2 Of 52500 are a versatile option for anybody wanting to produce professional-quality documents rapidly and easily. Whether you require personalized invitations, returns to, organizers, or calling card, these design templates permit you to individualize material easily. Merely download the template, modify it to fit your needs, and publish it in the house or at a print shop.

These design templates save money and time, offering a cost-effective alternative to working with a designer. With a wide variety of styles and layouts available, you can locate the ideal design to match your individual or company requirements, all while preserving a refined, professional look.

2 Of 52500

2 Of 52500

Easy to use printable tap drill chart and drill bit sizes table available for a FREE download on our website View drill and tap chart DRILL. SIZE. 80. 79. 1/64. 78. 77. 76. 75. 74. 73. 72. 71. 70. 69. 68. 1/32. 67. 66. 65. 64. 63. 62. 61. 60. 59. 58. 57. 56. 3/64. 55 ... DRILL SIZE CONVERSION ...

Decimal Equivalents Chart Fastenal

107414774 1715706160019 gettyimages 2152925728 wm 10055 qt3laq2n jpeg v

2 Of 52500Our tap and clearance drill charts are available as an Adobe Acrobat PDF file. You can print this file to use in your shop. To download the file, right-click ... DRILL SIZE DECIMAL EQUIVALENT TAP DRILL CHART DECIMAL EQUIVALENT CHART TAP DRILL CHART PHONE 1 800 558 2808 FAX 1 800 553 8769 WEB www

Millimeter sizes are priced as “Special”. 80. Fractional, Letter & Number Drill Sizes Millimeter & Decimal Equivalent tel. 800.932.0076 • fax. 908.789.9429. Download 00FF00 Prismatic Out Of Many 3 SVG FreePNGImg Understanding Dental Health World Of Dentistry

