What Is A 10 Increase Of 58000 are a versatile option for anybody aiming to develop professional-quality papers quickly and quickly. Whether you require personalized invitations, resumes, coordinators, or business cards, these layouts allow you to customize web content effortlessly. Merely download the layout, modify it to fit your demands, and publish it at home or at a printing shop.

These themes save money and time, using an economical option to employing a designer. With a wide variety of styles and formats available, you can find the excellent style to match your personal or company needs, all while maintaining a refined, professional appearance.

What Is A 10 Increase Of 58000

What Is A 10 Increase Of 58000

Does your name match the name on your social security card If not to ensure you get credit for your earnings contact SSA at 800 772 1213 You may complete a new Form IL-W-4 to update your exemption amounts and increase your. Illinois withholding. How do I figure the correct number of allowances?

Blank W 4 withholding forms Symmetry Software

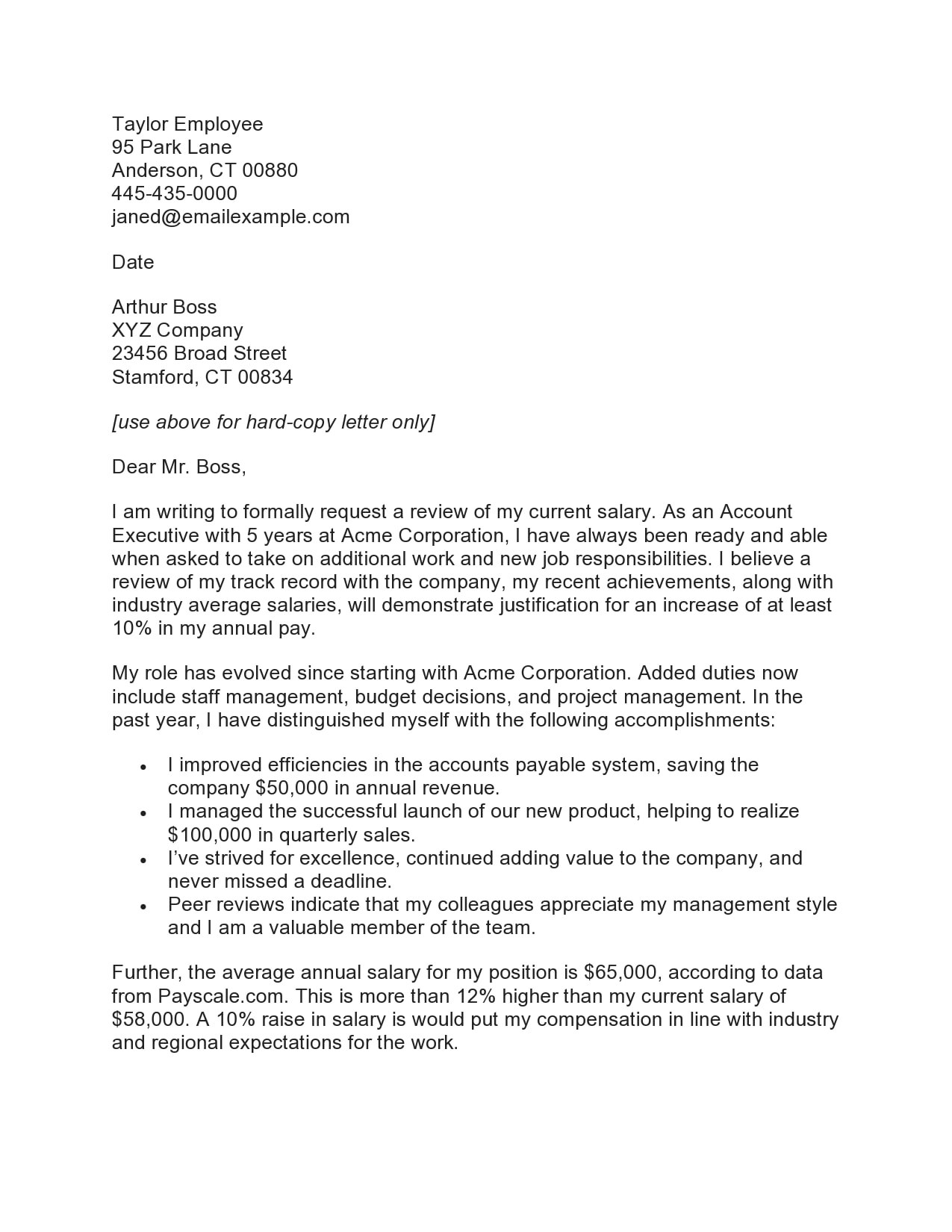

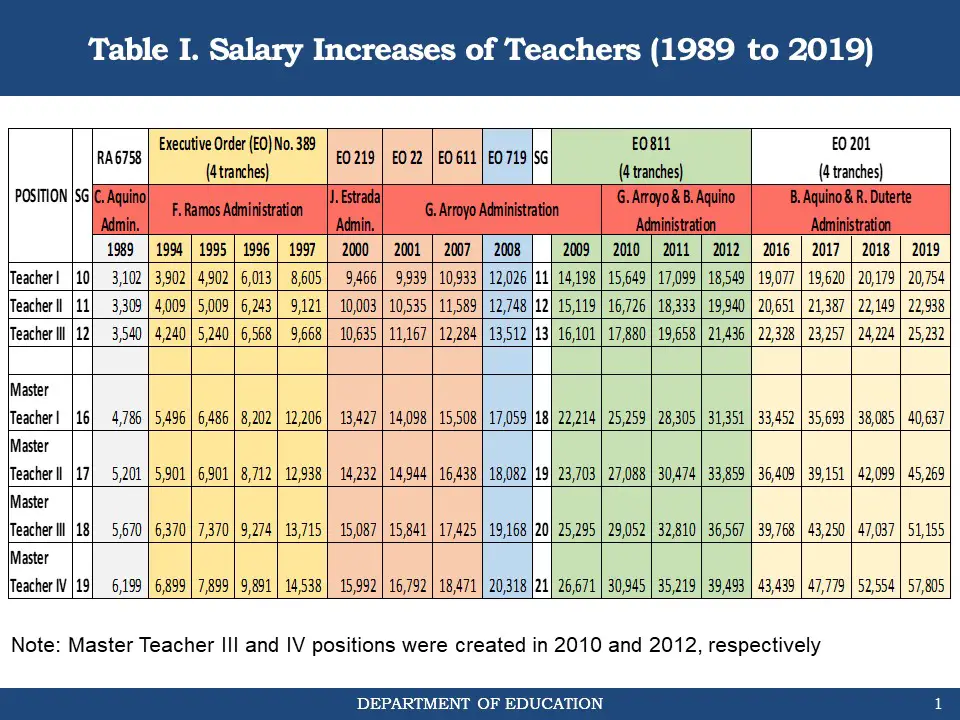

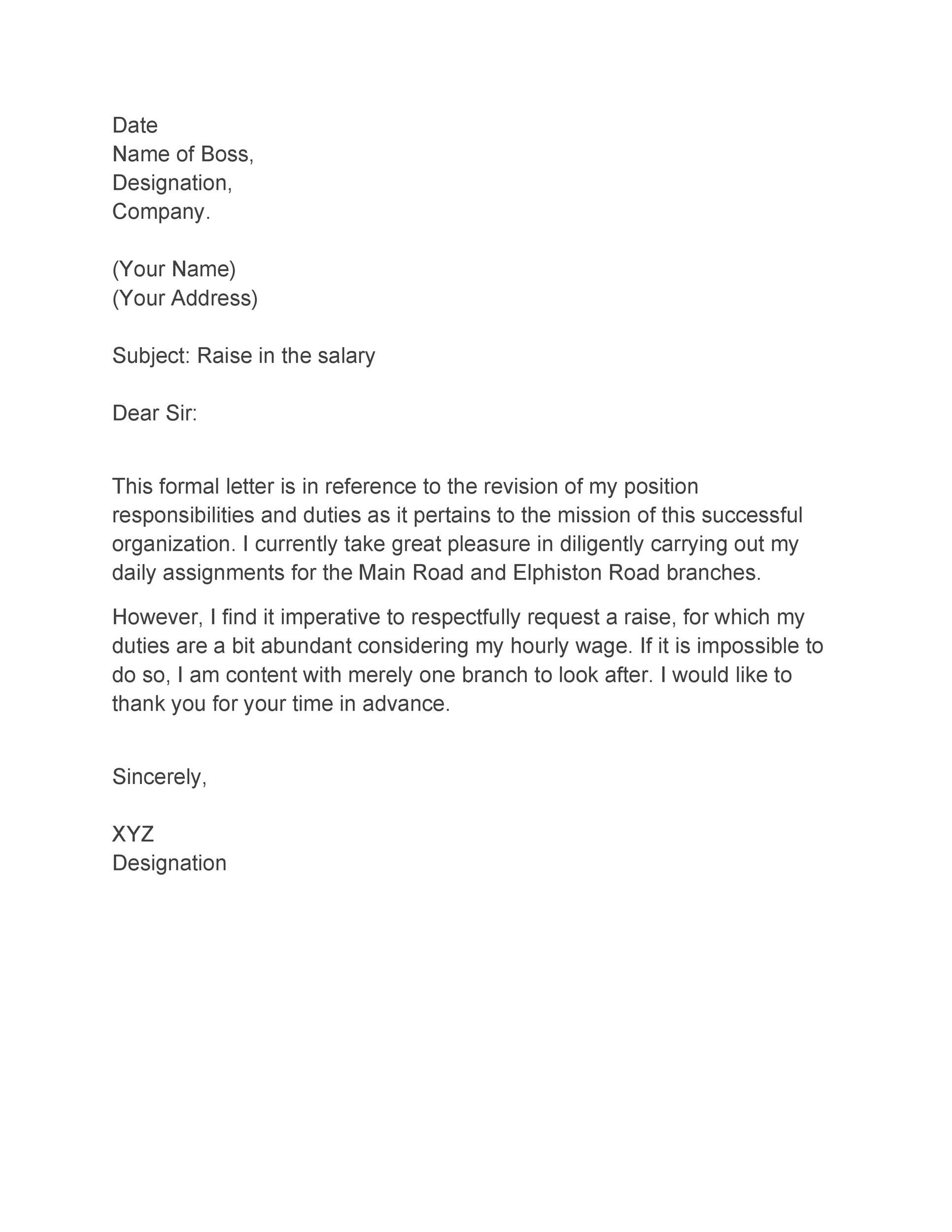

30 Effective Salary Increase Letters Samples TemplateArchive

What Is A 10 Increase Of 58000This certificate is for Michigan income tax withholding purposes only. Read instructions on page 2 before completing this form. Issued under P.A. 281 of 1967. > ... Information about Form W 4 Employee s Withholding Certificate including recent updates related forms and instructions on how to file

