8 Divided By 156 are a functional service for any individual wanting to create professional-quality papers promptly and quickly. Whether you require custom-made invitations, returns to, coordinators, or calling card, these templates enable you to customize web content easily. Simply download the theme, modify it to match your demands, and print it in the house or at a printing shop.

These design templates save money and time, offering a cost-efficient choice to hiring a developer. With a large range of styles and formats readily available, you can discover the perfect design to match your personal or service demands, all while preserving a refined, expert appearance.

8 Divided By 156

8 Divided By 156

We offer DIY templates with custom options for fonts colors stickers photos and so much more We specialize in online editable wedding invitation cards Find your perfect Printable Wedding Invitation Card and Suite Template. Customize and print elegant designs for your special day. Start personalizing now!

Free Wedding Invitation Templates Adobe Express

107311388 16964287912023 10 04t141001z 1152379547 rc2ql3av8fhx rtrmadp

8 Divided By 156Design and print wedding invitations as unique and special as your big day. Start from our selection of beautiful templates, add a personal touch. We offer great designs that you can customize download and print at home for free Enjoy these designs and have fun making your own unique wedding invitation

Why hire a designer when you can do it yourself? These lovely Wedding Invitations can be customized and printed at home or your local print shop. The Division 3 8 Divided By 3 7 In Simplest Form Brainly

Printable Wedding Invitation Card Suite Template

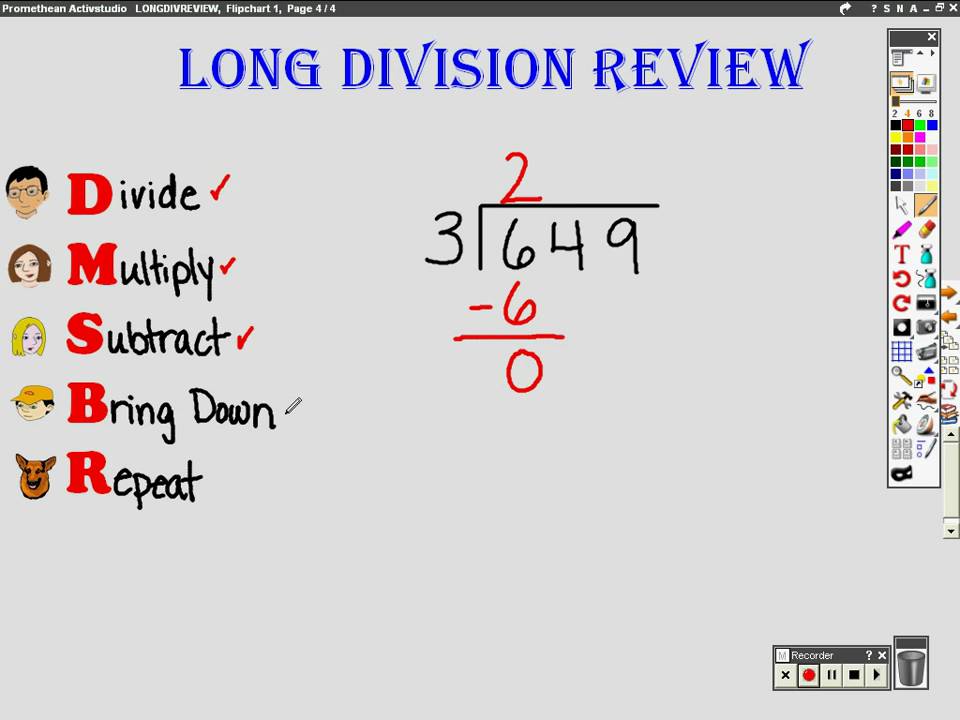

Long Division Review YouTube

Check out our printable wedding invitation selection for the very best in unique or custom handmade pieces from our invitation templates shops 8 Divided By 9 8 9 YouTube

DIY custom wedding invitations Add your wedding details and customize colors online Download a print ready file then print unlimited copies at home 4 Divided By 5 4 5 Or 4 5 YouTube 156 6 156 6 Dividir 156 Por 6 Dividir 156 Entre 6 156 Dividido

How To Divide By 7 YouTube

5 Divided By 8 5 8 YouTube

16 Divided By 1 8 Sixteen Divided By One Eighth YouTube

7 Divided By 8 7 8 YouTube

8 Divided By 7 8 7 YouTube

9 Divided By 8 9 8 YouTube

8 Divided By 1 3 Eight Divided By One Third YouTube

8 Divided By 9 8 9 YouTube

Long Division Video Corbettmaths Primary

18 8 Divided By 2 8 Divided By 4x2 Brainly in