What Is 6 Percent Of 26000 are a functional remedy for any individual seeking to develop professional-quality documents rapidly and easily. Whether you require custom-made invitations, resumes, coordinators, or calling card, these design templates permit you to customize content effortlessly. Simply download and install the template, edit it to fit your needs, and publish it in your home or at a print shop.

These design templates conserve time and money, supplying a cost-efficient alternative to employing a developer. With a wide range of designs and layouts readily available, you can find the ideal style to match your individual or company requirements, all while maintaining a sleek, professional appearance.

What Is 6 Percent Of 26000

What Is 6 Percent Of 26000

Social Security accepts laser printed Forms W 2 W 3 as well as the standard red drop out ink forms Both the laser forms and the red drop out ink forms must Find out how to get and where to mail paper federal and state tax forms. Learn what to do if you don't get your W-2 form from your employer or it's wrong.

W 2 Form Free Template Dropbox Sign

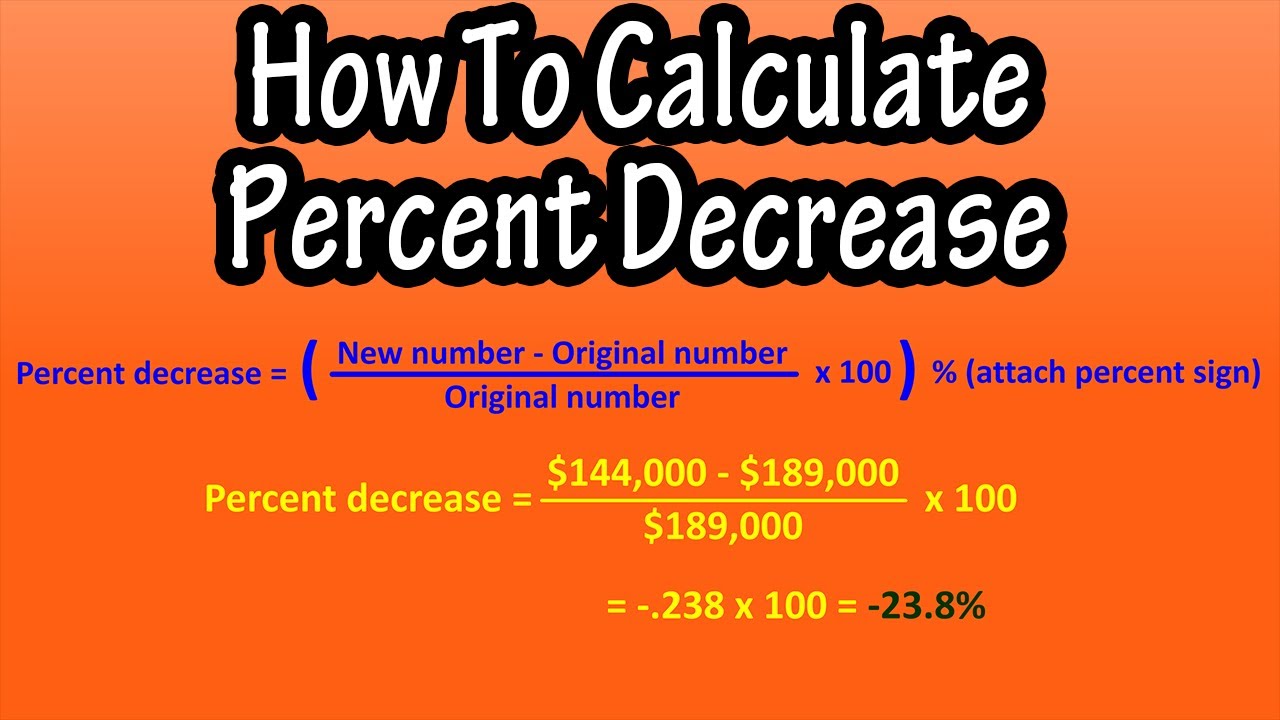

How To Calculate Percent Or Percentage Decrease Explained Formula For

What Is 6 Percent Of 26000Edit your w2 online form online. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more. Information about Form W 2 Wage and Tax Statement including recent updates related forms and instructions on how to file Form W 2 is filed by employers

