What Is The Irs Form 5498 Used For are a versatile remedy for any individual wanting to produce professional-quality papers swiftly and conveniently. Whether you need custom invitations, returns to, planners, or business cards, these design templates allow you to customize content easily. Merely download the template, edit it to suit your needs, and publish it at home or at a printing shop.

These design templates conserve money and time, supplying an affordable alternative to employing a designer. With a variety of styles and formats readily available, you can locate the excellent style to match your individual or service requirements, all while maintaining a refined, expert appearance.

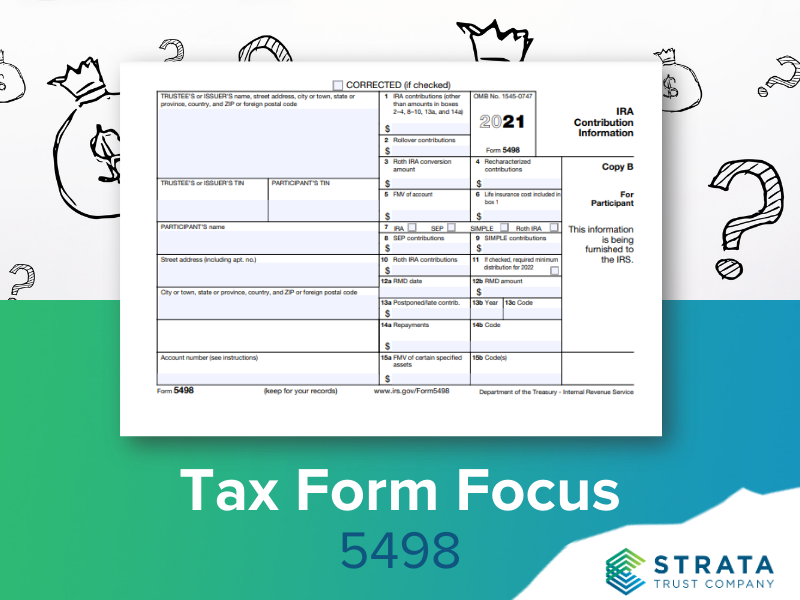

What Is The Irs Form 5498 Used For

What Is The Irs Form 5498 Used For

Dots and Boxes is a pencil and paper game that probably every child and adult Just click on the pages above to download the printable Dots and boxes printable game can be played by the whole family. All you need is some pens and out dot and boxes template.

