What Is A Deferred Compensation Program are a functional solution for anybody wanting to create professional-quality papers quickly and quickly. Whether you require custom-made invites, resumes, organizers, or calling card, these layouts allow you to individualize web content easily. Simply download the theme, edit it to match your requirements, and publish it at home or at a print shop.

These themes save money and time, using a cost-effective option to working with a developer. With a wide variety of designs and layouts offered, you can discover the excellent style to match your personal or business requirements, all while maintaining a polished, specialist look.

What Is A Deferred Compensation Program

What Is A Deferred Compensation Program

Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Form W 4 PDF Form 1040 ES Estimated Tax Texas State University staff can only answer general questions about Form W-4. It is recommended that employees use the IRS's Tax Withholding Estimator, (www.

Form IL W 4 Employee s and other Payee s Illinois Withholding

:max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png)

What Is Income Tax And How Are Different Types Calculated 60 OFF

What Is A Deferred Compensation ProgramYou must submit a Michigan withholding exemption certificate (form MI-W4) to your employer on or before the date that employment begins. If you fail or refuse. Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Consider completing a new Form W 4 each

Use lines 3, 4, and 5 below to have additional withholding per pay period under special agreement with your employer. 3 New York State amount ... Deferred Revenue Debit Or Credit And Its Flow Through The Financials Nys Deferred Compensation Limit 2024 Salary Willi Marjory

About Form W 4 Employee s Withholding Certificate

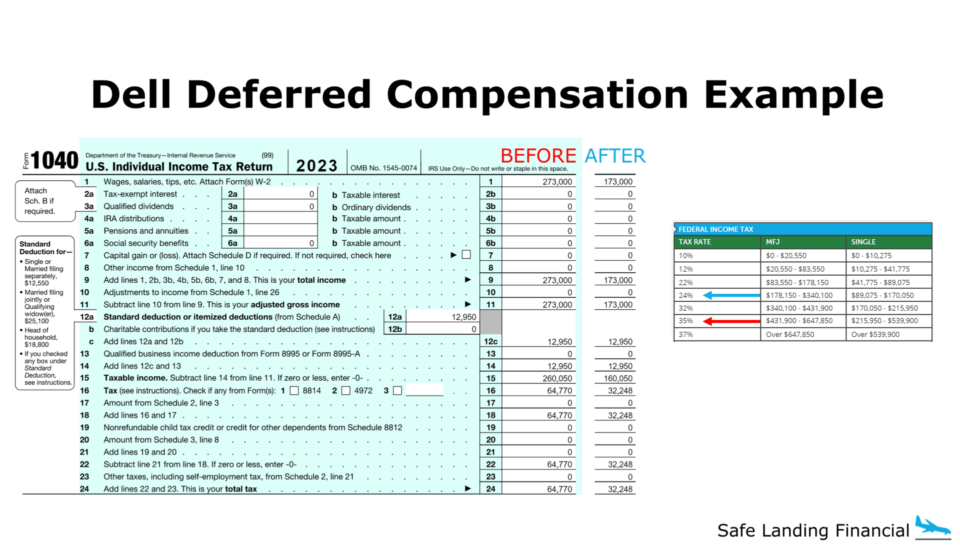

Financial Planning For Dell Employees

If you completed a 2024 Form W 4 you must complete Form W 4MN to determine your Minnesota withholding allowances What if I am exempt from Minnesota Max Deferred Comp 2025 Natka Vitoria

