Root Of 1099 are a functional service for anybody seeking to create professional-quality papers rapidly and conveniently. Whether you need personalized invitations, resumes, organizers, or business cards, these themes allow you to individualize web content effortlessly. Merely download the theme, modify it to match your requirements, and publish it at home or at a print shop.

These templates conserve time and money, supplying an affordable alternative to hiring a designer. With a vast array of designs and styles available, you can discover the excellent layout to match your individual or business requirements, all while preserving a refined, specialist look.

Root Of 1099

Root Of 1099

FREE Printable Cleaning Planner with daily weekly monthly and seasonal schedules checklists by rooms and a 30 day declutter challenge I have a checklist of basic tasks I do every day either before or after work. Then I do deep clean once a week over the weekend. With the mini ...

Weekly Cleaning Checklist with free downloadable

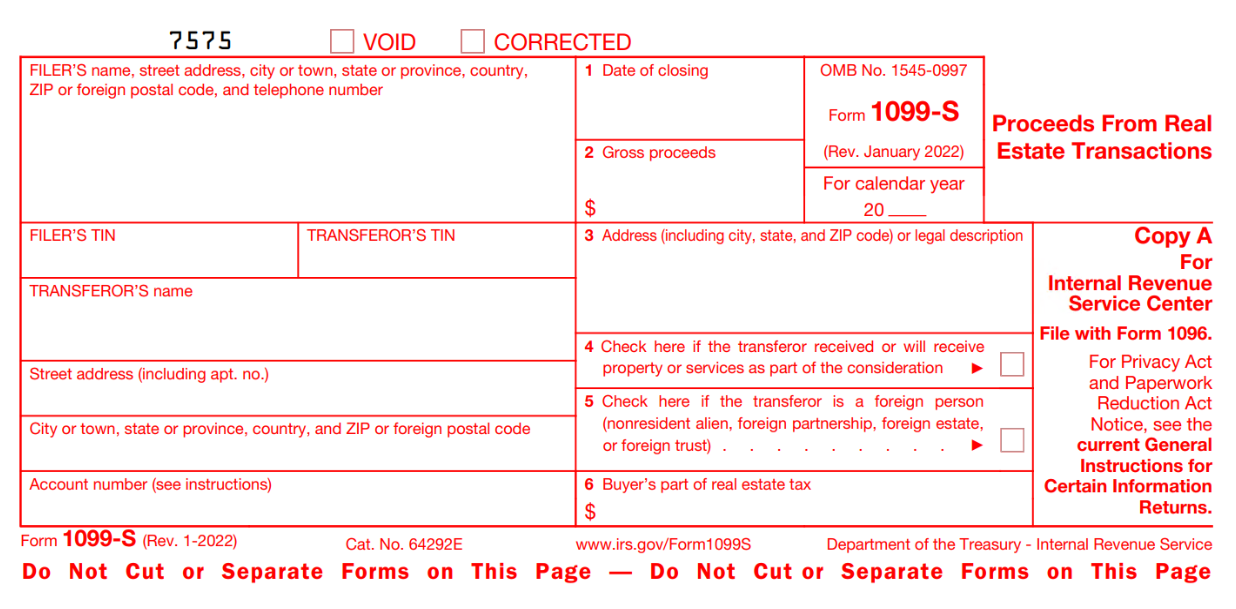

1099 S 2022 Public Documents 1099 Pro Wiki

Root Of 1099I created this new (free printable) weekly cleaning schedule and feel like it will help tremendously. I hope it helps you too! Track all the places and things you ve cleaned in your house or office by using Canva s free cleaning checklist template Personalize print and share easily

This cleaning schedule template gives you a lot of flexibility to say exactly what you plan to do each day of the week, for 4 weeks (a month). A 1099 MISC F 2022 5 Part Set And 1096 Kit For 25 What Is A 1099 Employee Zippia For Employers