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Form W-4 PDF. Form 1040-ES. Estimated Tax ... Business Growth Investment Profit Increase Growing Fast Or Adidas Launch Latest Pogba Signature Predator Accuracy SoccerBible

Form IL W 4 Employee s and other Payee s Illinois Withholding

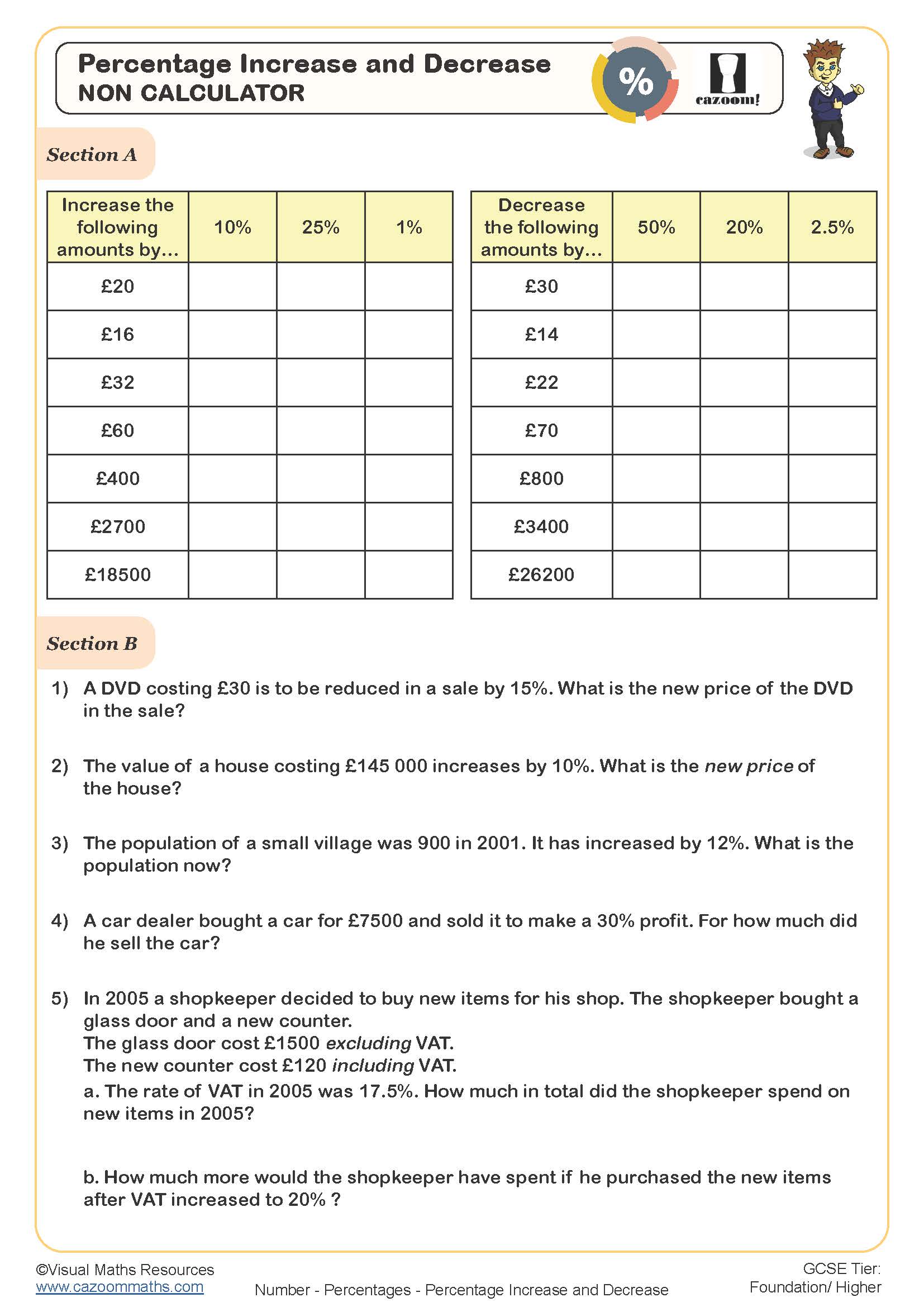

Percentage Increase And Decrease Worksheet Fun And Engaging PDF

NC 4 Employee s Withholding Allowance Certificate Documents Contact Information North Carolina Department of Revenue PO Box 25000 Raleigh NC 27640 0640 Part Whole Percent Worksheet

Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay If too little is withheld you will generally owe tax when Salary Increase 2025 Guidelines Nyc Annette J Young California Flsa Salary Threshold 2025 End Kaden Bamboo

