What Times What Equals 300 are a flexible solution for anyone seeking to create professional-quality files quickly and conveniently. Whether you require custom-made invitations, returns to, planners, or business cards, these templates allow you to customize material easily. Merely download and install the design template, modify it to suit your requirements, and publish it in the house or at a printing shop.

These layouts save time and money, using an affordable option to working with a designer. With a wide range of styles and styles readily available, you can locate the best design to match your individual or service requirements, all while preserving a refined, specialist appearance.

What Times What Equals 300

What Times What Equals 300

Need for game night some friends struggle to recognize NFL team logos Thought itd be fun to test knowledge maybe learn a bit too Free NFL Team Logos coloring pages. All of the NFL team logos for coloring in one place free to print, download or color. Get them now!

Printable NFL Logos Images Search Shopping Bing

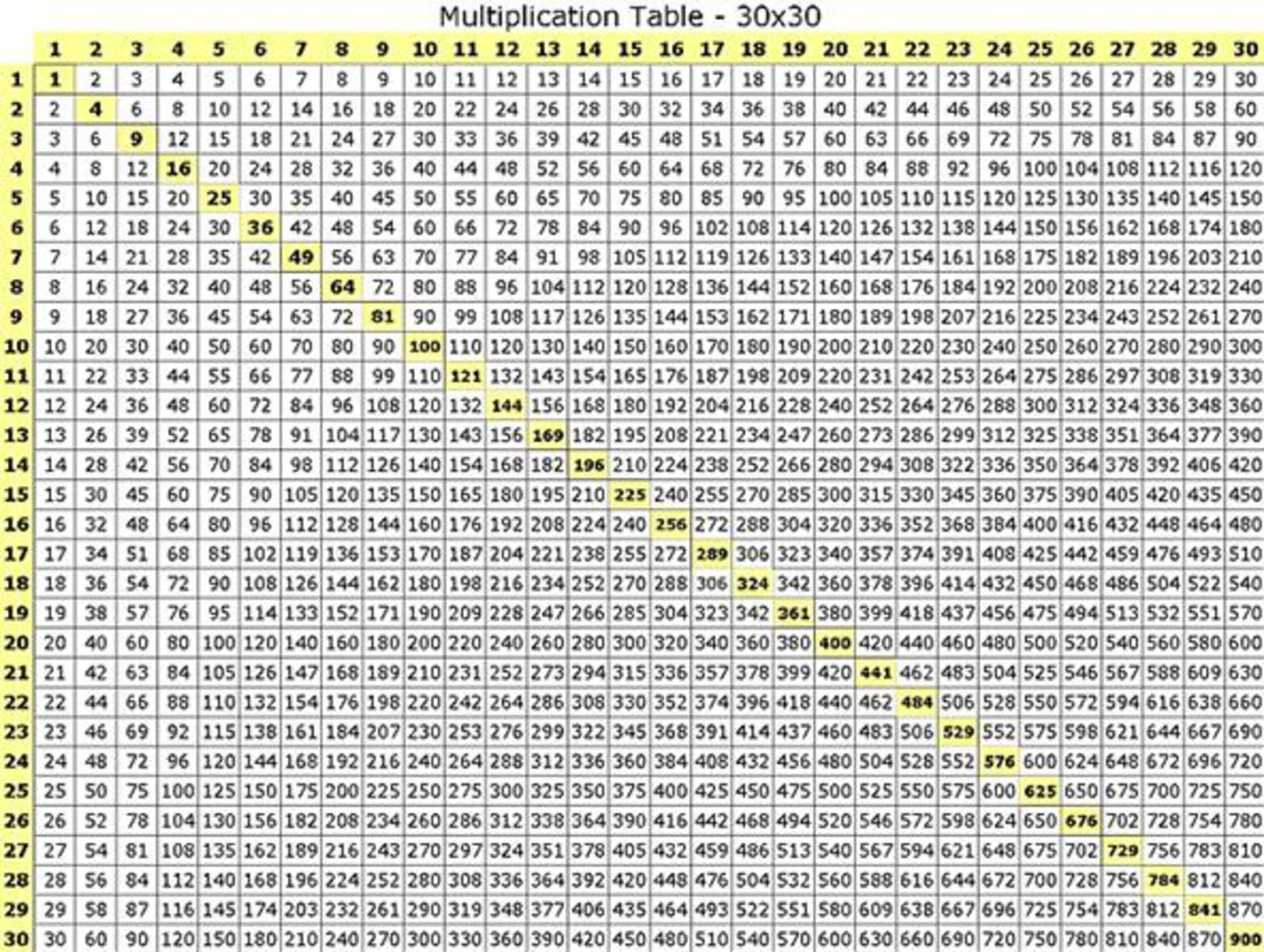

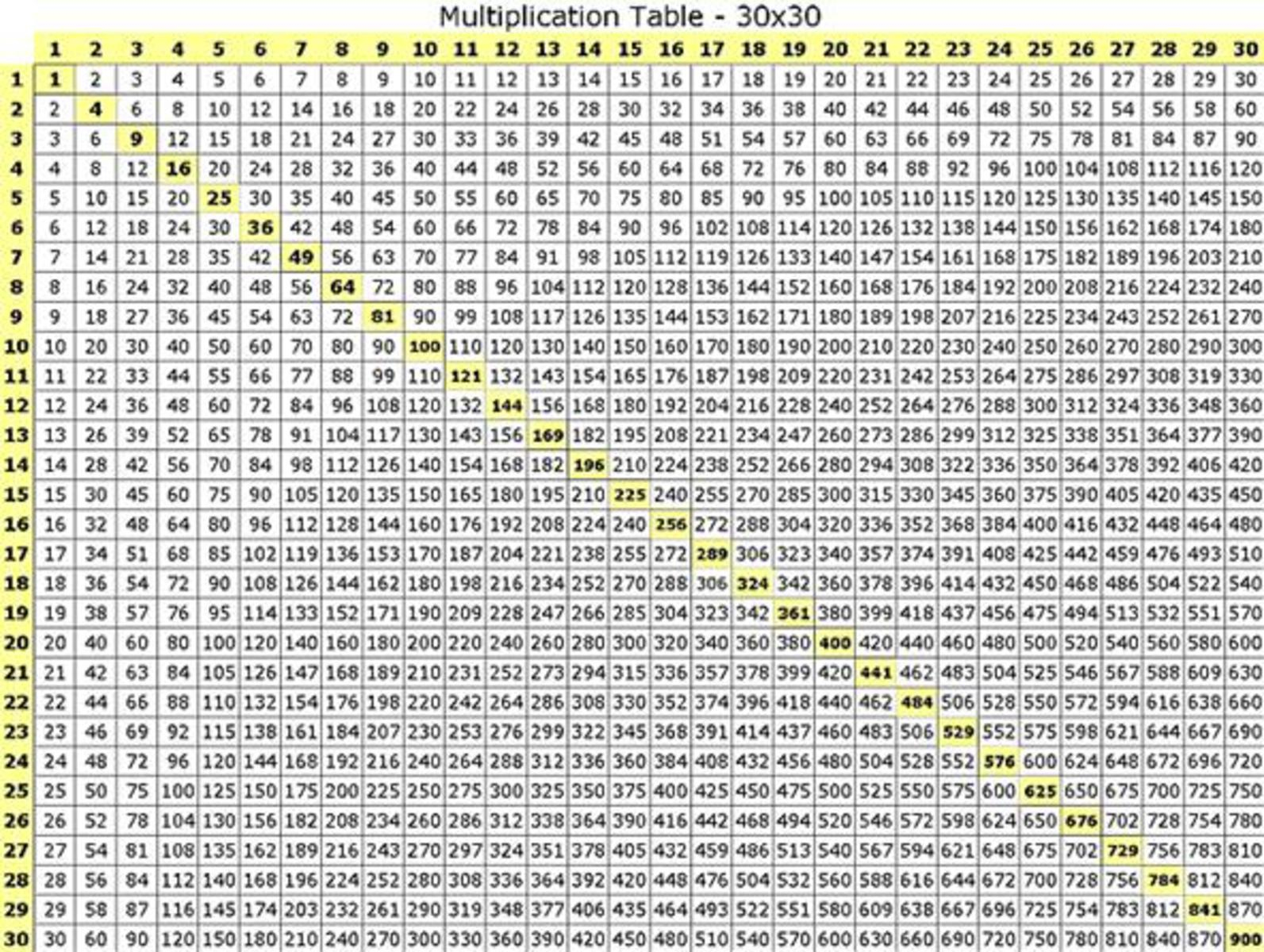

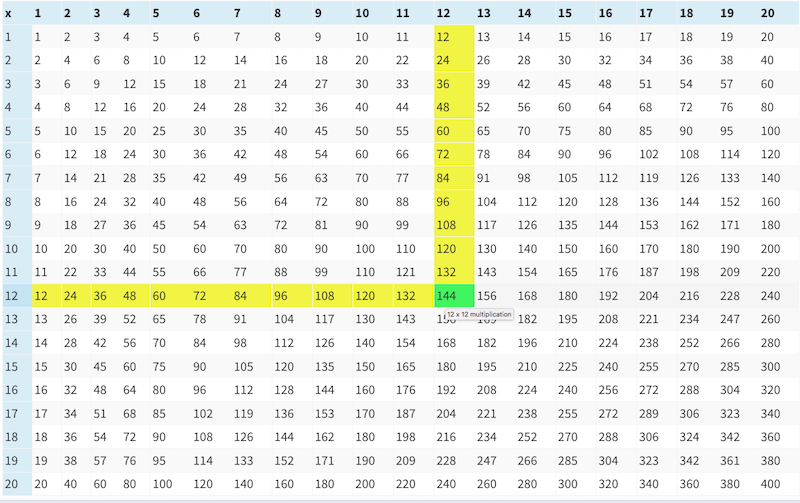

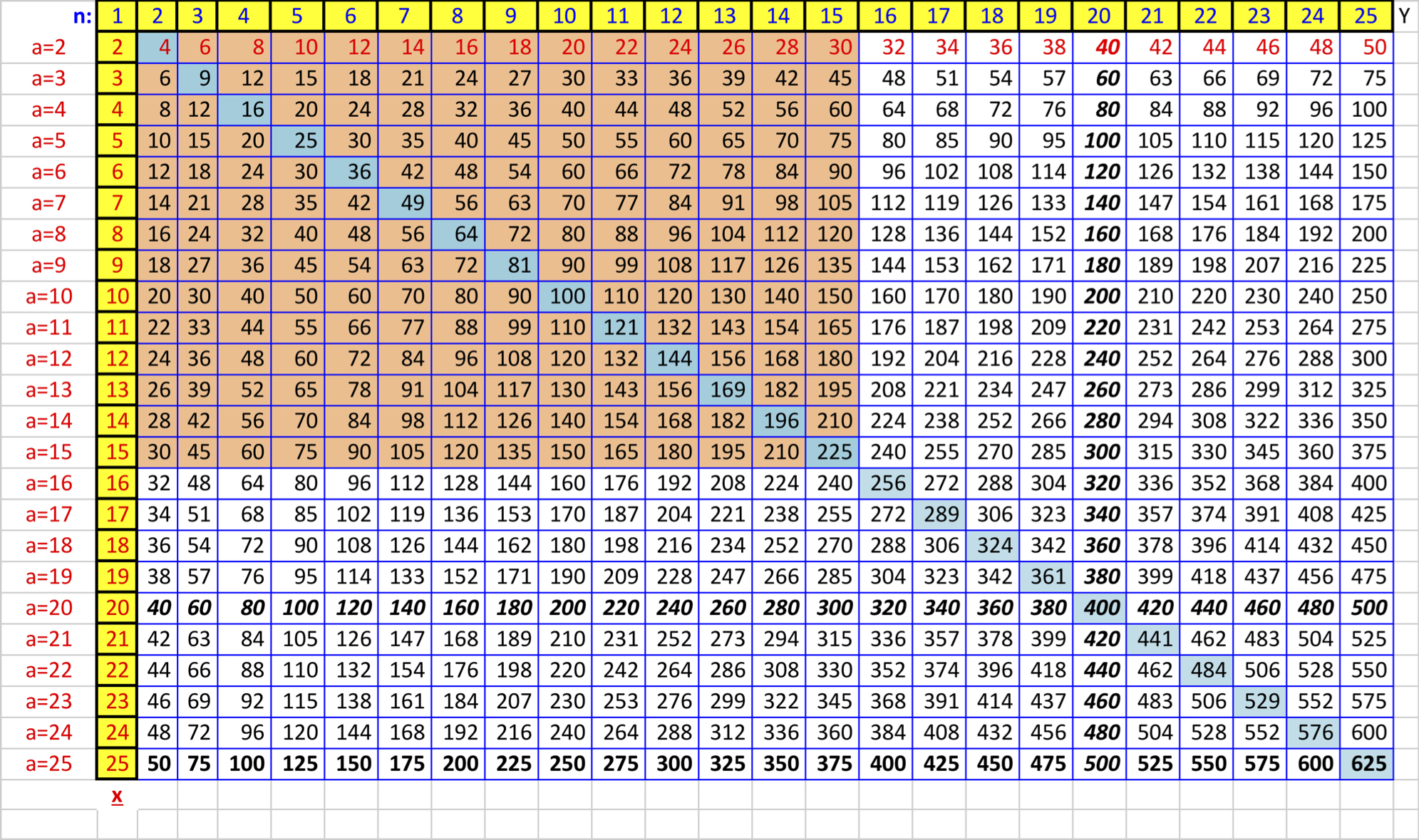

Multiplication Table Through 30 Multiplication Chart Multiplication

What Times What Equals 300Free printable NFL Team Logos coloring pages for kids of all ages. You can print or download them to color and offer them to your family and friends. Nothing defines a football team more than its logo helmets and uniforms You can download all NFL football team logos and names as transparent PNG images

NFL Teams Logo Svg, National Football League Svg, NFL Svg, NFL Team Svg, American Football Svg, Sport Svg, Clipart, Cut Files, Cricut, Silhouette, ... Printable Multiplication Chart 1 25 PrintableMultiplication What Times What Equals 39

NFL Team Logos Coloring Pages for kids Free and easy print and

Printable Multiplication Tables 1 12 Jafpublications

This poster a must for the wall of any true NFL fan features the official logo designs of all NFL squads in their divisional alignment with all helmets and logos updated for 2024 Multiplication Table 1 12 No Answers Brokeasshome

Free Printable Coloring Pages You can choose from our printable coloring pages with American football teams logos AFC American Football Conference Printable Multiplication Table Chart Multiplication Chart 600x600

Multiplication Chart 64 PrintableMultiplication

Opdreunen Maar Die Tafels Times Table Chart Multiplication Chart

Large Multiplication Table To Train Memory Activity Shelter

10 Times What Equals 1000

Multiplication Tables With Times Tables Games Multiplication Table

2 Times Tables Up To 100 Elcho Table

What Times What Equals 1000

Multiplication Table 1 12 No Answers Brokeasshome

100 Multiplication Chart

What Times What Equals 2025 Gale Eugenie