10 Divided By 5 8 Times 4 are a functional service for any individual looking to produce professional-quality files promptly and quickly. Whether you require personalized invitations, resumes, planners, or business cards, these themes permit you to personalize content easily. Merely download and install the layout, modify it to fit your demands, and print it at home or at a print shop.

These templates conserve money and time, supplying an affordable option to employing a designer. With a vast array of styles and styles readily available, you can find the excellent style to match your individual or business needs, all while maintaining a sleek, specialist look.

10 Divided By 5 8 Times 4

10 Divided By 5 8 Times 4

Easy to use printable tap drill chart and drill bit sizes table available for a FREE download on our website View drill and tap chart DRILL. SIZE. 80. 79. 1/64. 78. 77. 76. 75. 74. 73. 72. 71. 70. 69. 68. 1/32. 67. 66. 65. 64. 63. 62. 61. 60. 59. 58. 57. 56. 3/64. 55 ... DRILL SIZE CONVERSION ...

US Tap and Drill Bit Size Table Bolt Depot

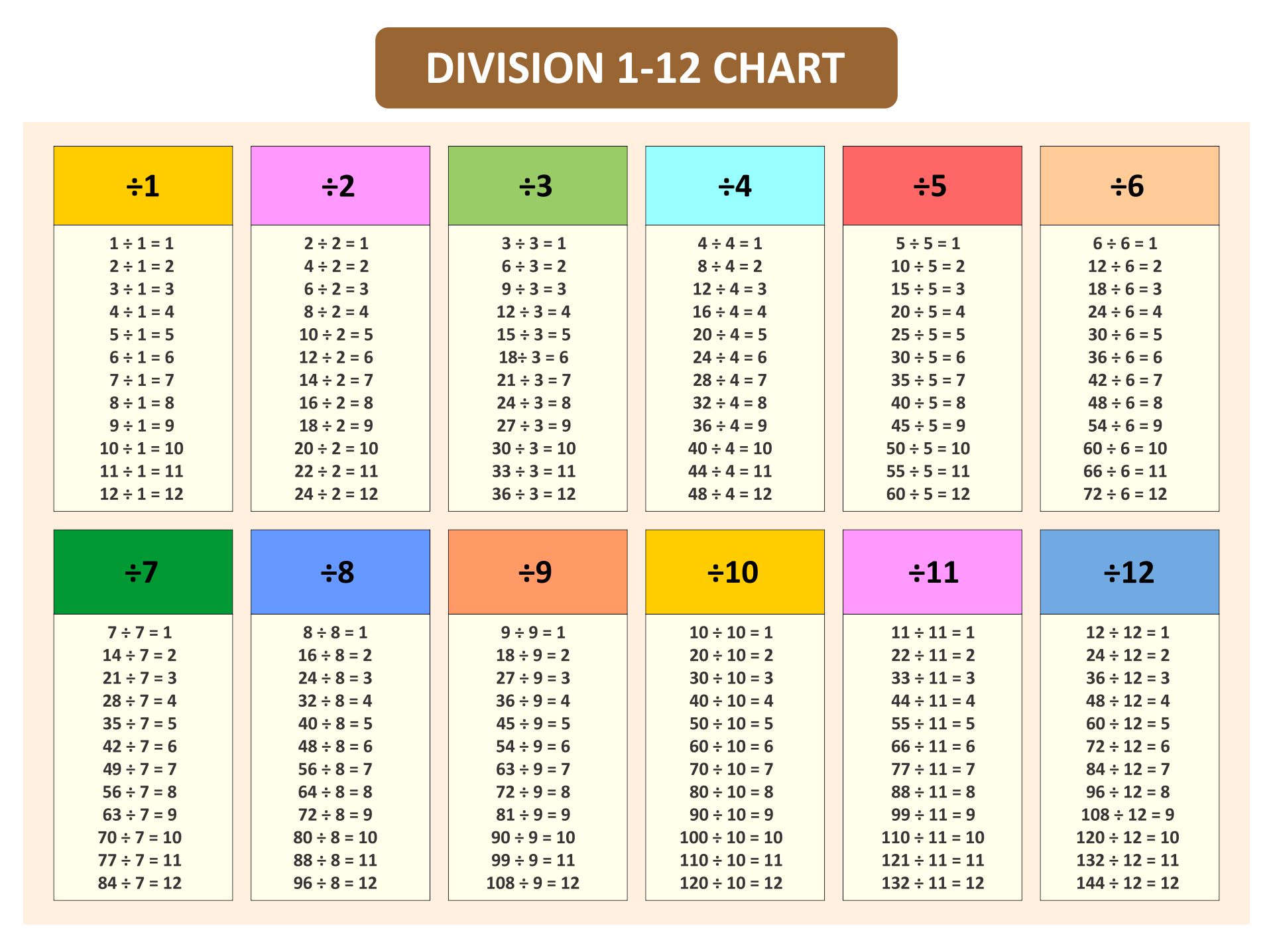

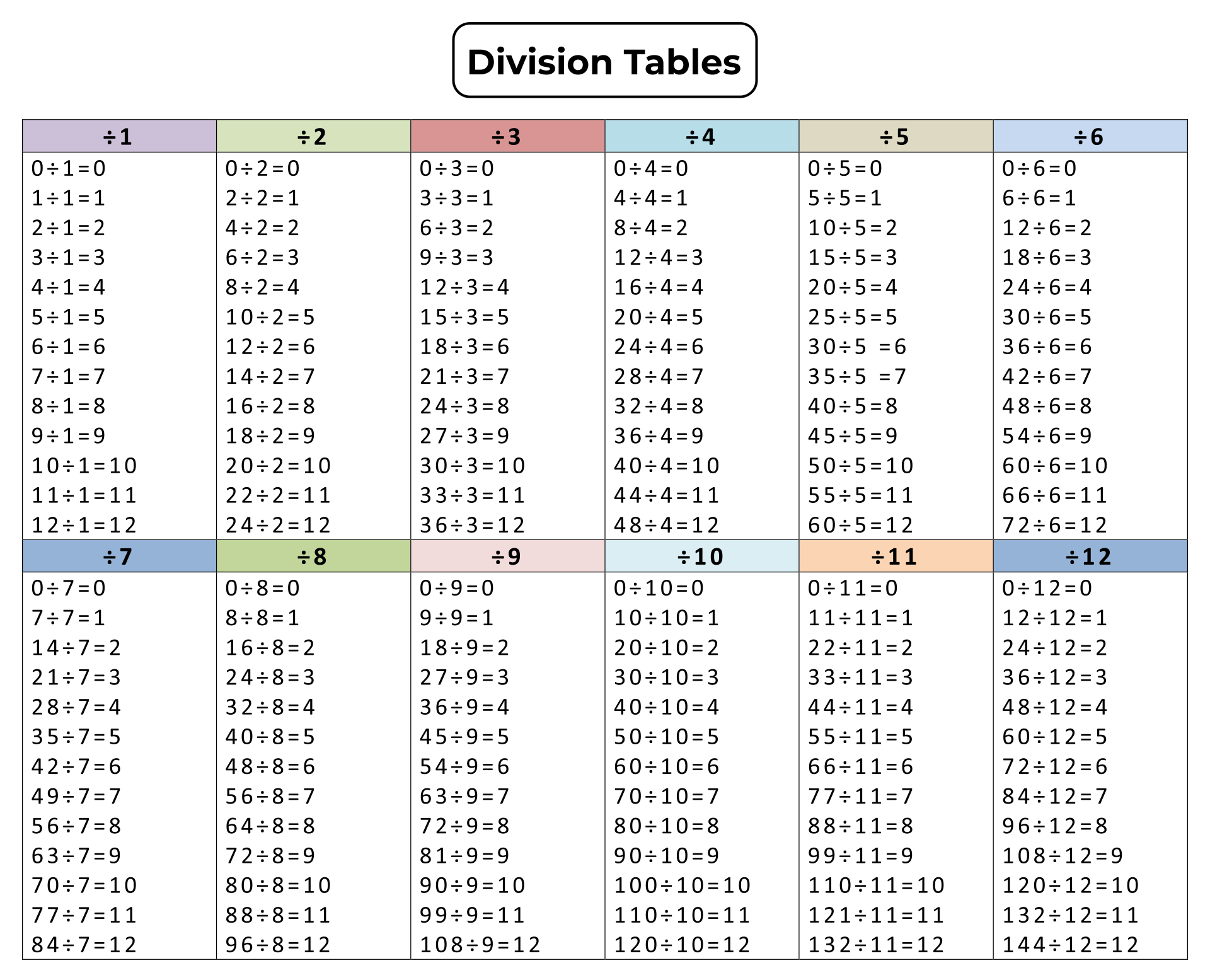

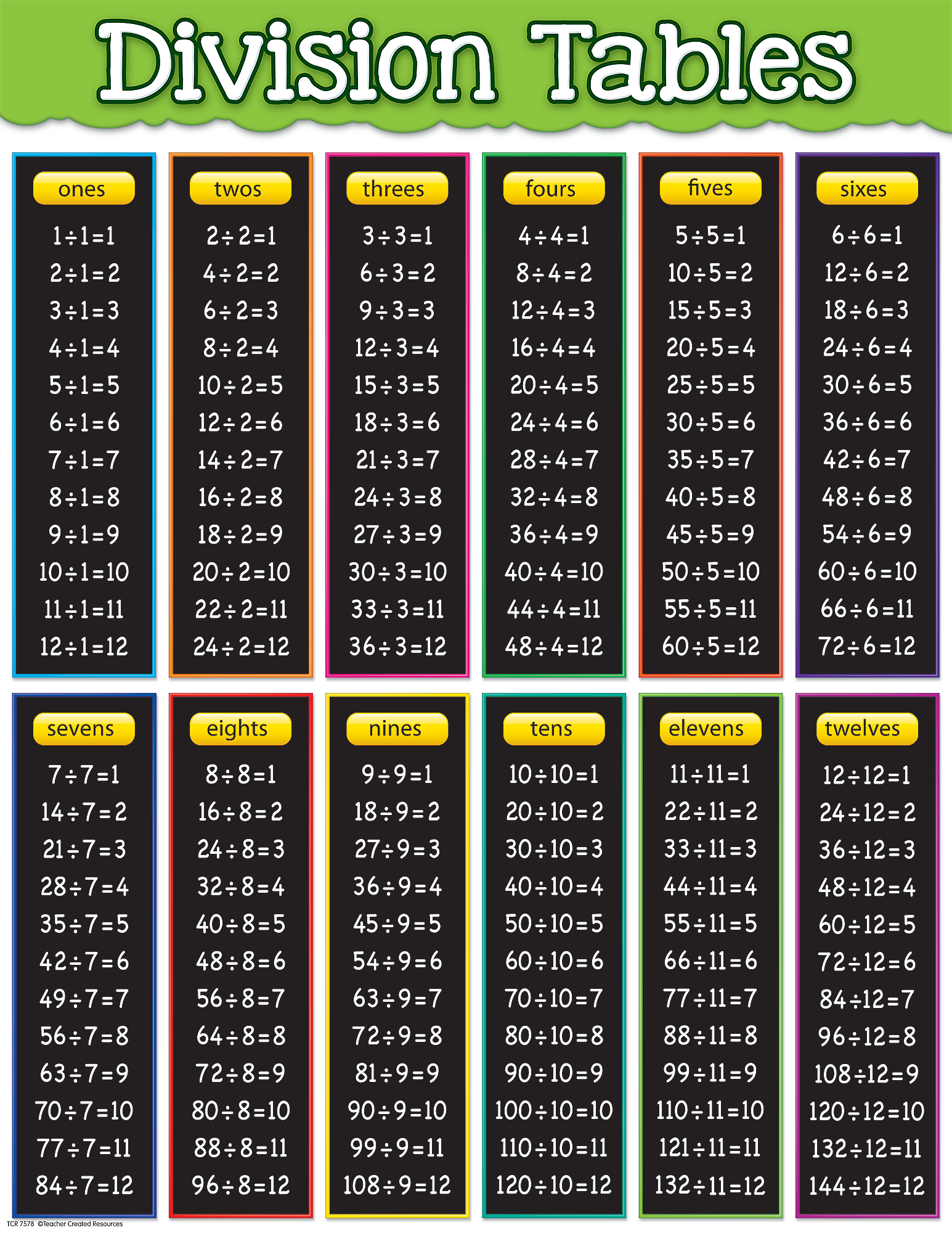

