Llp Vs Llc are a versatile option for any person wanting to create professional-quality records quickly and quickly. Whether you need personalized invitations, resumes, coordinators, or business cards, these templates permit you to customize web content with ease. Simply download and install the template, modify it to suit your requirements, and print it at home or at a print shop.

These themes conserve time and money, offering a cost-effective choice to working with a designer. With a vast array of designs and layouts offered, you can locate the ideal style to match your individual or service demands, all while keeping a polished, professional appearance.

Llp Vs Llc

Llp Vs Llc

Date Opponent Time Mar 20 at San Diego 6 05 Mar 21 San Diego 6 05 Mar 28 St Louis 4 10 Mar 29 St Louis 10 10 Mar 30 St Louis 9 10 SPRING TRAINING SCHEDULE ; 1, Thu, Feb 22, 2024, 12:10 PM ; 2, Fri, Feb 23, 2024, 12:05 PM ; 3, Sat, Feb 24, 2024, 12:10 PM ; 4, Sun, Feb 25, 2024, 12:05 PM ...

2024 Los Angeles Dodgers Schedule MLB CBSSports

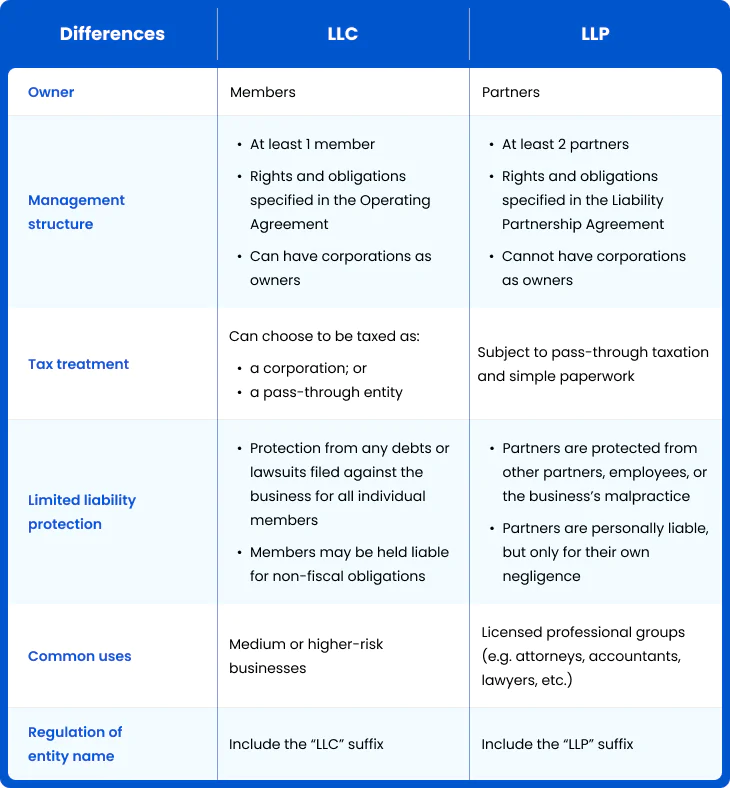

LLC Vs LLP What Are The Differences Step By Step Business

Llp Vs LlcESPN has the full 2025 Los Angeles Dodgers Spring Training MLB schedule. Includes game times, TV listings and ticket information for all Dodgers games. Dodgers CSV Schedules Download Full Season ScheduleDownload Home Game ScheduleDownload Away Game Schedule Downloading the CSV file

Get the complete Oklahoma City Dodgers schedule added directly to your calendar ... Schedule Promotional Schedule Game-by-game Results Printable Schedule. LLC VS LLP Which Should I Select For My Business TechnologyWire LLP Vs LLC Which Business Structure Is Right For You LawDistrict