Dot game template TPT

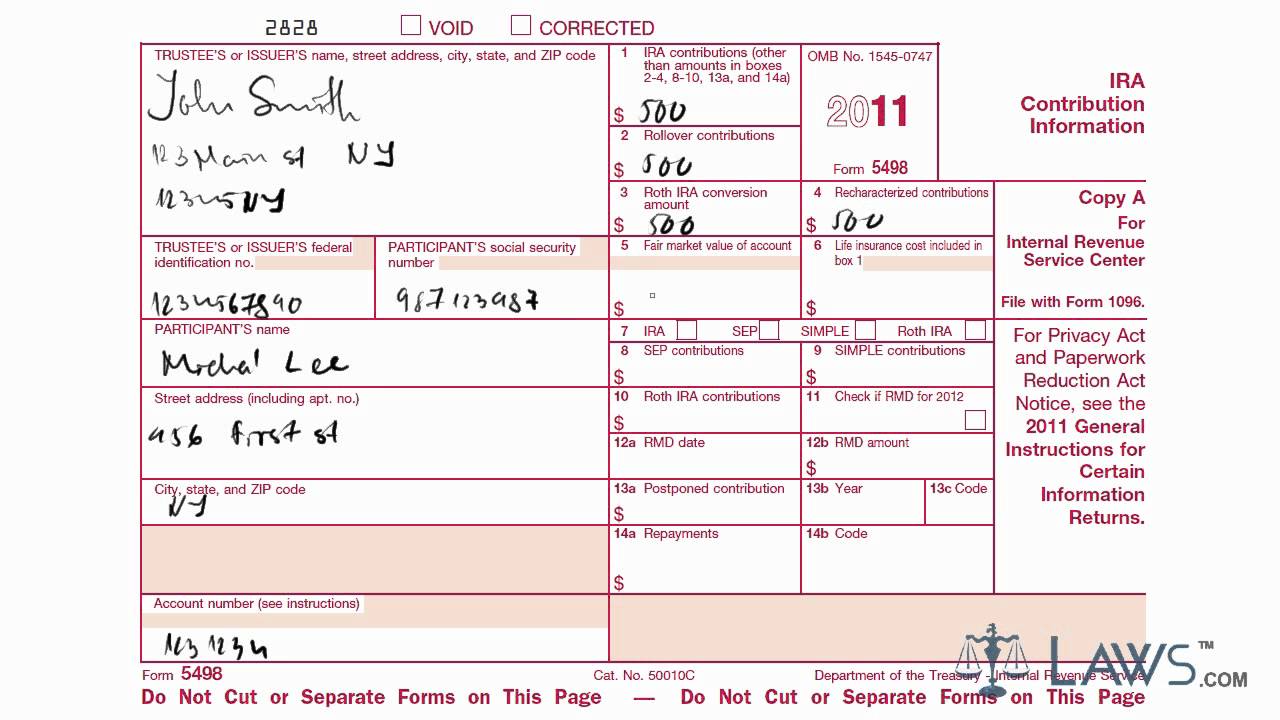

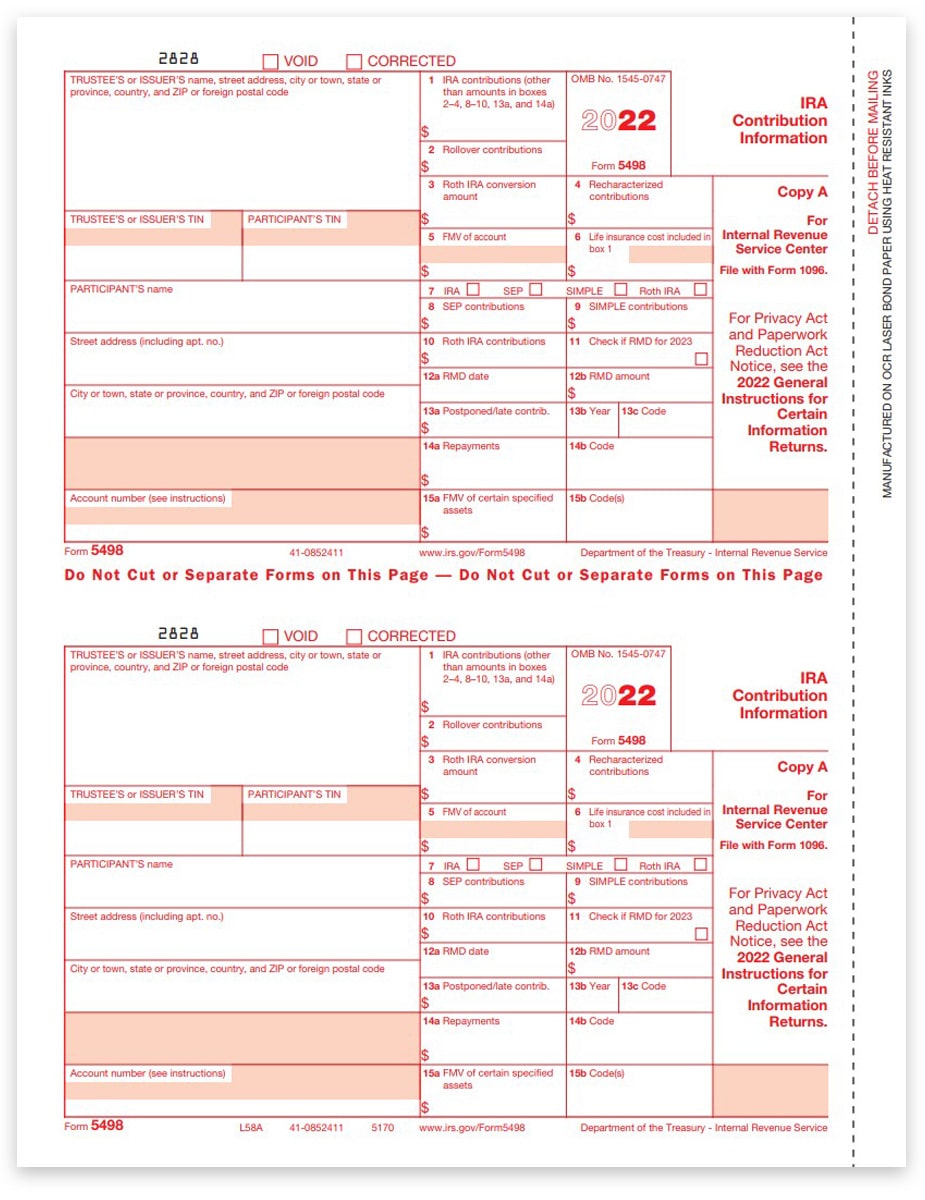

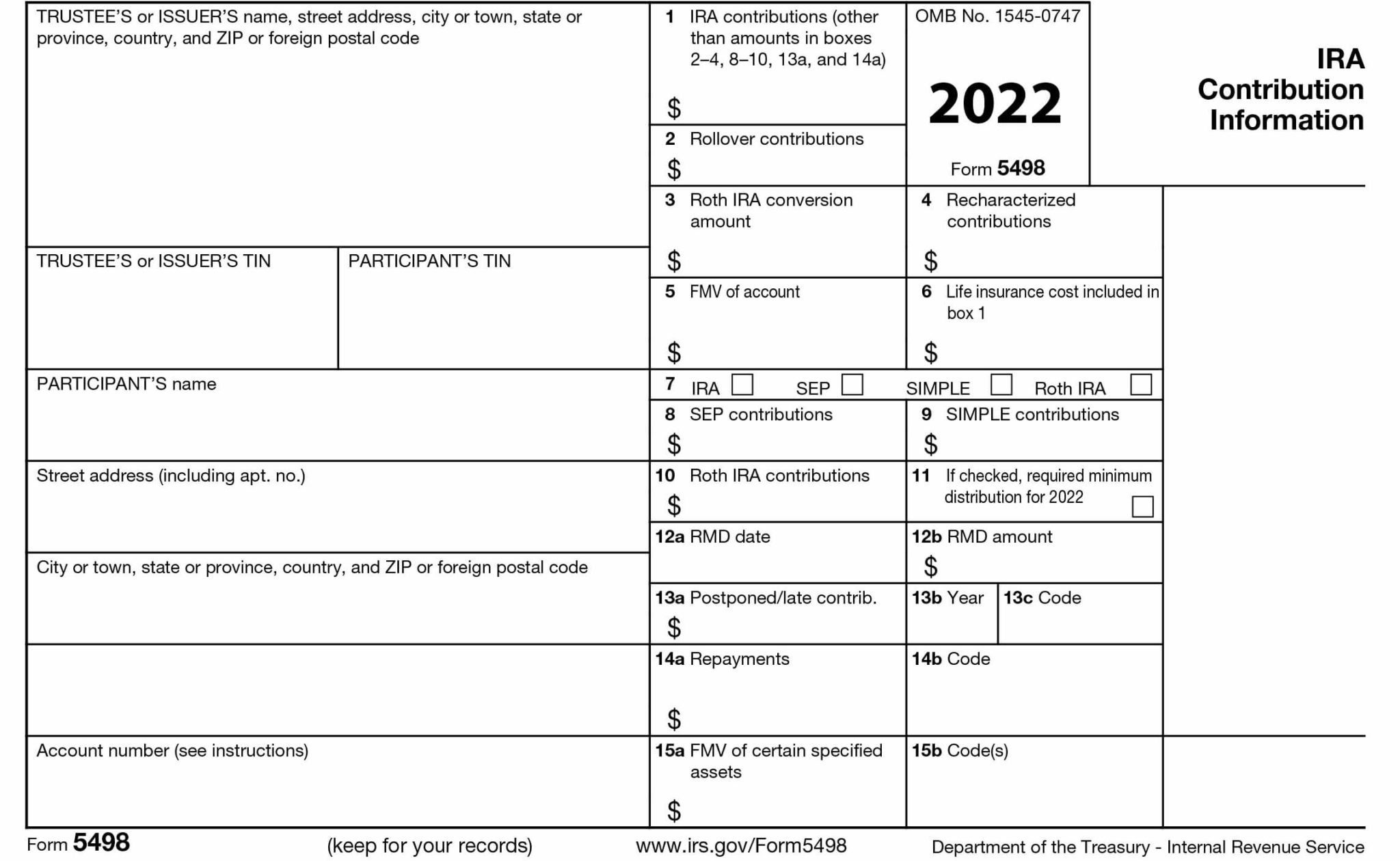

Learn How To Fill The Form 5498 Individual Retirement Account

What Is The Irs Form 5498 Used ForDots to dots game, Connect the Dots games, free printable Dot To Dot Puzzles and Activities for kids,Free Printable Dot To DotEaster Preschool Worksheets. Dots to boxes is a classic pencil and paper game a perfect travel game for the whole family Download now