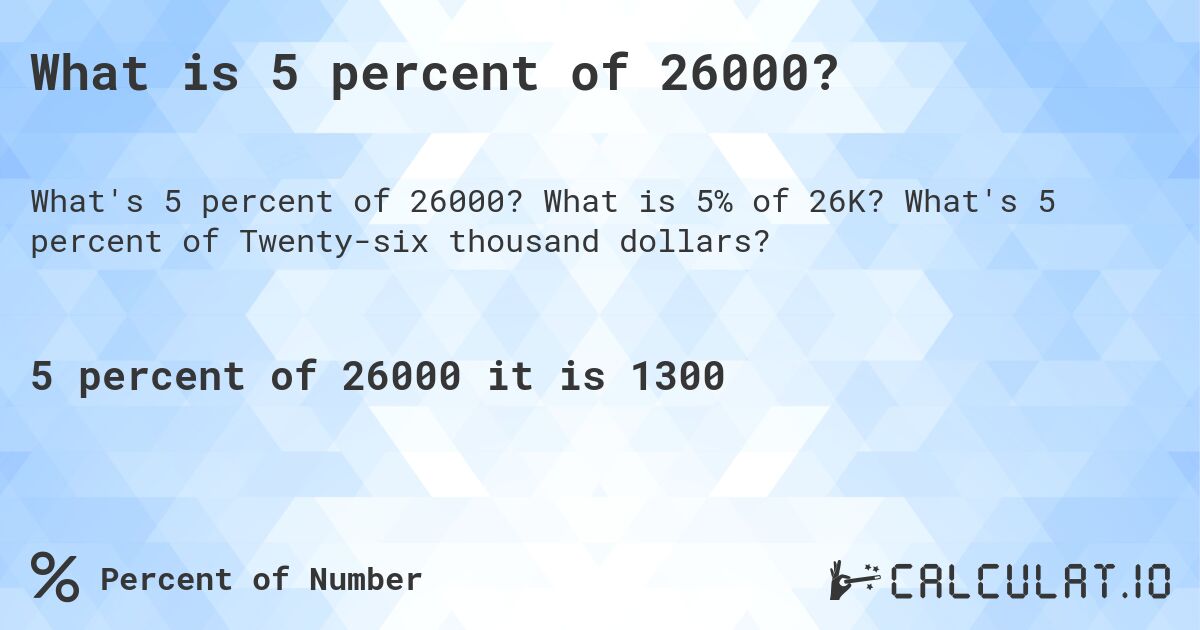

Select Employees, then Payroll Center. Select the File Forms tab. Select View/Print Forms & W-2s. Enter your payroll PIN, then select OK. Select the W-2s tab. What Is 6 Percent Of 1000 Solution With Free Steps What Is 6 Percent Of 10000

