When To File Form 8886 are a functional remedy for anyone seeking to create professional-quality documents rapidly and quickly. Whether you require personalized invitations, resumes, coordinators, or calling card, these themes permit you to personalize content with ease. Merely download and install the theme, edit it to fit your demands, and publish it in the house or at a print shop.

These templates conserve time and money, offering a cost-efficient choice to hiring a designer. With a wide variety of designs and styles available, you can discover the excellent style to match your personal or business demands, all while keeping a refined, professional look.

When To File Form 8886

When To File Form 8886

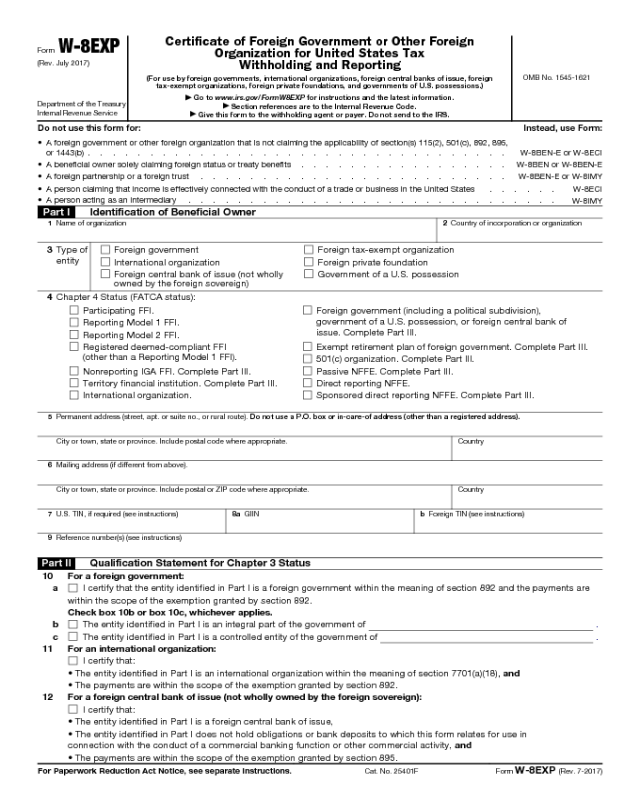

An individual or entity Form W 9 requester who is required to file an information return with the IRS must obtain your correct taxpayer identification number Una persona o entidad (solicitante del Formulario W-9) a quien se le requiera presentar una declaración informativa ante el IRS le está dando este formulario ...

W 9 blank IRS Form Financial Services Washington University

How To File HSA Tax Form 8889 Irs Forms Health Savings Account Hsa

When To File Form 8886A person who is required to file an information return with the IRS must obtain your correct taxpayer identification number (TIN) to report, for example, income ... Use Form W 9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS

Complete your W-9 online with our fillable form W-9 solution. Quickly fill out, e-sign, and securely submit or download the W-9 form for your tax needs. Form 8886 Edit Fill Sign Online Handypdf Form 8886 Edit Fill Sign Online Handypdf

Form W 9 sp Rev March 2024 IRS

Blog Teach Me Personal Finance

Form MA W 9 Rev April 2009 Print Form Page 2 What Name and Number to Give the Requester For this type of account Give name and SSN of 1 Individual Form 8886 Key To Avoiding IRS Penalties With Expert Guidance Ridge Wise

Give form to the requester Do not send to the IRS Before you begin For guidance related to the purpose of Form W 9 see Purpose of Form below Print or type Form 8886 Key To Avoiding IRS Penalties With Expert Guidance Ridge Wise Form 8886 Printable Form 8886 Blank Sign Forms Online PDFliner

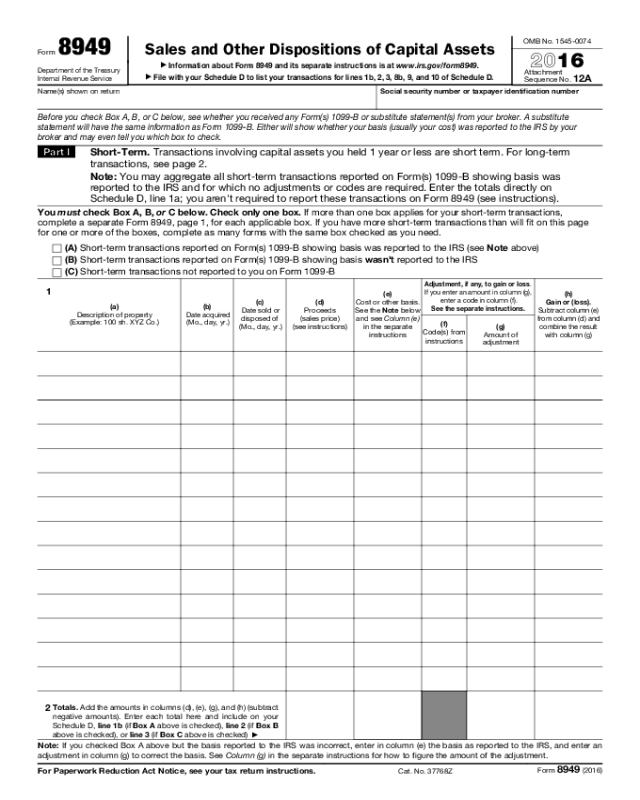

Form 8886 Reportable Transaction Disclosure Statement 2011 Free

Tax Training ADSN

2023 IRS Gov Forms Fillable Printable PDF Forms Handypdf

2023 IRS Gov Forms Fillable Printable PDF Forms Handypdf

Form 8886 Reportable Transaction Disclosure Statement 2011 Free

Form 8886 Reportable Transaction Disclosure Statement 2011 Free

Form 8886 Key To Avoiding IRS Penalties With Expert Guidance Ridge Wise

Form 8886 Key To Avoiding IRS Penalties With Expert Guidance Ridge Wise

Filing Tax 2025 Deadline Kareem Zara

How To Have Us Handle Your 8886 s Buckeye Dealership Consulting