100 Crore Inr In Usd are a functional service for anyone aiming to create professional-quality papers rapidly and quickly. Whether you need custom invites, resumes, organizers, or business cards, these layouts allow you to personalize material easily. Merely download and install the template, edit it to match your requirements, and publish it in your home or at a print shop.

These templates conserve money and time, providing a cost-efficient alternative to employing a developer. With a large range of styles and formats readily available, you can find the perfect style to match your personal or organization needs, all while maintaining a refined, professional look.

100 Crore Inr In Usd

100 Crore Inr In Usd

An individual or entity Form W 9 requester who is required to file an information return with the IRS must obtain your correct taxpayer identification number The IRS has created a page on IRS.gov for information about Form W-9, at www.irs.gov/w9. Information about any future developments affecting Form W-9 (such ...

Form W 9 Rev November 2017 IRS

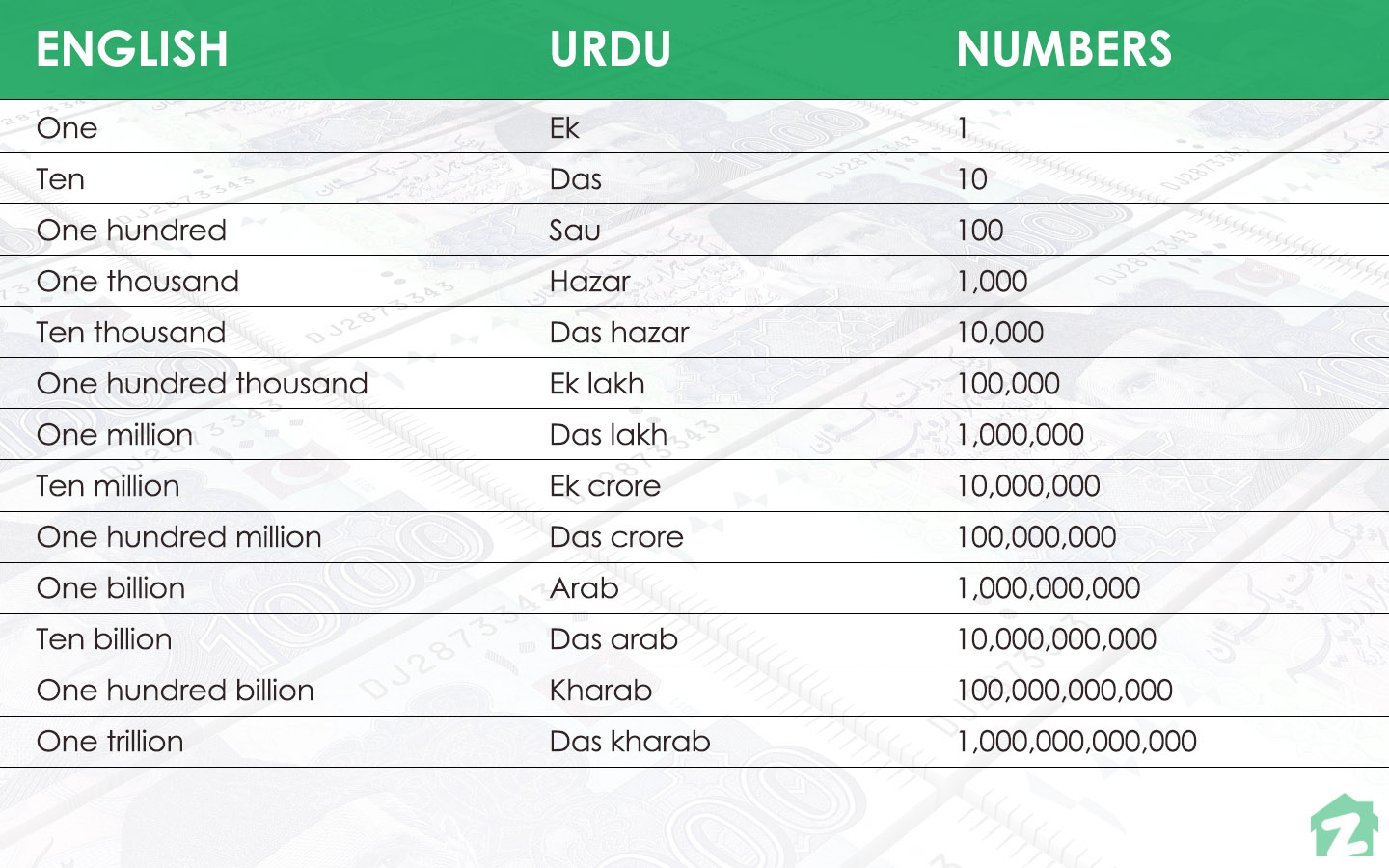

How Many Zeros In Thousand Lakh Crore Million Billion Trillion

100 Crore Inr In UsdW-9 (blank IRS Form). IRS Form W-9 (rev March 2024). W-9 Form. ©2024 Washington University in St. Louis. Notifications. Use Form W 9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS

