1 4 Divided By 3 Simplified are a functional solution for any individual aiming to create professional-quality papers rapidly and conveniently. Whether you require personalized invitations, resumes, organizers, or business cards, these templates enable you to individualize material with ease. Simply download the design template, edit it to suit your needs, and print it at home or at a printing shop.

These templates conserve money and time, offering a cost-efficient choice to working with a developer. With a variety of styles and formats readily available, you can discover the ideal style to match your personal or organization demands, all while keeping a refined, professional look.

1 4 Divided By 3 Simplified

1 4 Divided By 3 Simplified

These Dog and Cat dot marker printables are a FUN and MESS FREE activity Even better they are an engaging activity that helps foster motor skills Enjoy this FREE train dot marker printable! This printable was created to be used with Do-a-dot markers or other similar dot markers.

A Z Do A Dot Worksheets Confessions of a Homeschooler

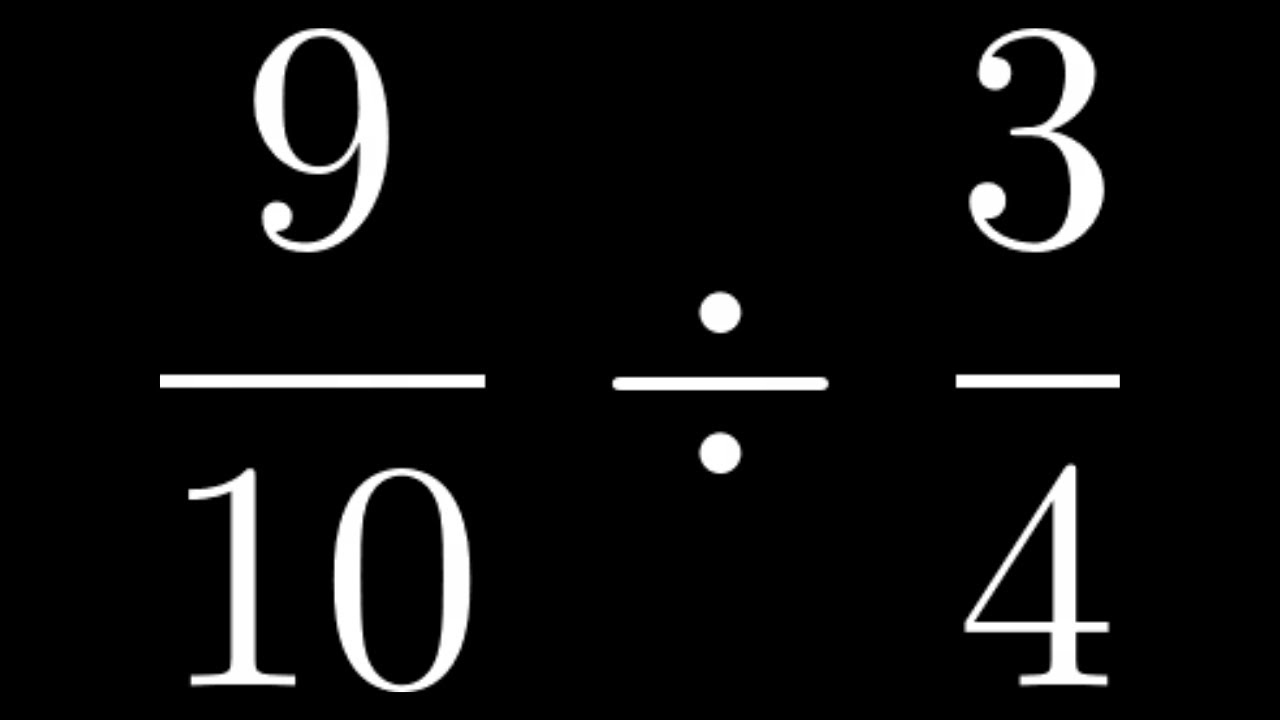

4 Divided By 3 4 Four Divided By Three Fourths YouTube

1 4 Divided By 3 SimplifiedIn this article we show you how to get started with do-a-dot worksheets and round up some of our favorite do-a-dot books and free do-a-dot printables for kids. Dot marker printables and dot sticker sheets are such a fun and easy activity to do with toddlers and preschoolers There are over 100 pages to grab

These do a dot printables include 7 shapes that kids can learn to identify as well as the shape name too. 1 4 Divided By 20 Times Table And Division