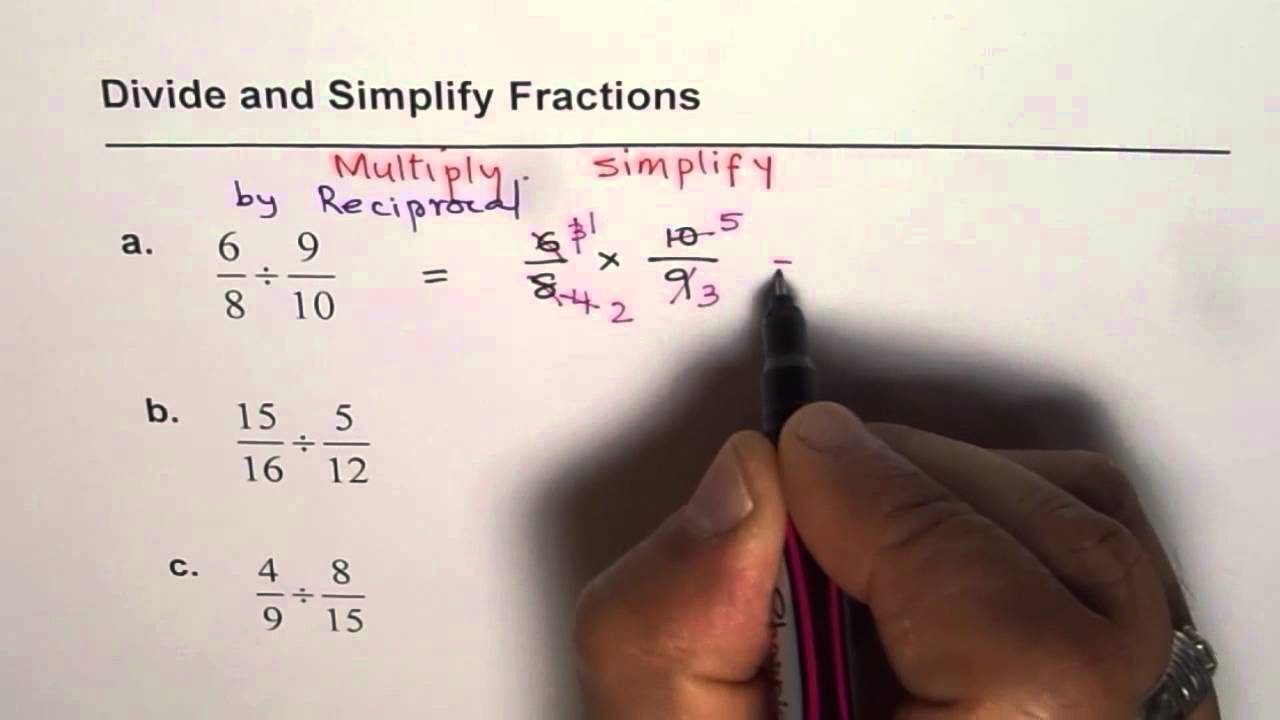

7 Essential Division Chart Tricks

10 Divided By 5 8 Times 4METRIC TAP, DRILL SIZES. 42 .0935. 51. 37/64 14.50 .5781. 60. Tap Size. 3/32 .0938. 50. 3/4-10. 41/64 .6406. 81. Tap Drill. Size. Tap Size. Tap ... DRILL SIZE DECIMAL EQUIVALENT TAP DRILL CHART DECIMAL EQUIVALENT CHART DRILL DECIMAL SIZE MM EQUIVALENT 0 10 0039 0 20 0079 0 25 0098

