What Is 1 4 15 Simplified are a functional solution for any person aiming to produce professional-quality files promptly and easily. Whether you require custom-made invites, returns to, planners, or calling card, these layouts enable you to customize material easily. Just download and install the theme, edit it to match your needs, and publish it in the house or at a printing shop.

These themes save money and time, providing an affordable alternative to working with a designer. With a large range of styles and layouts offered, you can discover the best design to match your personal or business needs, all while maintaining a sleek, professional appearance.

What Is 1 4 15 Simplified

What Is 1 4 15 Simplified

Lord make me an instrument of your peace Where there is hatred let me sow love where there is injury pardon where there is doubt faith where there is May He turn His countenance to you and give you peace. The Lord bless you! download printable prayer poster. Prayer of Saint Francis of Assisi.

Prayer of St Francis Printable Etsy

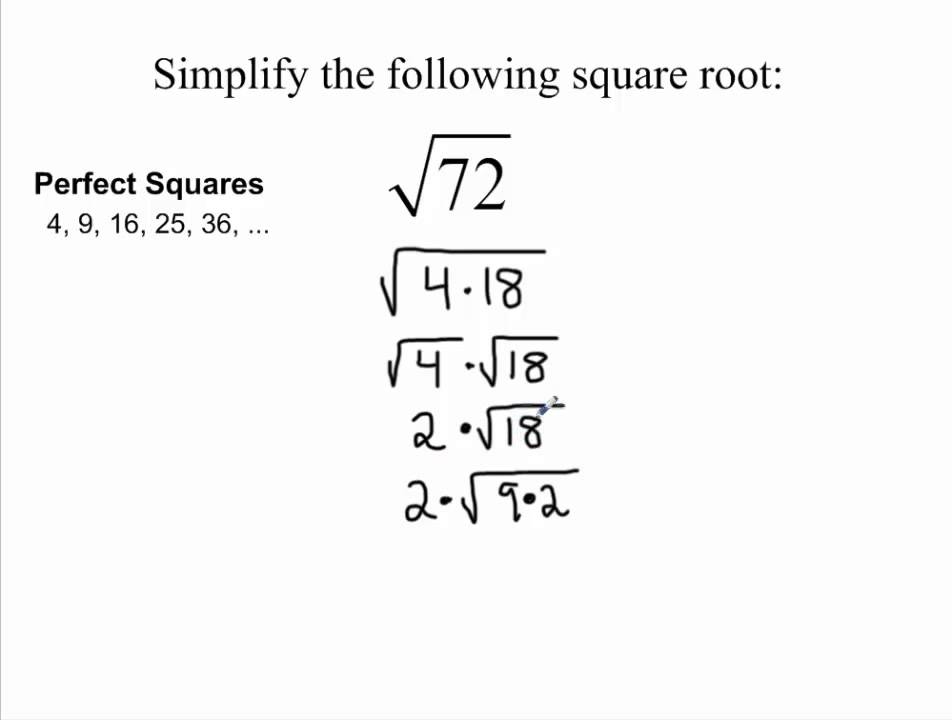

Simplifying A Square Root Multi Step YouTube

What Is 1 4 15 SimplifiedMake Me an Instrument of Your Peace, Saint Francis Prayer is a timeless reminder to always remain level-headed, kind, and mindful of others. Download a FREE PDF ... Lord make me an instrument of Thy peace Where there is hatred let me sow love Wh h i i j d Where there is injury pardon Where there is doubt

Prayer of St Francis Big Book AA Christian Printable Prayer Wall Art Printable Saint Francis of Assisi Peace Prayer Watercolor Art Print. PPT Breuken Vereenvoudigen PowerPoint Presentation Free Download Akhilesh Name Meaning Origins Nicknames Sibling Ideas

Franciscan Prayers FSPA Franciscan Sisters of Perpetual Adoration

11 4 How To Find Simplest Radical Form YouTube

This is a prayer pack with posters worksheets and more for the Peace Prayer of St Francis This can be used to accompany a lesson 26 36 Simplified 6 Root 2

Lord make me an instrument of your peace where there is hatred let me sow love where there is injury pardon where there is doubt faith where there is 26 36 Simplified 6 Root 2 Polymer Clip

