32 Divided By 75 As A Percent are a versatile remedy for any individual wanting to develop professional-quality files promptly and conveniently. Whether you need custom invitations, returns to, organizers, or calling card, these templates enable you to individualize web content effortlessly. Simply download and install the theme, edit it to suit your requirements, and publish it in the house or at a printing shop.

These themes conserve money and time, providing an economical choice to employing a developer. With a wide range of designs and layouts readily available, you can locate the ideal layout to match your personal or service requirements, all while preserving a sleek, expert appearance.

32 Divided By 75 As A Percent

32 Divided By 75 As A Percent

This website has tons of free printable wallpaper in scale for dollhouses There are probably 100 different designs I love the result 12 Dollhouse Vintage Wallpaper Patterns - 12 Sheets in A4 format - Instant Download - Print, cut and glue to your dollhouse - PDF Sheet

Dollhouse wallpaper free download Micki

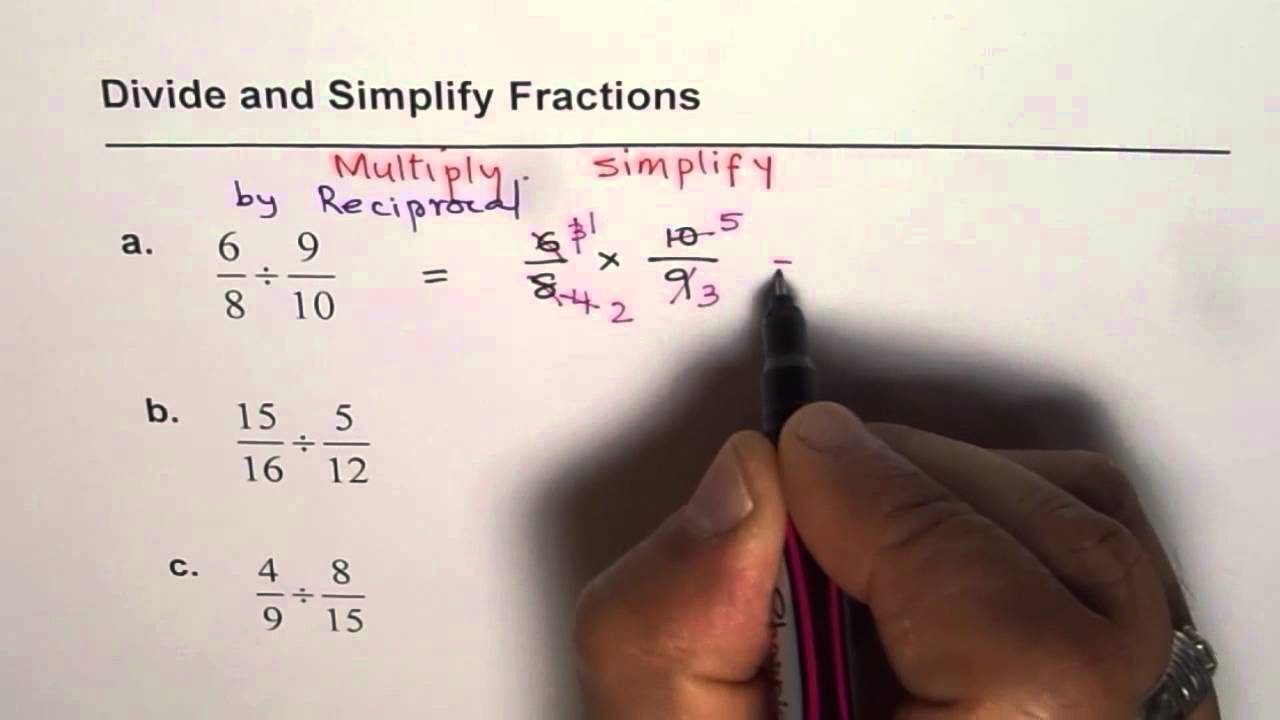

How To Divide Decimals Easily And Correctly fastandeasymaths math

32 Divided By 75 As A PercentHere are the downloadable miniature wallpapers, artwork and flooring. I recommend printing on cardstock and using double sided tape to adhere. These miniature wallpapers are meant for 1 12th scale doll s houses but they can be used for other projects as well People have used them for decorating

