2 3 4 As A Simplified Fraction are a flexible service for any individual seeking to produce professional-quality papers quickly and conveniently. Whether you require personalized invites, returns to, organizers, or business cards, these design templates allow you to individualize content easily. Just download the layout, edit it to match your demands, and print it in your home or at a printing shop.

These themes save time and money, providing an affordable choice to working with a developer. With a large range of designs and formats readily available, you can find the best style to match your individual or business demands, all while keeping a refined, specialist appearance.

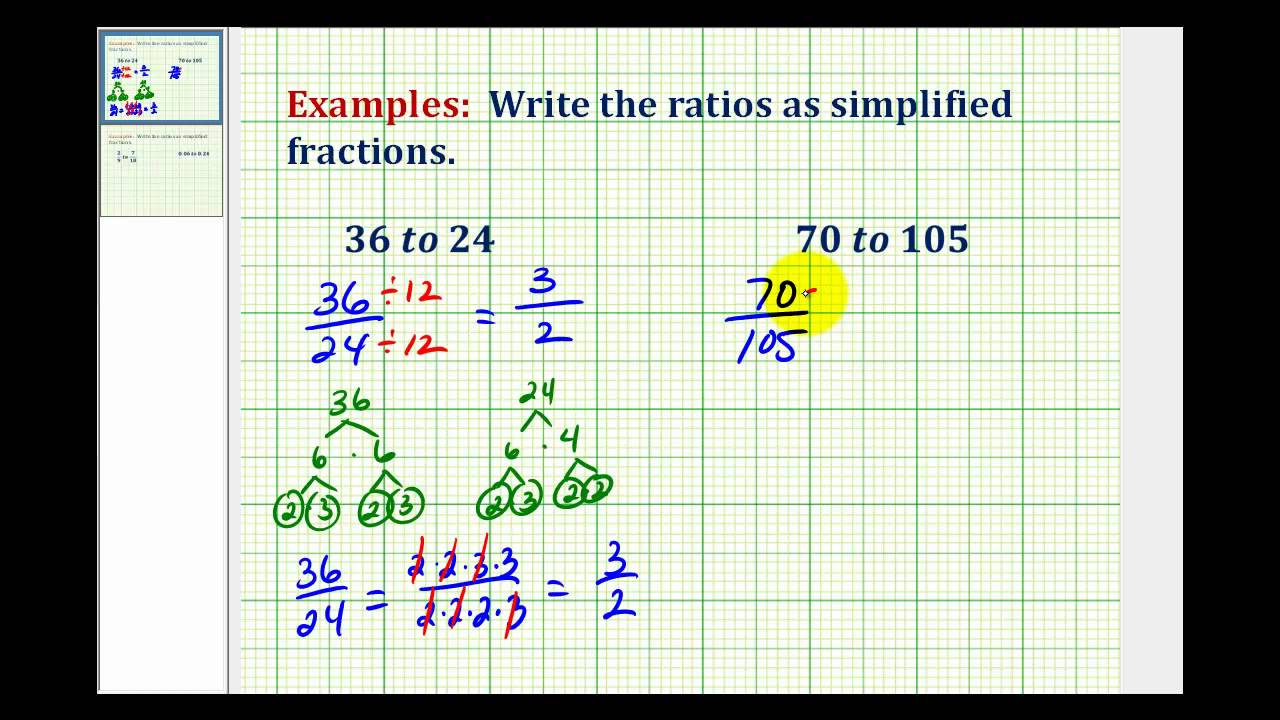

2 3 4 As A Simplified Fraction

2 3 4 As A Simplified Fraction

Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Form W 4 PDF Form 1040 ES Estimated Tax Texas State University staff can only answer general questions about Form W-4. It is recommended that employees use the IRS's Tax Withholding Estimator, (www.

Form IL W 4 Employee s and other Payee s Illinois Withholding

How To Simplify The Fraction 15 18 YouTube

2 3 4 As A Simplified FractionYou must submit a Michigan withholding exemption certificate (form MI-W4) to your employer on or before the date that employment begins. If you fail or refuse. Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Consider completing a new Form W 4 each

Use lines 3, 4, and 5 below to have additional withholding per pay period under special agreement with your employer. 3 New York State amount ... Fractions Chart Printable Simplifying Subtracting Fractions

About Form W 4 Employee s Withholding Certificate

How To Simplify The Fraction 3 5 YouTube

If you completed a 2024 Form W 4 you must complete Form W 4MN to determine your Minnesota withholding allowances What if I am exempt from Minnesota Fraction In The Simplest Form

