Schedule Ii Of Companies Act 2013 Pdf are a flexible remedy for any person aiming to create professional-quality files promptly and easily. Whether you require custom-made invites, resumes, organizers, or calling card, these themes permit you to personalize web content with ease. Merely download the template, modify it to suit your demands, and publish it in your home or at a print shop.

These design templates conserve time and money, supplying a cost-effective choice to hiring a developer. With a variety of styles and formats readily available, you can locate the best design to match your personal or organization demands, all while preserving a polished, specialist appearance.

Schedule Ii Of Companies Act 2013 Pdf

Schedule Ii Of Companies Act 2013 Pdf

Mar 10 2022 Explore Katherine Geary s board Spring Easter Printables on Pinterest See more ideas about easter printables easter easter crafts Look no further than this easy DIY project that uses a free printable, a canvas from the dollar tree, and some acrylic paint.

DLTK s Crafts for Kids Easter Activities DLTK Holidays

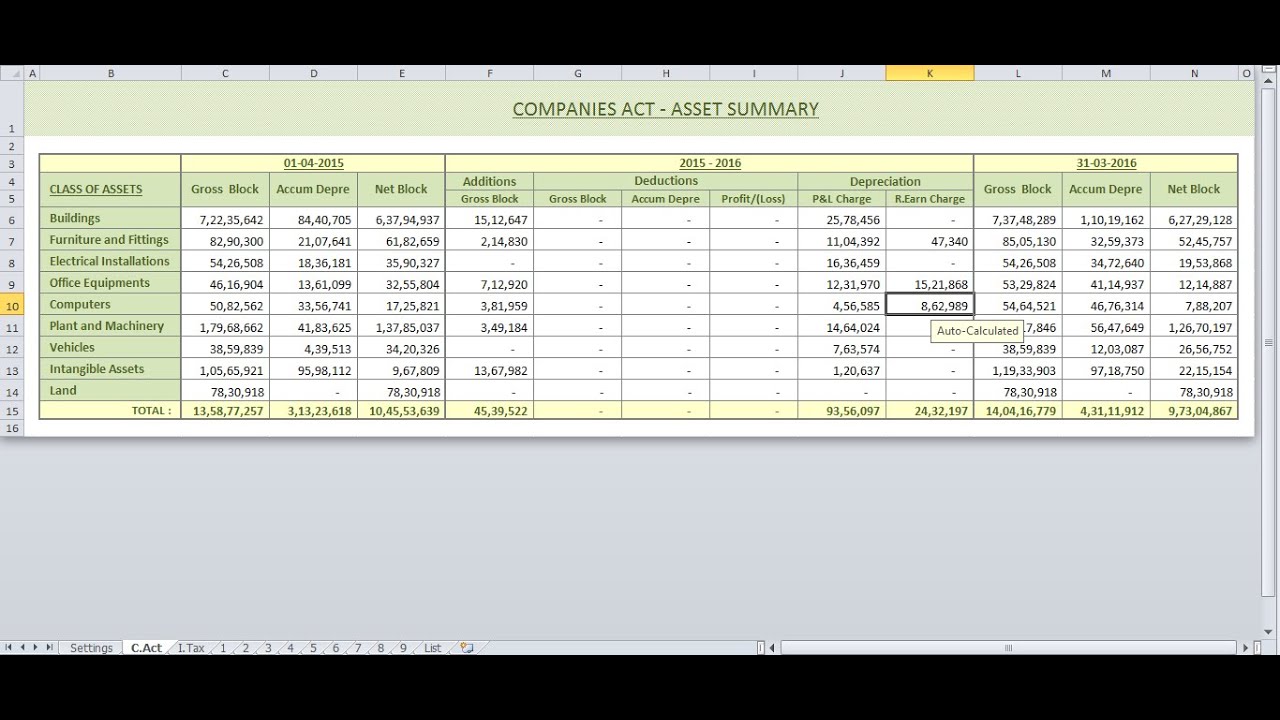

Taxguru In Depreciation As Per Schedule II Of Companies Act 2013

Schedule Ii Of Companies Act 2013 PdfEasy Easter Crafts | Simple ideas for kids. Use the free printable template to make with kids. Great with preschool, prek, and kindergarten children. Easy FREE printable Easter Crafts for kids making a wreath Print in color or black white to make this cute Easter craft for preschoolers

28.Şub.2024 - Crafting this charming Easter Egg Friend is a breeze and adds a delightful touch to any creative session! Section 5 The Companies Act 2013 Section 281 Of Income Tax Act 1961

Farmhouse Easter Print Free Download Makeable Crafts

BALANCE SHEET FORMAT AS PER SCHEDULE III COMPANY ACT 2013 FOR

DOWNLOAD PRINT CREATE Enhance your Easter festivities with our Easter Collection of digital handprint and footprint art craft for babies and kids Depreciation Calculator Companies Act 2013 Income Tax Act YouTube