Cleaning schedule for someone with an 8 5 job r CleaningTips

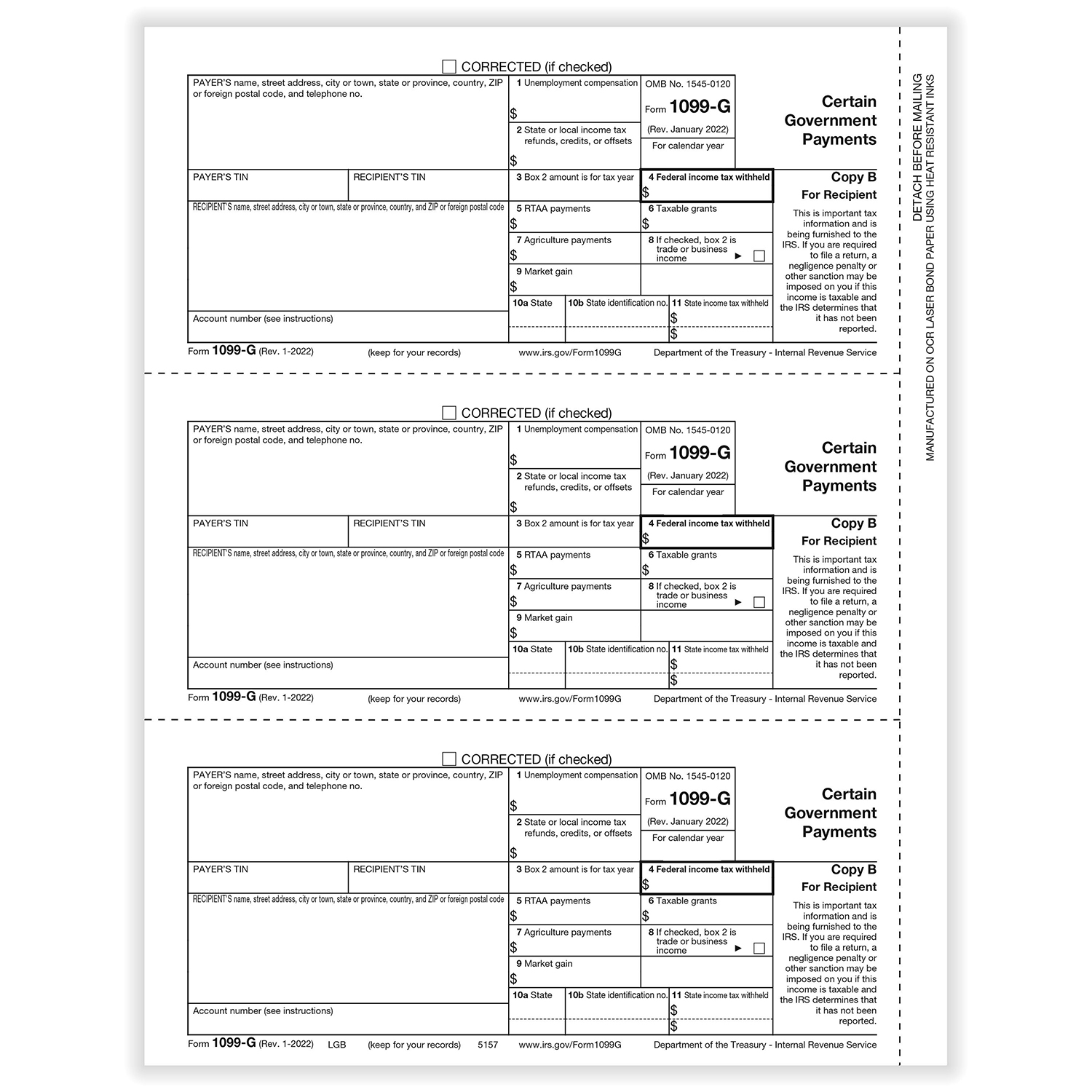

1099 G Recipient Copy B Formstax

I had some kind of template to help me track daily weekly biweekly and monthly recommended cleaning tasks so that I don t let it get too far ahead of me 1099 R Recipients Copy B Laser Cutsheet Form LRB

