15 Usc Code are a flexible service for any individual wanting to produce professional-quality records rapidly and easily. Whether you require custom-made invitations, resumes, planners, or business cards, these design templates enable you to personalize content effortlessly. Just download and install the layout, modify it to suit your needs, and publish it in the house or at a print shop.

These layouts save time and money, supplying an affordable option to working with a developer. With a large range of styles and formats offered, you can find the ideal layout to match your individual or company needs, all while preserving a polished, specialist appearance.

15 Usc Code

15 Usc Code

An individual or entity Form W 9 requester who is required to file an information return with the IRS must obtain your correct taxpayer identification number Form W-9. Request for Taxpayer Identification Number (TIN) and Certification. Used to request a taxpayer identification number (TIN) for ...

W 9 blank IRS Form Financial Services Washington University

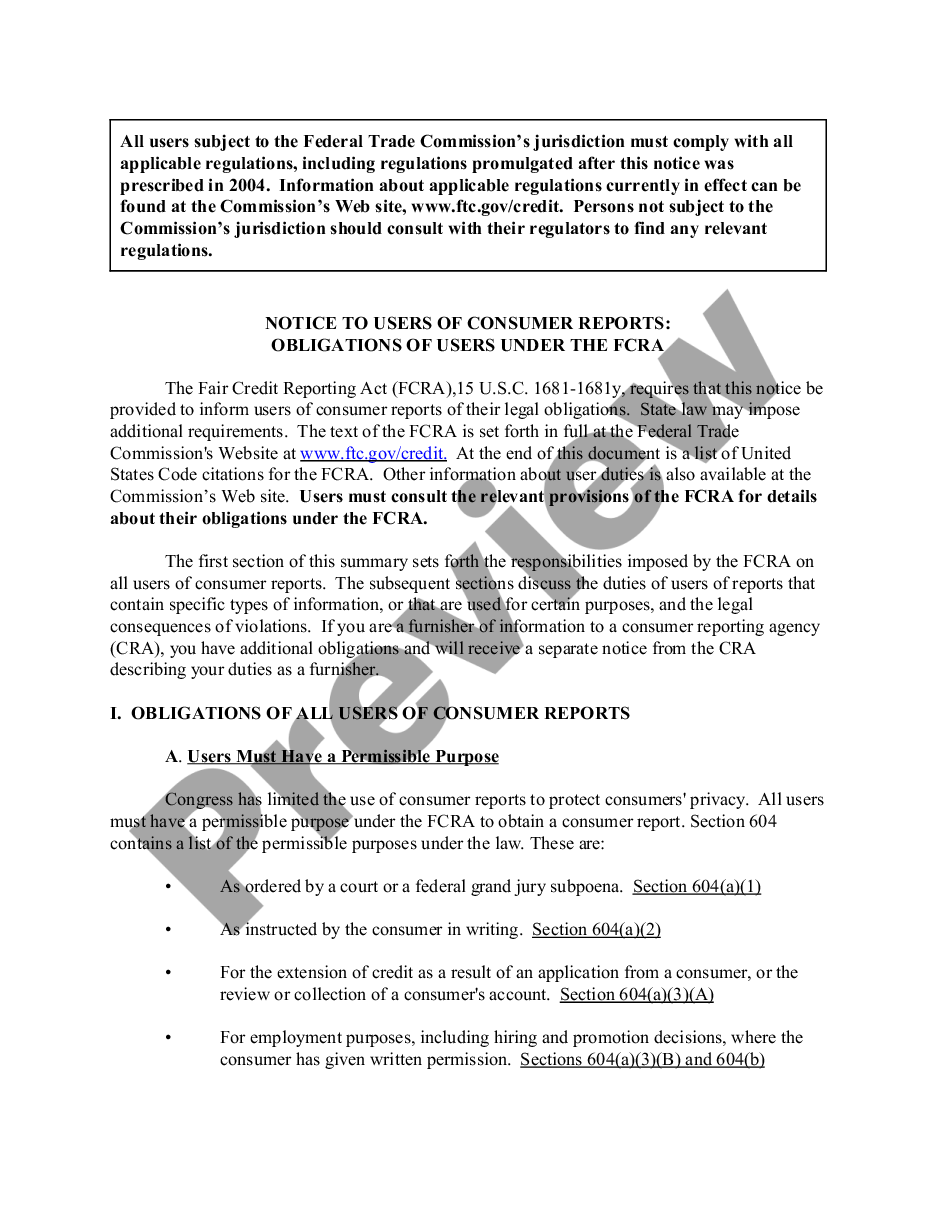

Debt Collection Laws How To Mark Up Your Collection Letters Title 15

15 Usc CodeEasily complete a printable IRS W-9 Form 2024 online. Get ready for this year's Tax Season quickly and safely with pdfFiller! Create a blank & editable W-9 ... Use Form W 9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS

Enter your TIN in the appropriate box. For individuals, this is your social security number (SSN) However, for a resident alien, sole proprietor, ... 15 USC Section 1681a Of The FCRA YouTube Fair Credit Reporting Act 15 Usc 1681 Et Seq Fcra Credit Walls

Forms instructions Internal Revenue Service

609 Letter Templates Credit Repair Secrets Printable Word Searches

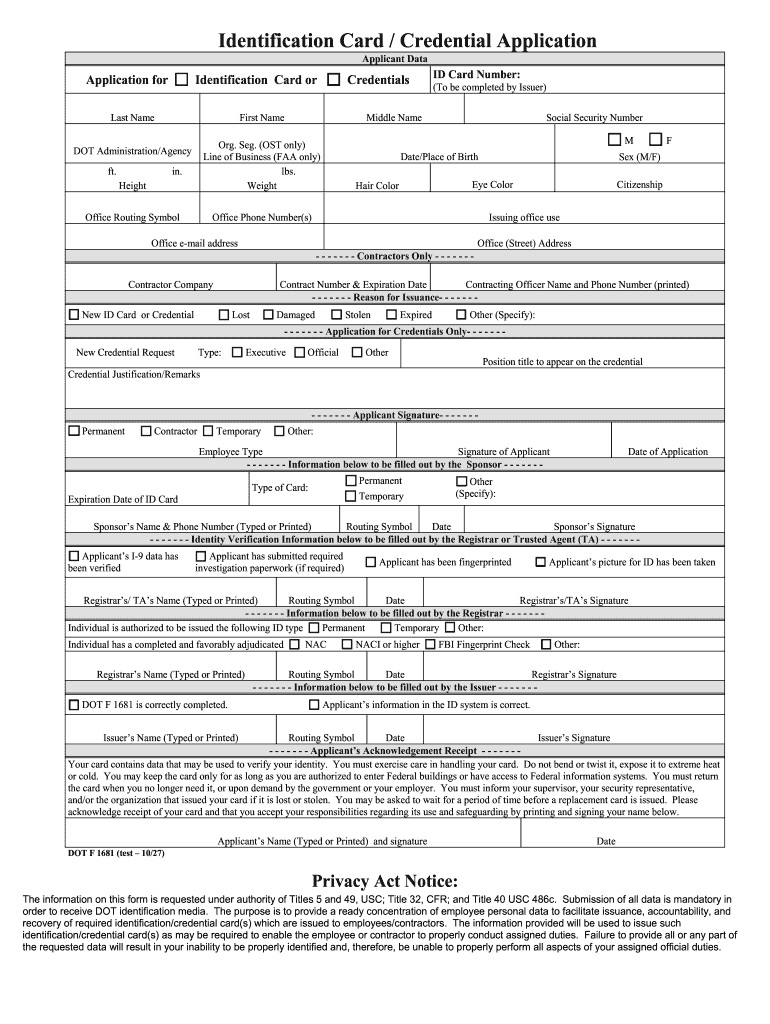

Go to www irs gov Forms to view download or print Form W 7 and or Form SS 4 Or you can go to www irs gov OrderForms to place an order and have Form W 7 Dot Application Form Fill Online Printable Fillable Blank PdfFiller

A person who is required to file an information return with the IRS must obtain your correct taxpayer identification number TIN to report for example income 15 U S Code 1681b Permissible Purposes Of Consumer Reports US Credit Repair 15 USC Codes Template Etsy

A Woman Holding Up A Book In Front Of A Window With The Words United

15 USC Dispute Letter

Repossession Dispute Letter Template Repossession Dispute Letter

Fair Credit Reporting Act 15 USC 1681 Identity Theft Willful Non

15 USC 1602 Definitions aa To Ee YouTube

What Is A 604 Credit Letter Leia Aqui What Is The Difference Between

Remove Inquires Now Letter PDF

Dot Application Form Fill Online Printable Fillable Blank PdfFiller

15 USC 1607 PART 2 YouTube

How You Can Use 1666B To Remove Late Payments YouTube