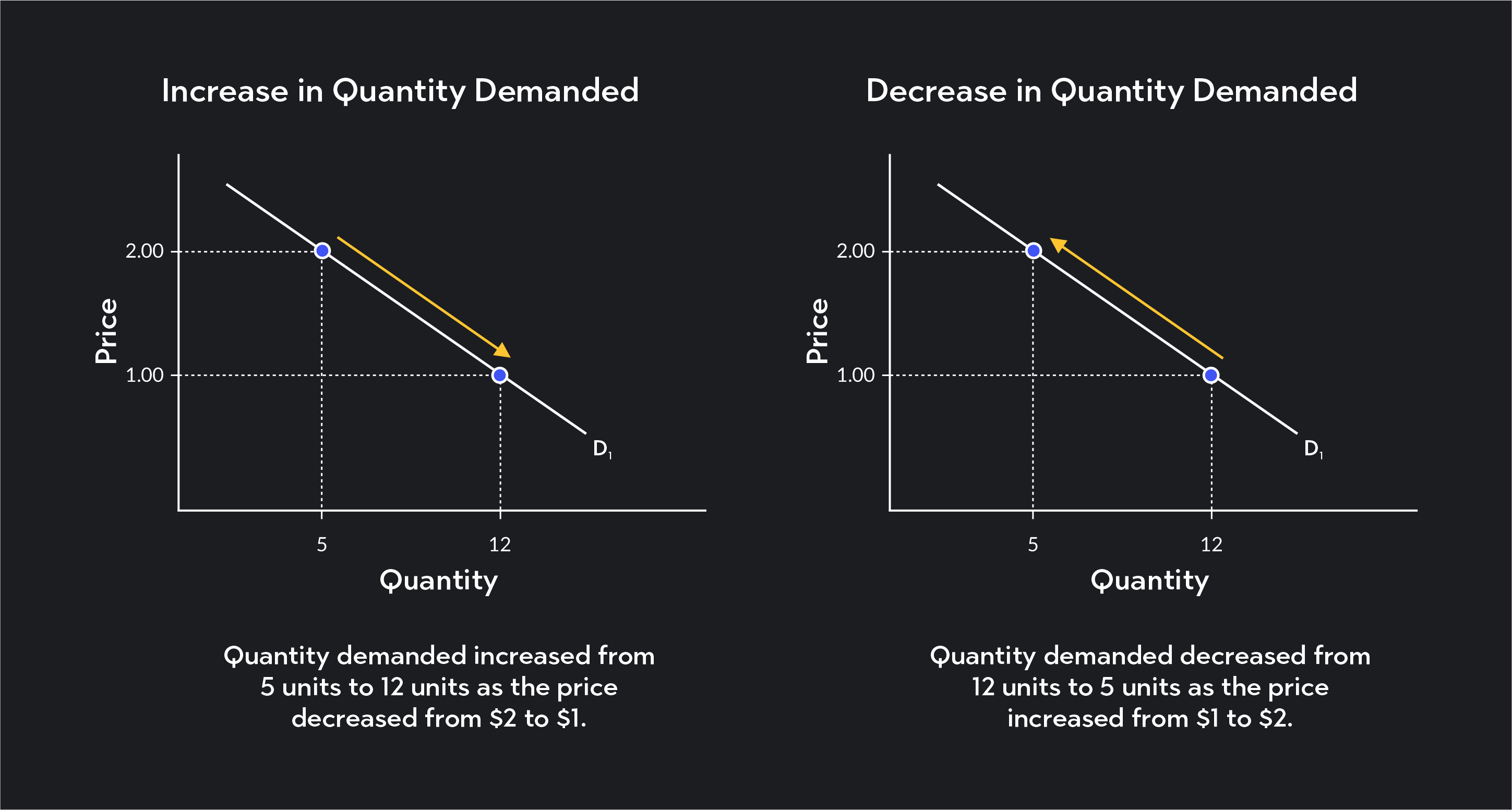

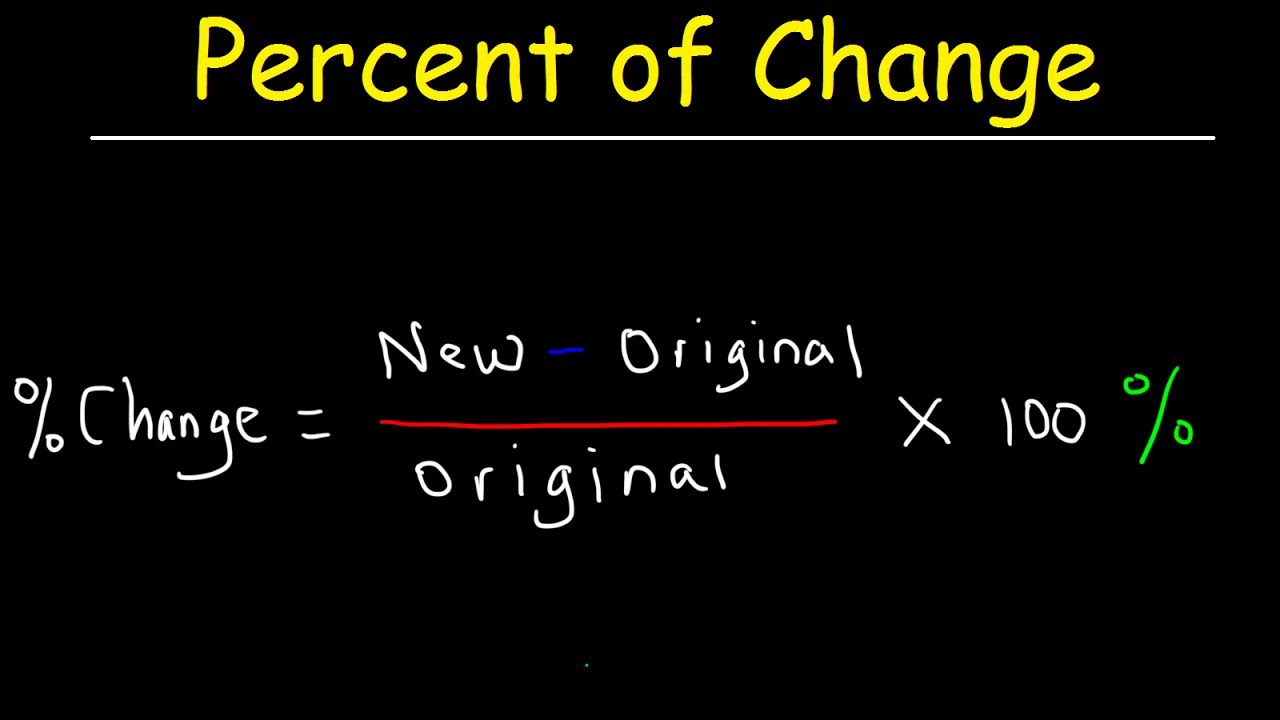

Decrease And Increase

What Changes Quantity Demanded Outlier