Use on one section, or through the entire house. Cute and custom fitted to the flisat, I use only high resolution images and custom crafted designs to ... 28 Divide By 4 100 Divided By 86

Dollhouse Wallpaper Printable Etsy

10

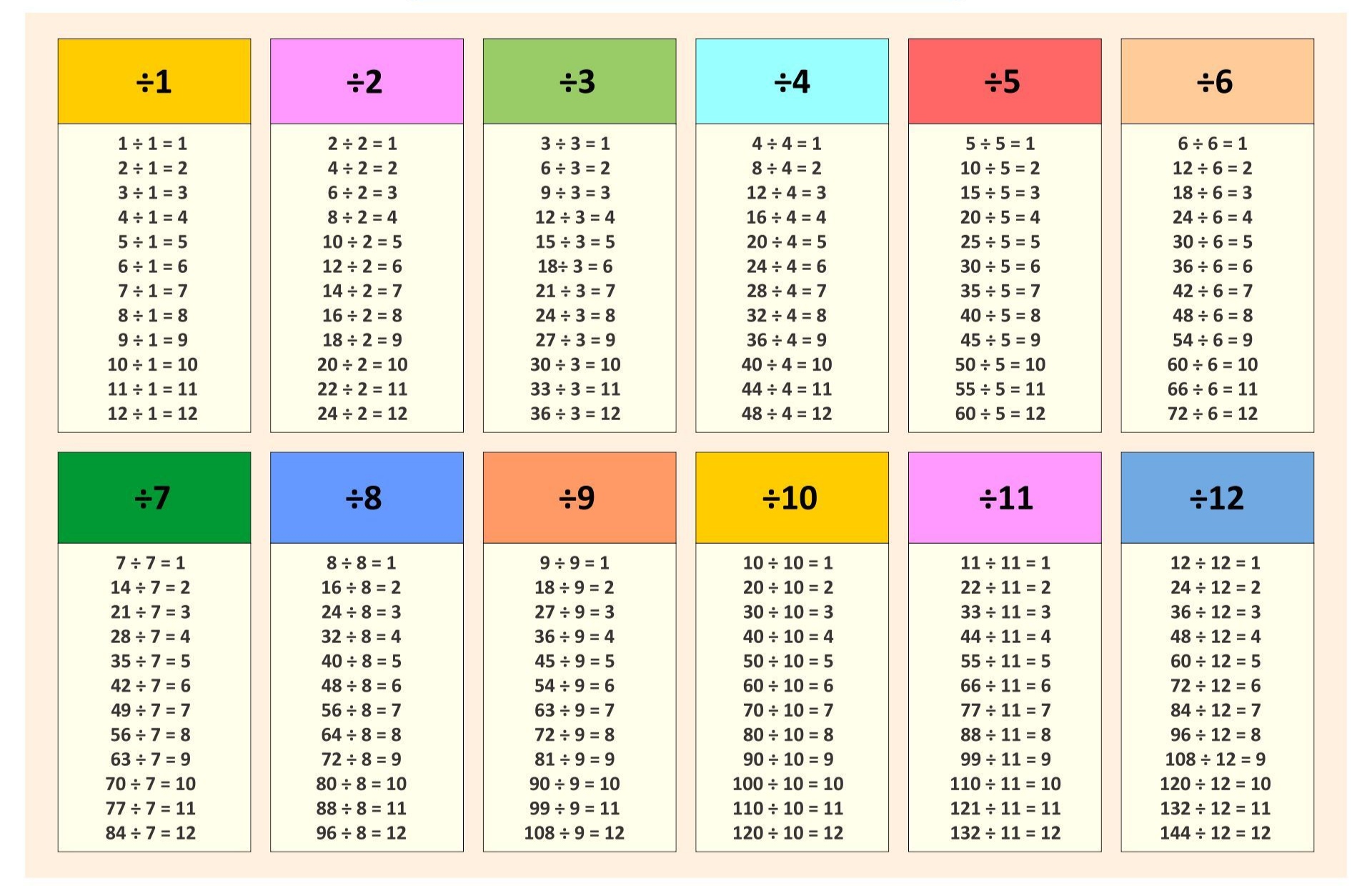

Pattern 001 There are 18 patterned wallpapers to choose from If you find a wallpaper you like click on the sample Clicking the sample will bring up a Division Chart Printable

