How Many Times Does 6 Go Into 150 are a functional service for anybody seeking to produce professional-quality files swiftly and quickly. Whether you require custom invitations, resumes, organizers, or calling card, these templates allow you to individualize material easily. Simply download the template, edit it to suit your requirements, and print it at home or at a printing shop.

These themes conserve money and time, providing a cost-effective alternative to hiring a designer. With a vast array of styles and styles available, you can discover the ideal design to match your personal or organization requirements, all while preserving a refined, expert look.

How Many Times Does 6 Go Into 150

How Many Times Does 6 Go Into 150

Commemorate your marriage and make your own cherished keepsake by making a free printable Marriage Certificate that can be kept in your wedding memory book Customizable marriage certificates. Choose from hundreds of themes and designs, then easily fill in details like names, dates, locations, and signatures.

Marriage Certificate Elegant White Design Wedding Bliss Planner

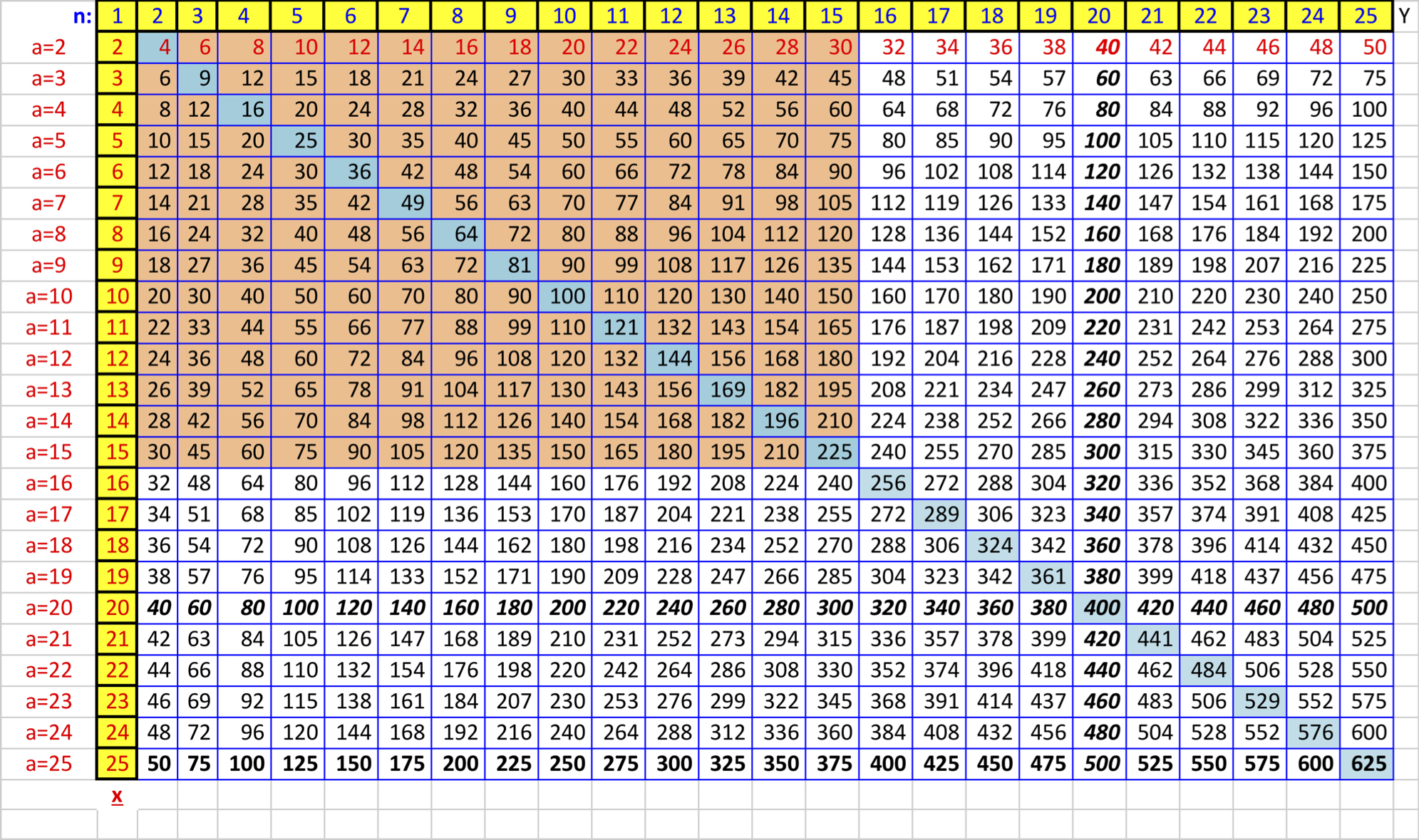

Multiplication Chart From 1 To 100

How Many Times Does 6 Go Into 150Create a personalized fake marriage certificate for fun and personal purposes within minutes. Choose a template from our wide range of fake marriage certificate ... Edit your marriage certificate online form online Type text complete fillable fields insert images highlight or blackout data for discretion add comments

Our template instantly generates a beautiful PDF marriage certificate to have and hold, print, and frame. It's the ideal way to commemorate one of the biggest ... [img_title-17] [img_title-16]

Free Marriage Certificate Templates Edit Printable WordLayouts

[img_title-3]

Discover the collection of editable and printable certificate of marriage Templates in Google Docs Word and other formats [img_title-11]

This printable certificate of marriage template is an editable file for editing with Templett ready for instant download No physical files will be shipped to [img_title-12] [img_title-13]

[img_title-4]

[img_title-5]

[img_title-6]

[img_title-7]

[img_title-8]

[img_title-9]

[img_title-10]

[img_title-11]

[img_title-14]

[img_title-15]