Una persona o entidad (solicitante del Formulario W-9) a quien se le requiera presentar una declaración informativa ante el IRS le está dando este formulario ... 136 Individuals Earn More Than Rs 100 Crore With A Combined Income Of I T Search In Karnataka s Co op Banks Reveals Fund Routing Worth 1 000

W9 form ei sig pdf

Invest Rs 1000 Per Month And Get 1 Crore Rs How To Invest In Sip YouTube

The information from a W9 form is most commonly used to create a 1099 form which contains income received by a worker and tax payments made by a company Income Tax Authorities To Impose 200 Penalty On Any abnormal Rise In

Go to www irs gov FormW9 for instructions and the latest information Give form to the requester Do not send to the IRS Before you begin For Hyderabad Water Board s Offer Of Interest Waiver On Pending Bills Extended Currency Rs 3 8 Lakh Crore Short Yet Bank Vaults Overflow

Billion Trillion Chart

40 20 Million Pounds In Rupees Info Ecurrency

Convert Rupees To Dollars

31 10000 Crore Inr To Billion Usd Ideas In 2021 Ecurrency

USD INR Rupee Rises To A Weekly High Currency Live

Units Tens Hundreds Thousands Chart In India

Jharkhand I T Dept Raids Unearth Rs 2 Cr In Cash Rs 100 Cr Unaccounted

Income Tax Authorities To Impose 200 Penalty On Any abnormal Rise In

Jharkhand I T Dept Raids Unearth Rs 2 Cr In Cash Rs 100 Cr Unaccounted

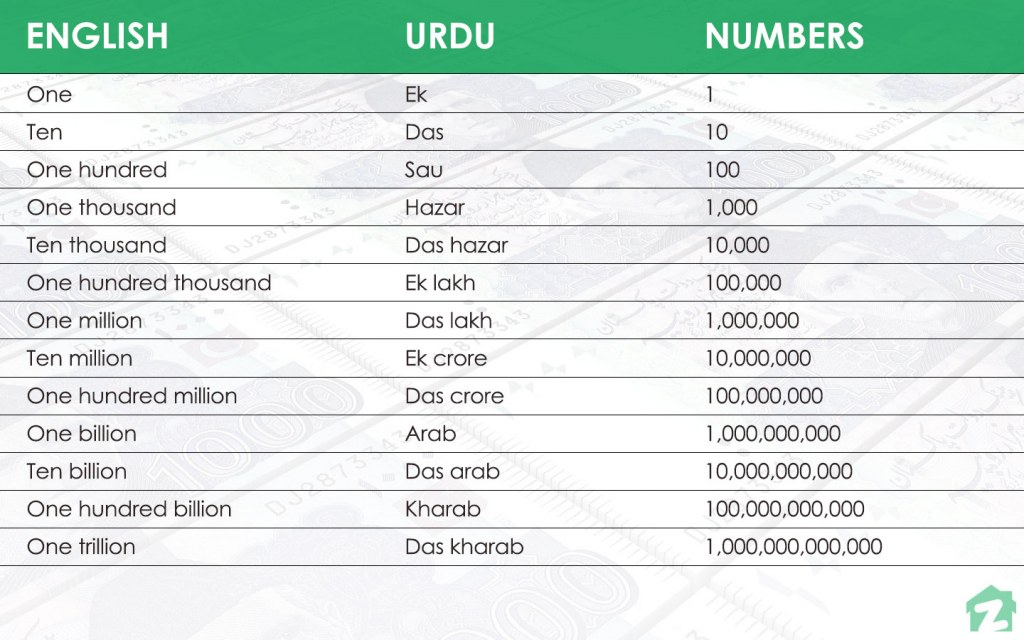

E invoicing Threshold Limit GST E invoicing Limit E invoicing