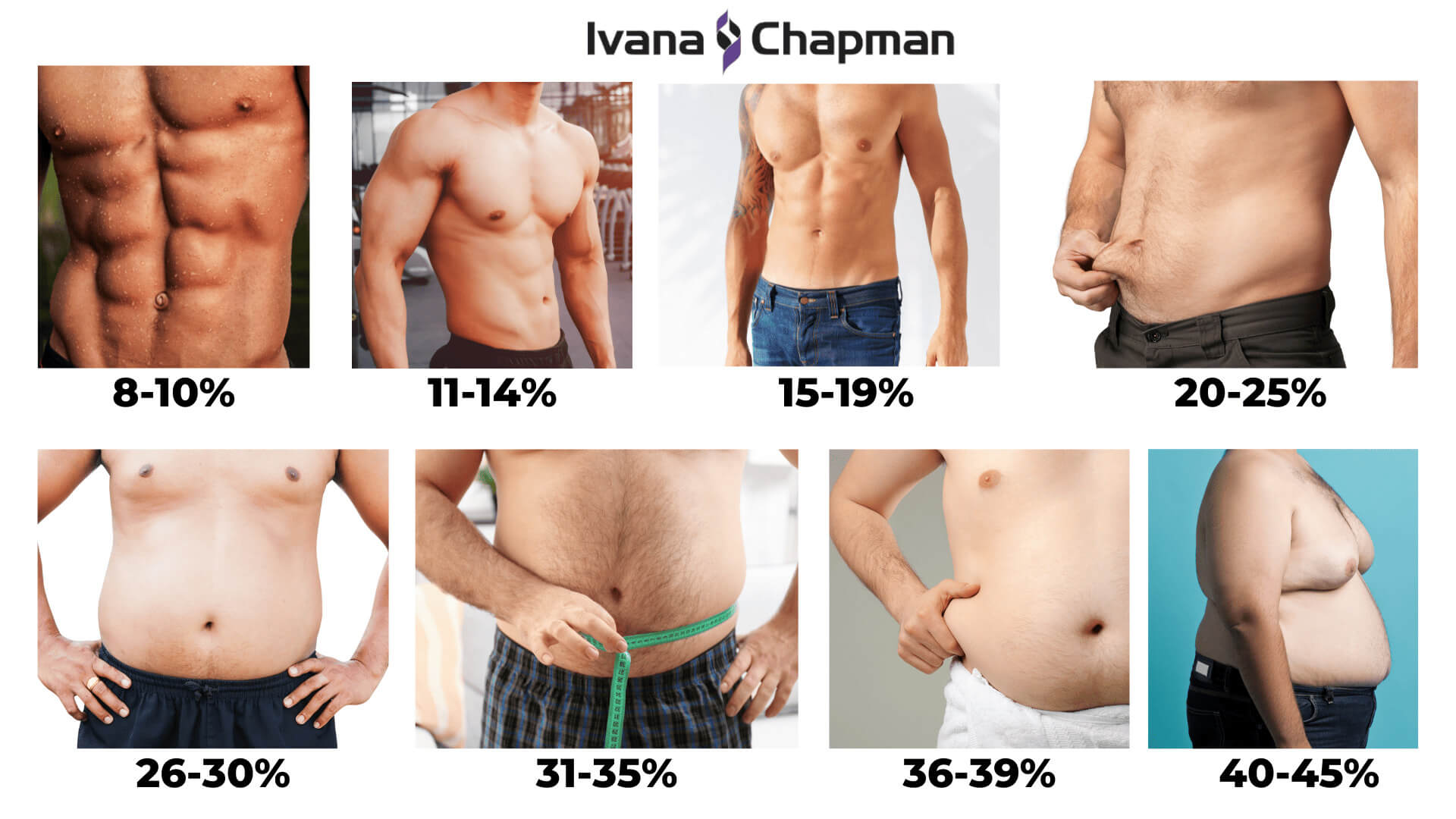

Body Fat Percentage Chart For Women And Men Examples 46 OFF

![]()

Icon Number 5 Percent Promotion 11297617 PNG

6 Percent To Decimal

What Is 5 Percent Of 50000 Calculatio

Different Tint Percentage

What Is 5 Percent Of 50 In Depth Explanation The Next Gen Business