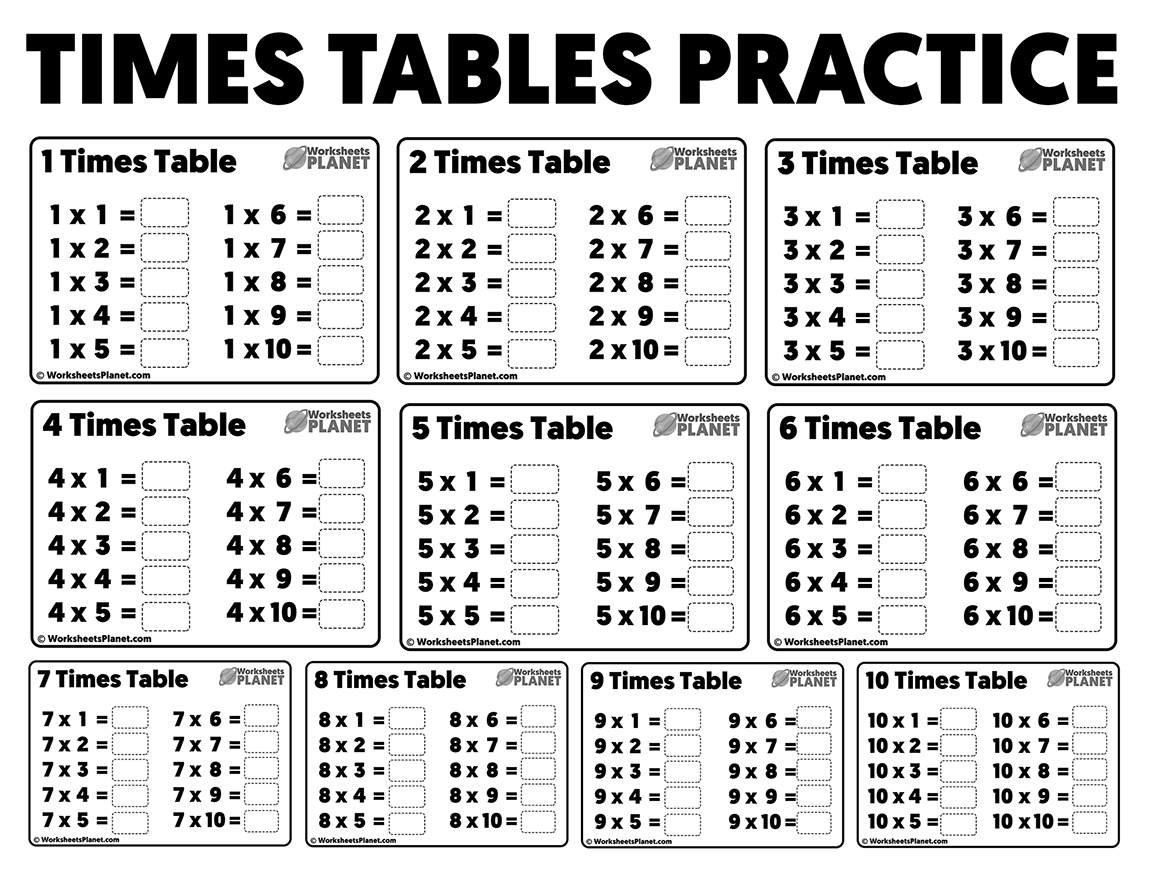

Letter Drill Sizes. This chart shows the diameters of letter gauge drills size A (the smallest) to size Z (the largest). 3 Times Table To 100 Printables Multiplication Tables

Drill Size Conversion Chart ICS Cutting Tools

Calling All Cooks 1 2 3 Cookbooks set Of 3 Munimoro gob pe

This chart provides info on the appropriate tap and drill bit sizes to use when creating threaded holes in various materials 100 Divided By 10

In general there are 3 categories of common imperial drill sizes fractional in 1 64 increments lettered A Z and numbered 1 80 Generated by K 1 4 Divided By 12 1000 Divided By 12

.png)