Check out this weekly cleaning checklist that will help you tackle every room in your home complete with a free editable printable 1099 Blank For Various Forms Formstax 1099 Program The Loan Division

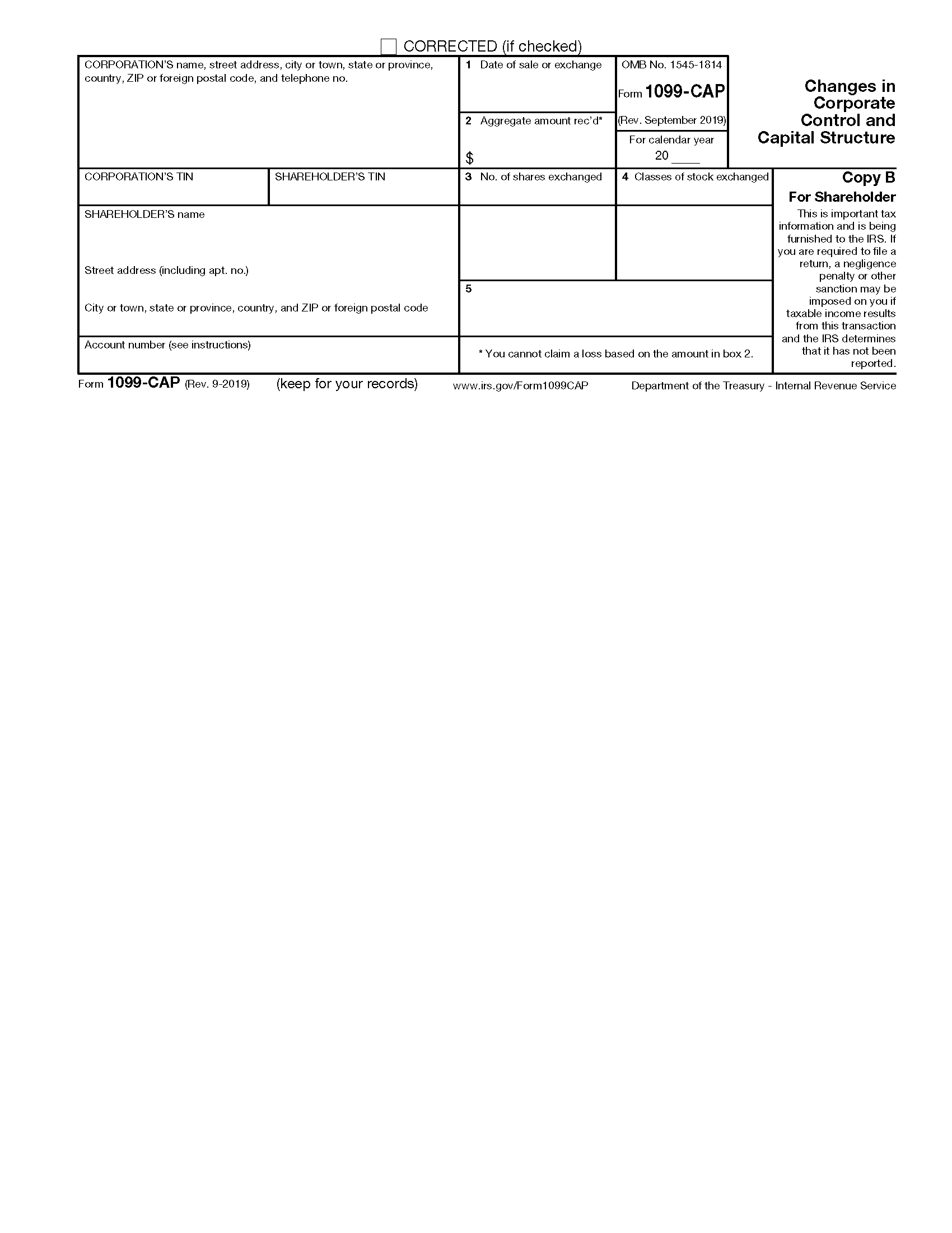

Form 1099 SA Form 1099

