How Do I Calculate 2307 Withholding are a functional option for any person wanting to develop professional-quality files quickly and quickly. Whether you require custom-made invitations, resumes, coordinators, or calling card, these layouts enable you to individualize web content easily. Merely download the design template, edit it to fit your requirements, and publish it in the house or at a printing shop.

These design templates conserve time and money, supplying an economical choice to hiring a designer. With a wide variety of styles and formats offered, you can locate the perfect design to match your personal or company needs, all while maintaining a polished, specialist look.

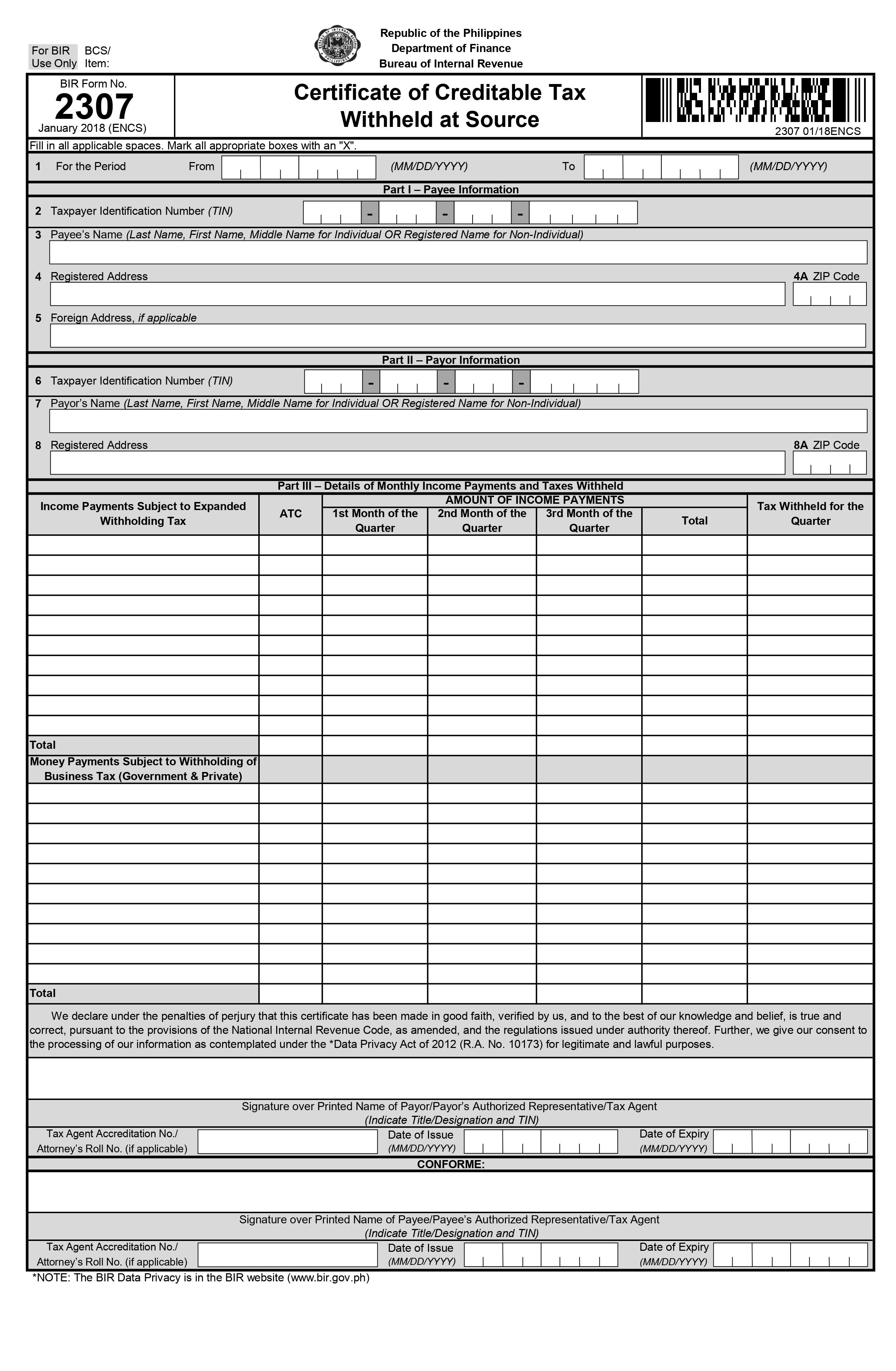

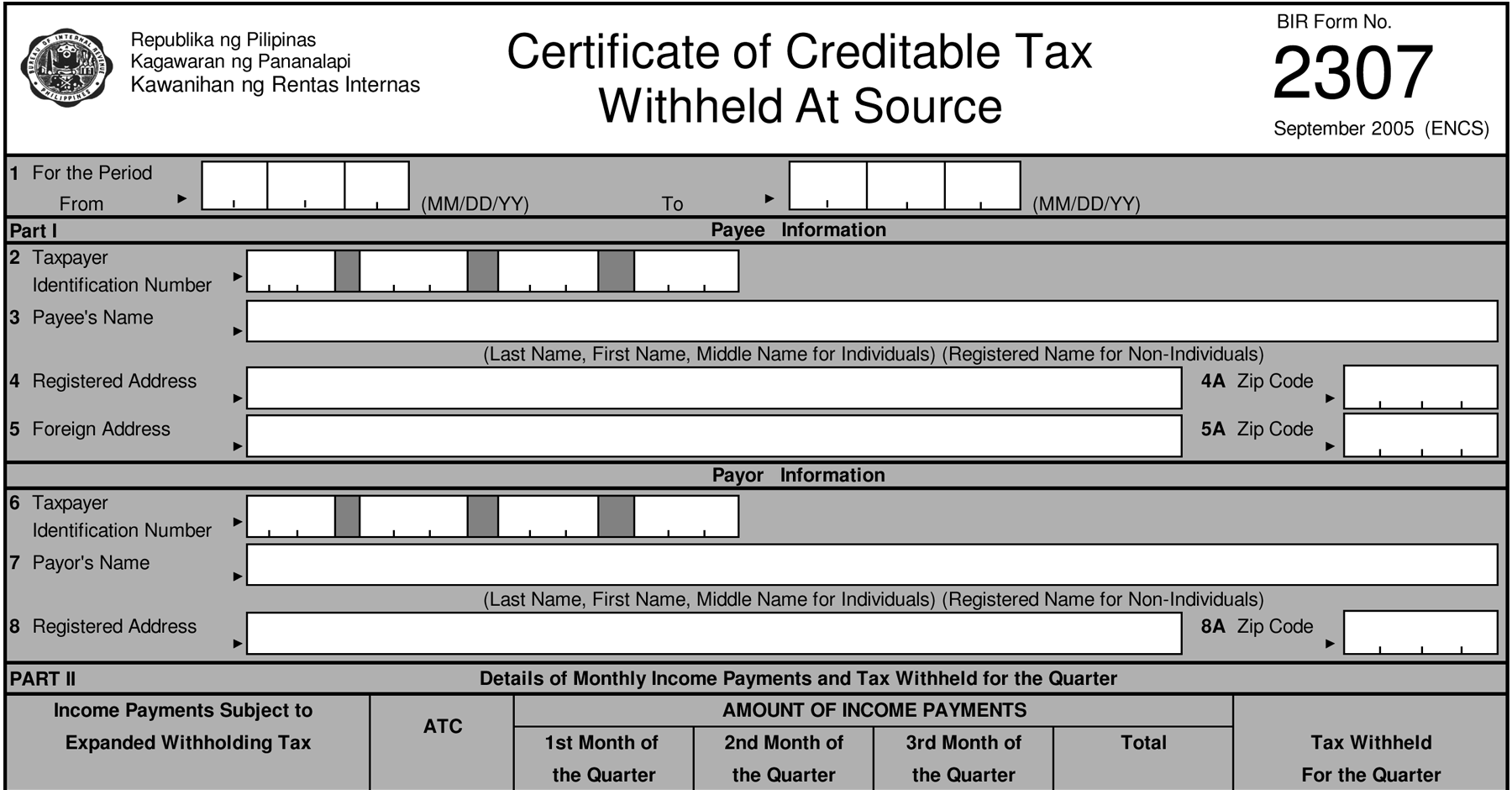

How Do I Calculate 2307 Withholding

How Do I Calculate 2307 Withholding

Modern Calligraphy Wedding InvitationThe Botanical Invitation Suite Seating ChartPineapple Suite Free Printable Wedding Place CardHeart and Arrow Free Does anyone know any good websites with FREE wedding sign printables? Looking for: Classic, and formal styles preferably.