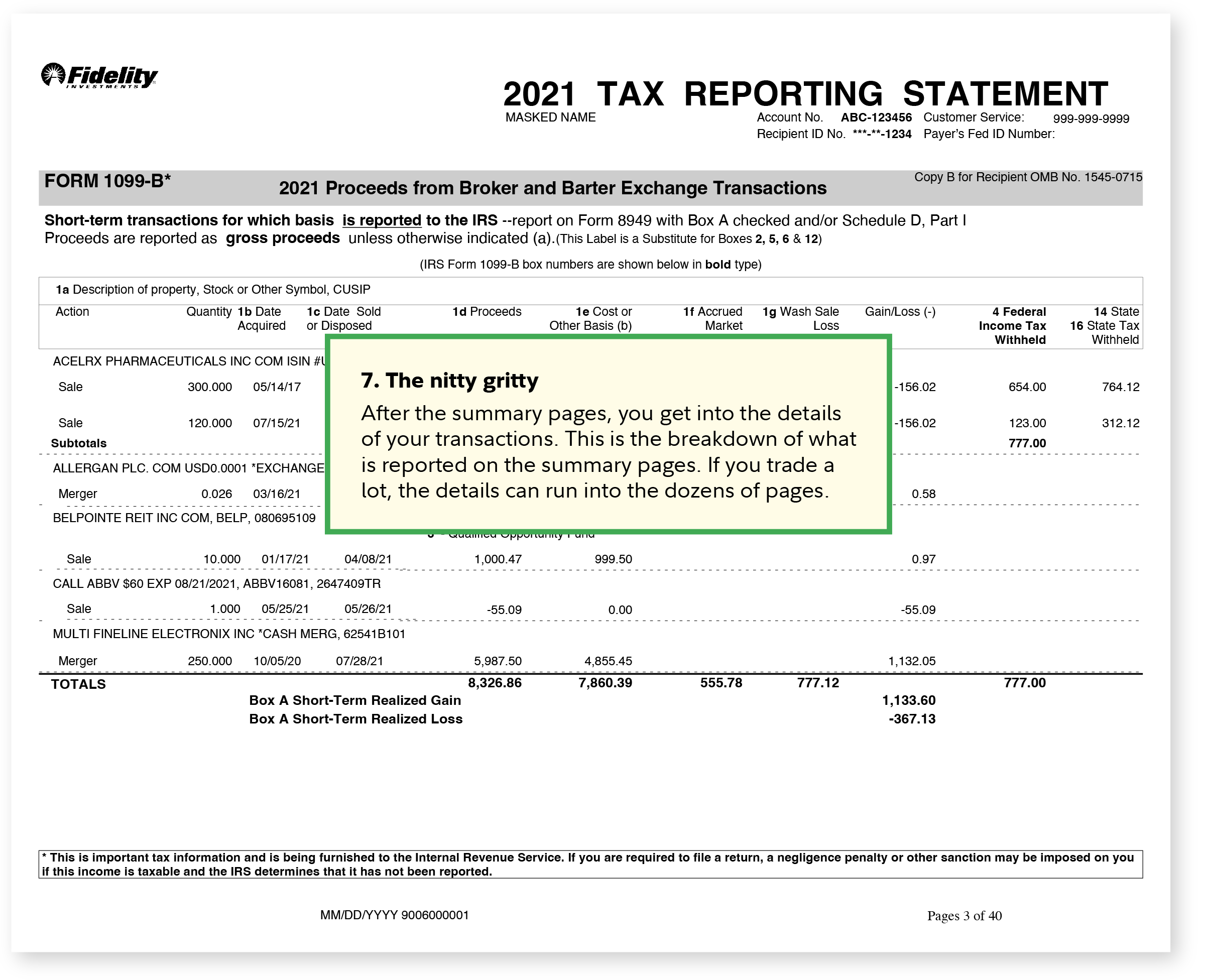

... Dots Paper Game - Dots Travel Game - Dot Box Game - Dots Game. IRS Form 5472 An Overview Tax Law Advocates 2024 Form 5498 Yetta Katerine

Free Dots And Boxes Printable Game Template Just Family Fun

ClausLochlan

This handy dots game printable template PDF will make it easy to play the classic dots and boxes pencil and paper game Backdoor IRA Gillingham CPA