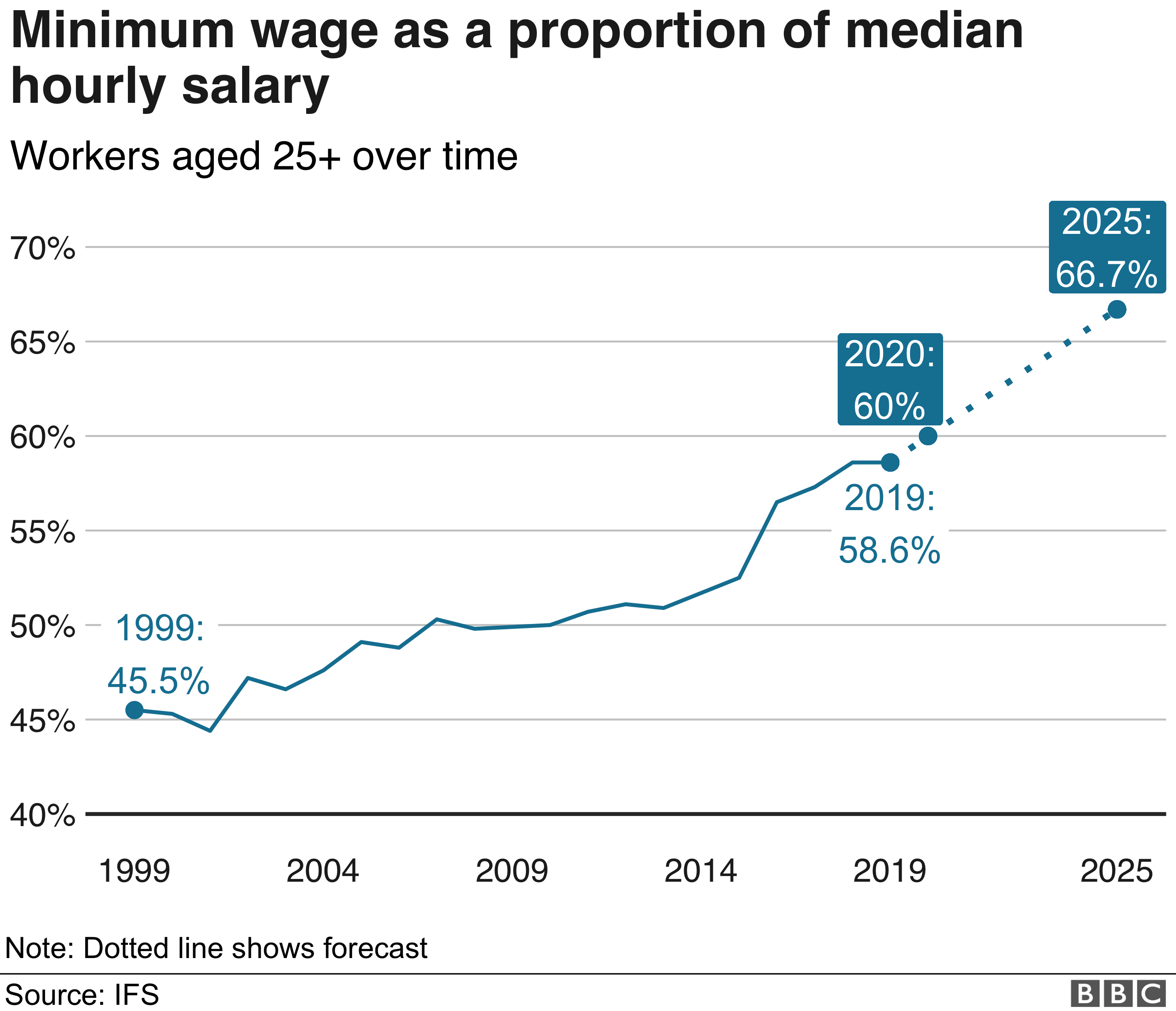

Minimum Wage 2024 Ny Cecily Phyllys

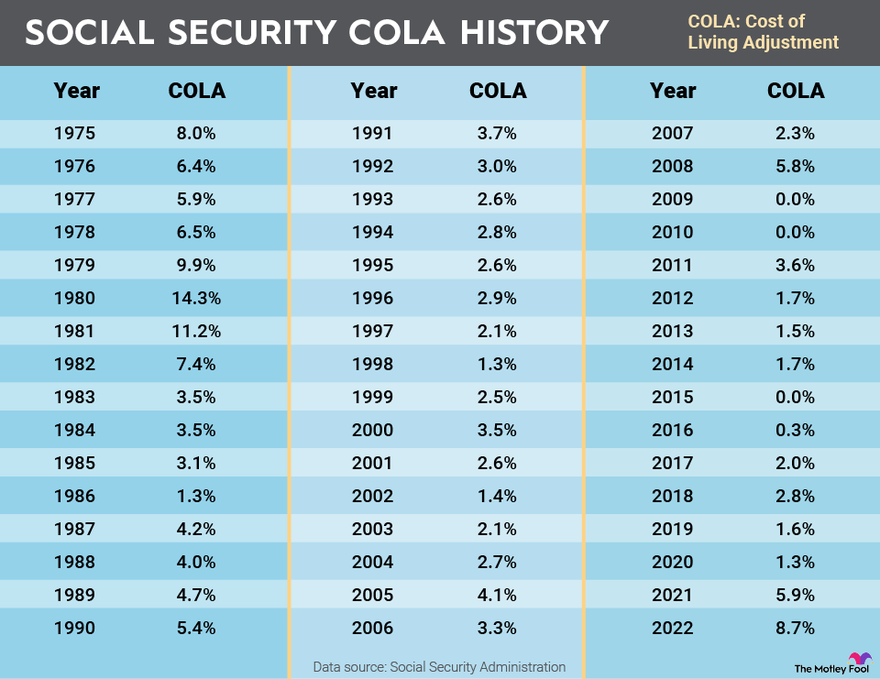

2025 Us Ssdi Cola