Va Pay Scale Gs 13 are a functional option for anybody looking to develop professional-quality papers promptly and conveniently. Whether you need custom invites, returns to, planners, or business cards, these design templates permit you to personalize material with ease. Merely download and install the layout, edit it to suit your demands, and print it in your home or at a printing shop.

These design templates save money and time, offering an affordable option to employing a designer. With a vast array of designs and styles readily available, you can discover the best design to match your personal or company requirements, all while maintaining a refined, professional look.

Va Pay Scale Gs 13

Va Pay Scale Gs 13

An individual or entity Form W 9 requester who is required to file an information return with the IRS must obtain your correct taxpayer identification number Form W-9. Request for Taxpayer Identification Number (TIN) and Certification. Used to request a taxpayer identification number (TIN) for ...

W 9 blank IRS Form Financial Services Washington University

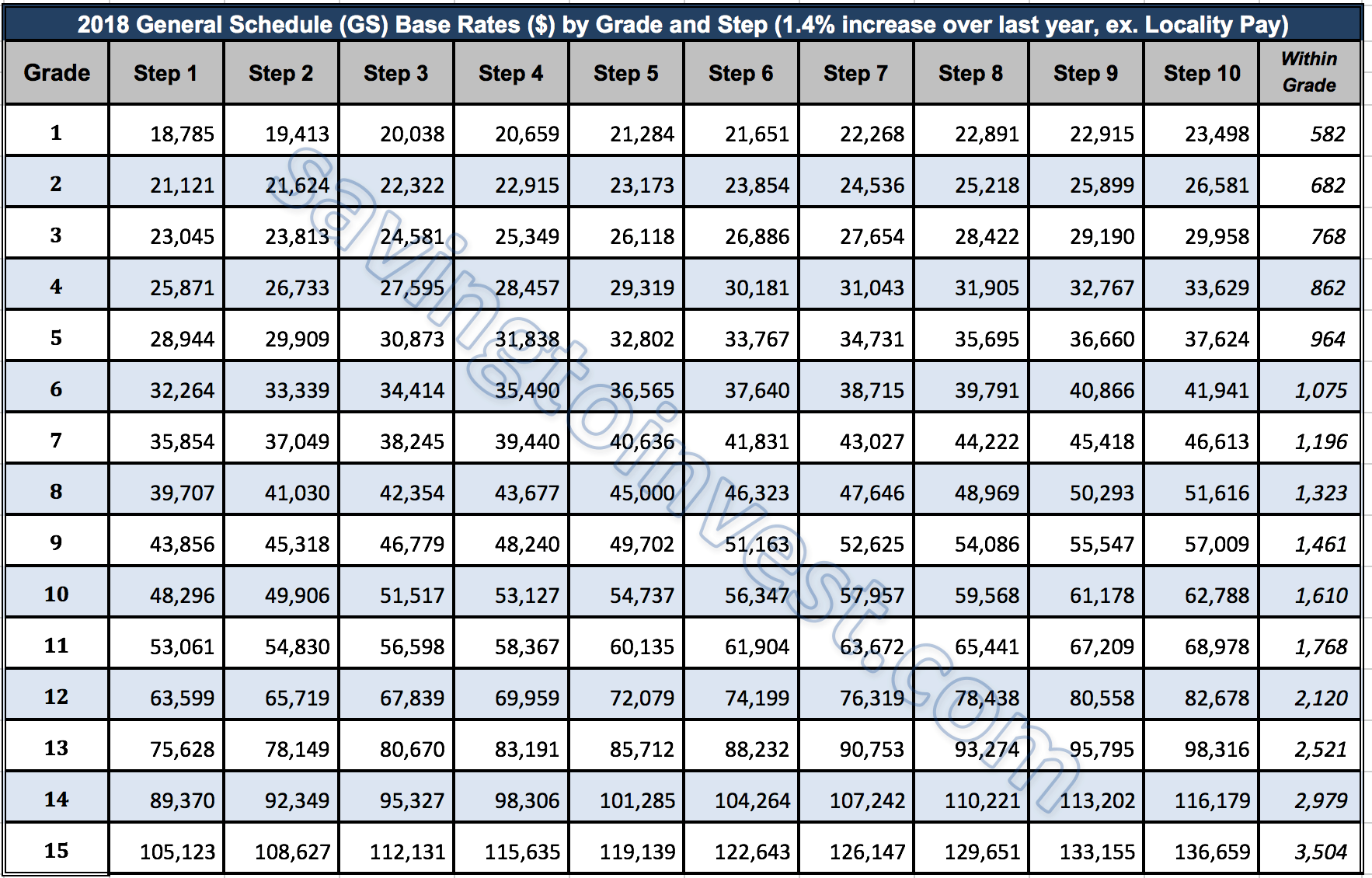

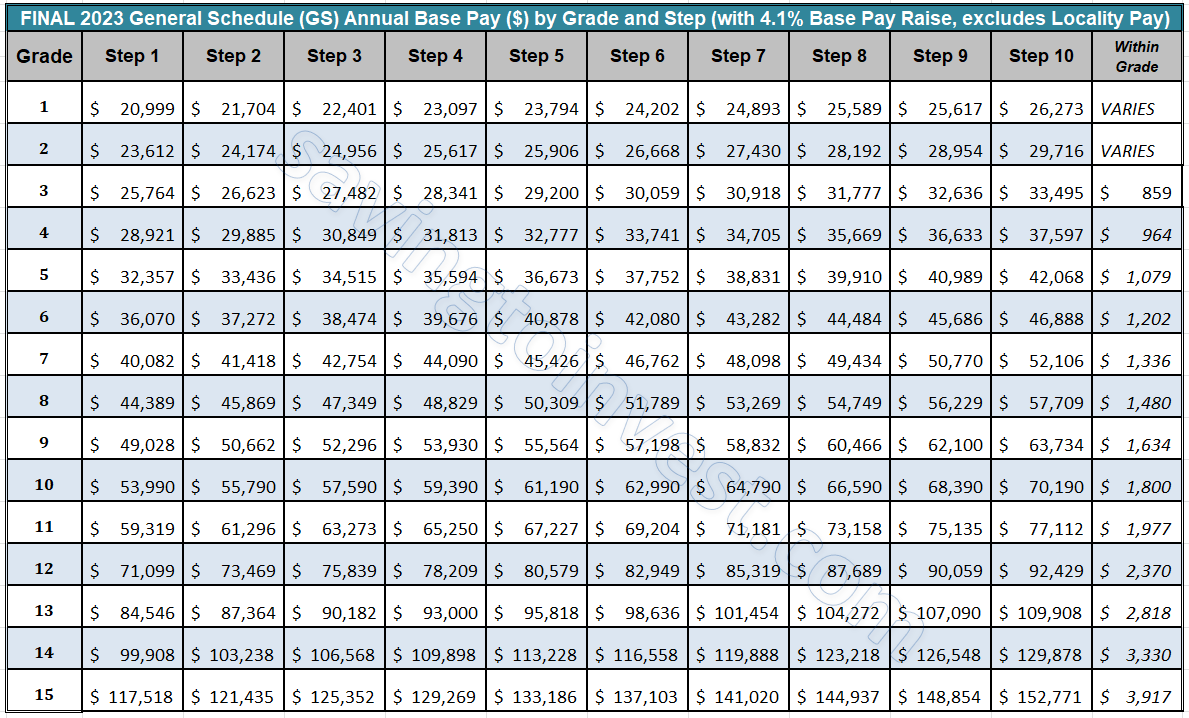

Federal Pay Increase 2024 Nevsa Adrianne

Va Pay Scale Gs 13Easily complete a printable IRS W-9 Form 2024 online. Get ready for this year's Tax Season quickly and safely with pdfFiller! Create a blank & editable W-9 ... Use Form W 9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS

Enter your TIN in the appropriate box. For individuals, this is your social security number (SSN) However, for a resident alien, sole proprietor, ... [img_title-17] [img_title-16]

Forms instructions Internal Revenue Service

[img_title-3]

Go to www irs gov Forms to view download or print Form W 7 and or Form SS 4 Or you can go to www irs gov OrderForms to place an order and have Form W 7 [img_title-11]

A person who is required to file an information return with the IRS must obtain your correct taxpayer identification number TIN to report for example income [img_title-12] [img_title-13]

[img_title-4]

[img_title-5]

[img_title-6]

[img_title-7]

[img_title-8]

[img_title-9]

[img_title-10]

[img_title-11]

[img_title-14]

[img_title-15]