What Is 6 Percent Of 9800 are a versatile remedy for any person aiming to create professional-quality records quickly and easily. Whether you need custom-made invites, returns to, planners, or business cards, these themes enable you to personalize material effortlessly. Just download the template, edit it to match your needs, and publish it in your home or at a print shop.

These design templates save time and money, supplying a cost-effective choice to working with a developer. With a large range of styles and styles readily available, you can locate the perfect layout to match your personal or service requirements, all while keeping a polished, expert appearance.

What Is 6 Percent Of 9800

What Is 6 Percent Of 9800

KOALA PAPER Printable Waterproof Paper for Inkjet Printer 8 5x11 In 30 Sheets Matte White Vinyl Printer Paper Non Tearable Durable Quick Drying 8 5x11 TerraSlate paper is a digital-compatible, durable, rip-proof, and 100% waterproof synthetic paper that can print through any laser printer or copy machine.

Waterproof Paper PuffinPaper works anywhere you do

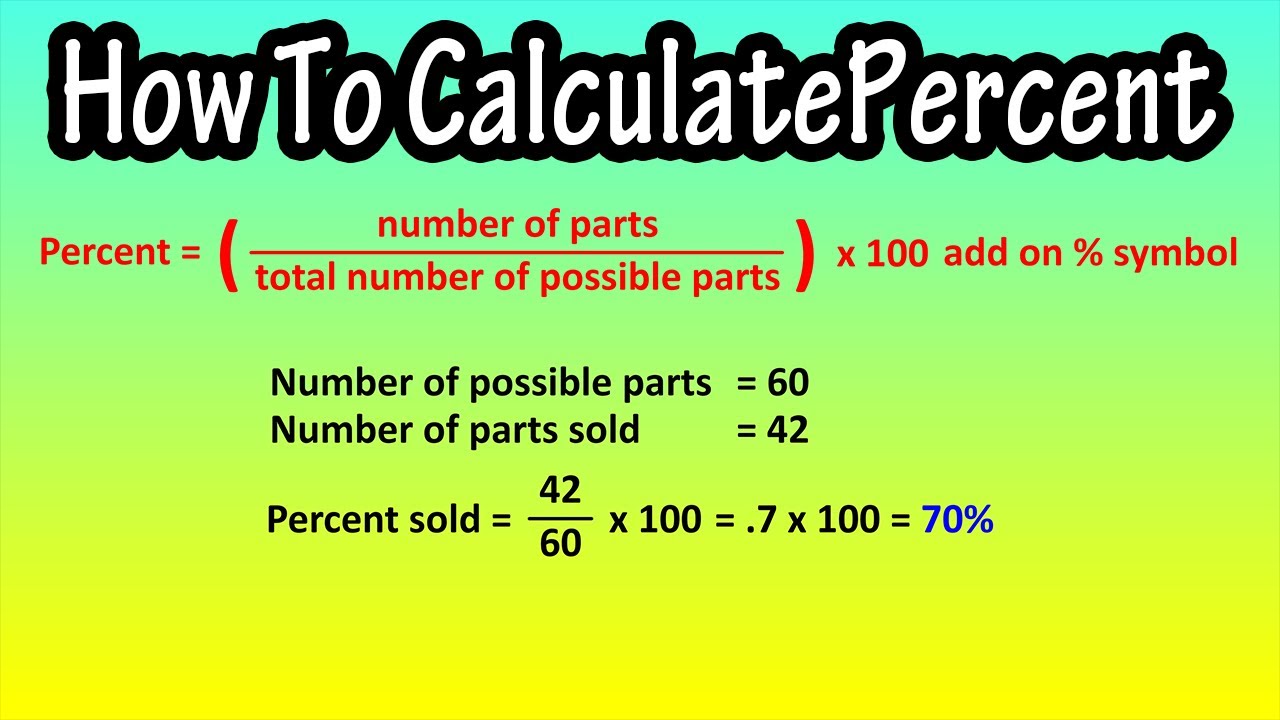

What Is 6 Percent Of 3000 Math Percentage YouTube

What Is 6 Percent Of 9800Waterproof papers for inkjet and laser printers. Optimum price and performance from an waterproof paper without sacrificing print longevity and image accuracy. TerraSlate waterproof paper offers a total of 22 unique sizes and weights of stock for all your printing needs

Koala Printable Waterproof Paper for Inkjet Printer, 8.5x11 in 300 Matte White Printable Vinyl Sheets, Synthetic Paper Non-Tearable, Premium Multipurpose ... 6 100 As A Decimal Calculatio Changing Fractions To Percents

