14 95 Usd To Eur are a functional service for any person seeking to develop professional-quality papers swiftly and quickly. Whether you need personalized invitations, returns to, coordinators, or calling card, these design templates permit you to individualize content with ease. Simply download the layout, edit it to match your demands, and publish it at home or at a print shop.

These templates save time and money, using a cost-efficient alternative to working with a designer. With a wide variety of styles and layouts offered, you can find the excellent layout to match your personal or company needs, all while preserving a refined, professional look.

14 95 Usd To Eur

14 95 Usd To Eur

An individual or entity Form W 9 requester who is required to file an information return with the IRS must obtain your correct taxpayer identification number Use Form W-9 only if you are a U.S. person (including a resident alien), to provide your correct TIN. If you do not return Form W-9 to the requester with a TIN, ...

W 9 blank IRS Form Financial Services Washington University

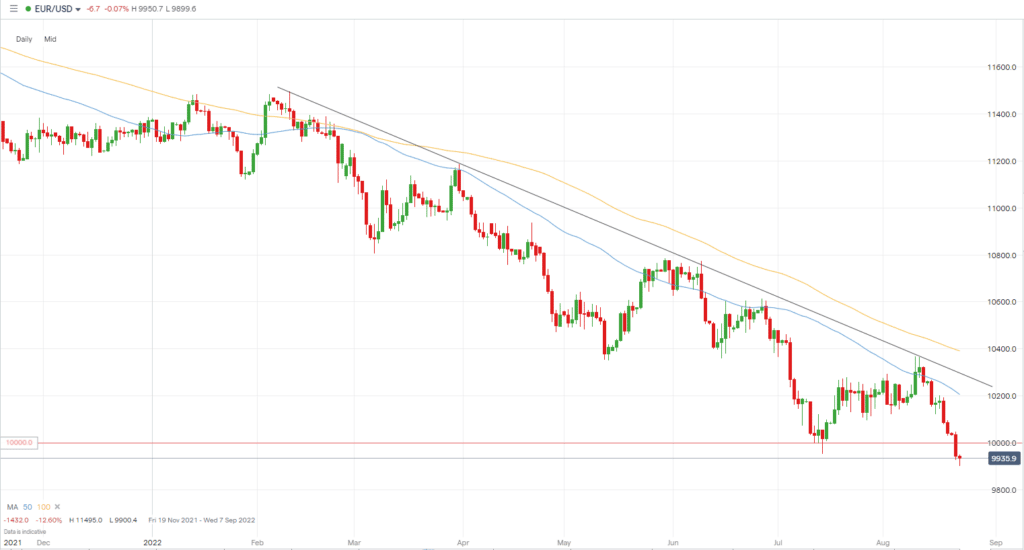