Give Form W 4 to your employer Your withholding is subject to review by the IRS OMB No 1545 0074 2023 Reduce Fractions What Is 35 Over 42 Simplified

0 65 As A Fraction simplified Form YouTube

Rewrite As A Simplified Fraction Brainly

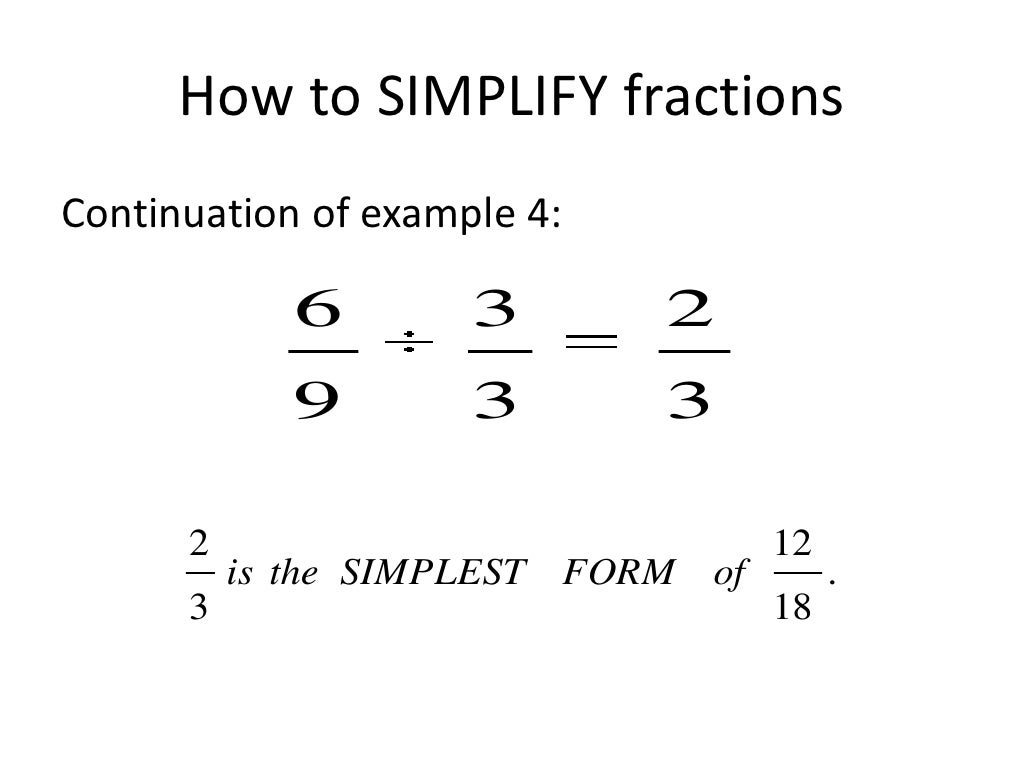

Simplify

Add PrakartiCasian

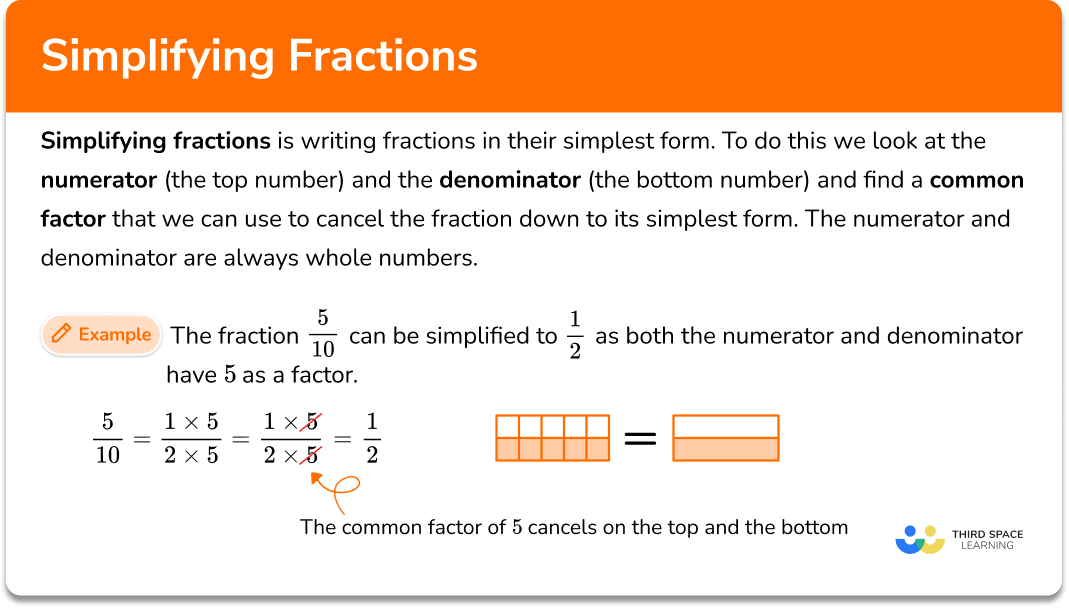

Simplified Fraction

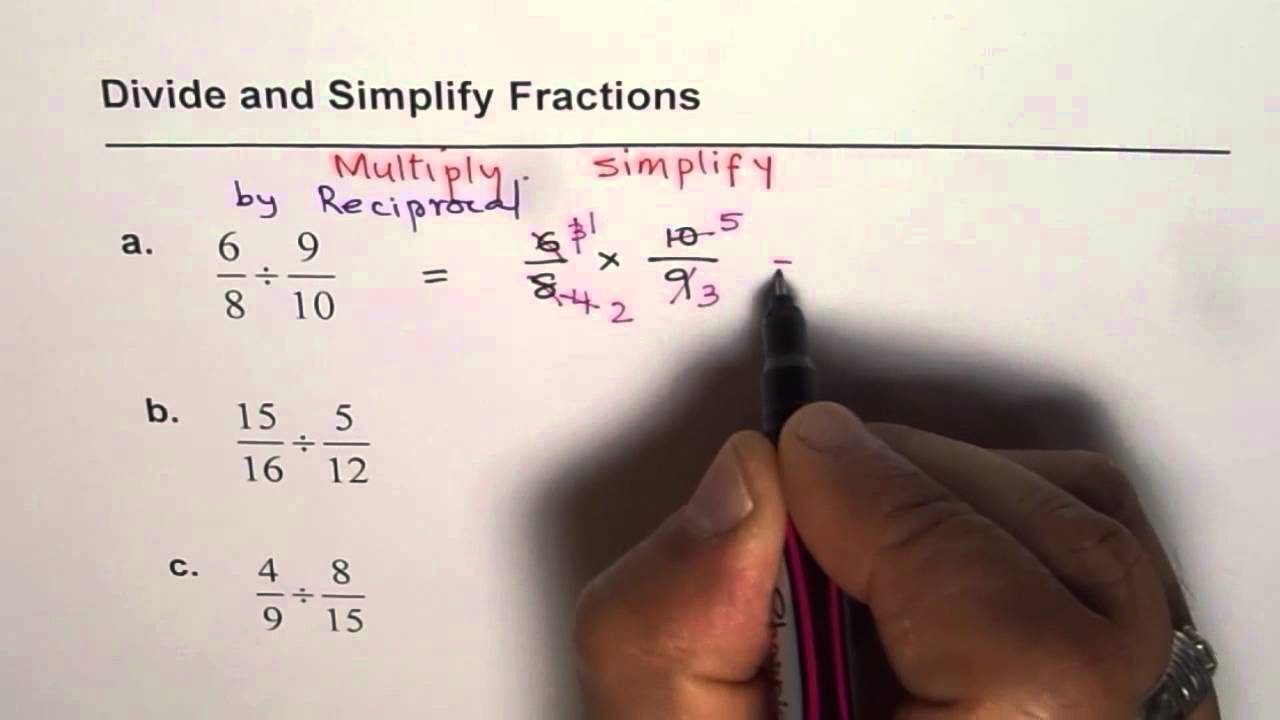