Waterproof Printer Paper Weatherproof Paper Underwater Paper

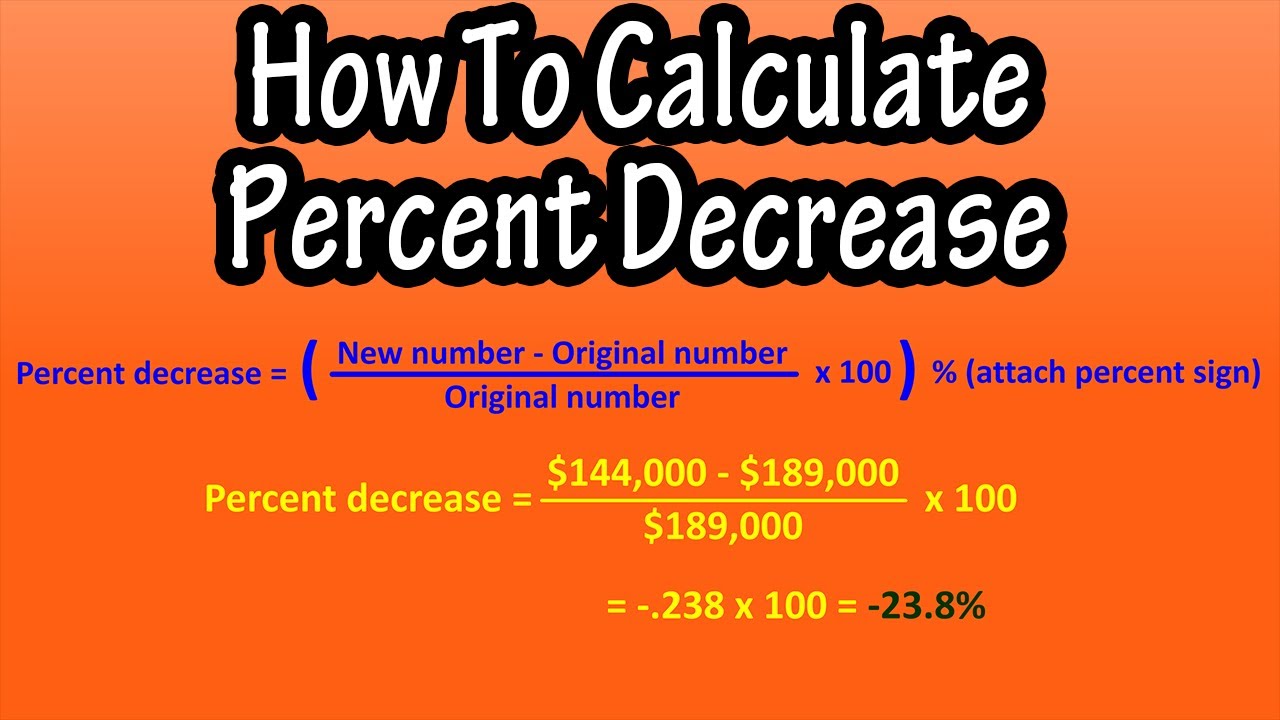

How To Calculate Percent Or Percentage Decrease Explained Formula For

Free printable calendars maps targets and graph paper in easy to print pdf document files Waterproof Paper waterproof puffin paper HomePuffinPaper Best What Is 6 1000 Simplified To Simplest Form Calculatio

Print weatherproof forms maps photos on copier paper that survives rain sweat mud Toner won t rub or wash off 20 white 50 pk Punkt Genau GRUBER R SCHITZ What Is The LCM Of 6 And 5 Calculatio

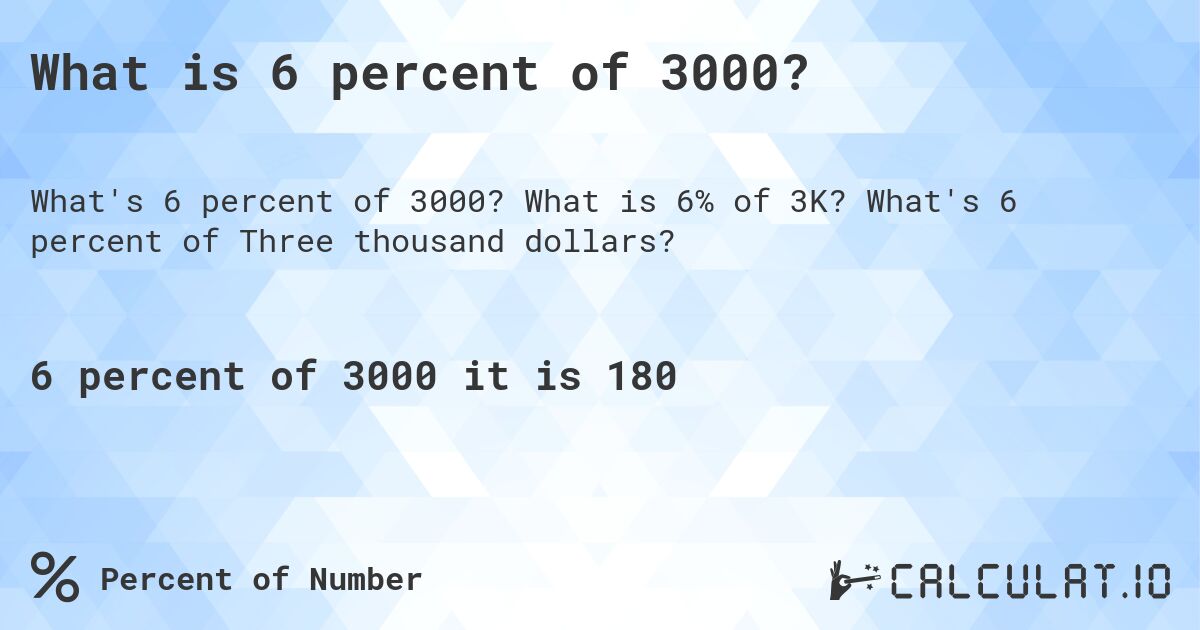

What Is 6 Percent Of 3000 Calculatio

What Is 6 Percent Of 3000 Calculatio

What Is 6 Percent Of 9000000000 Calculatio

What Is 6 5 As A Percent Calculatio

What Is 6 Percent Of 120000 Calculatio

Percent Error

9800 Poaflex br

What Is 6 1000 Simplified To Simplest Form Calculatio

What Is 20 Of 200003

What Is 6 Percent Of 10000