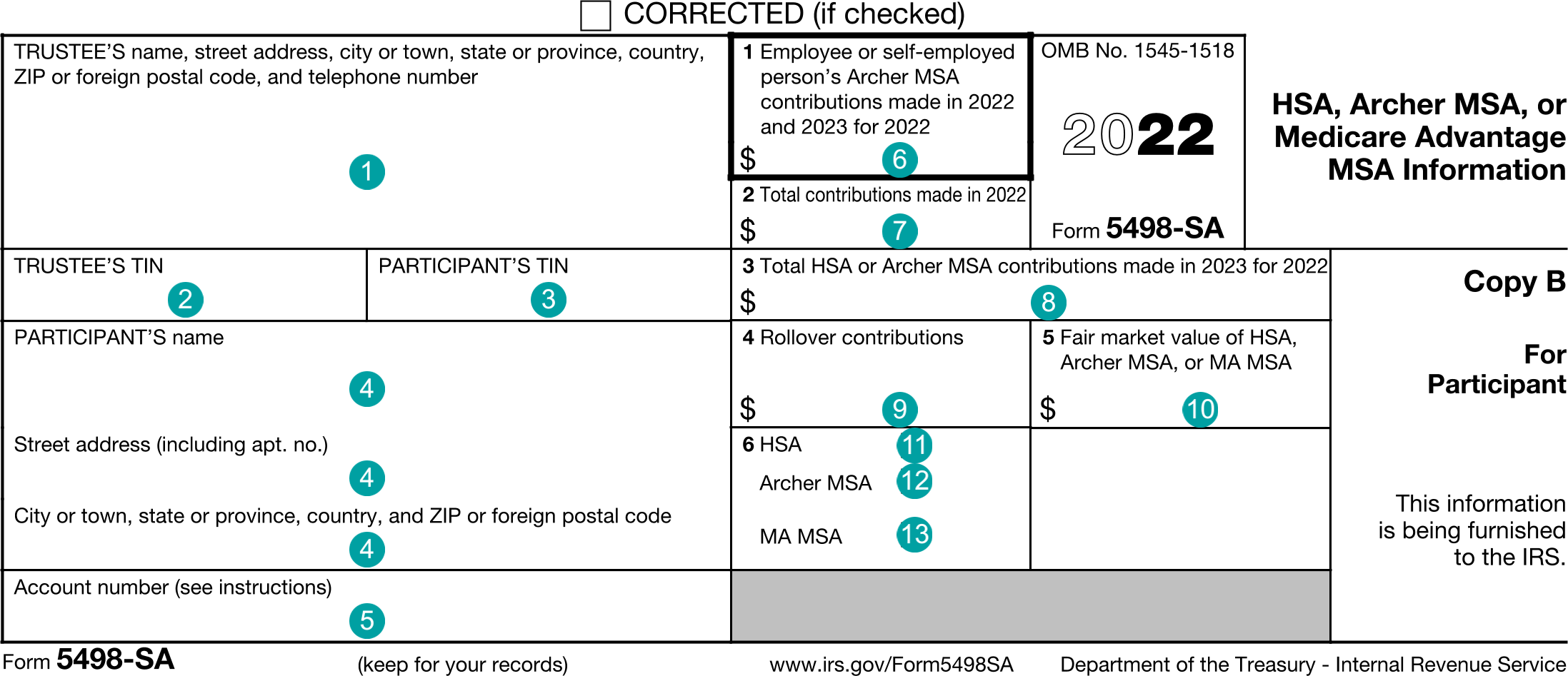

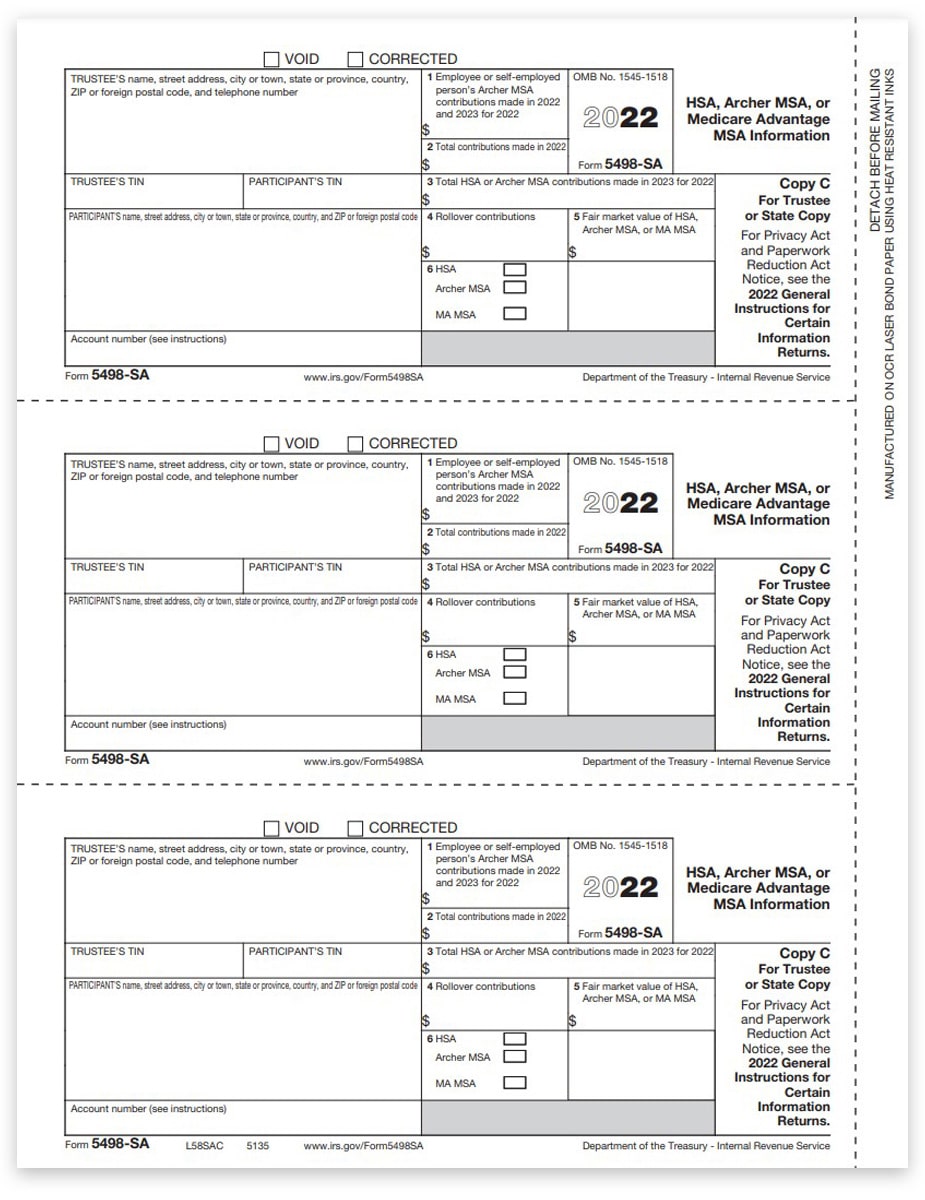

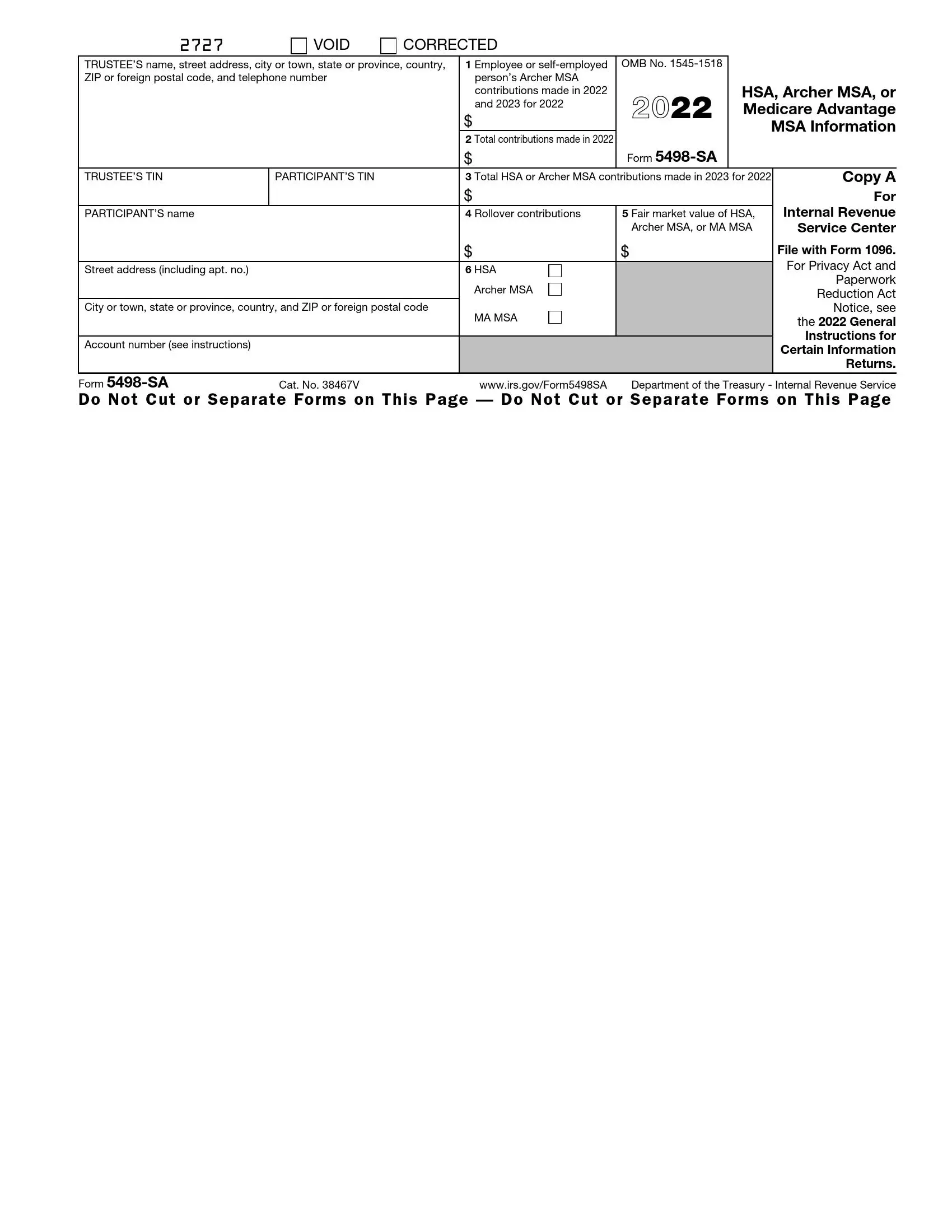

Players 2 or more In a grid below take turns drawing a single horizontal or vertical line between two dots The player who completes the fourth side of a Benefits 101 IRS Form 1095 The Spot What Is IRS Form 5498 SA BRI Benefit Resource

