2 30 Pm Est To Ist are a flexible remedy for anyone wanting to create professional-quality records promptly and quickly. Whether you need custom-made invites, returns to, planners, or calling card, these design templates enable you to customize web content with ease. Just download and install the layout, edit it to suit your needs, and print it in your home or at a print shop.

These design templates save time and money, using an economical choice to employing a developer. With a vast array of styles and layouts readily available, you can discover the excellent design to match your personal or company demands, all while preserving a polished, professional look.

2 30 Pm Est To Ist

2 30 Pm Est To Ist

This post contains printable dollar bills in 6 different denominations 1 5 10 20 50 and 100 These printable worksheets, lesson plans, lessons, and interactive material will help students master concepts of counting money with coins and bills.

Fake Money Printable Pinterest

Time Zones And Time Differences 4th Grade Math Class Ace

2 30 Pm Est To IstA simple one-page PDF of play money for you to print out and use in games or simulations. One- dollar bills only, but for history simulations, there's no ... A simple one page PDF of play money for you to print out and use in games or simulations One dollar bills only but for history

We'll help you craft professional business cards, mailers, flyers, brochures, reports, postcards and other marketing essentials. [img_title-17] [img_title-16]

Play Money Printable Fake Money Teaching Reproducible

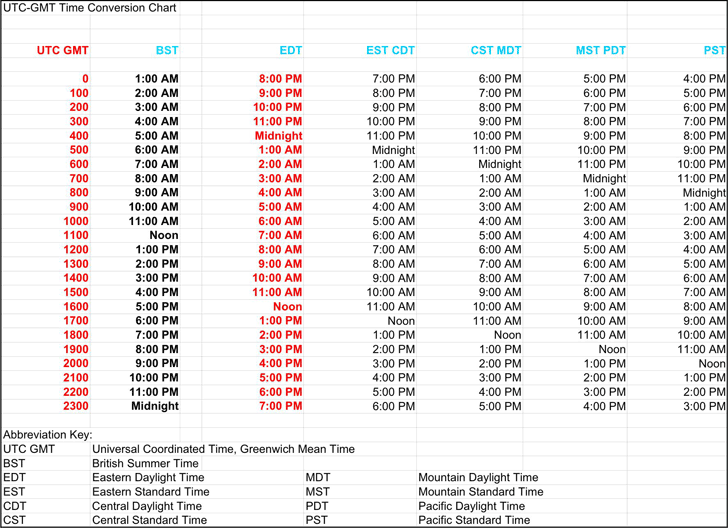

EST To IST Conversion

Printable small money sheets with cut marks 6 per page cash dollar image for letter size paper 1 5 10 20 50 100 dollar bills back side 6up [img_title-11]

Printable Play Money There are seven U S banknotes Learn to recognize and count U S currency with these printable money cutouts Learn more [img_title-12] [img_title-13]

[img_title-4]

[img_title-5]

[img_title-6]

[img_title-7]

[img_title-8]

[img_title-9]

[img_title-10]

[img_title-11]

[img_title-14]

[img_title-15]