Federal tax forms USAGov

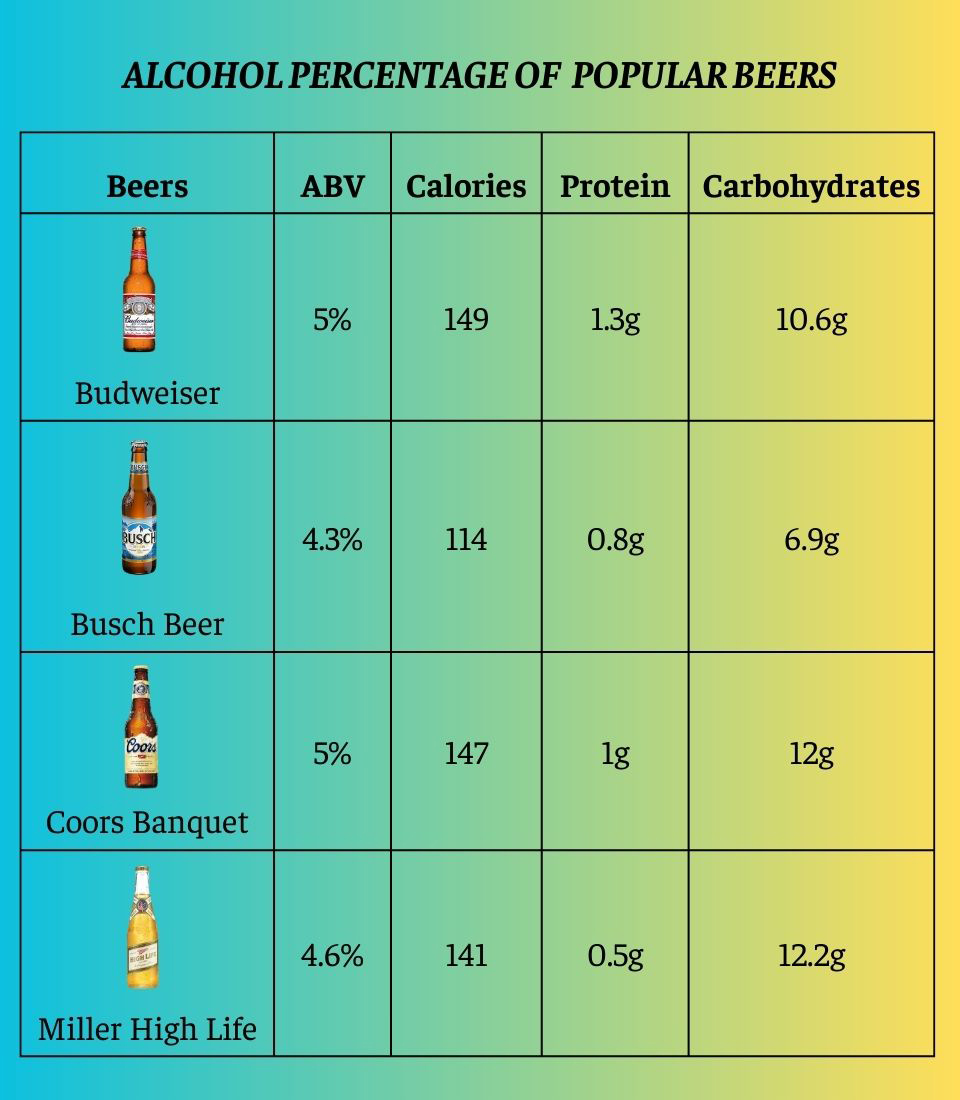

Beer Alcohol Percentage Chart Hot Sex Picture

Can you print a W2 form W2 forms are typically printed and mailed to employees Some online programs allow employers to auto mail W 2 forms to employees What Is 6 20 As A Percent Calculatio

Download W 2 form PDF 2024 in one click Above is a fillable Form W 2 that you can print or download If you need a W 2 form from the previous What Is 6 1000 Simplified To Simplest Form Calculatio Who s In The 1 Foundation National Taxpayers Union

Class Environment SC School Report Cards

Percent Change Calculator Mashup Math

World Trade Center Kharadi Pune Premium Business Spaces

What Is 5 Percent Of 26000 Calculatio

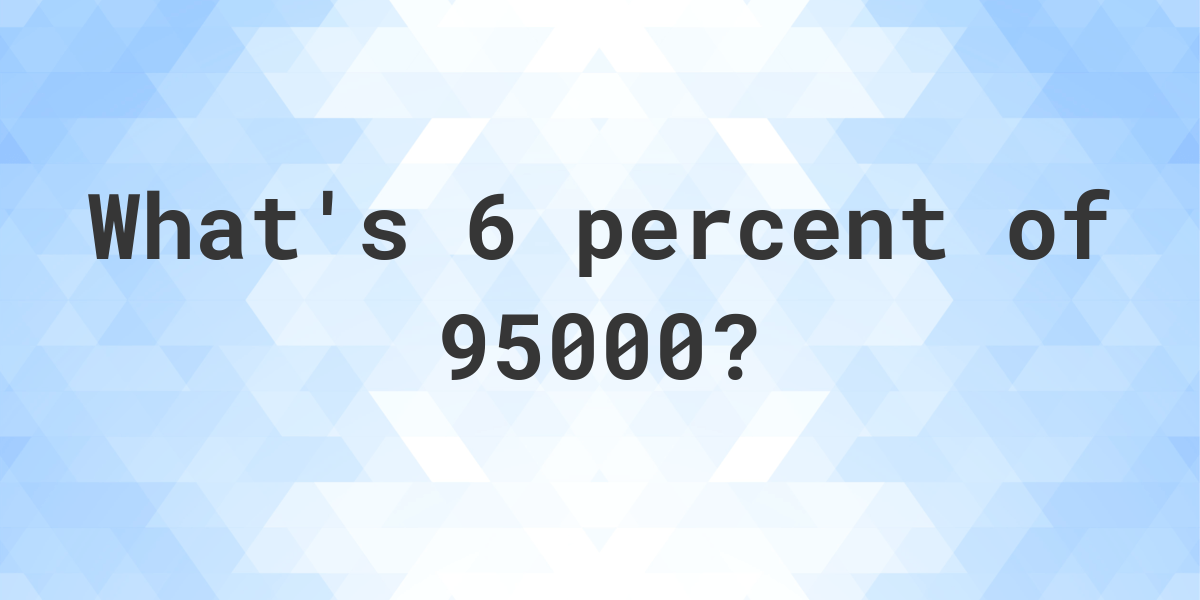

What Is 6 Percent Of 95000 Calculatio

What Is 6 Of 1000

What Is 6 Percent Of 9000000000 Calculatio

What Is 6 20 As A Percent Calculatio

What Is The LCM Of 6 And 5 Calculatio

What Is 20 Of 200003