IRS Form 5498 Walkthrough ARCHIVED COPY READ COMMENTS ONLY YouTube

IRS Form 1099 SA What It Is Who Has To File And How 48 OFF

What Is Form 5498 And How Does It Affect My Taxes 58 OFF

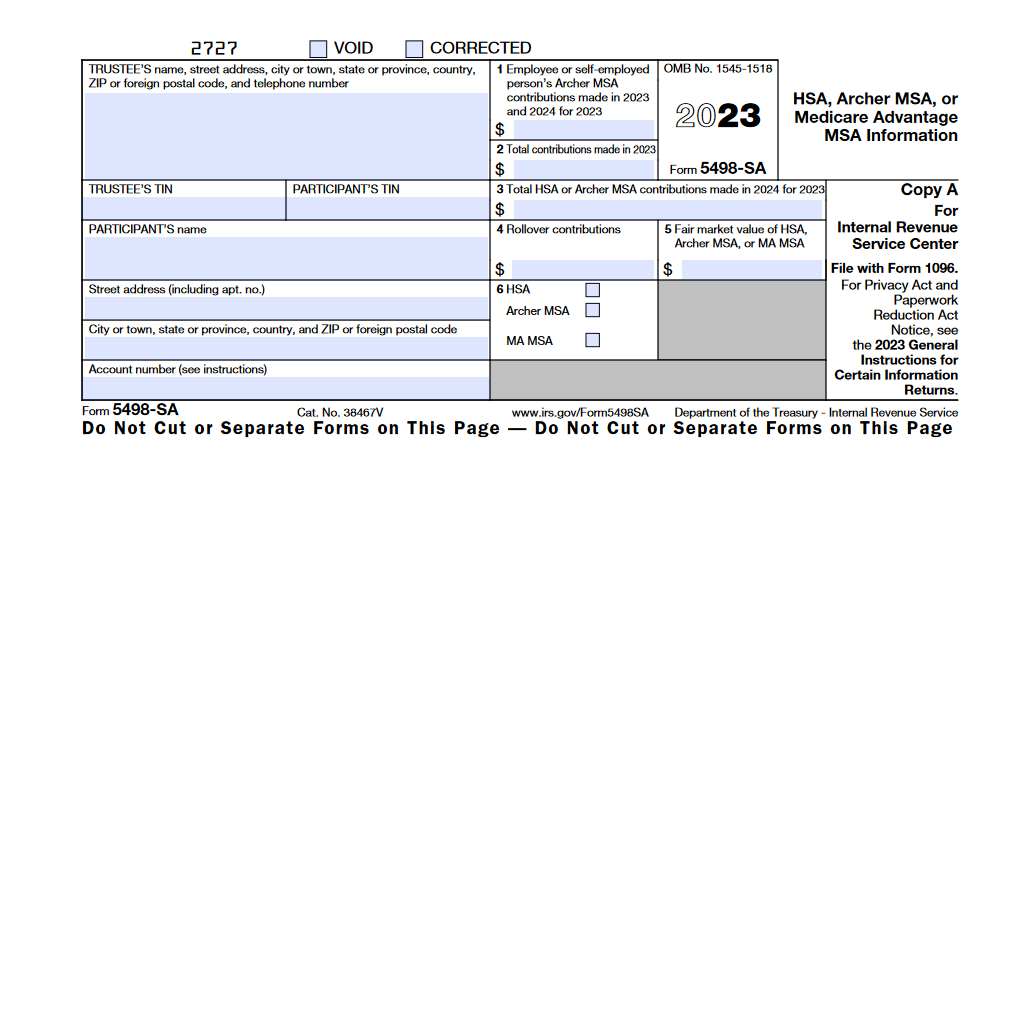

What Is IRS Form 5498 SA BRI Benefit Resource 57 OFF