Printable Wedding Signs Etsy

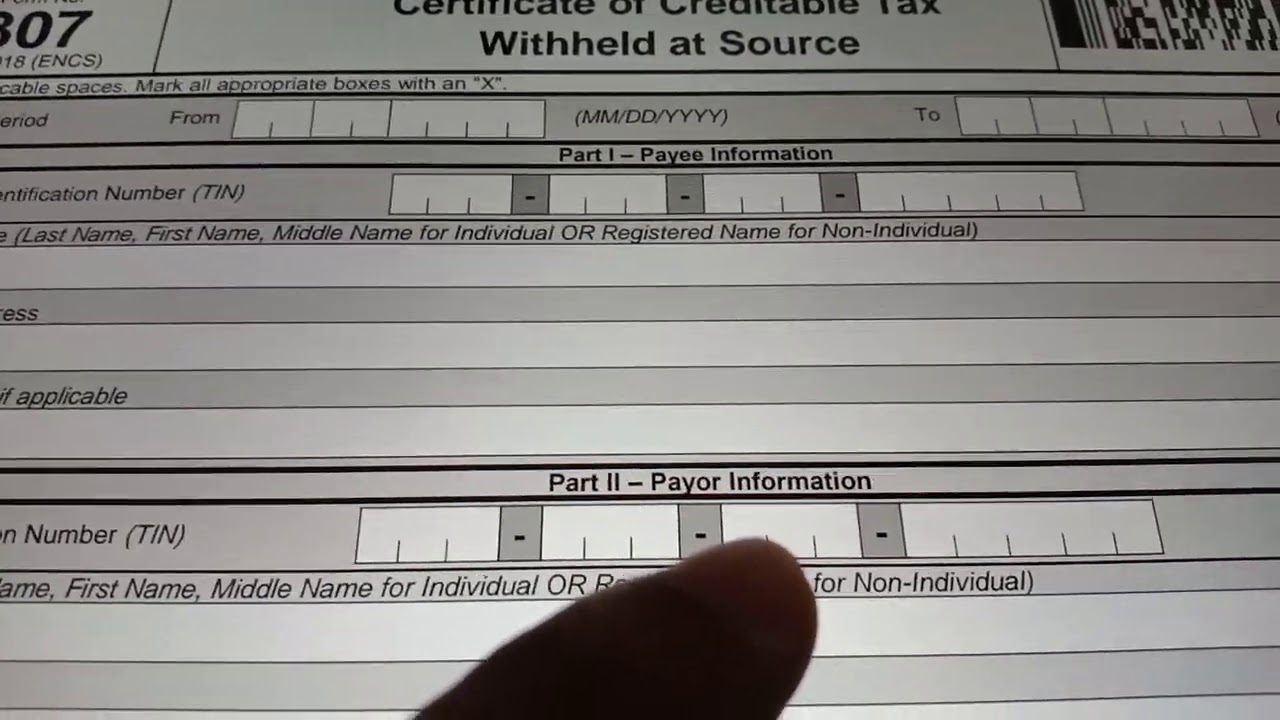

Ano Ang BIR Form 2307 YouTube

How Do I Calculate 2307 WithholdingThis listing is for a non EDITABLE DIGITAL TEMPLATE of a wedding signage cards which are downloadable and ready to print. So have fun and test these out to make sure they're the right fit for your wedding stationery needs. Free Wedding Sign Package Instant Download Printable Free Wedding Sign Package Instant Download Printable 17 Total signs sized 7 x 5 2100 px x 1500 px

