Simplify 24 4 2 8 4 Answer are a flexible option for anyone seeking to develop professional-quality documents promptly and quickly. Whether you need personalized invites, returns to, organizers, or business cards, these themes permit you to individualize web content with ease. Simply download the template, edit it to match your demands, and publish it at home or at a print shop.

These themes conserve money and time, using a cost-effective choice to working with a developer. With a wide range of styles and layouts readily available, you can find the perfect design to match your personal or company requirements, all while preserving a refined, professional look.

Simplify 24 4 2 8 4 Answer

Simplify 24 4 2 8 4 Answer

An individual or entity Form W 9 requester who is required to file an information return with the IRS must obtain your correct taxpayer identification number The IRS has created a page on IRS.gov for information about Form W-9, at www.irs.gov/w9. Information about any future developments affecting Form W-9 (such ...

Form W 9 Rev November 2017 IRS

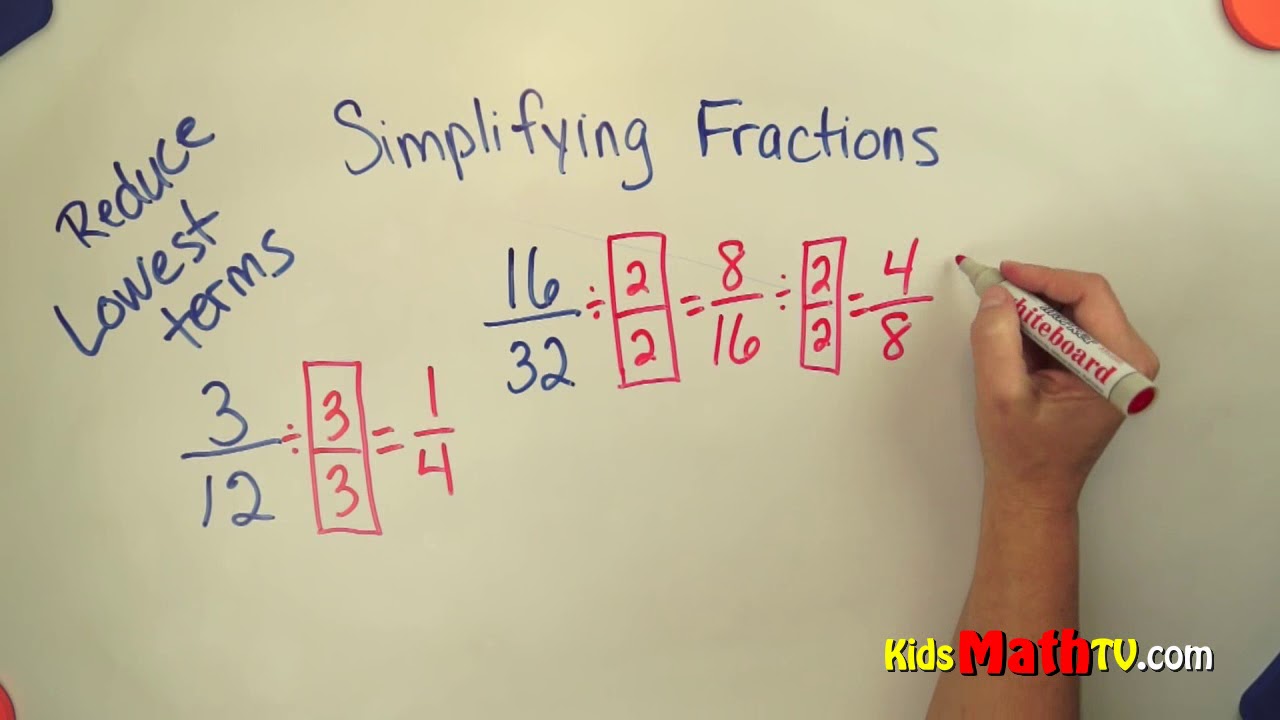

How To Simplify Fractions To The Lowest Terms Math Video YouTube

Simplify 24 4 2 8 4 AnswerW-9 (blank IRS Form). IRS Form W-9 (rev March 2024). W-9 Form. ©2024 Washington University in St. Louis. Notifications. Use Form W 9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS

Una persona o entidad (solicitante del Formulario W-9) a quien se le requiera presentar una declaración informativa ante el IRS le está dando este formulario ... Facebook Facebook

W9 form ei sig pdf

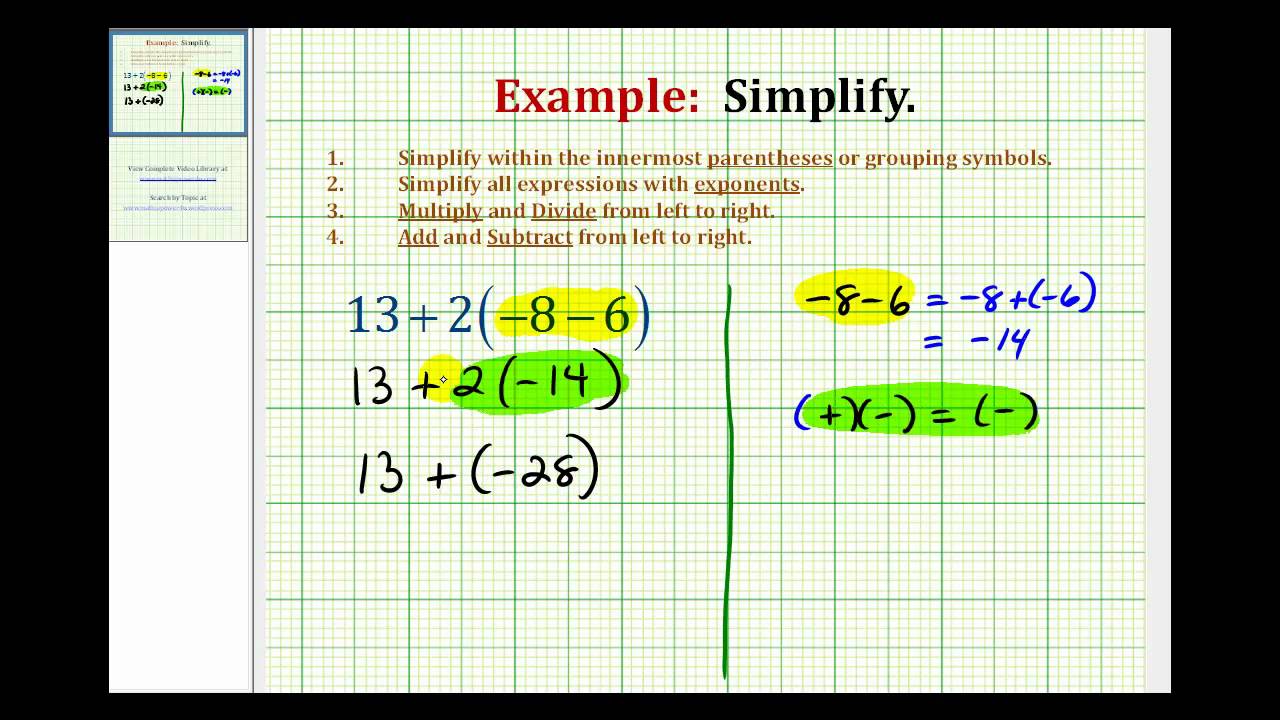

Ex Simplify An Expression With Integers Using The Order Of Operations

The information from a W9 form is most commonly used to create a 1099 form which contains income received by a worker and tax payments made by a company 14

Go to www irs gov FormW9 for instructions and the latest information Give form to the requester Do not send to the IRS Before you begin For Facebook Facebook

14

14

19 14