7 Percent Of 34000 Calculator are a versatile remedy for any person seeking to create professional-quality files promptly and conveniently. Whether you need custom-made invitations, returns to, organizers, or calling card, these layouts enable you to customize material effortlessly. Merely download the layout, edit it to fit your demands, and print it in your home or at a printing shop.

These layouts save time and money, using an economical option to working with a developer. With a large range of styles and styles offered, you can locate the perfect style to match your personal or service needs, all while maintaining a refined, expert look.

7 Percent Of 34000 Calculator

7 Percent Of 34000 Calculator

Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Form W 4 PDF Form 1040 ES Estimated Tax Texas State University staff can only answer general questions about Form W-4. It is recommended that employees use the IRS's Tax Withholding Estimator, (www.

Form IL W 4 Employee s and other Payee s Illinois Withholding

Percentages Revision Poster Studying Math Math Methods Teaching Math

7 Percent Of 34000 CalculatorYou must submit a Michigan withholding exemption certificate (form MI-W4) to your employer on or before the date that employment begins. If you fail or refuse. Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Consider completing a new Form W 4 each

Use lines 3, 4, and 5 below to have additional withholding per pay period under special agreement with your employer. 3 New York State amount ... FDIC Speeches Testimony 2 28 2023 Remarks By FDIC Chairman FDIC Speeches Testimony 2 28 2023 Remarks By FDIC Chairman

