Calculate 1 10 Of 260 are a versatile option for anyone aiming to develop professional-quality files rapidly and easily. Whether you need personalized invitations, returns to, organizers, or business cards, these templates permit you to customize material with ease. Merely download the theme, modify it to fit your needs, and publish it in your home or at a print shop.

These layouts save time and money, using an affordable option to hiring a designer. With a variety of styles and styles available, you can locate the ideal style to match your individual or service demands, all while preserving a sleek, professional appearance.

Calculate 1 10 Of 260

Calculate 1 10 Of 260

A simple one page PDF of play money for you to print out and use in games or simulations One dollar bills only but for history A simple one-page PDF of play money for you to print out and use in games or simulations. One- dollar bills only, but for history simulations, there's no ...

Fake Money Printable Pinterest

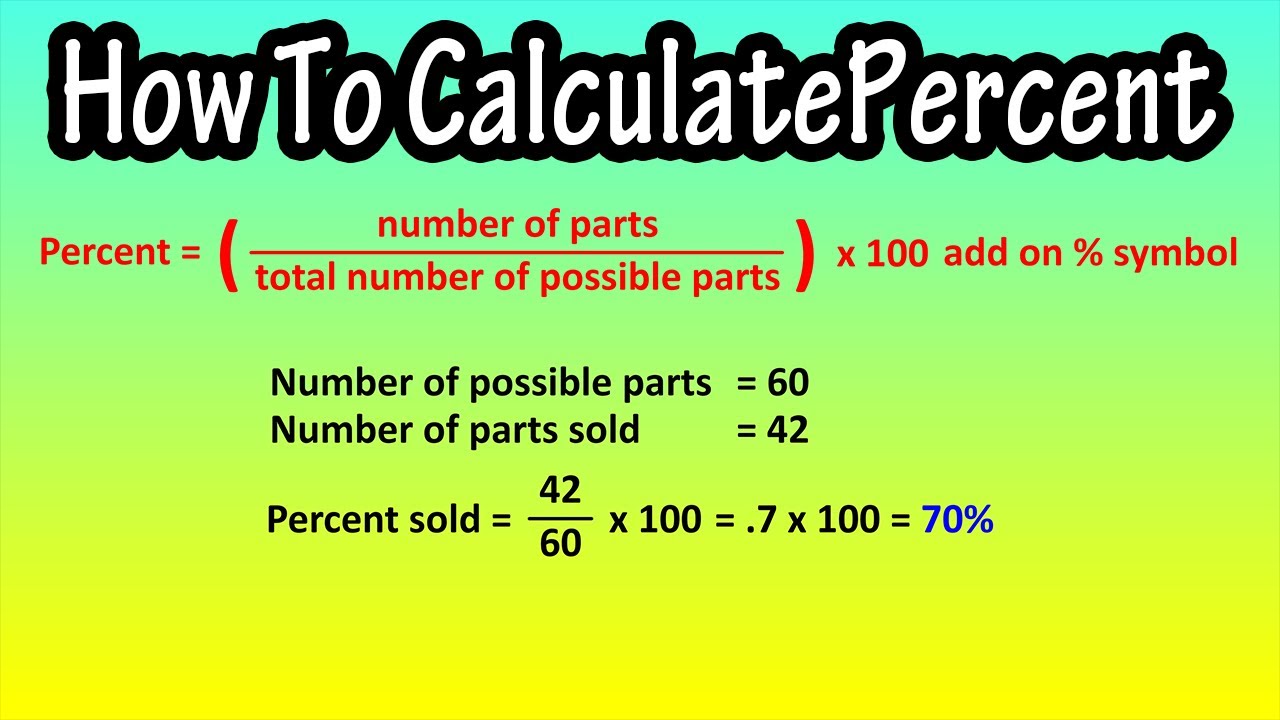

How To Calculate Percent Or Percentage Explained Formula For Percent

Calculate 1 10 Of 260This post contains printable dollar bills in 6 different denominations- $1, $5, $10, $20, $50, and $100. Printable Play Money There are seven U S banknotes Learn to recognize and count U S currency with these printable money cutouts Learn more

This free play money printable with a template can be personalized with your child's photo. Can be used by parents or teachers. EPIC Green River Regional Educational Cooperative Credentials NYU SPS Credentials Accredible Certificates Badges And Blockchain

Play money dollars printable TPT

Rutgers University New Brunswick Credentials Rutgers University New

This printable features realistic illustrations of one dollar bills that can be used for counting and handling money perfect for developing early math skills Professionals Profreeio

These printable worksheets lesson plans lessons and interactive material will help students master concepts of counting money with coins and bills Current Affairs Upttake Jobs Shop Ocheenjapan co

Jobs At Triumph Financial

Shop

Explore Mybnbguest

Drops Dumcap

QUAD A Credentials Accredible Certificates Badges And Blockchain

Shop Lembiknomore

Blocore ICO Analytics

Professionals Profreeio

ORCA Products Clearly Development

Rutgers University Credentials Rutgers University Digital Credentials