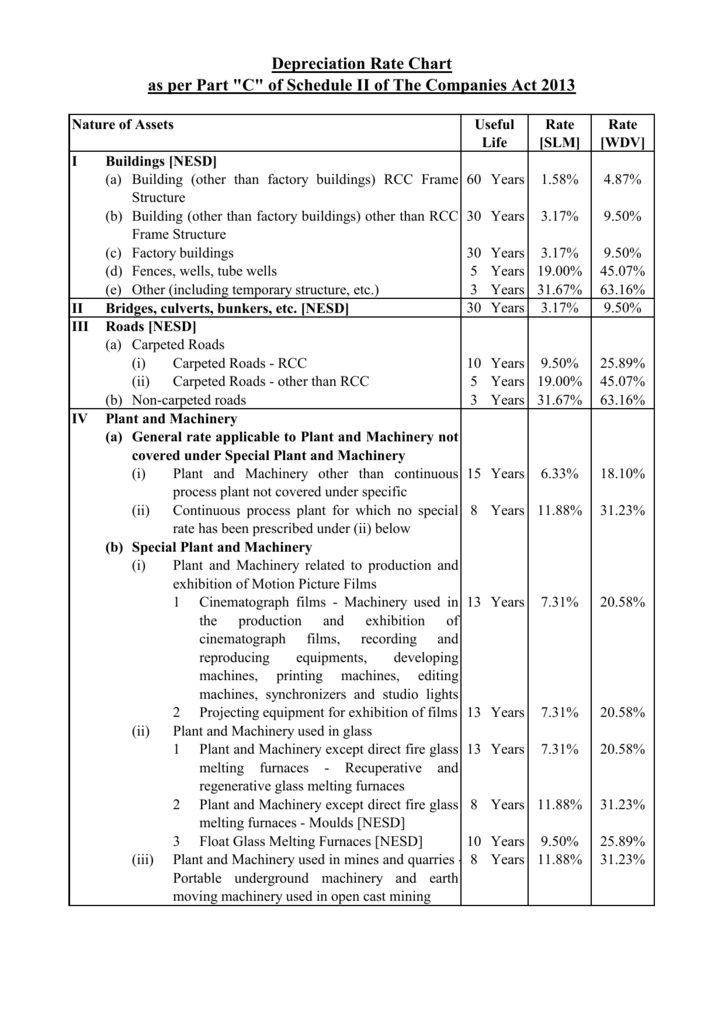

Easter craft ideas and guides Fun easy to follow instructions to create Easter crafts Baker Ross Bouchercon 2024 Schedule Iii Maren Sadella Depreciation Rates Chart Under Companies Act 2013

UseFul Life Of Assets As Per Companies Act 2013 Useful Life Of Assets

How To Calculate Depreciation As Per Companies ACT 2013 Depreciation

Depreciation Calculator As Per Companies Act 2013 Depreciation

Pin By ThiThi Aung On Balance Sheet Template Balance Sheet Balance

Depreciation Rate Chart As Per Companies Act 2013 With 46 OFF

Casual Info About Balance Sheet Mca Corelee

Board Of Directors Flow Chart

Depreciation Calculator Companies Act 2013 Income Tax Act YouTube

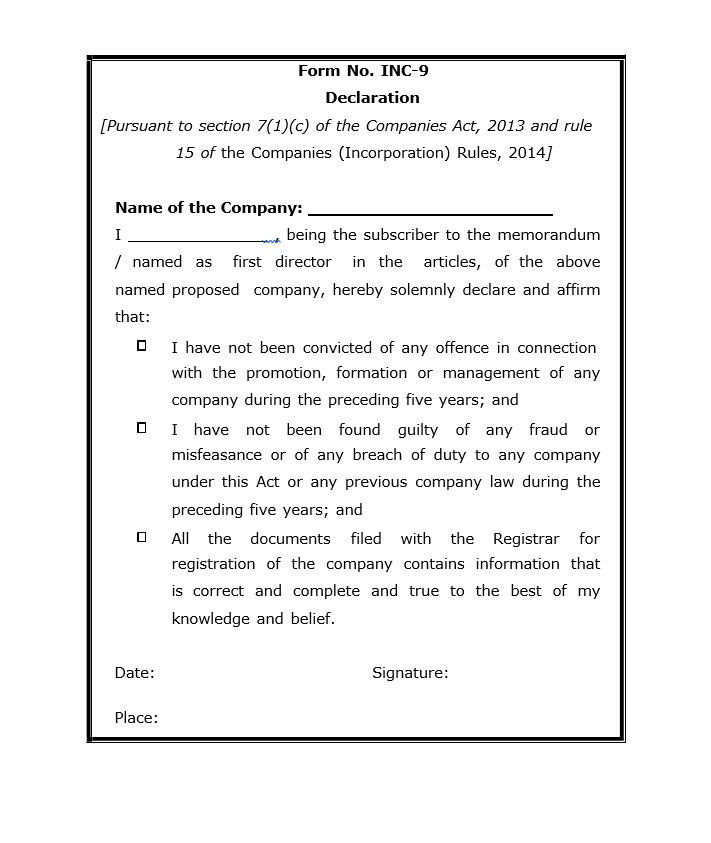

Form INC 9 Declaration By Subscriber First Director Learn By Quicko

Depreciation Rates For Vehicles As Per Income Tax Tax Walls