What Is Maine Sales Tax On Food are a versatile option for any individual seeking to produce professional-quality files quickly and quickly. Whether you need personalized invitations, returns to, planners, or calling card, these themes permit you to individualize content effortlessly. Merely download and install the template, modify it to match your requirements, and publish it in the house or at a print shop.

These themes conserve time and money, using a cost-efficient alternative to hiring a developer. With a wide range of styles and styles readily available, you can discover the perfect style to match your individual or organization demands, all while maintaining a refined, professional look.

What Is Maine Sales Tax On Food

What Is Maine Sales Tax On Food

Our detailed wedding checklist maps out your journey from the moment you get engaged to the six month mark and through to the day after Use our 12 month wedding checklist to keep on top of all the wedding tasks you need to complete on the run up to your wedding day.

Wedding Checklist Worksheet pdf Amazon S3

Which States Tax The Sale Of Food For Home Consumption In 2017

What Is Maine Sales Tax On FoodFirst few were: discuss a budget, build a vision board for your wedding, pick season and year, look at venues online, book the tours (tour them), ect. Big Picture Wedding Checklist Ultimate Wedding Budget Checklist 90 Day Wedding Planning Checklist Elopement Checklist Barn Wedding

Engaged? Start planning with our free wedding printables! From wedding checklists and timelines to worksheets and questionnaires, ... Form St 7c Maine Sales And Use Tax Return Printable Pdf Download Classic Black Shaker Sink Base Cabinet 33 RTA Blue Lane Cabinety

Wedding planning checklist 3 pdf Pinterest

:max_bytes(150000):strip_icc()/GettyImages-185415626-5ab286498e1b6e00377efa93.jpg)

When Computers Has Then Stubborn Is That Insured Have One Compulsory

This is a 30 page Google Sheets workbook I created to help go from being newly engaged and gathering ideas all the way to scheduling the day of your wedding Missouri Income Tax Rates 2025 Harry L Mustar

The checklists are designed to help couples plan their wedding day and include sections for music ceremony details reception details and a timeline of events Irs Estimated Tax Payment Schedule 2024 Rosie Koralle HB25 1296 Tax Expenditure Adjustment CCW

Grocery Food

Tax Percentage In South Africa 2024 Image To U

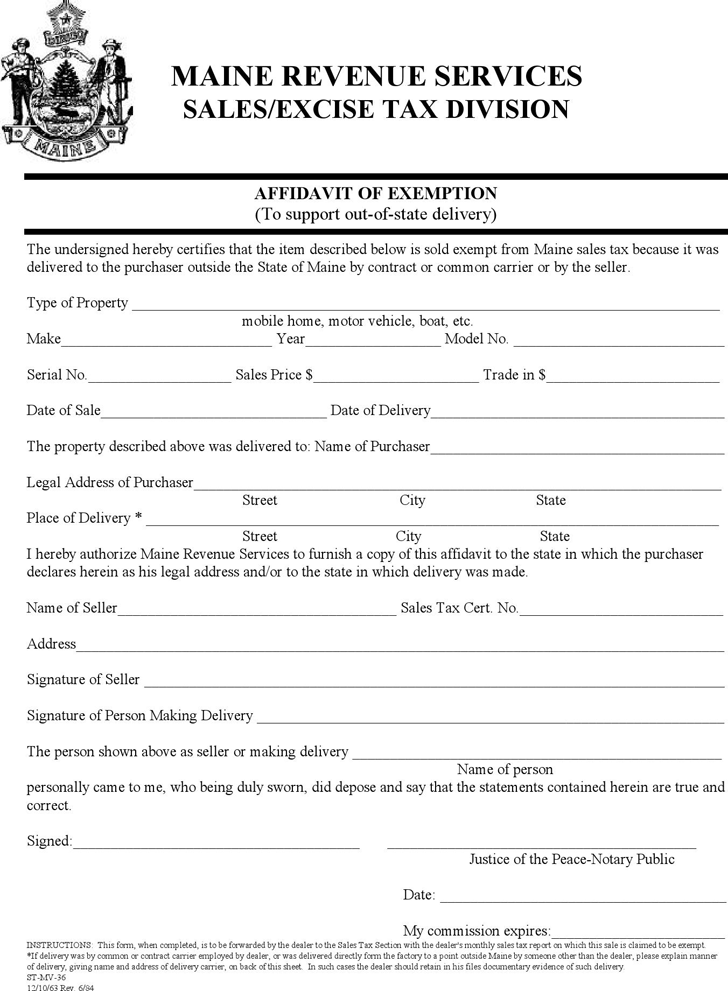

Sales And Use Tax Identification Numbers TheBusinessProfessor

Specialty Tax Consulting Utility Sales Tax Exemption

Maine Sales Tax 2024 2025

Maine Sales Tax 2024 2025

Tax Free Maryland 2025 Brianna J Summerville

.png)

Missouri Income Tax Rates 2025 Harry L Mustar

Maine Sales Tax Rate 2025 J David Oney

Nm State Sales Tax 2025 Lily C Alcock