Feb 23 2024 Explore Karla van Baarle s board Dolls house printables wallpaper flooring on Pinterest See more ideas about wallpaper 4 6 Divided By 1 2 110 Divided By 1000

48 6 Divided By 27 Show Work Brainly

15 Divided By 23

15 Divided By 23

.png)

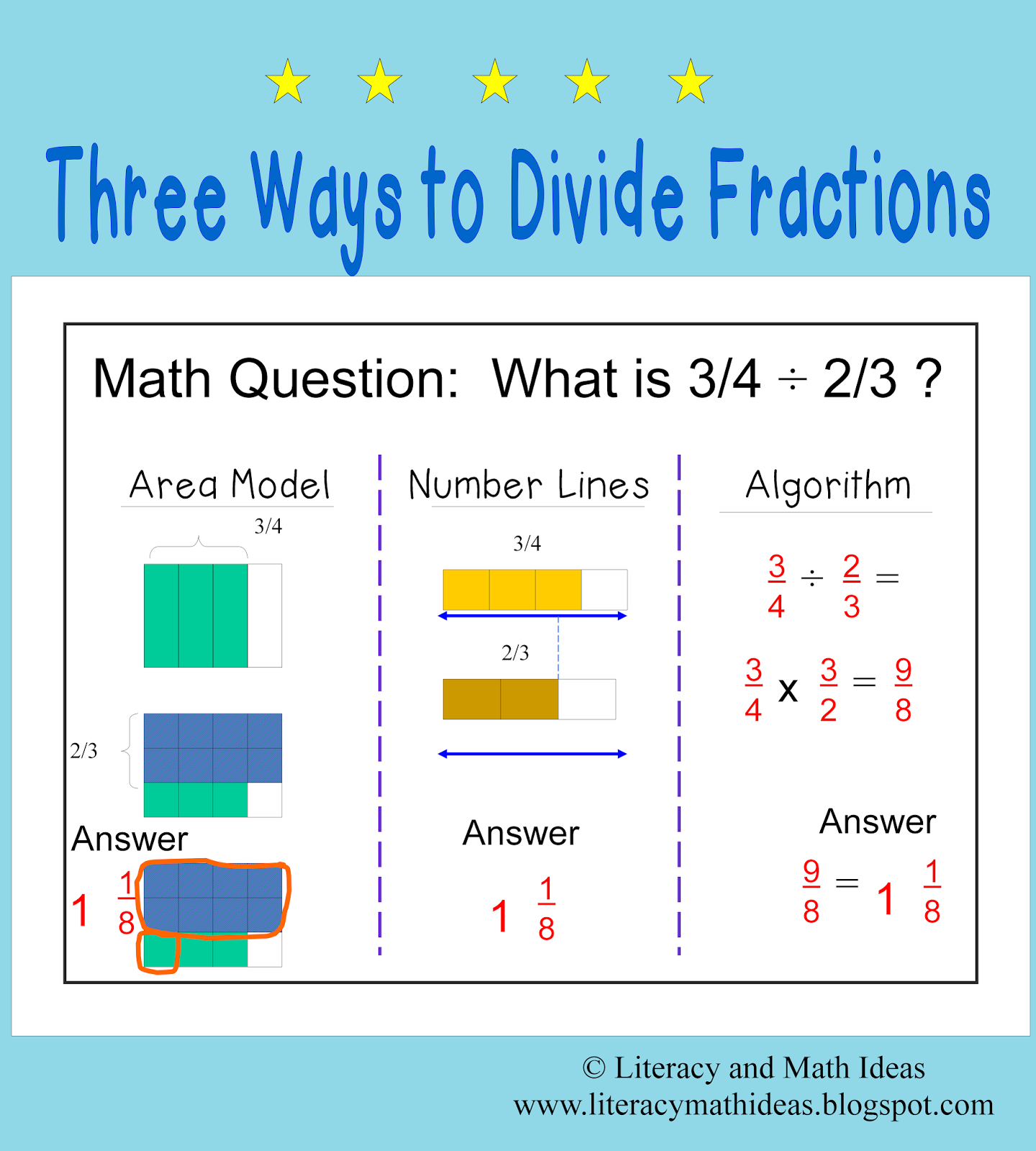

Bar Diagram Fractions

Math Division Chart

Two Division Tables

Division Charts Printable

Division Chart Printable

New Division Method

What Is 8 Divided By 56