Schedule Los Angeles Dodgers Spectrum SportsNet

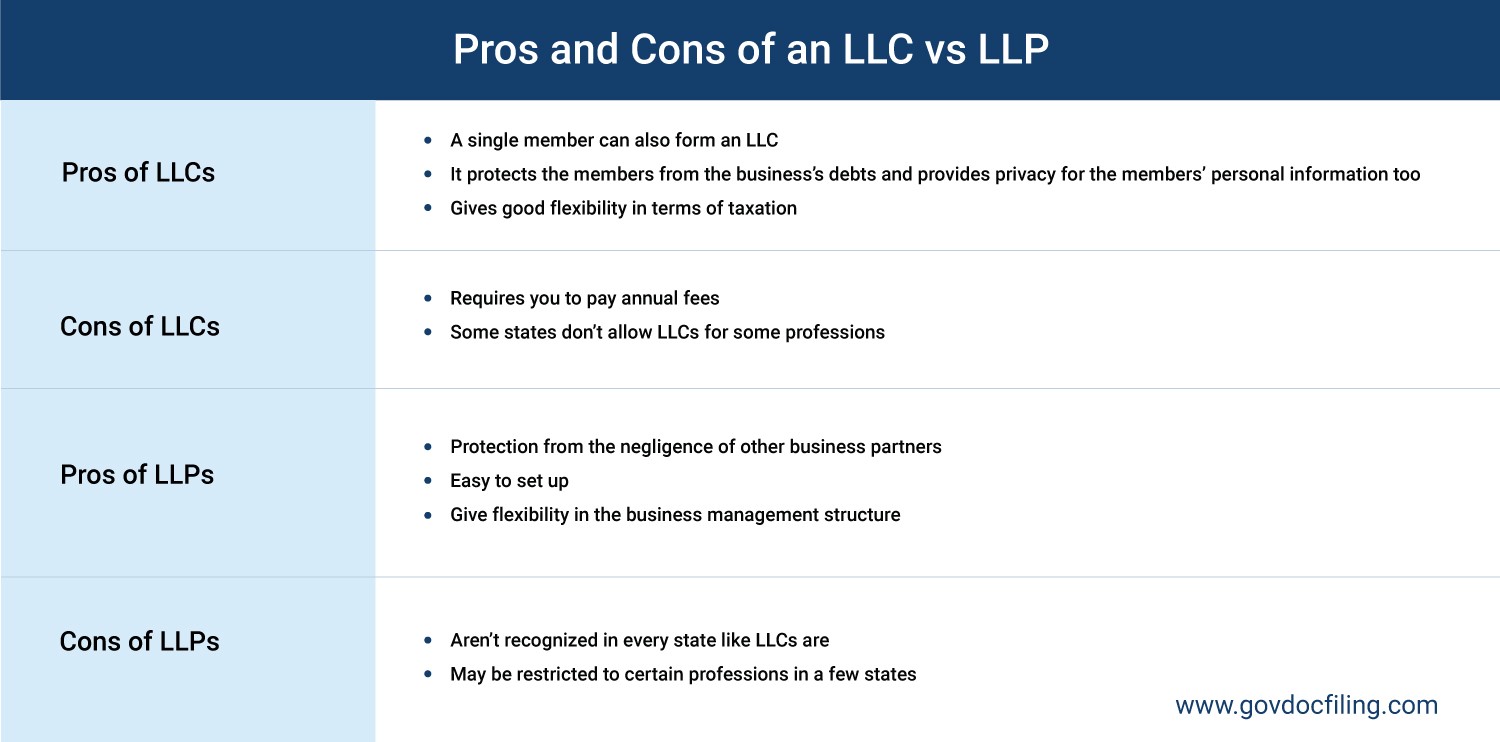

LLP Vs LLC What s Best For Your Business

Full 2025 Los Angeles Dodgers schedule Scores opponents and dates of games for the entire season Webinar Corporation LLC Or LLP Which Entity Is Right For Your

Date Home Away Opponent Time Tue Mar 18 Chi Cubs0 0 Time TBD Wed Mar 19 Chi Cubs0 0 Time TBD Thu Mar 27 vs Detroit0 0 4 10 PM PDT Limited Liability Company LLC Vs Limited Liability Partnership LLP Considering An LLC Vs An LLP Learn The Key Differences Starting Up

LLP VS INC WHAT S THE DIFFERENCE InSight

LLC Vs LLP What Are The Main Differences

Images Of CO C LO Corporation JapaneseClass jp

LLP Vs LLC What s Best For Your Business

LLC Vs LLP What Are The Differences Step By Step Business

The Differences Between LLPs And LLCs You Should Know In 2024

Limited Liability Partnership What Every Entrepreneur Needs To Know

Webinar Corporation LLC Or LLP Which Entity Is Right For Your

LLP Vs LLC Differences Tax Benefits Pros And Cons Jotscroll

Limited Liability Company LLC Vs Limited Liability Partnership LLP