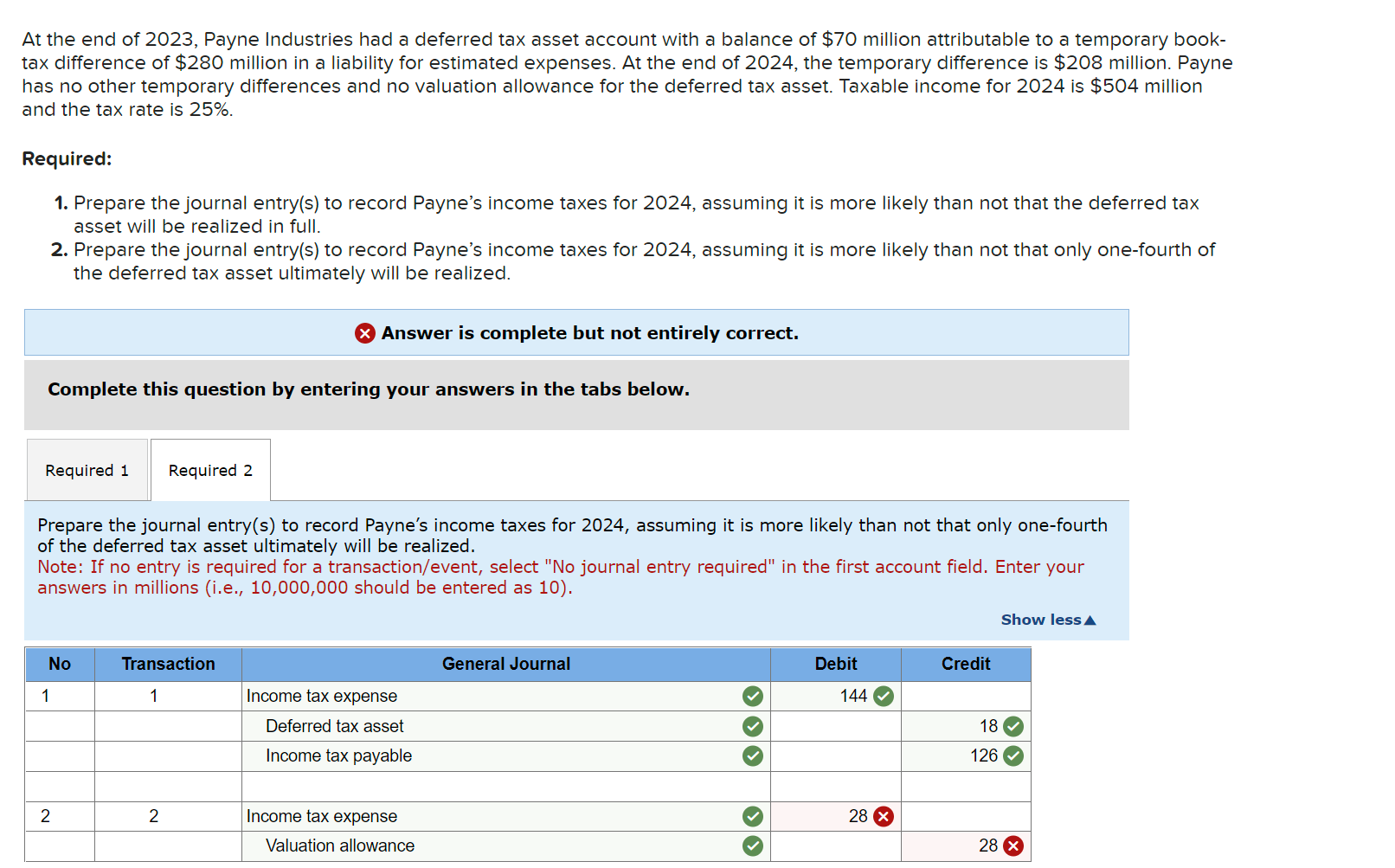

Give Form W 4 to your employer Your withholding is subject to review by the IRS OMB No 1545 0074 2023 Deferred Compensation Limits 2024 Andy Maegan Worked Example Accounting For Deferred Tax Assets The Footnotes Analyst

End 2024 Penny Blondell

Create Financial Waterfall Charts How To Customize Templates Mosaic

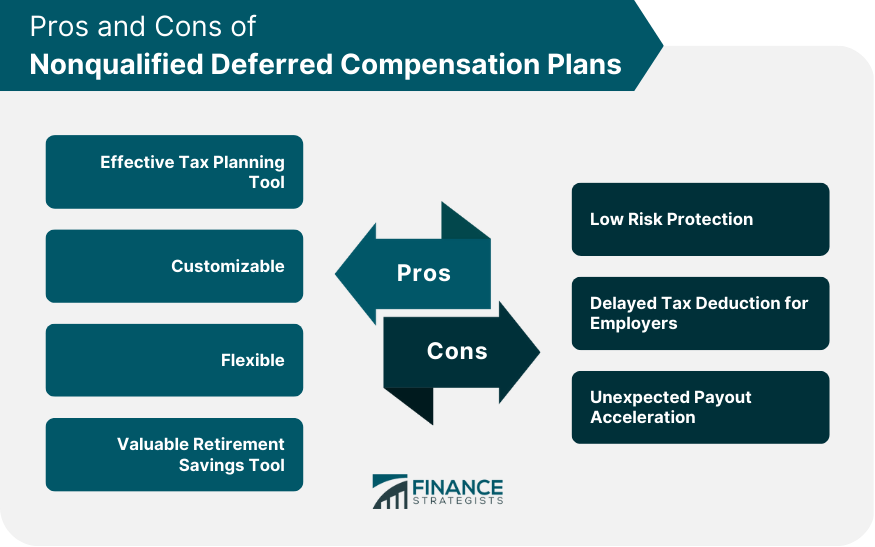

Non Qualified Deferred Compensation Plans NQDCs CIP Group

Workers Compensation Business Services Paso Robles Joint Unified

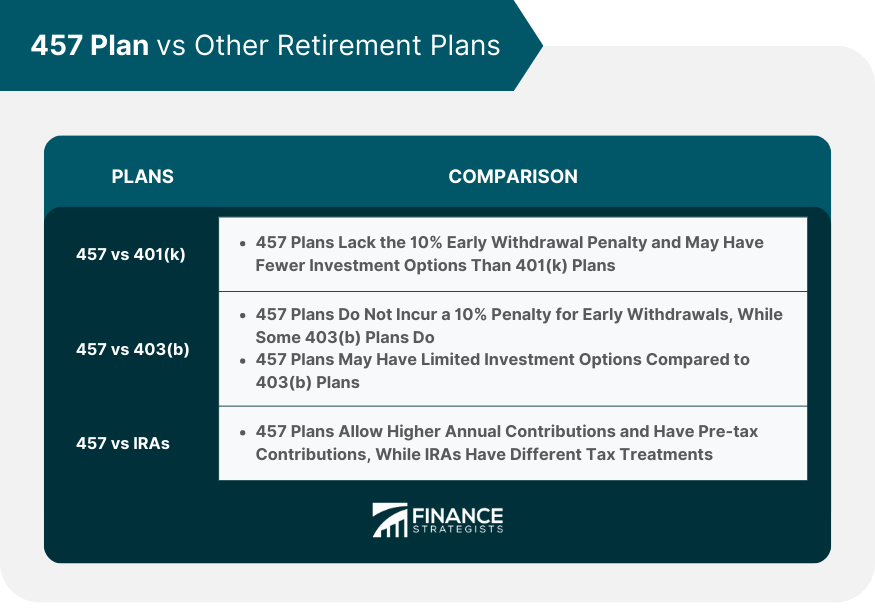

457 Deferred Compensation Plan Choosing Your Gold IRA

Max Deferred Comp 2025 Natka Vitoria

What Is A Deferred Compensation Plan

Max Deferred Comp 2025 Natka Vitoria

What Is Deferred Revenue Complete Guide Pareto Labs

Non Qualified Plans Compound Value Advisers