Increase Prediction Camila Blair

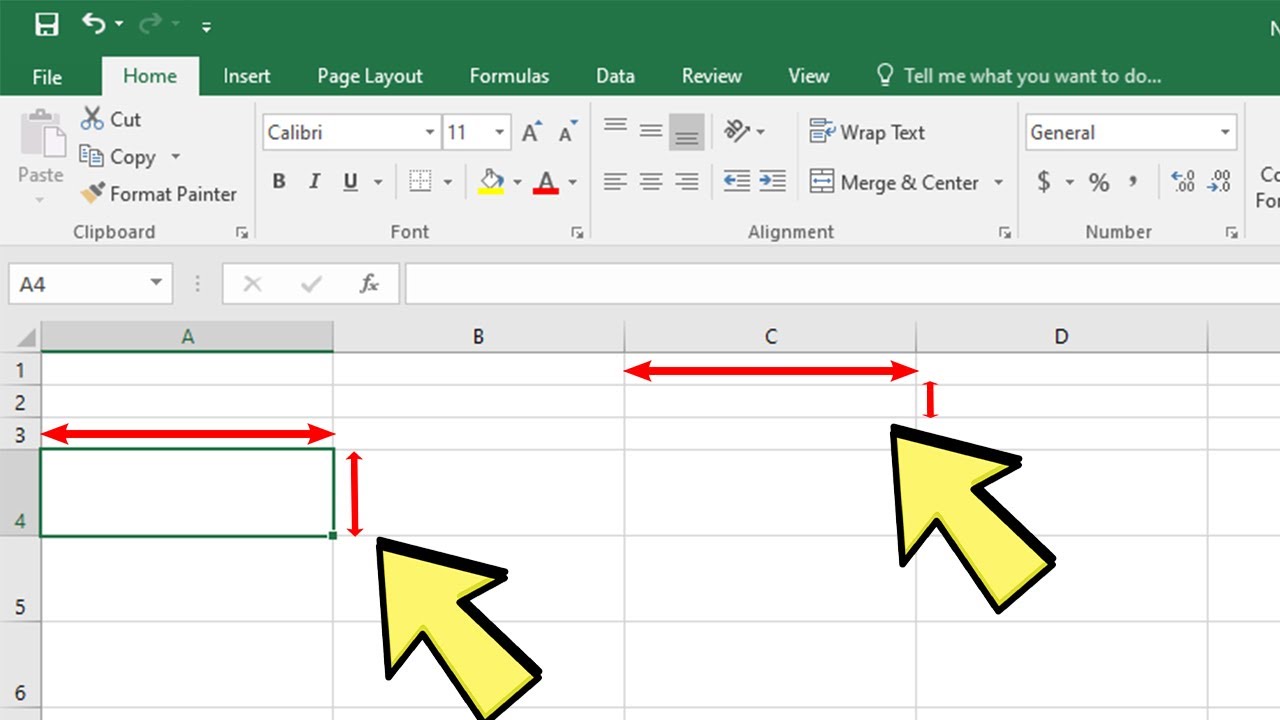

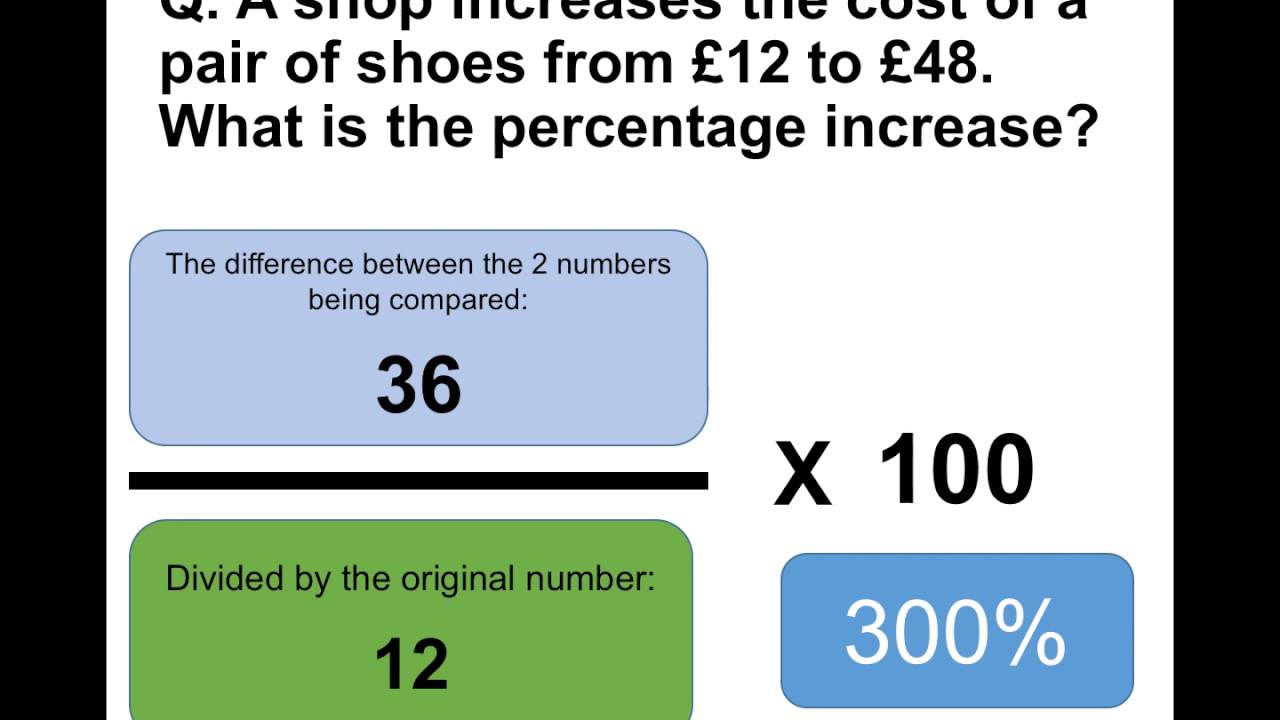

How To Increase By Percentage Crazyscreen21

