Whats 20 Percent Of 900 Dollars are a versatile remedy for any person wanting to develop professional-quality files swiftly and conveniently. Whether you need customized invites, resumes, planners, or business cards, these themes permit you to customize material with ease. Merely download the layout, edit it to suit your demands, and print it at home or at a print shop.

These themes save money and time, offering an economical alternative to employing a designer. With a wide variety of designs and formats readily available, you can locate the best design to match your personal or company requirements, all while maintaining a refined, professional look.

Whats 20 Percent Of 900 Dollars

Whats 20 Percent Of 900 Dollars

How to use the forms Fillable PDF to DownloadBlank PDF to PrintForm 14 If you need additional copies Schedule of Basic Child Support Obligations 12.901(b)(3). Petition for Dissolution of Marriage with No Dependent or Minor Child(ren) or Property. Download: PDF Download of 12.901(b)(3) ...

Self represented litigant petition for 103 1 divorce

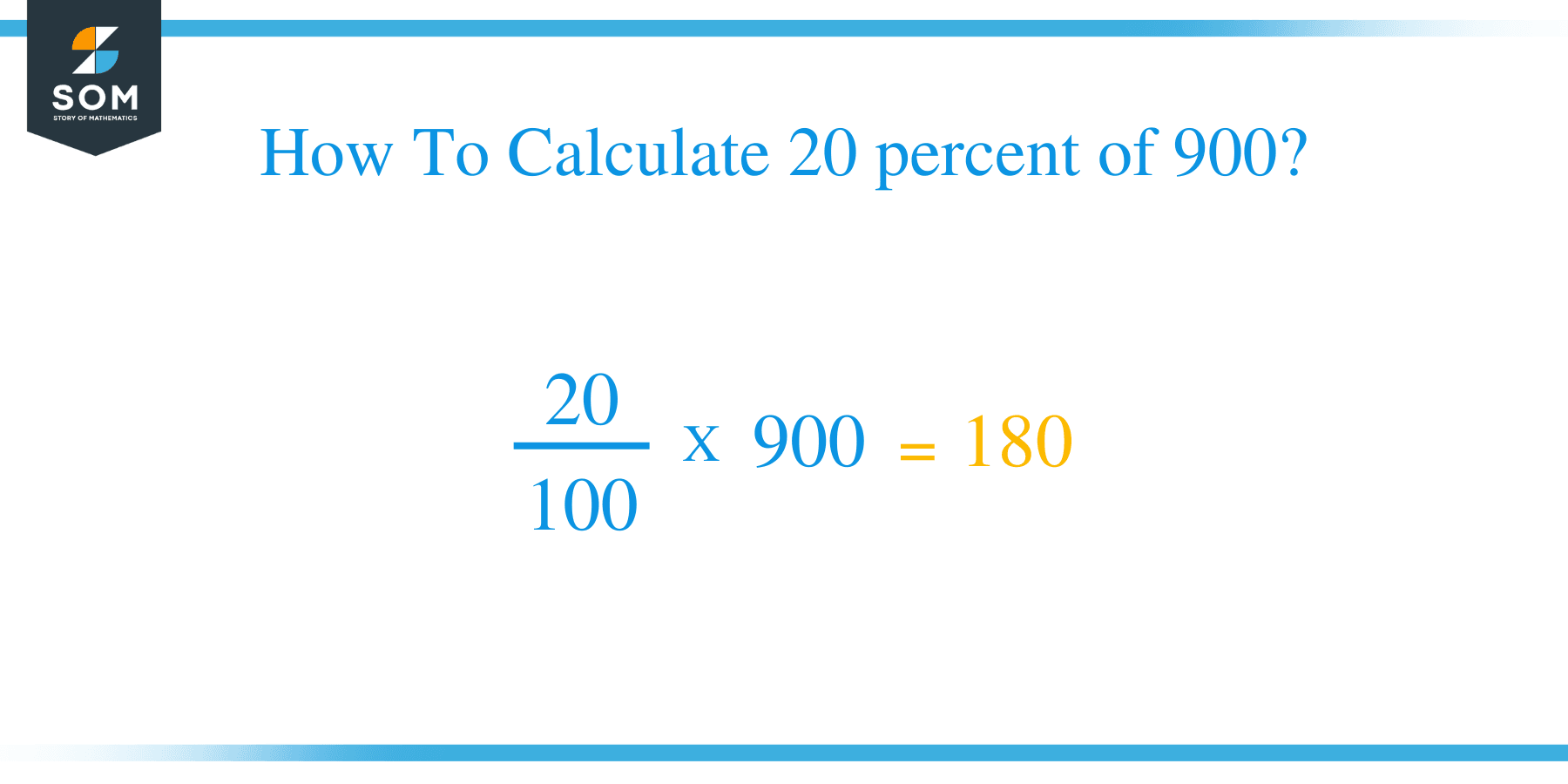

What Is 30 Percent Of 9000 Calculatio

Whats 20 Percent Of 900 DollarsYou may complete the court forms by printing the information in ink or by using the fillable forms on the. Judicial Branch website at www.jud.ct.gov/webforms. All California courts use the same basic set of forms for divorce You can find the most commonly used forms on this page

The forms presented in this packet are designed to guide you in the preparation of your divorce papers. You must fill in the required information as it ... What Is 60 Percent Of 900 Solution With Free Steps What Is 5 Percent Of 20000 1000 With 2 Solutions

Petition for Dissolution of Marriage 12 901 Forms A Florida Courts

How I Use The 80 20 Rule

These divorce forms were approved by the Tennessee Supreme Court as universally acceptable as legally sufficient Corey Kilgannon Page 4 The New York Times

Blank forms to print and fill out on your own with how to instructions for completing and filing Or use our do it yourself interview program Washington Solved The Images Show What Happened To Two People Who Invested 1 000 This Week s Mythic Affixes In WoW Dragonflight Jan 2 To 9 Dot Esports

Download Youtube 3D 3D Video Royalty Free Stock Illustration Image

Live Draw Monday 30th September Live Draw Monday 30th September Good

Live Draw Monday 30th September Live Draw Monday 30th September Good

What Is 20 Percent Of 900 In Depth Explanation The Next Gen Business

25 Best Dried Apricot Recipes To Try Insanely Good

Youtube Pixabay Pixabay

Changing Fractions To Percents

Corey Kilgannon Page 4 The New York Times

What Is 20 Percent Of 180 Solution With Free Steps

What Is 20 Percent Of 900 Solution With Free Steps