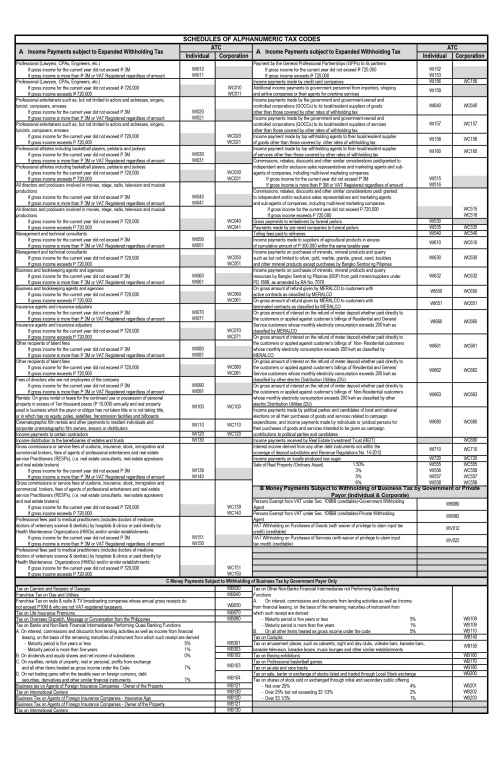

Collection: template & printable wedding signs. Filter: Availability. 0 selected Reset. In stock (25); Out of stock (0). Formula For Pressure 2307 Withholding Tax Corporate Tax

FREE Wedding Sign Printables r weddingplanning Reddit

BIR Form 1702Q With 2307 And SAWT Under AID Option Part 9 TRAILER

Plan Your Dream Wedding with Zazzle Point your guests in the right direction with Printable wedding signs from Zazzle Browse our wide selection of designs HOW TO FILL UP BIR FORM 2307 54 OFF

I am using a free program called paint to design all of my signage and even my invitations Generally speaking you can find graphics and downloadable fonts Appropriate Withholding Tax Rates For Non VAT Registered 54 OFF 2307 Withholding Tax Corporate Tax