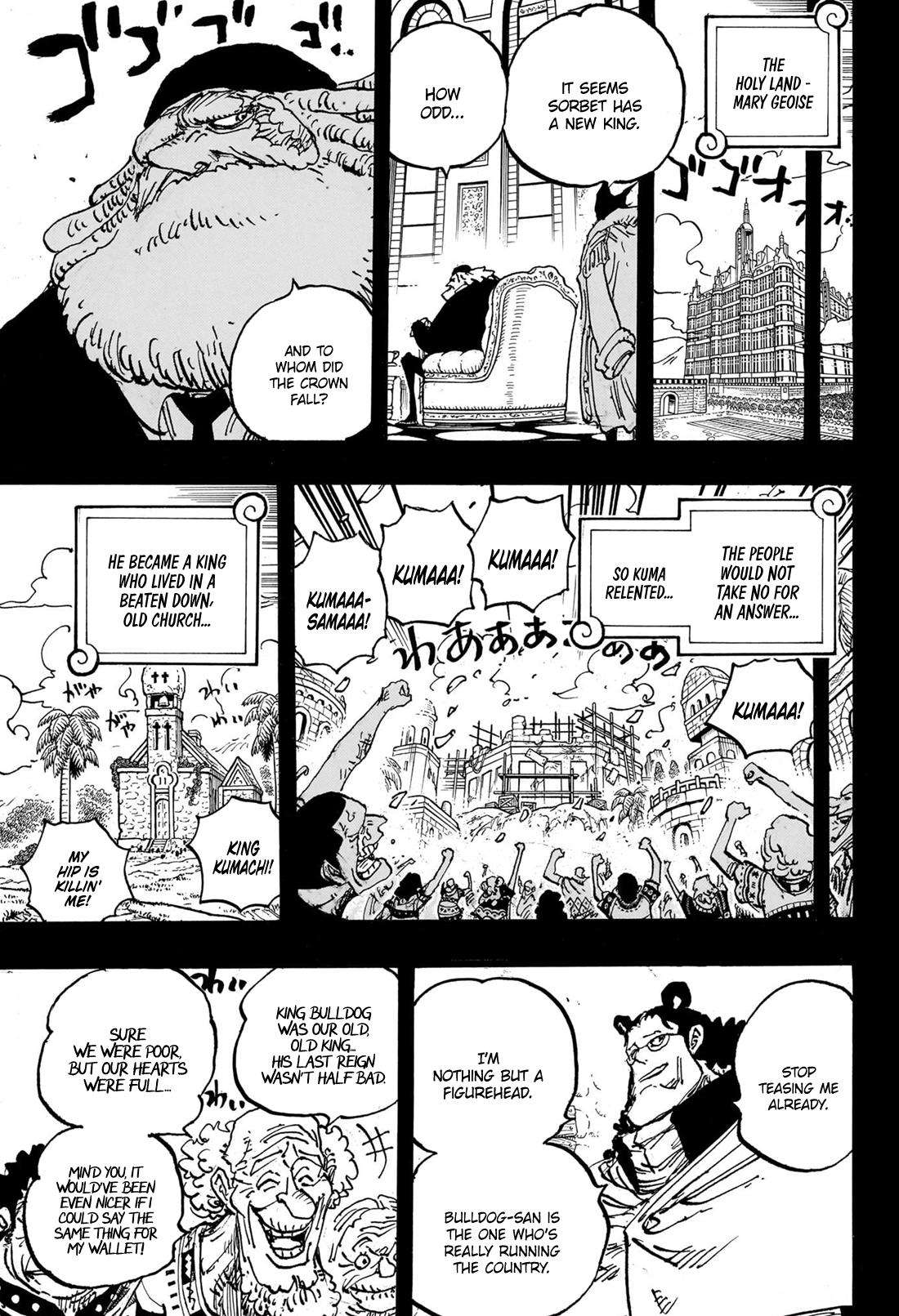

One Piece 1099 One Piece Chapter 1099 One Piece 1099 English

8Th Png 1104 Download

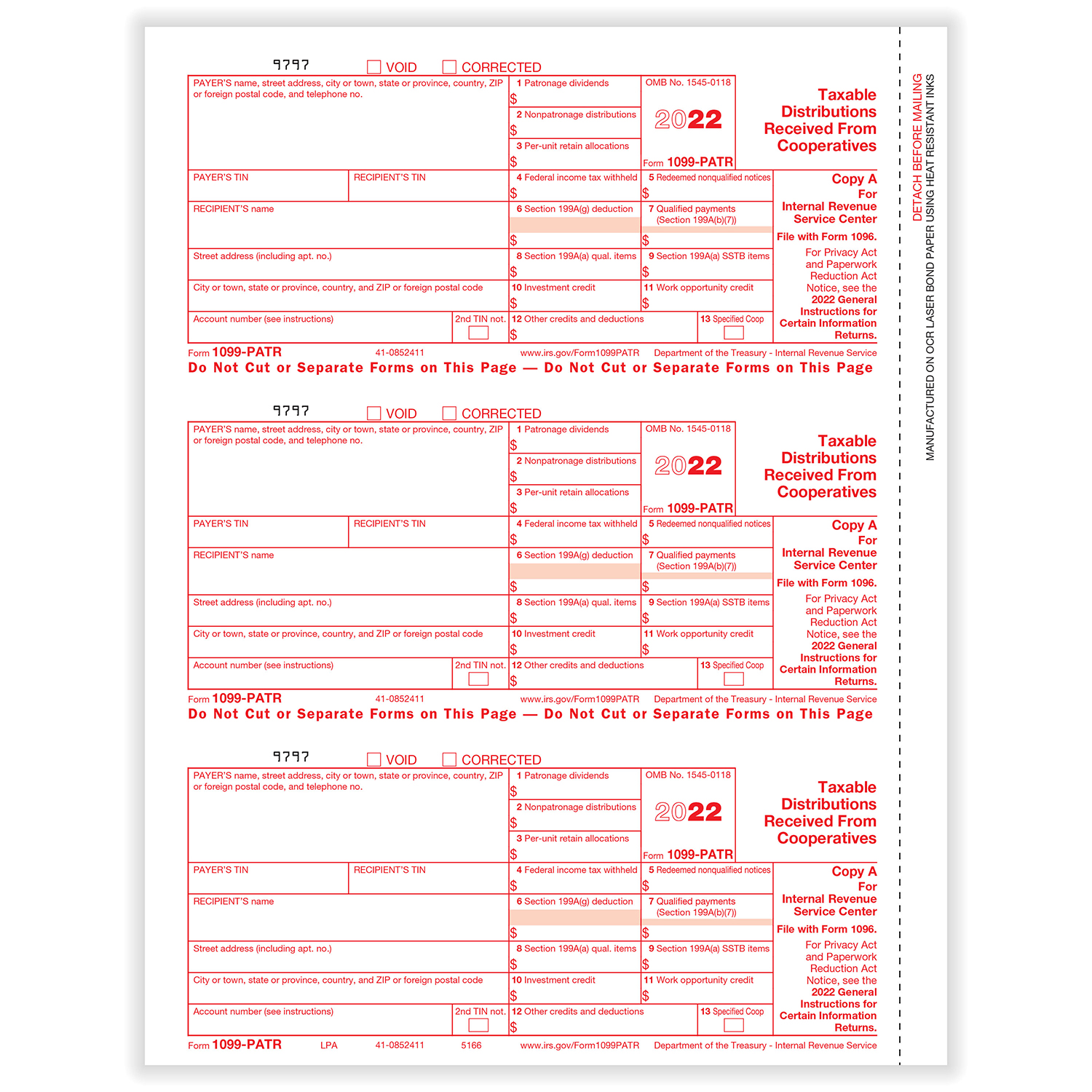

