What Is Gstr 9 And 9c With Example are a versatile service for any individual aiming to develop professional-quality documents rapidly and conveniently. Whether you require custom invitations, returns to, planners, or calling card, these themes enable you to personalize material with ease. Simply download and install the theme, edit it to fit your requirements, and publish it at home or at a print shop.

These themes save time and money, providing an affordable choice to working with a designer. With a large range of styles and styles readily available, you can discover the best layout to match your personal or organization demands, all while preserving a refined, professional look.

What Is Gstr 9 And 9c With Example

What Is Gstr 9 And 9c With Example

1 Inch Scale 1 12 Scale Printables All printables marked with an asterisk also have black and white patterns in the Patterns section Free printables for you! Miniature. I periodically design miniature printables for myself. They can be anything, from boxes (for toys, hats, ...

FREE Printable Fold Out Doll House MMHS

How To Make GST Reconciliation In Excel Sheet For GSTR 9 GSTR 9C

What Is Gstr 9 And 9c With ExampleFree Dollhouse Miniature Printables From MariasMinis.com. Please enjoy these free printables! If you use them, please link to my website or social media if ... Dec 18 2022 Explore Sherri s board Free Printables Miniatures on Pinterest See more ideas about miniatures miniature printables dollhouse

We decided to do a round up of the best free dollhouse miniature printables on the web. But first things first: What is a Miniature Printable? GSTR 9C Reconciliation Statement Certification Filing Format Rules GSTR 9 And 9C COMPLETE PRACTICAL GUIDE Consult With Batuk

Free printables for you r Dollhouses Reddit

How To File GSTR 9 And 9C Online For FY 2022 23 GSTR 9 And 9C Class

Looking for miniature printables Check out these resources for free and paid printables for your dolls houses and miniatures GSTR 9 Annual Return What Is GSTR 9 MyBillBook

Visitors come here for free printable doll s house wallpaper there are more than 200 miniature wallpapers posted here GSTR 9 And 9C Edukating Comparison Explained Between GSTR 9 And GSTR 9C Forms