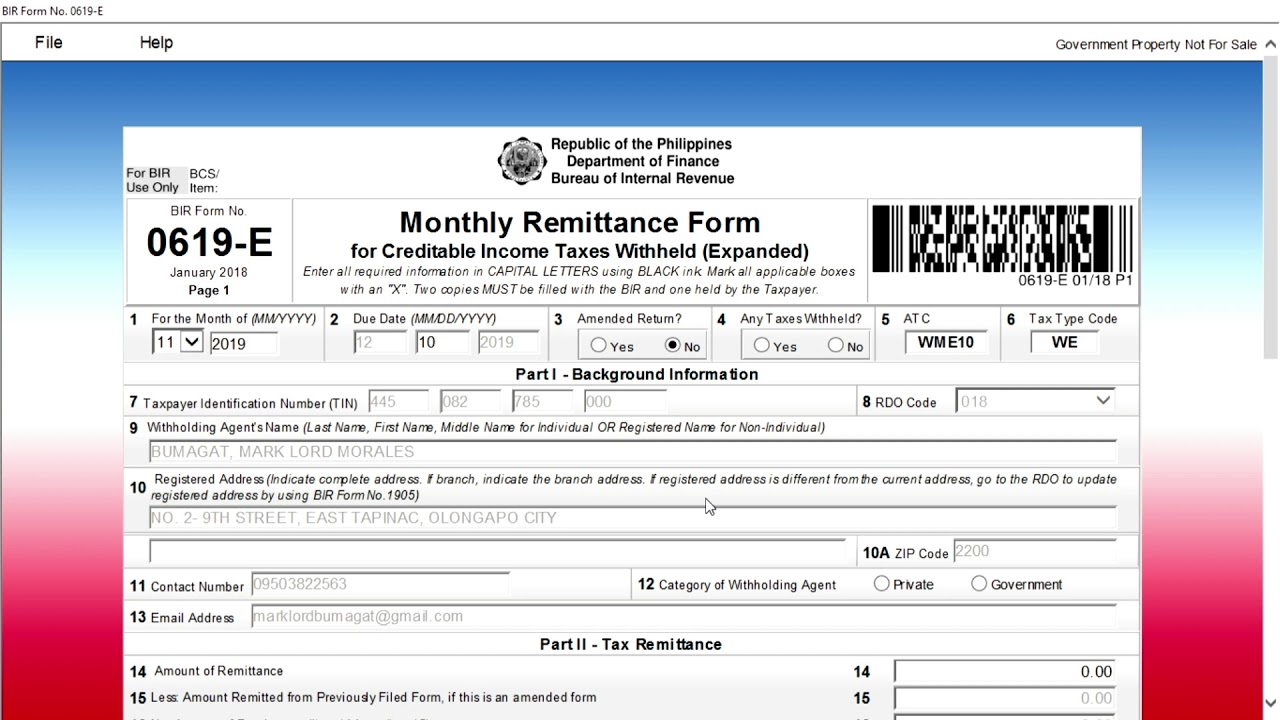

How To File And Pay Your Monthly Expanded Withholding Tax Using BIR

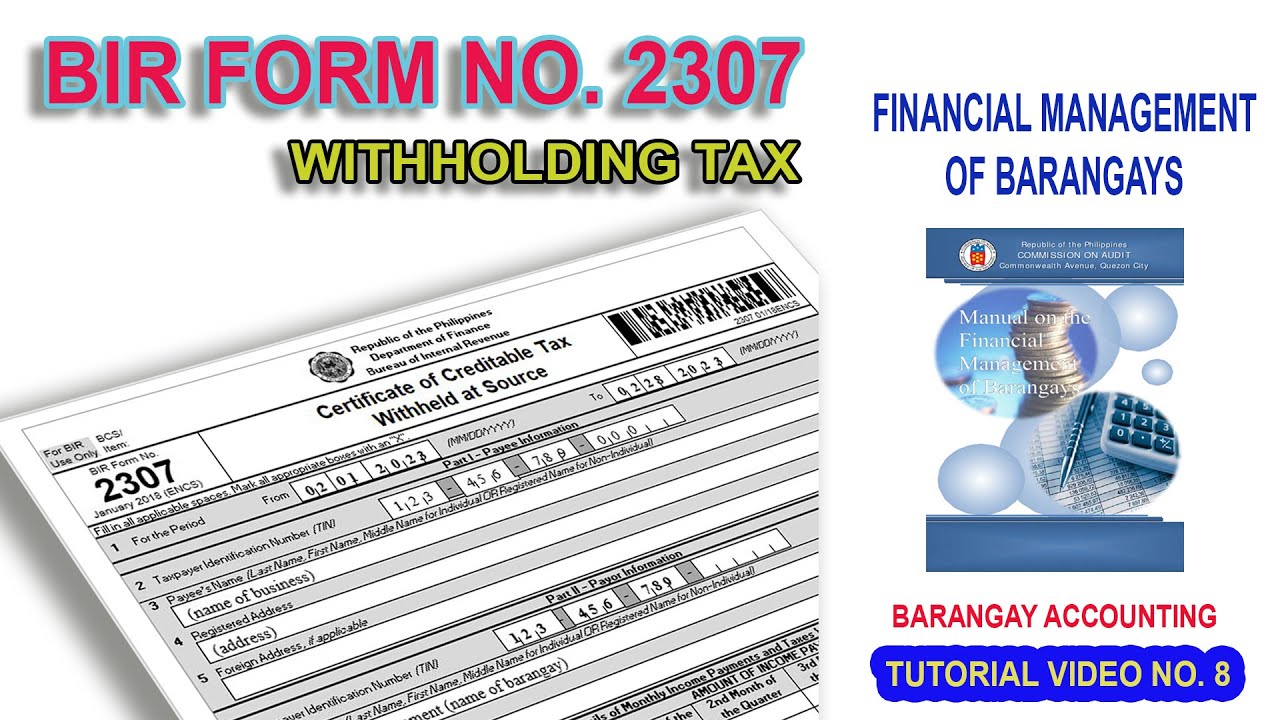

HOW TO FILL UP BIR FORM NO 2307 BARANGAY ACCOUNTING YouTube

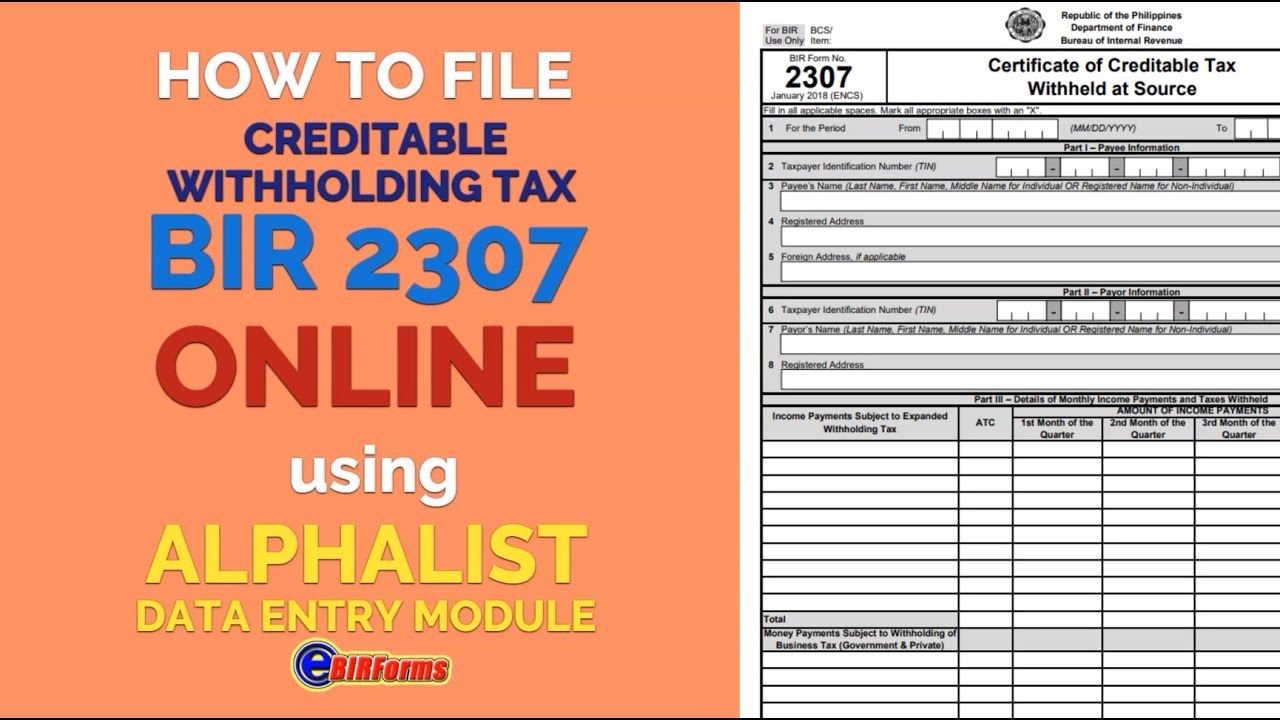

How To Attach BIR Form 2307 Online Using Alphalist Data Entry Module Of

Book Entry BIR Form 2307 Withholding Tax Accounting Income VAT

How To Compute Income Tax Using Tax Table When To Attach 2316 2306

SAWT

HOW TO FILL UP BIR FORM 2307 54 OFF

HOW TO FILL UP BIR FORM 2307 54 OFF

How To Generate BIR Form 2307 Bir excel uploader

Generate BIR Form 2307 In QNE Accounting System