What Is IRS Form 5498 SA BRI Benefit Resource 57 OFF

What Is IRS Form 5498 SA BRI Benefit Resource 57 OFF

What Is IRS Form 5498 SA BRI Benefit Resource 57 OFF

Backdoor IRA Gillingham CPA

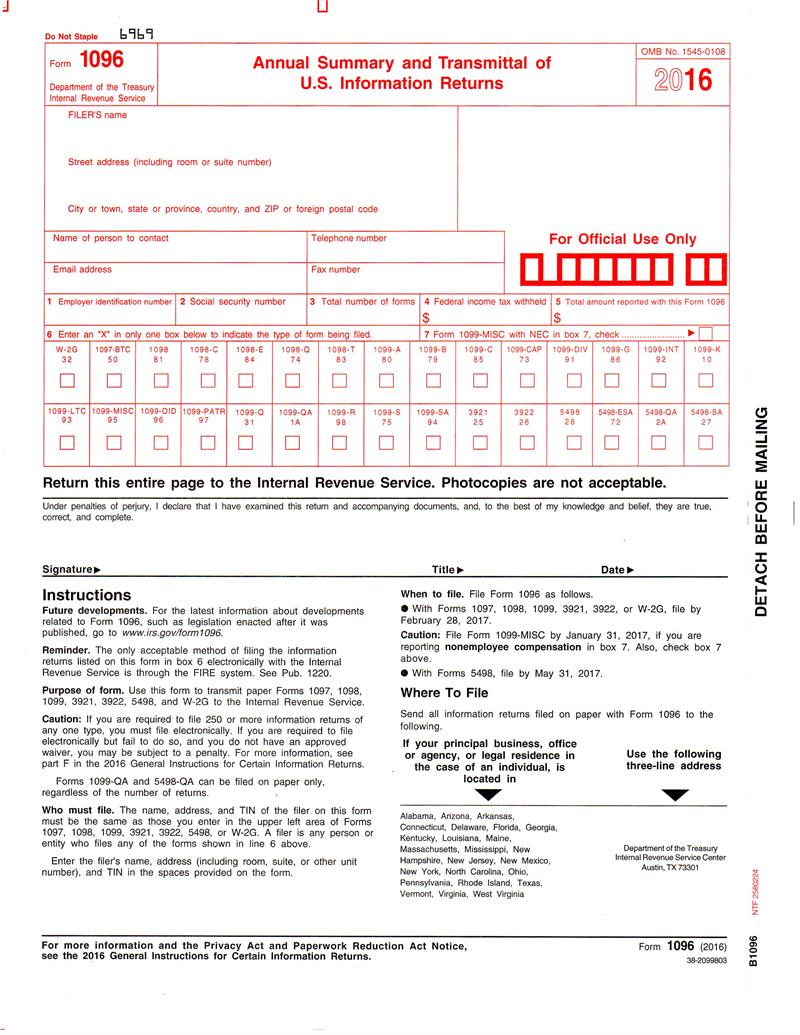

Form 1096 Transmittal Of Forms 1098 1099 5498 And W 2G To The IRS

Form 5498 2024 2025