Drill Size Conversion Chart ICS Cutting Tools

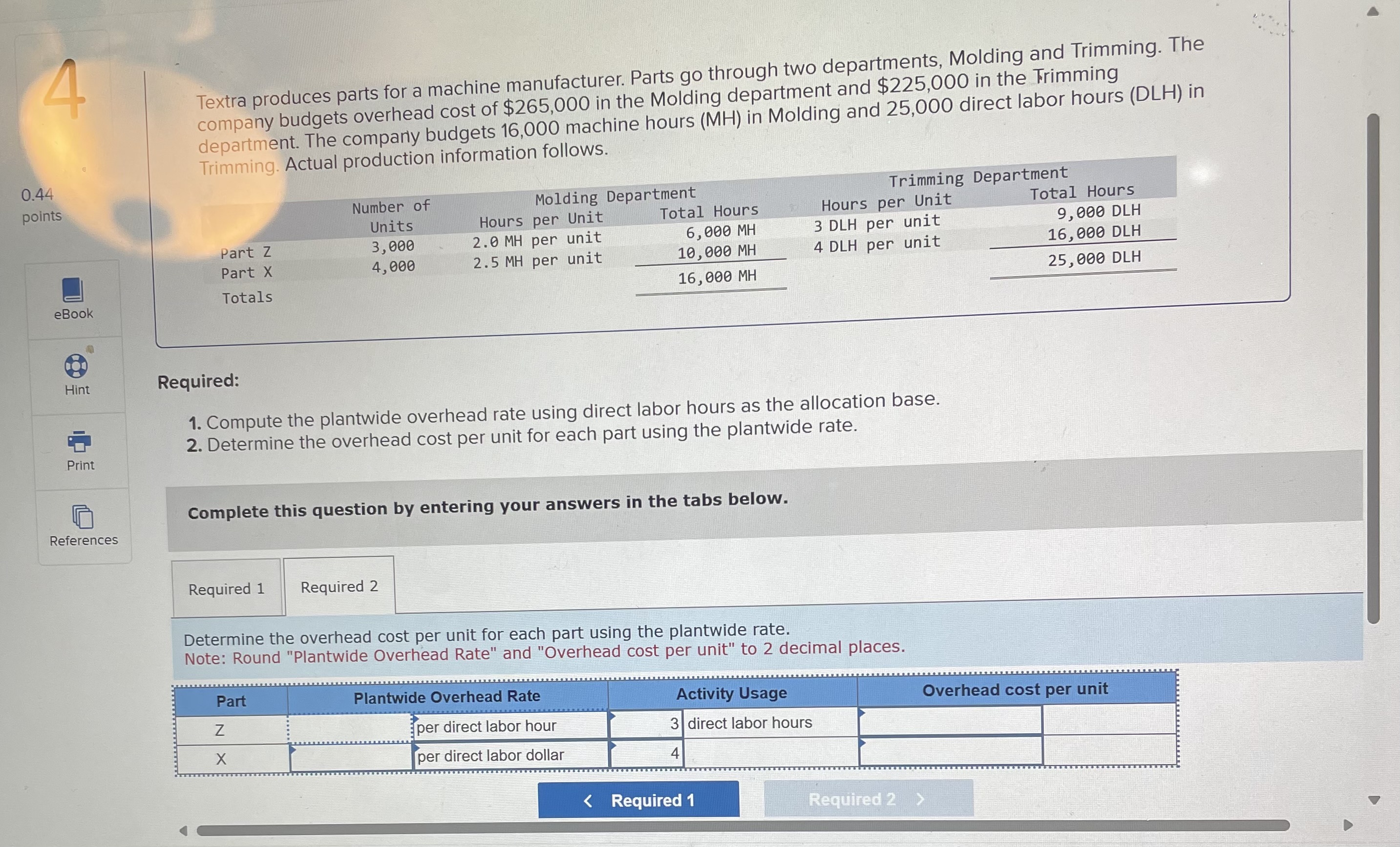

Solved Textra Produces Parts For A Machine Manufacturer Chegg

Screw Size mm Thread Pitch mm Drill Size mm Closest American Drill Drill Size mm Closest American Drill Drill Size mm Closest 107336093 1700270986223 107336093 1700270684717 gettyimages 1786606241

In general there are 3 categories of common imperial drill sizes fractional in 1 64 increments lettered A Z and numbered 1 80 Generated by K Solved Data Are Given Below On The Adjusted Gross Income X Chegg Tnc meta logo png