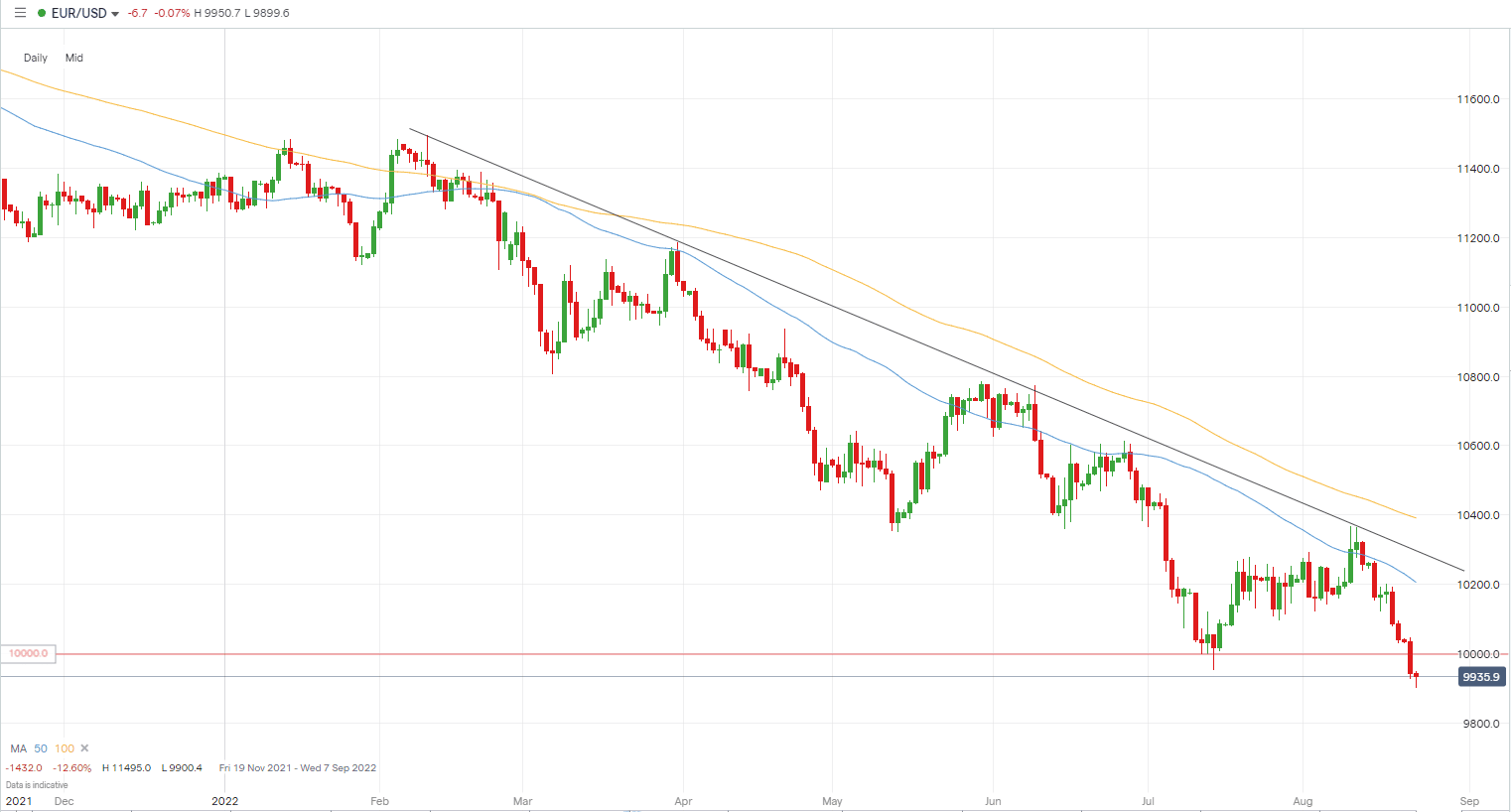

Eur To Usd Prediction 2024 Tiffy Giacinta

14 95 Usd To EurForm W-9. Request for Taxpayer Identification Number (TIN) and Certification. Used to request a taxpayer identification number (TIN) for ... Use Form W 9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS

For guidance related to the purpose of Form W-9, see Purpose of Form, below. Print or type. See. Specific Instructions on page 3. 1 Name of entity/individual ... [img_title-17] [img_title-16]

2021 W 9 Navy SEAL Foundation

Usd To Eur January 2024 Lucie Robenia

Any payee vendor who wishes to do business with New York State must complete the Substitute Form W 9 Substitute Form W 9 is the only acceptable documentation [img_title-11]

Go to www irs gov Forms to view download or print Form W 7 and or Form SS 4 Or you can go to www irs gov OrderForms to place an order and have Form W 7 and [img_title-12] [img_title-13]

[img_title-4]

[img_title-5]

[img_title-6]

[img_title-7]

[img_title-8]

[img_title-9]

[img_title-10]

[img_title-11]

[img_title-14]

[img_title-15]