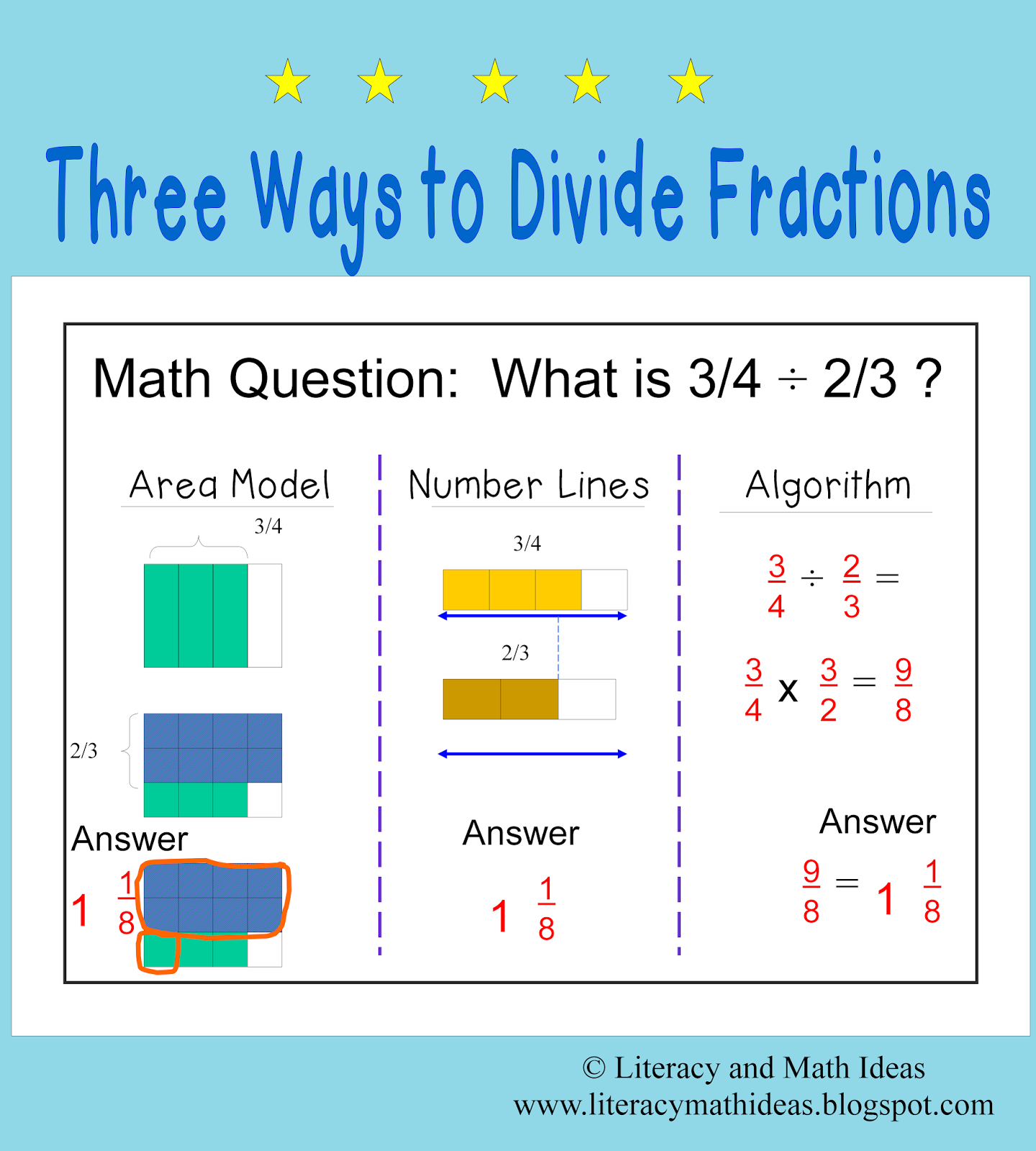

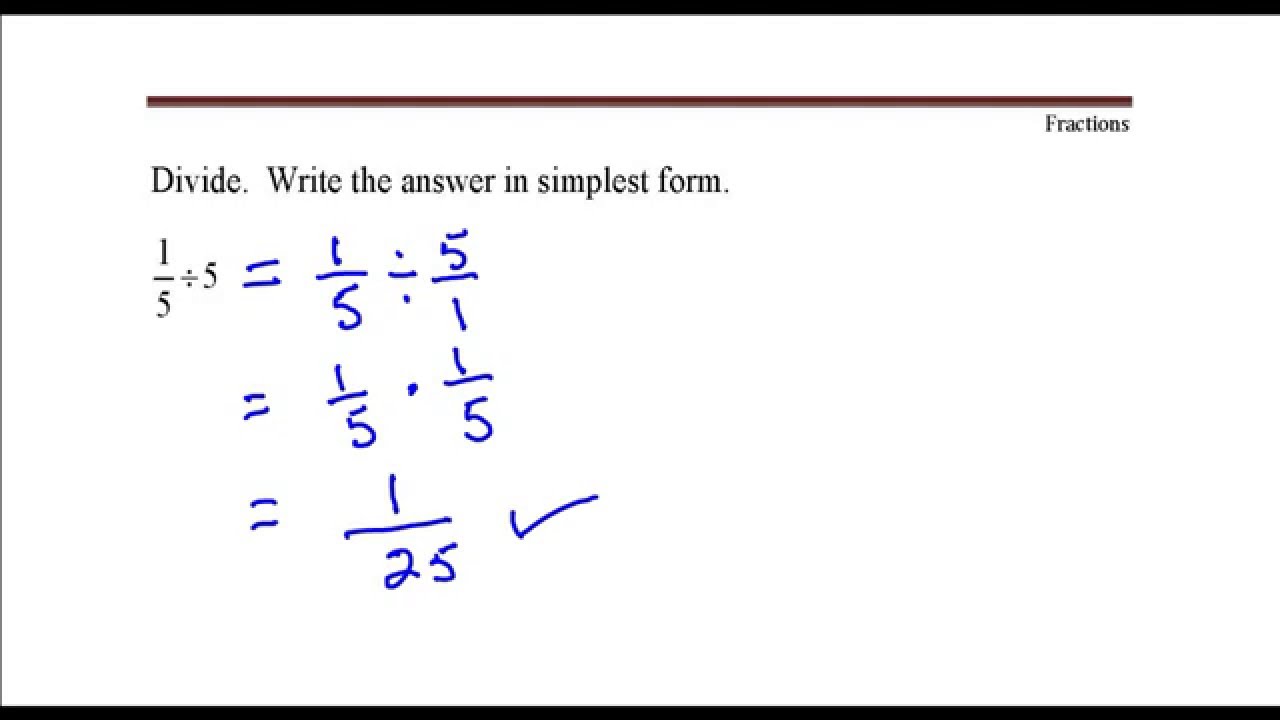

Bar Diagram Fractions

Division By 1

10 Division Table