Simplifying Ratios Explained How To Simplify A Ratio Math 44 OFF

Geometry Formulas Review Jeopardy Template

ios

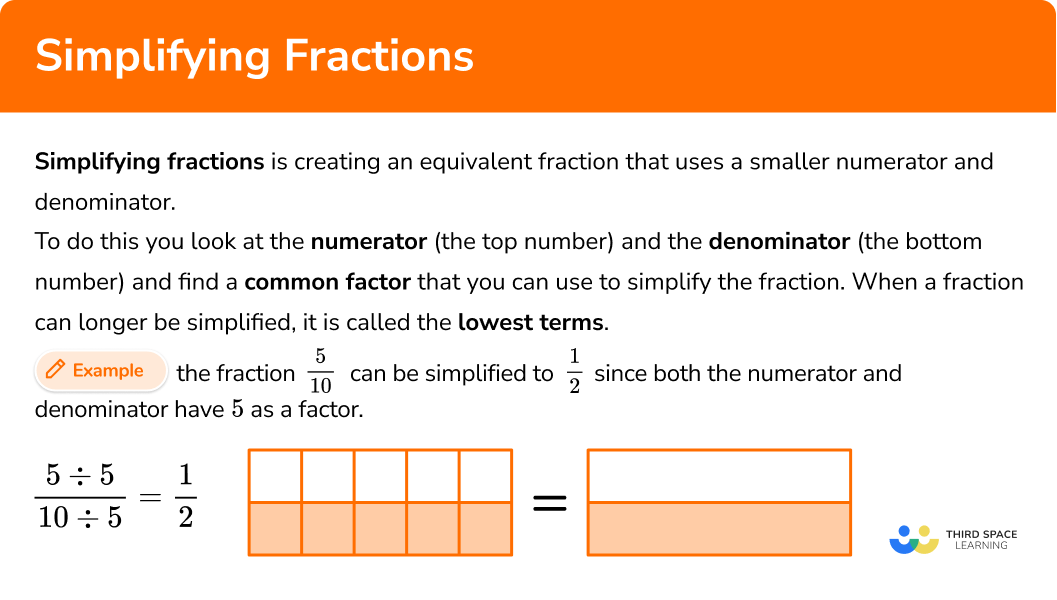

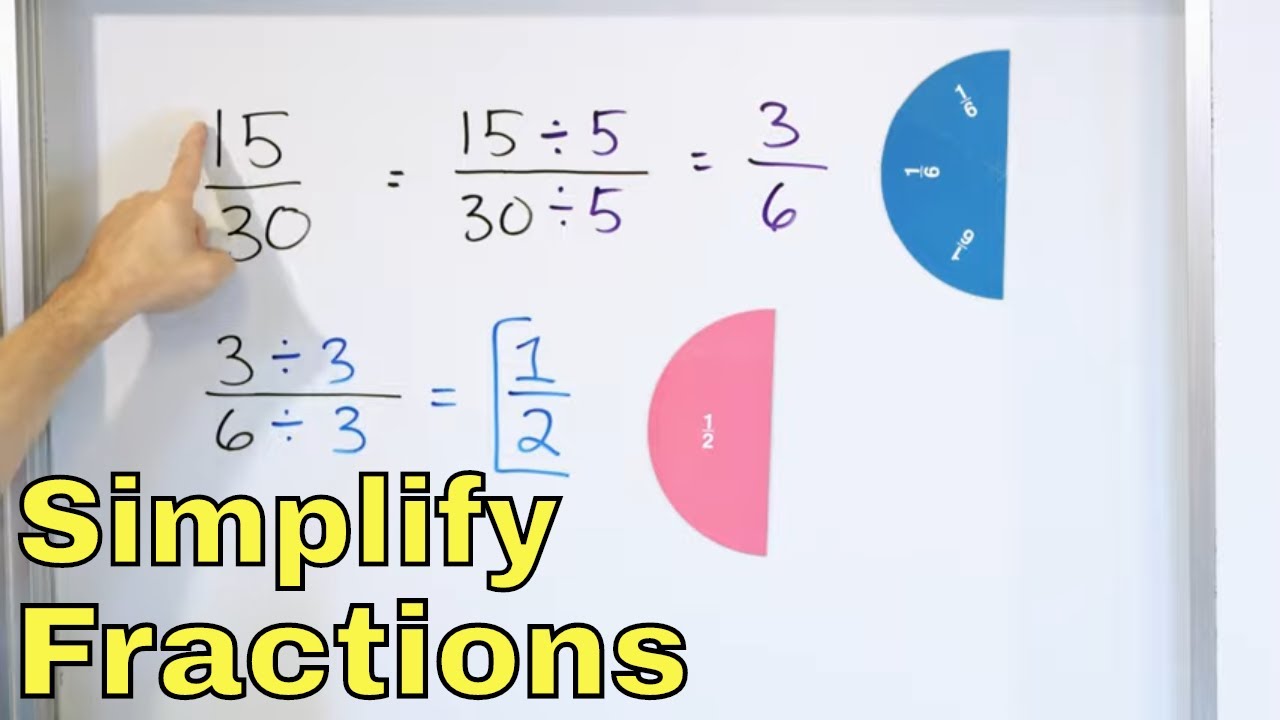

Simplified Fraction

Custom DTF Info Eh Okay Transfers

26 36 Simplified 6 Root 2

Paper Sizes And Formats The Difference Between A4 And 56 OFF

How To Simplify 9 15