1099 PATR 3 Up Federal Copy A Formstax

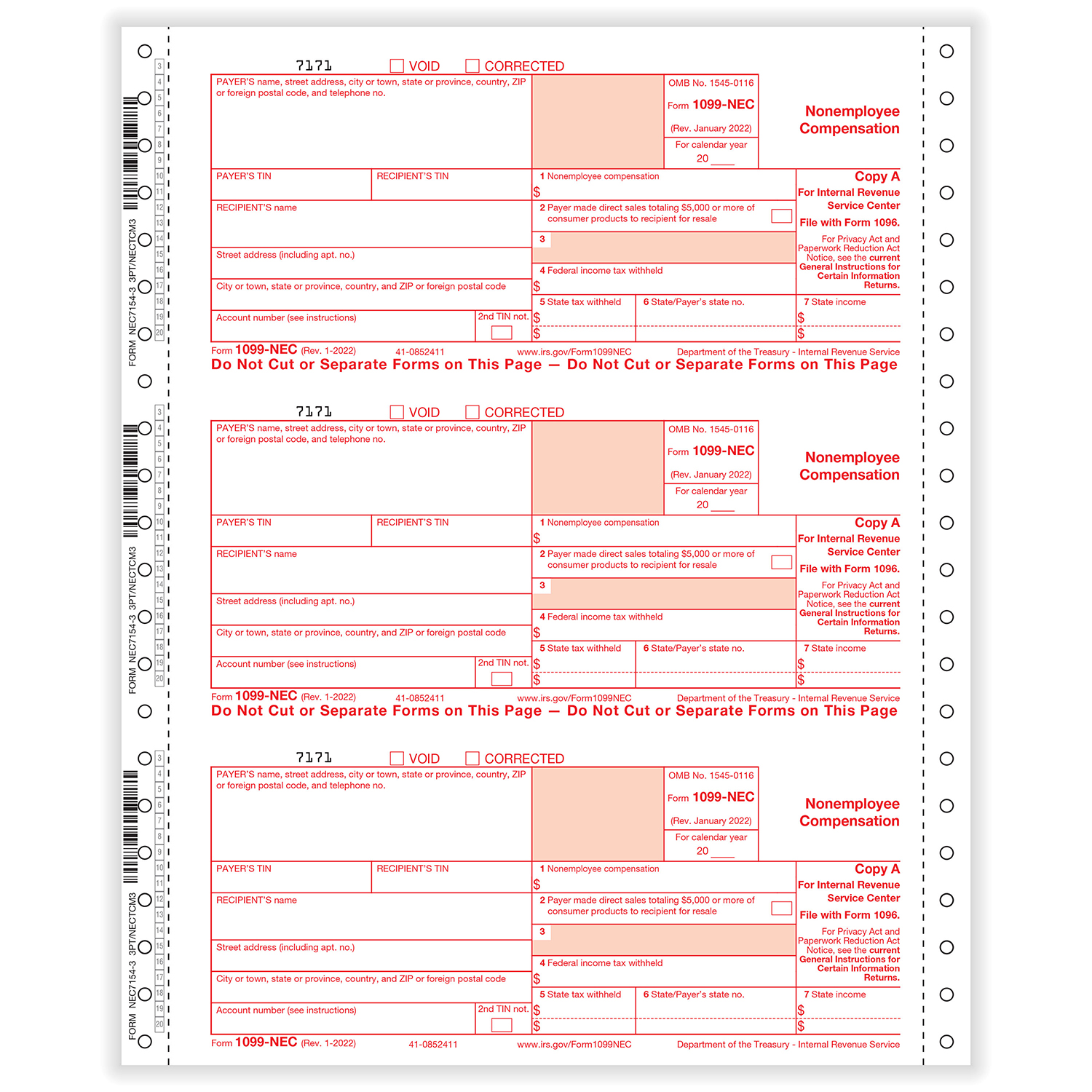

1099 NEC 3 Part Continuous 1 Wide Formstax