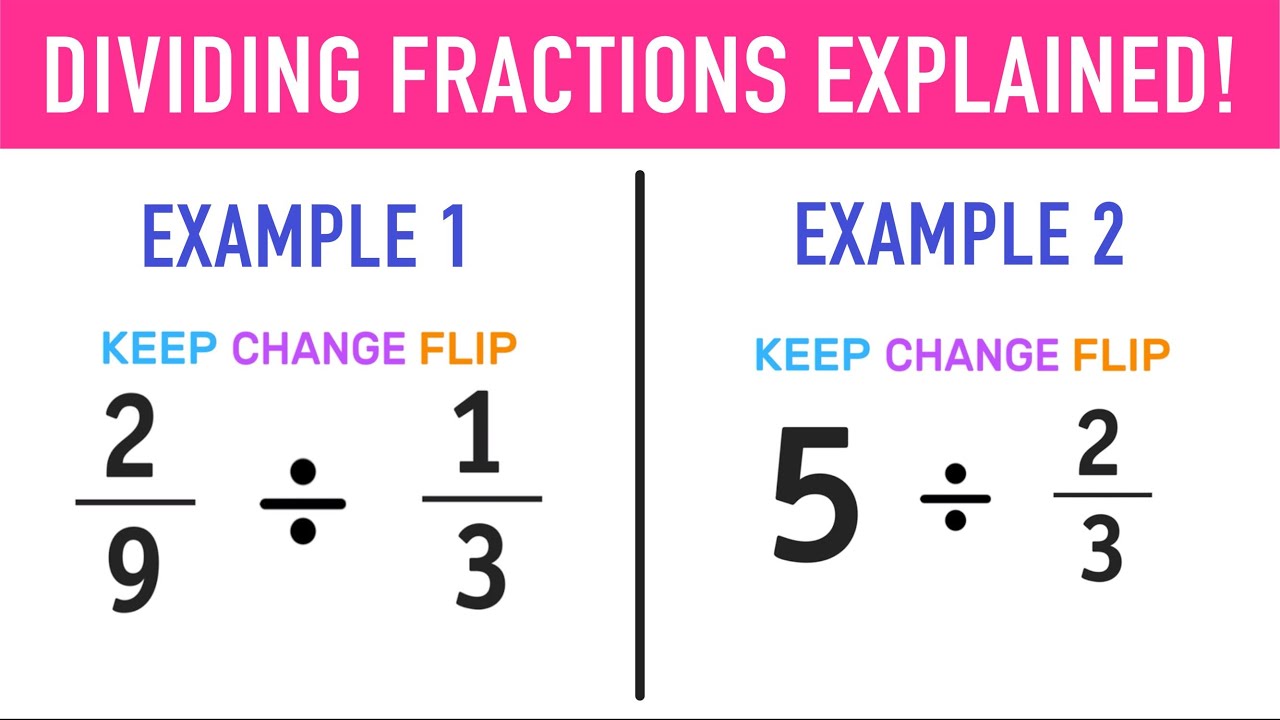

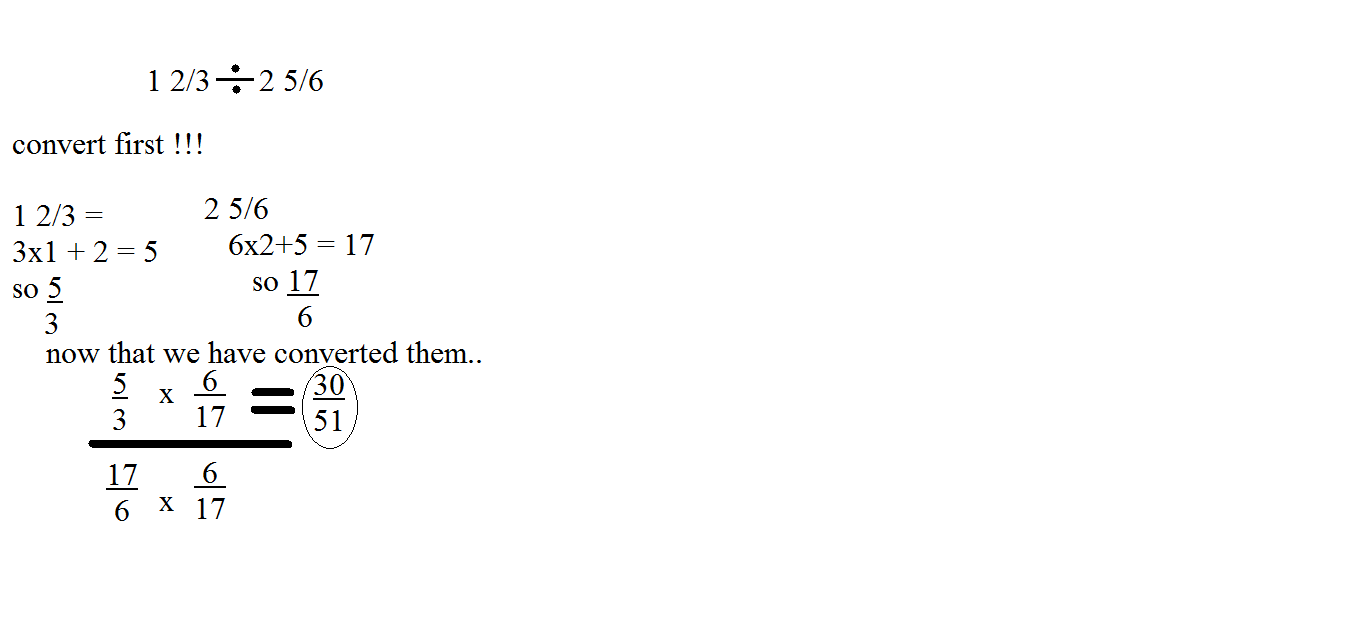

10 Divided By 2 3

Division Chart Printable

Times Table Practice Worksheets

Equivalent Fractions Using Division

100 Divided By 10

What Is 4 Divided By 1 8

10 Divided By 1 2