About Form W 4 Employee s Withholding Certificate

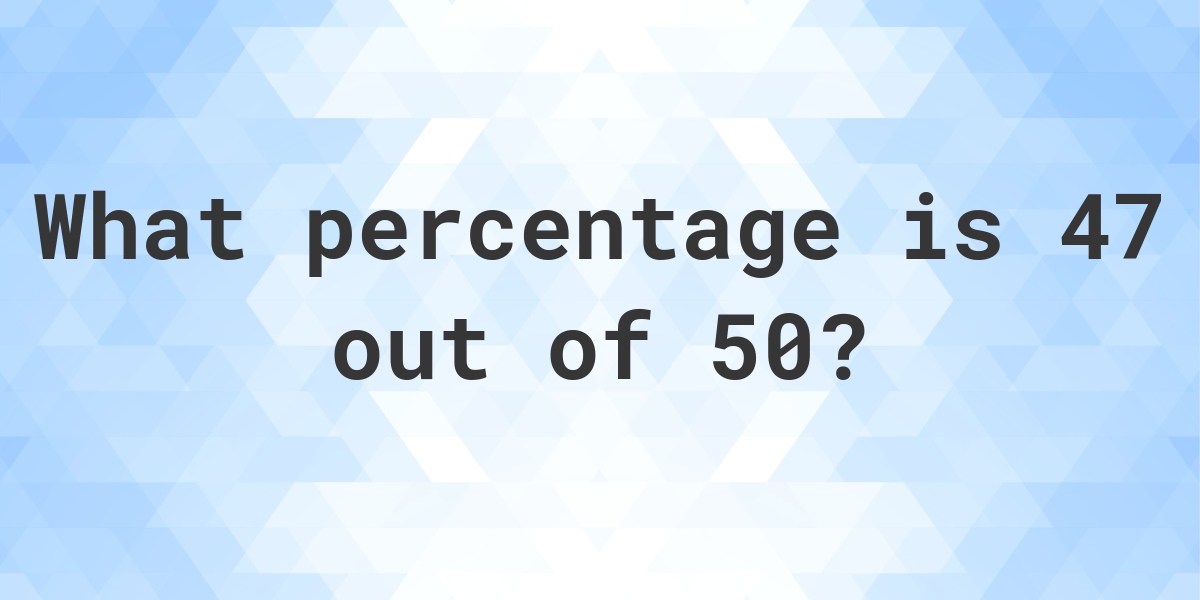

What Is 47 50 As A Percent Calculatio

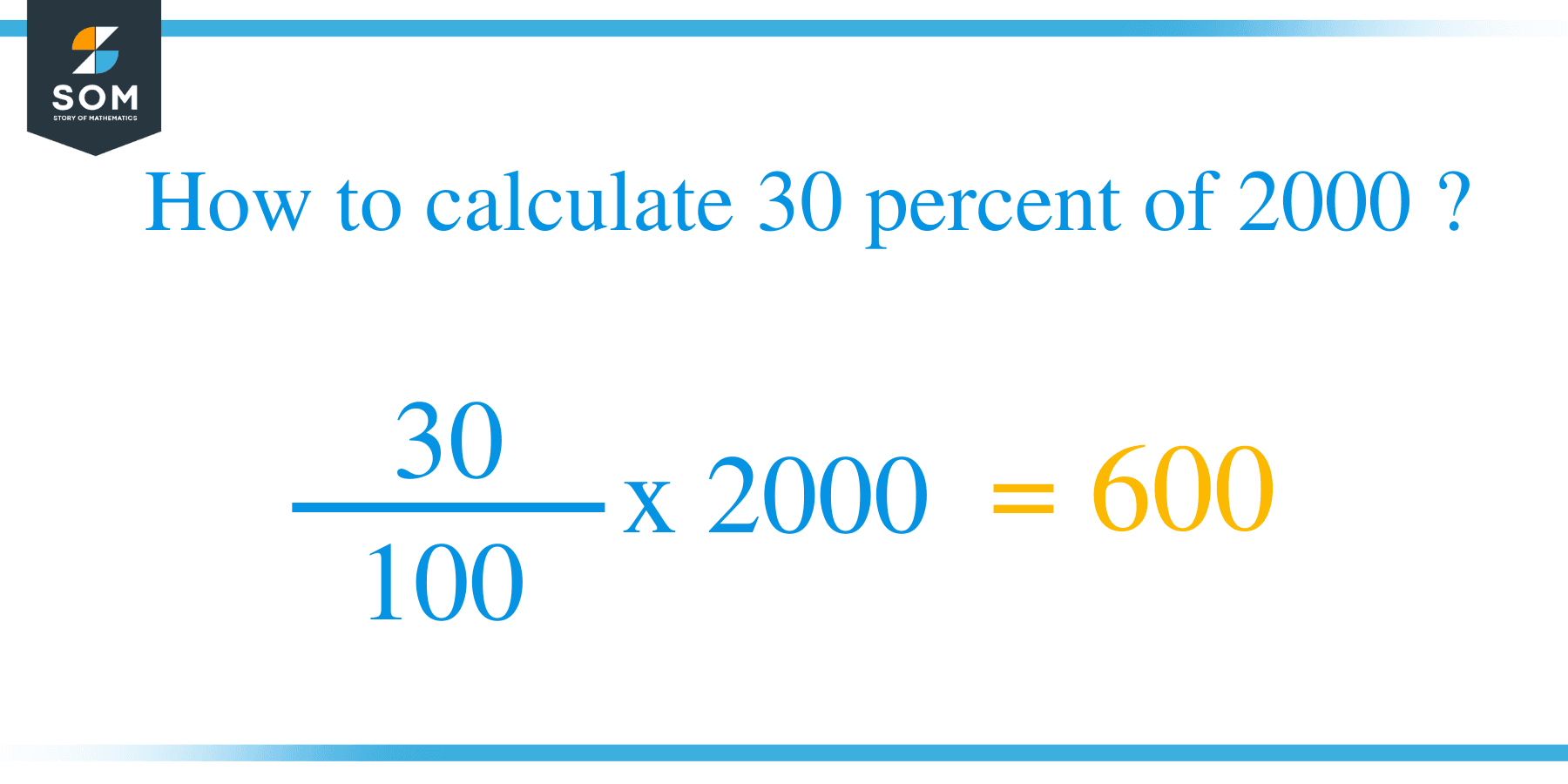

If you completed a 2024 Form W 4 you must complete Form W 4MN to determine your Minnesota withholding allowances What if I am exempt from Minnesota What Is 30 Percent Of 2000 Solution With Free Steps

Give Form W 4 to your employer Your withholding is subject to review by the IRS OMB No 1545 0074 2023 Wacc Calculator What Is 7 Percent Of 2000 Solution With Free Steps

Percentage Discount And Percent Of A Quantity

Saudi Finance Companies Q2 Net Income Fall 67 7 Over Q1 To 75 2m

Percentage Calculator

Fact Pack

Massachusetts GOP Chooses Trump endorsed Governor Candidate WORLD

How To Operate A Scientific Calculator with Pictures WikiHow

Comment Calculer Un Pourcentage Massique 13 tapes

What Is 30 Percent Of 2000 Solution With Free Steps

Operate A Scientific Calculator Basic Functions Explained

Percentage Calculator Simply Calculate Percentages