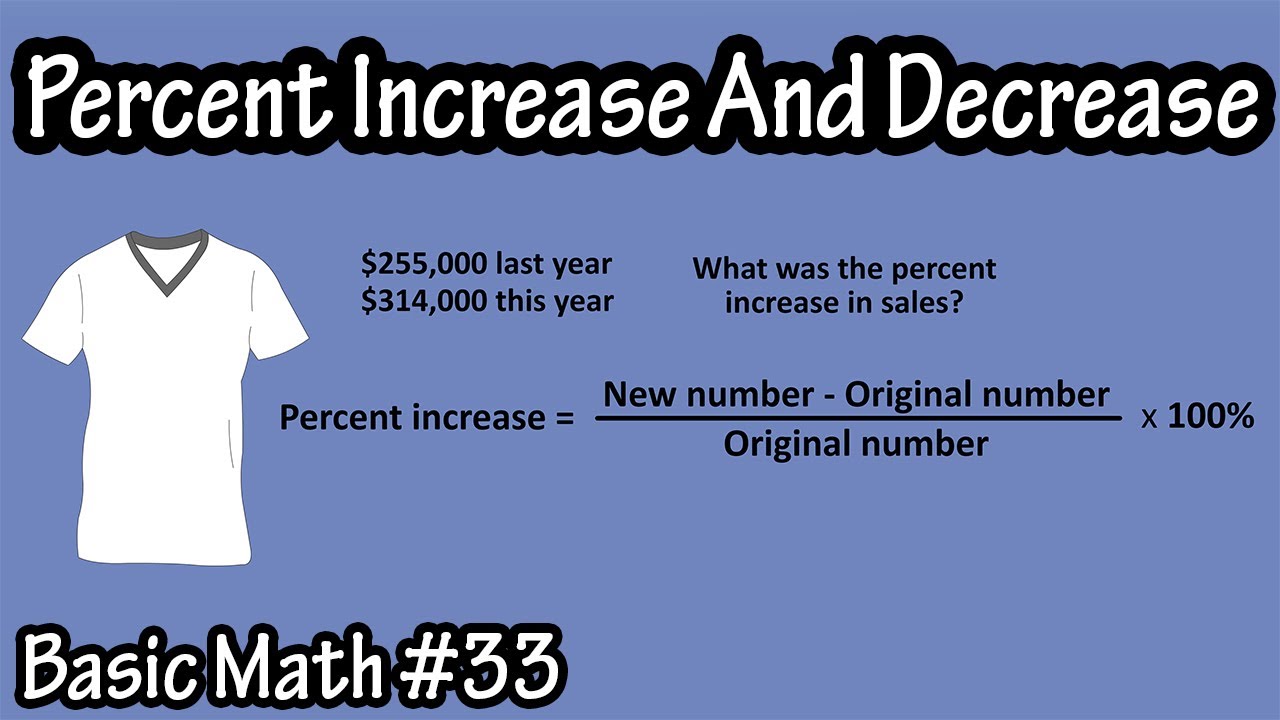

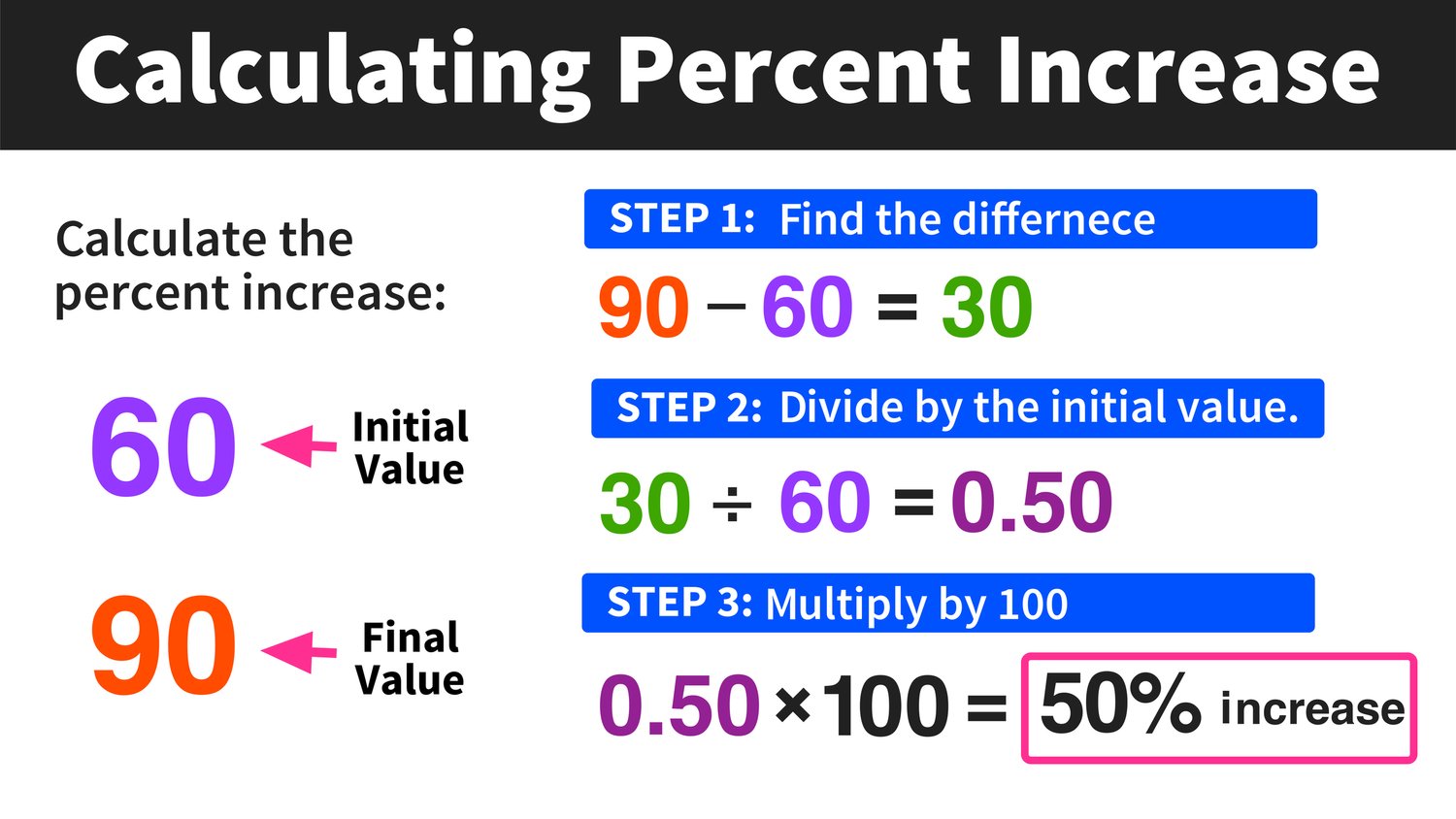

Calculating Percent Increase In 3 Easy Steps Mashup Math

Expected Salary Increase 2025 Lina Skye

Part Whole Percent Worksheet

Working Out The Percentage Increase

Rate Increase Letter Sample