FPPA 1099R Forms

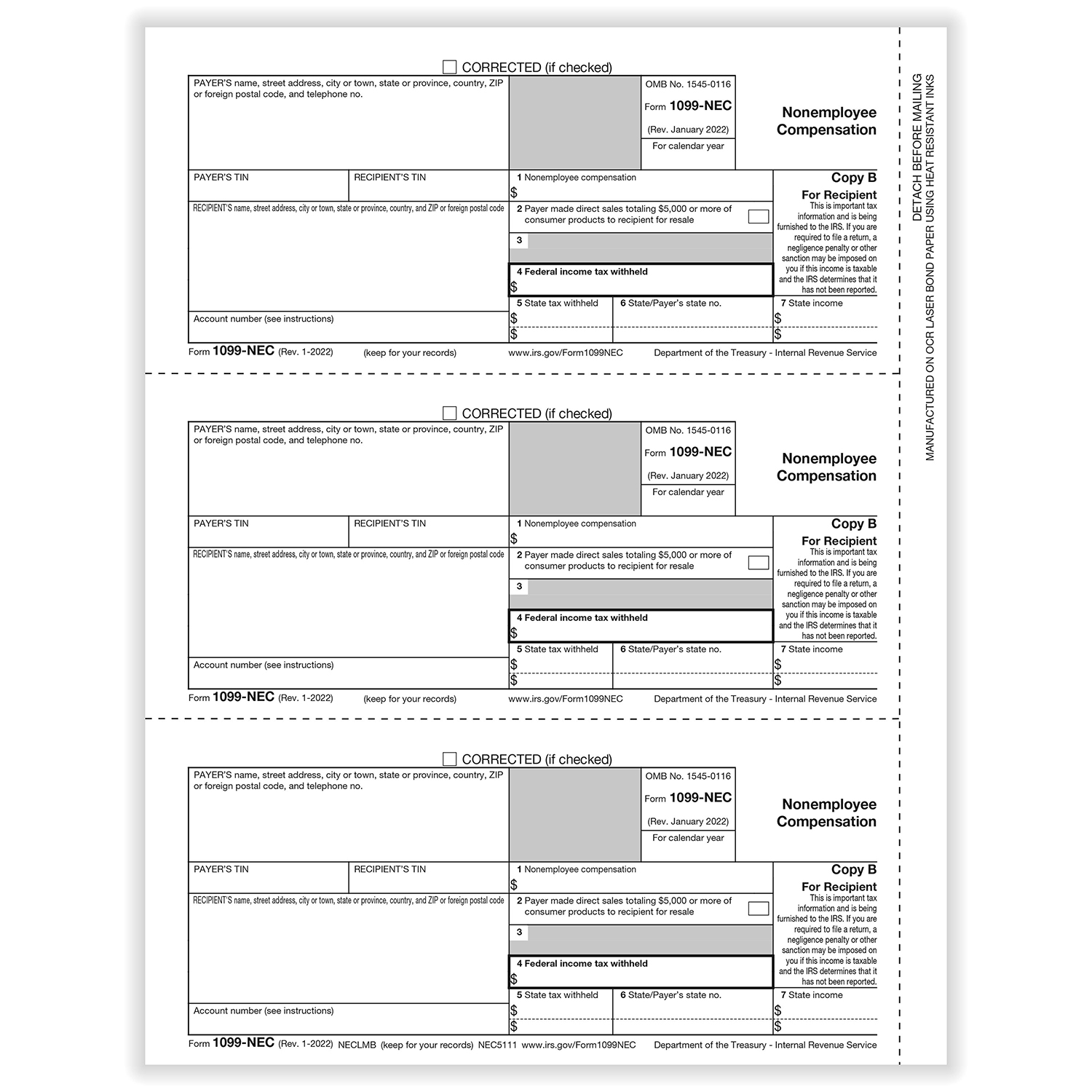

1099 NEC 3 Up Individual Recipient Copy B Formstax

1099 R Recipients Copy B Laser Cutsheet Form LRB