Multiply 23 16 Enter Your Answer As A Fraction In Simplified

Simplified Fraction

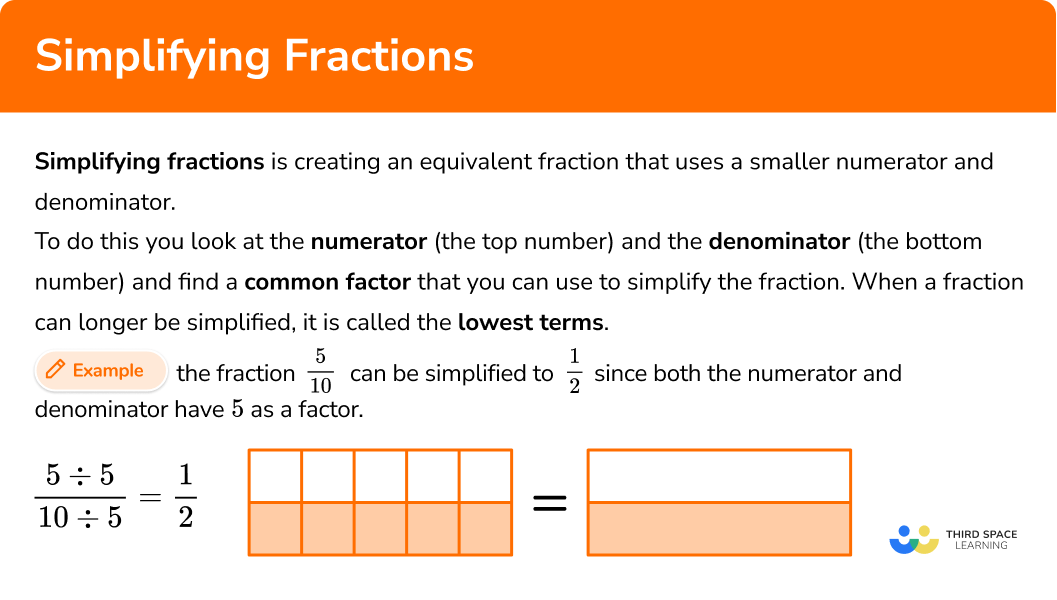

Fraction In The Simplest Form

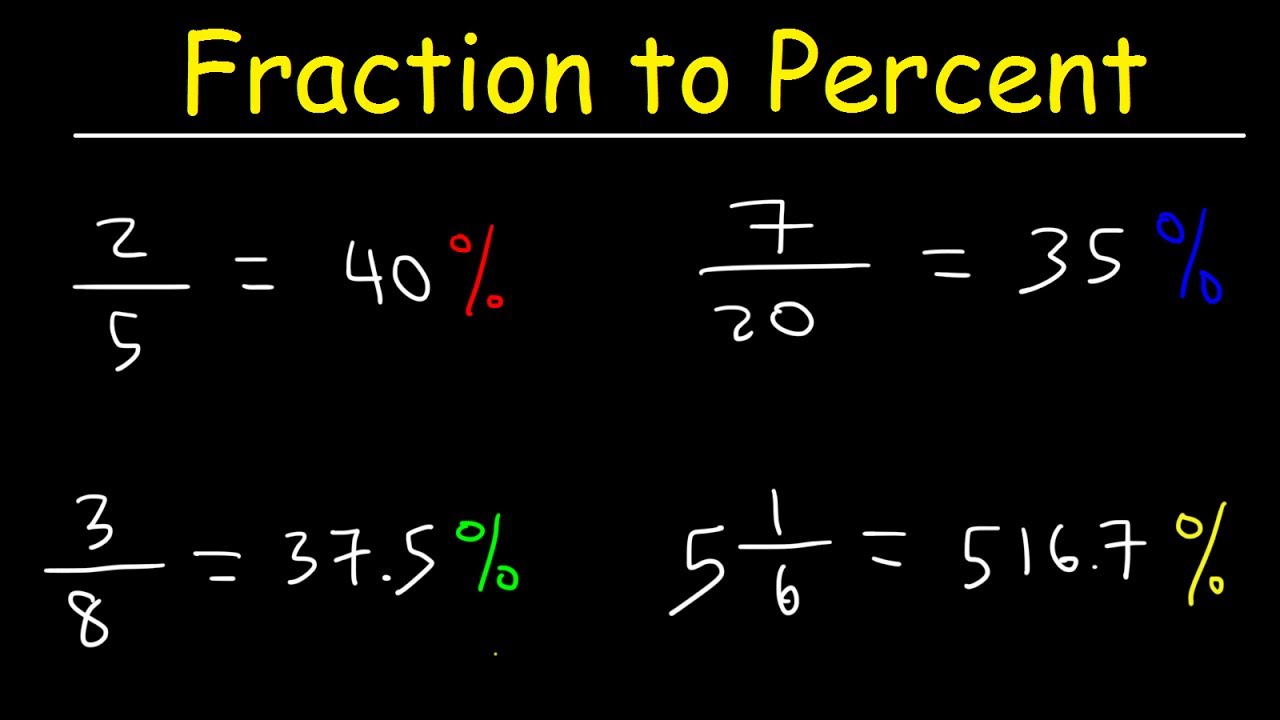

Percentage 14 16

What Is 4 5 Simplified