Dot Marker Activities Printable Freebie by Kim Heuer TPT

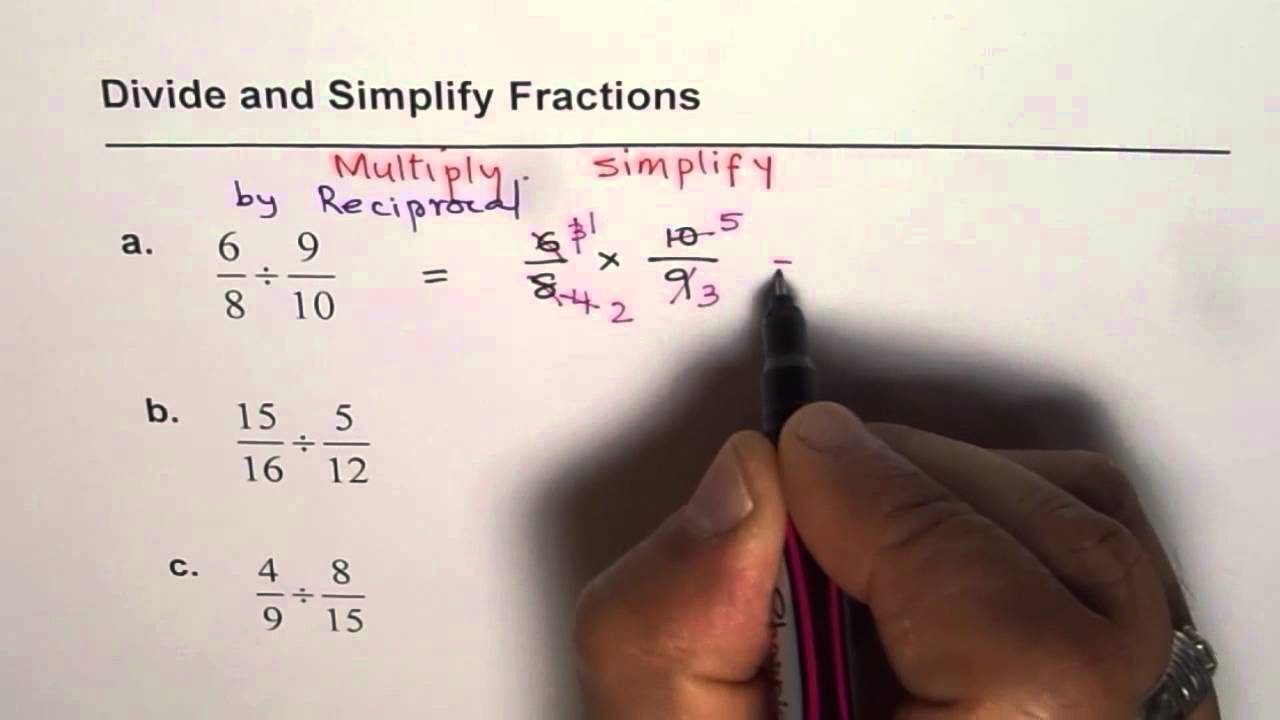

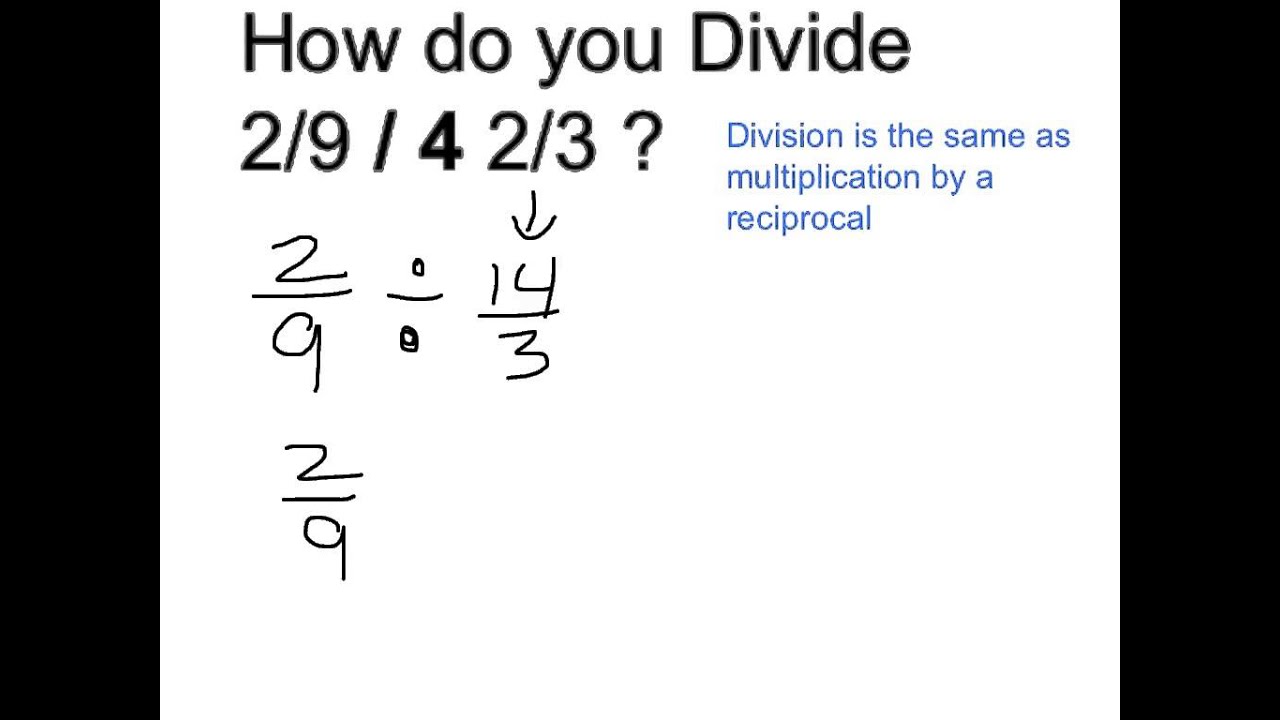

Dividing Fractions 3 4 Divided By 1 2 What Is 3 4 Divided By 1 2

Kids will have fun using bingo daubers to make these FREE Fall Do a Dot Printables These a fun activity for prek and kindergarten age kids 28 Divide By 30

Free Dinosaurs Do a Dot PrintablesFree Quiet Book Printable Ocean Animals Binder for Preschool and Kindergarten 10 Divided By 1 2 Simplest Terms Fractions