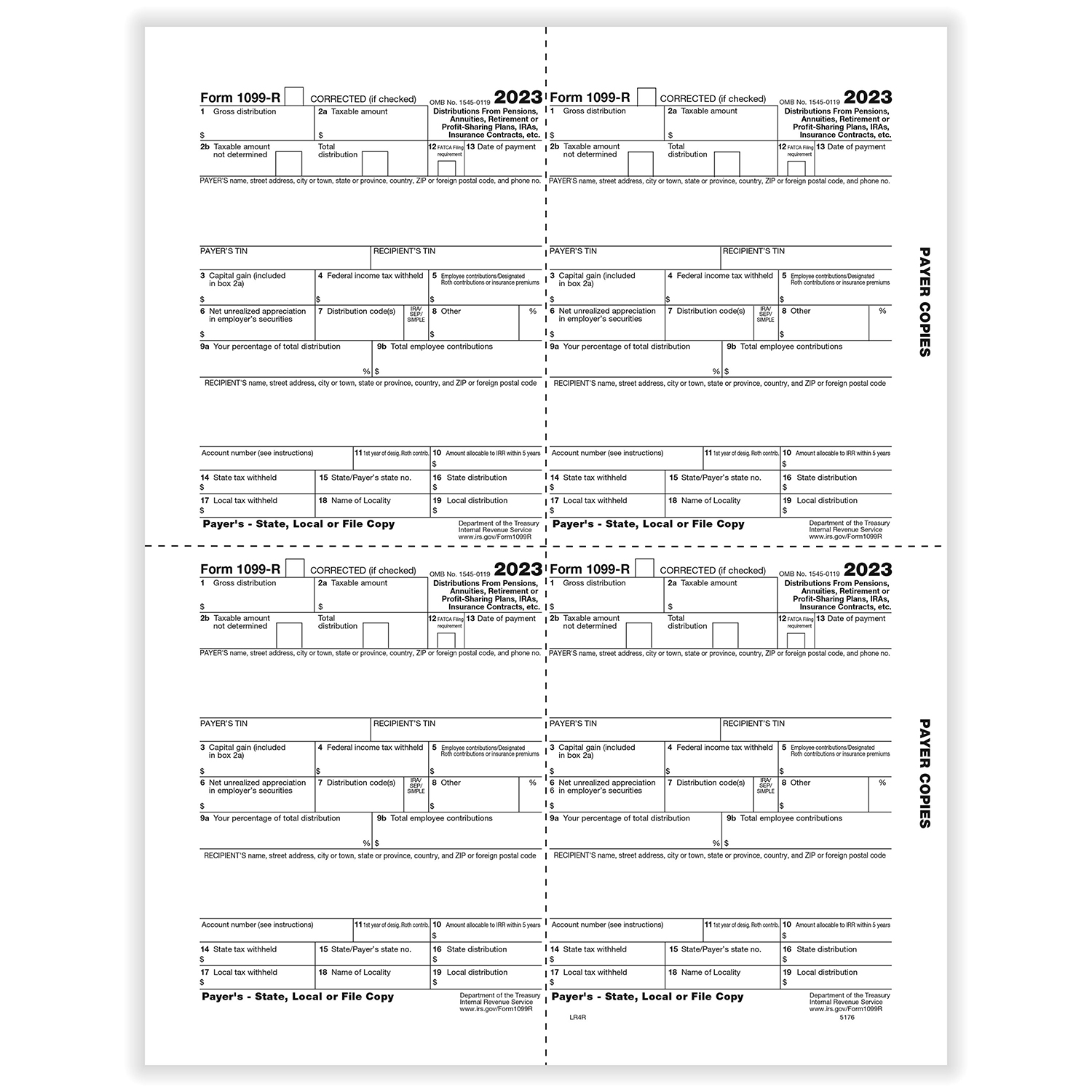

1099 R 4 Up Box Pre Printed Payer Copy Formstax

Free IRS 1099 Form PDF EForms