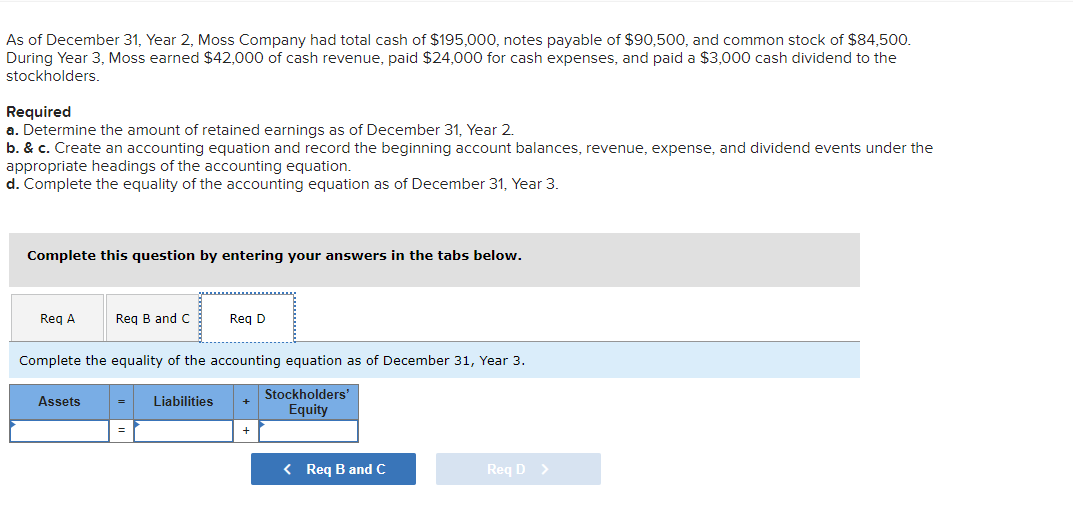

Solved As Of December 31 Year 2 Moss Company Had Total Chegg

88 A CELADON AND RUSSET JADE FIGURE OF A HORSE MING DYNASTY

Emerson File

107202442 16777817202023 03 02t182345z 978032107 rc2slz9amphv rtrmadp 0

107054737 gettyimages 1240401968 AFP 329D2HB jpeg v 1706626289 w 1920 h

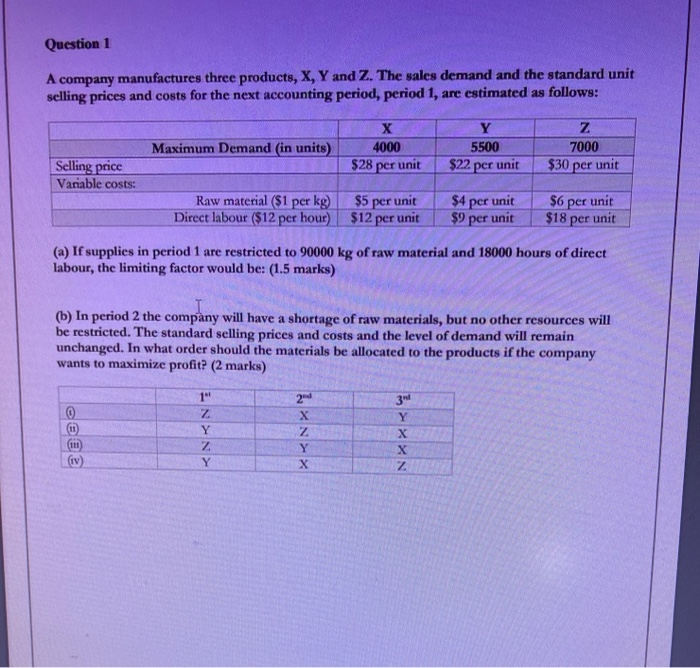

Solved Question 1 A Company Manufactures Three Products X Chegg

107336093 1700270986223 107336093 1700270684717 gettyimages 1786606241

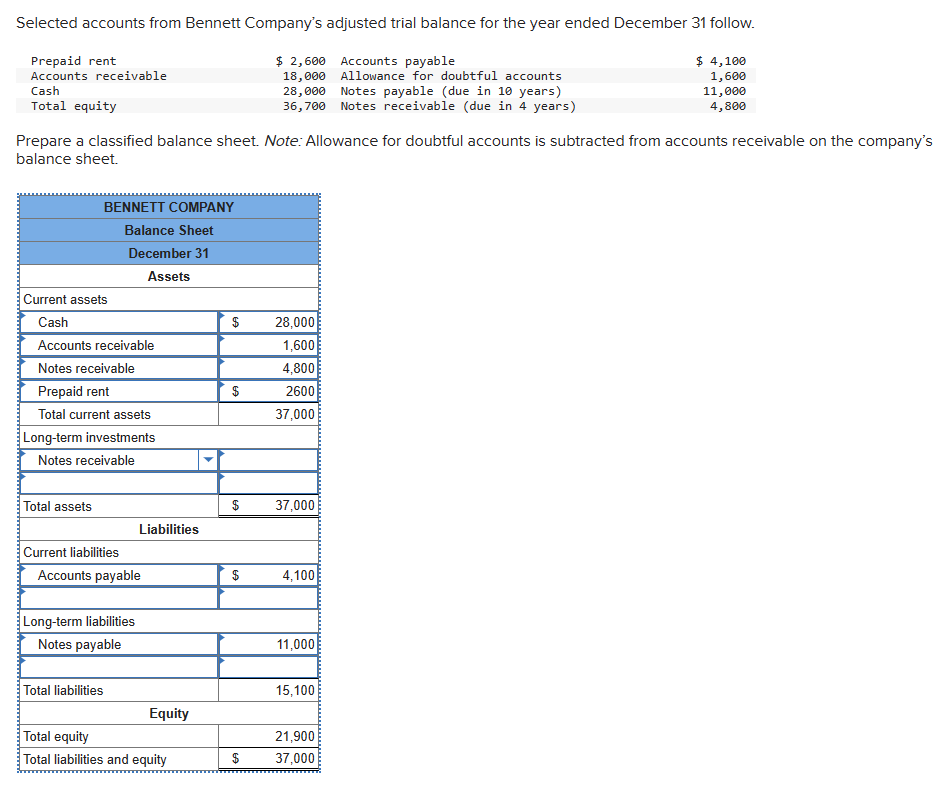

Solved Selected Accounts From Bennett Company s Adjusted Chegg

107357412 1704989068364 gettyimages 1542363443 OmarMarques