99 Divided By 60 are a flexible remedy for anybody aiming to create professional-quality documents rapidly and conveniently. Whether you need personalized invitations, resumes, coordinators, or calling card, these design templates permit you to personalize content with ease. Merely download and install the template, modify it to match your needs, and print it in the house or at a print shop.

These templates save money and time, using an economical alternative to employing a designer. With a vast array of styles and styles readily available, you can locate the ideal layout to match your individual or business needs, all while preserving a refined, expert appearance.

99 Divided By 60

99 Divided By 60

Download Free Printables We are excited to offer a NEW free printable every other Friday Sign up below to get your fun Do A Dot Art printable in your inbox Learn shapes & practice fine motor skills with do a dot printables! Free dot marker worksheets use bingo daubers for a FUN shape activity!

Do a dot worksheets Archives Easy Peasy Learners

What Is 5 Divided By

99 Divided By 60Free patriotic do a dot printables. Super cute and easy do a dot worksheets in patriotic style perfect for july 4th, memorial day, veterans day ... Dot marker printables and dot sticker sheets are such a fun and easy activity to do with toddlers and preschoolers There are over 100 pages to grab

Whether you're studying bugs and insects or your kids just love the do-a-dot pages, this fun pack from Easy Peasy Learners is sure to be a hit! [img_title-17] [img_title-16]

FREE Printable Shape Do a Dot Marker Worksheets

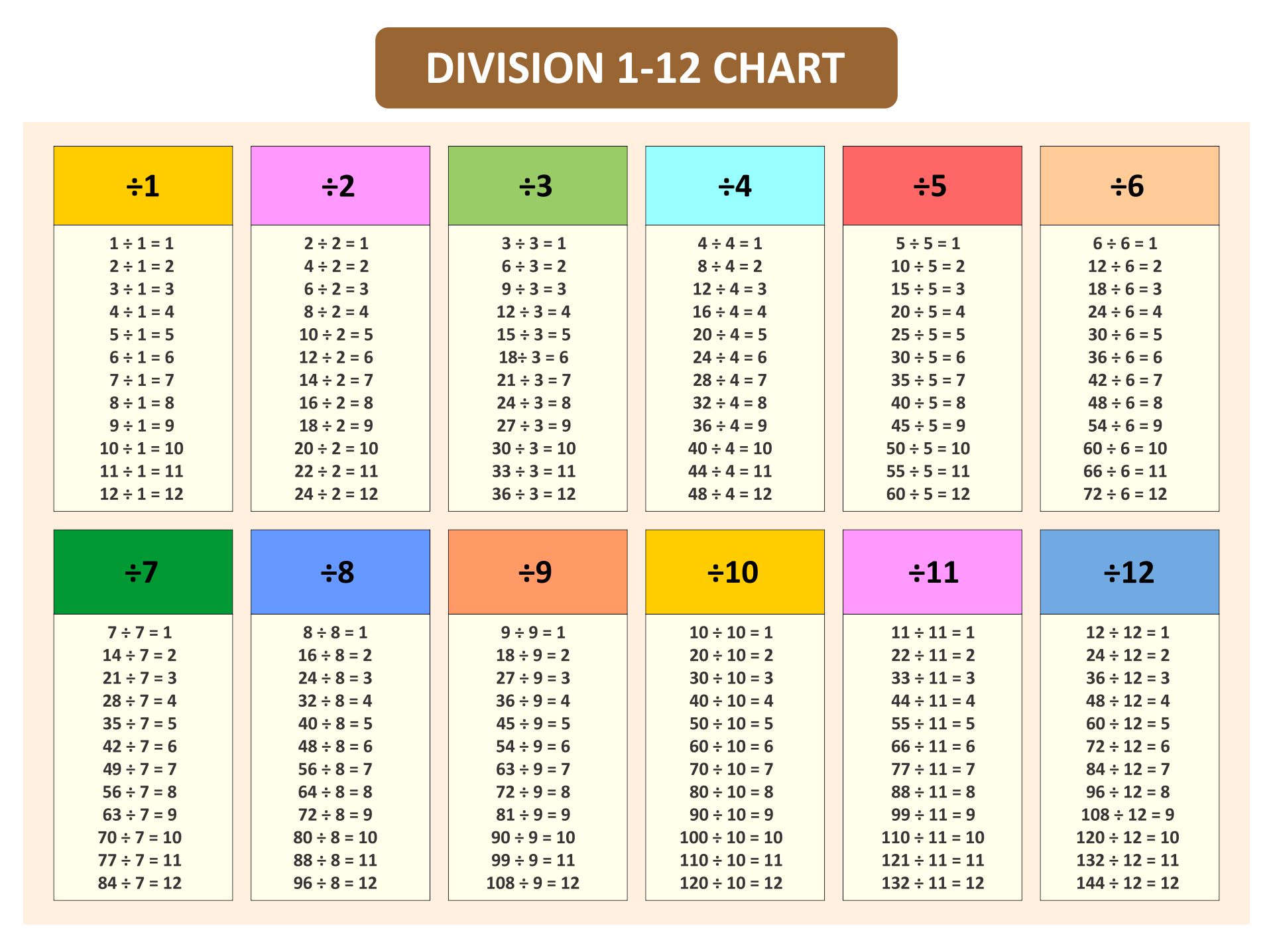

Times Table And Division

17 pages of free printable penguin do a dot worksheets for kids ages 2 6 Great skills practice and a fun resource for kids learning about penguins [img_title-11]

In this article we show you how to get started with do a dot worksheets and round up some of our favorite do a dot books and free do a dot printables for kids [img_title-12] [img_title-13]

Exploring The Enigma Of 1 Divided By 0

10 Divided By 1 2

What Is 2 Divided By 60

What Is 1 Divided By 32

[img_title-8]

[img_title-9]

[img_title-10]

[img_title-11]

[img_title-14]

[img_title-15]