10 45 Simplified

27 15 Simplified Form

28 Divide 400

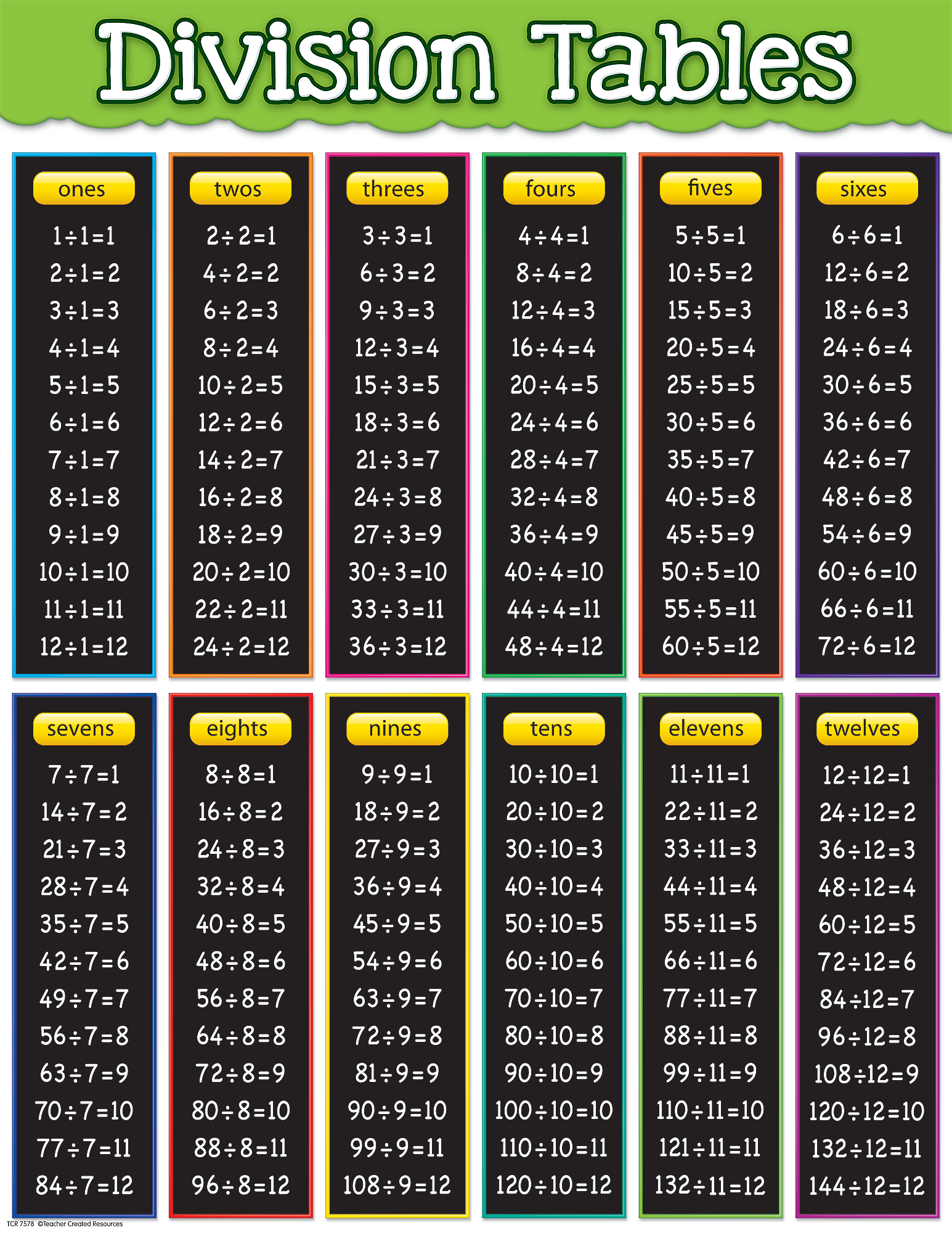

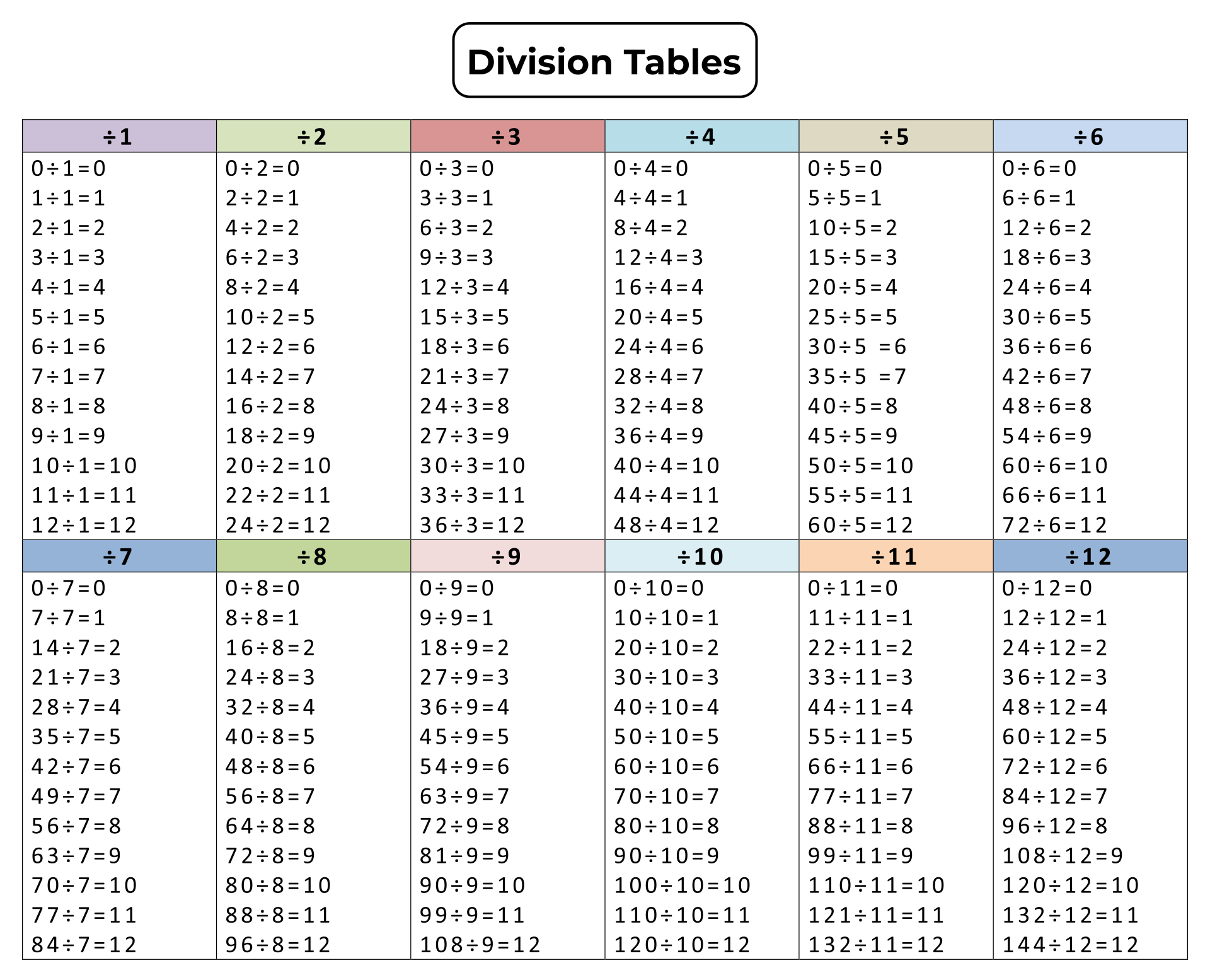

10 Division Table

5 6 Divided By 2

5 6 Divided By 2

28 Divide By 30

28 Divide By 30

Blank Division Chart

10 Divided By 1 2