GSTR Return Form GSTR 1 2 3 4 5 6 7 8 9 10 11 Part 1 YouTube

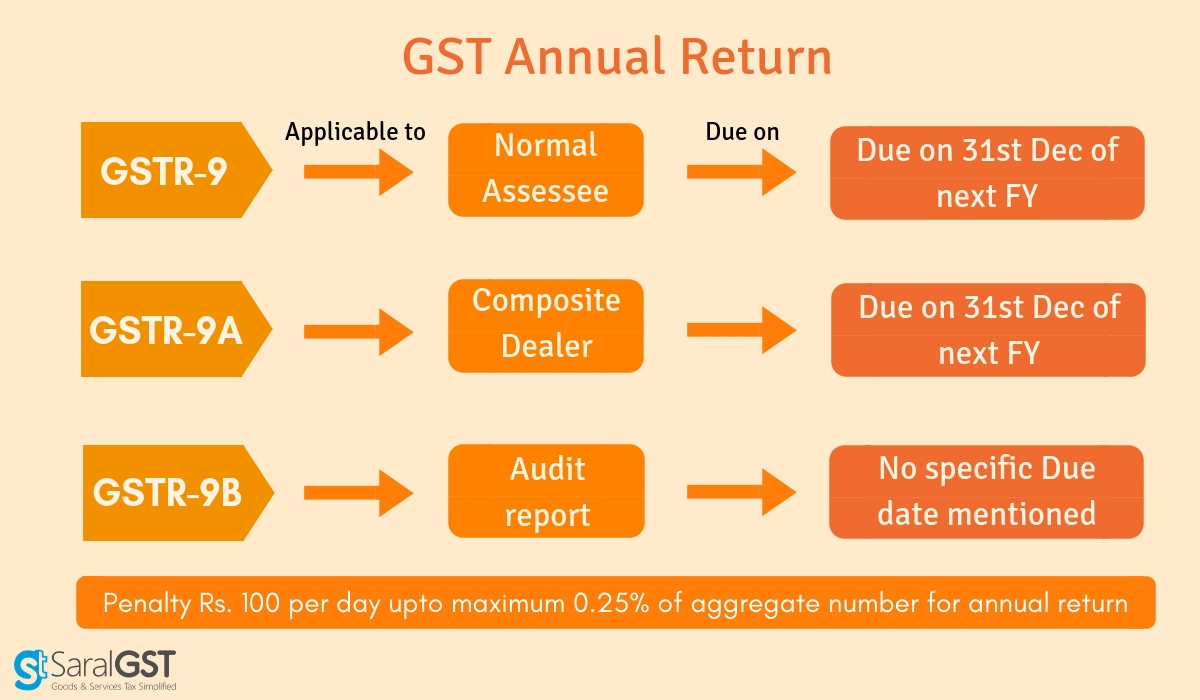

GSTR Annual Return 9 9C Due Date Applicability Threshold Limit

GSTR 9 GST ANNUAL RETURNS GSTR 9 9C For F Y 2021 2022 Changes In

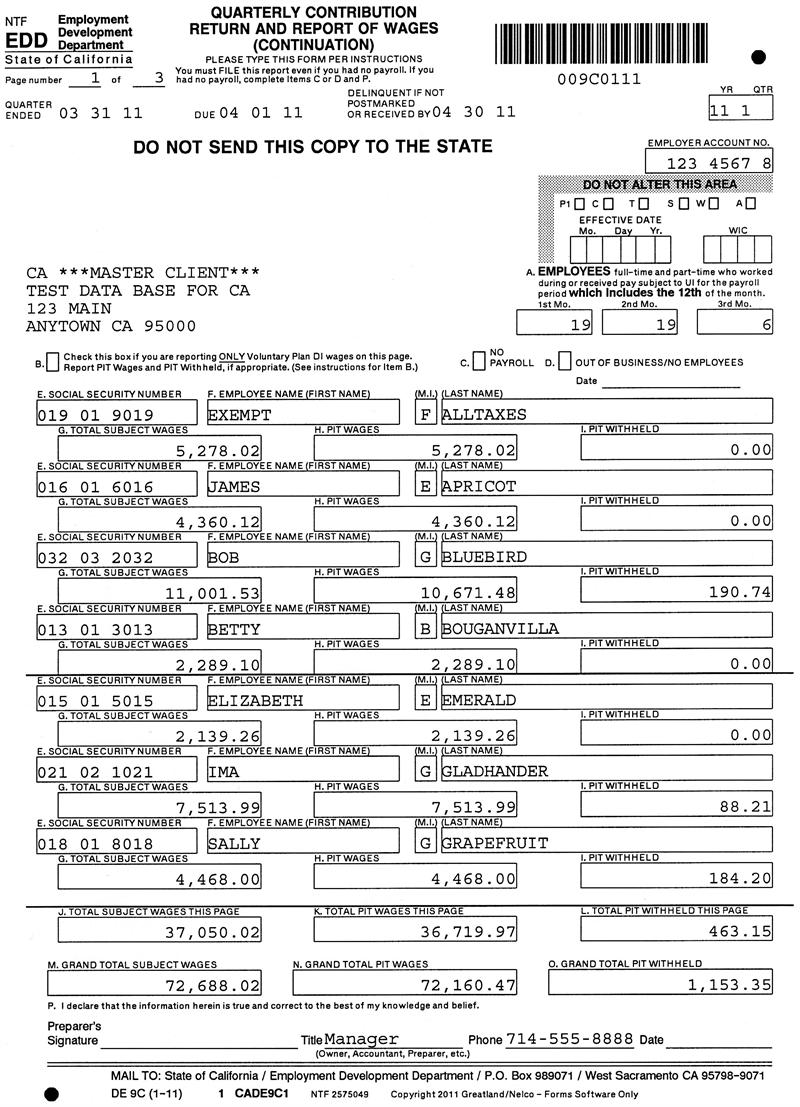

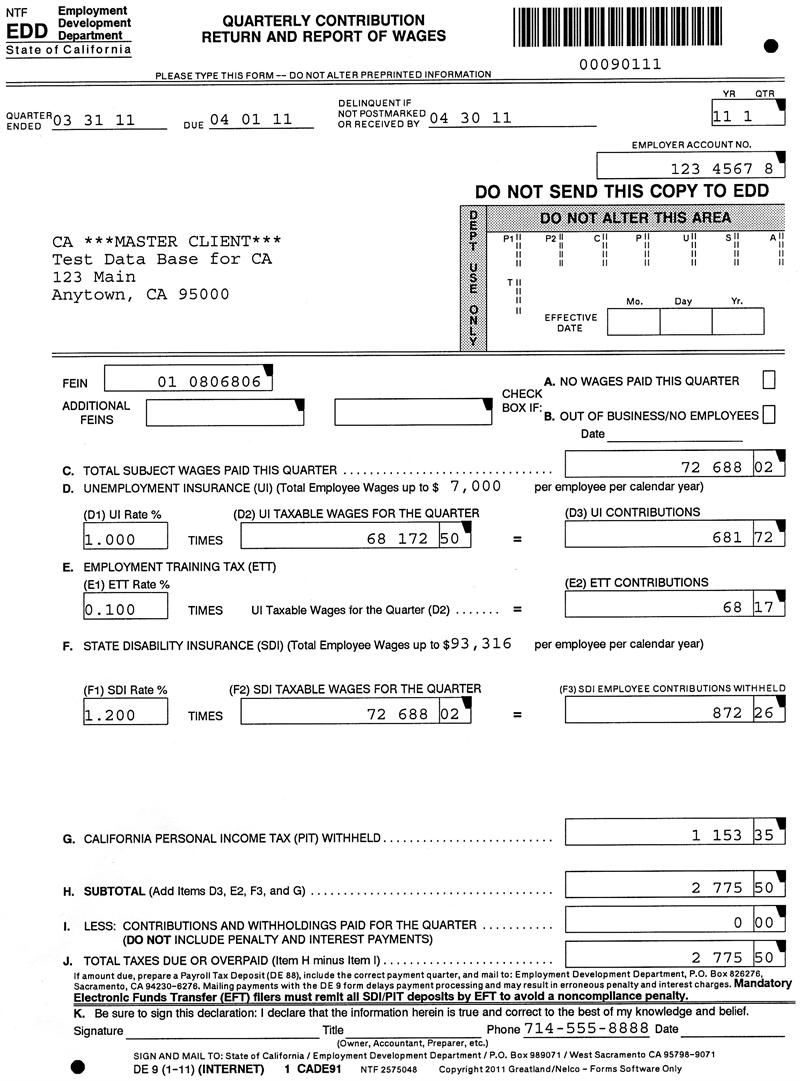

California DE 9 And DE 9C Fileable Reports

California DE 9 And DE 9C Fileable Reports

GSTR 9 Presentation

GSTR 9 Presentation

GSTR 9 Annual Return What Is GSTR 9 MyBillBook

GSTR 9 Annual GST Return

GSTR 9C How To File GSTR 9C Due Date MyBillBook