Whats 7 Percent Of 5000 are a versatile service for any individual aiming to produce professional-quality records swiftly and easily. Whether you need custom-made invitations, returns to, coordinators, or business cards, these themes enable you to personalize material with ease. Simply download and install the theme, modify it to suit your requirements, and print it in the house or at a printing shop.

These templates save time and money, using an affordable option to hiring a designer. With a wide variety of styles and formats readily available, you can locate the excellent style to match your individual or organization requirements, all while maintaining a refined, expert look.

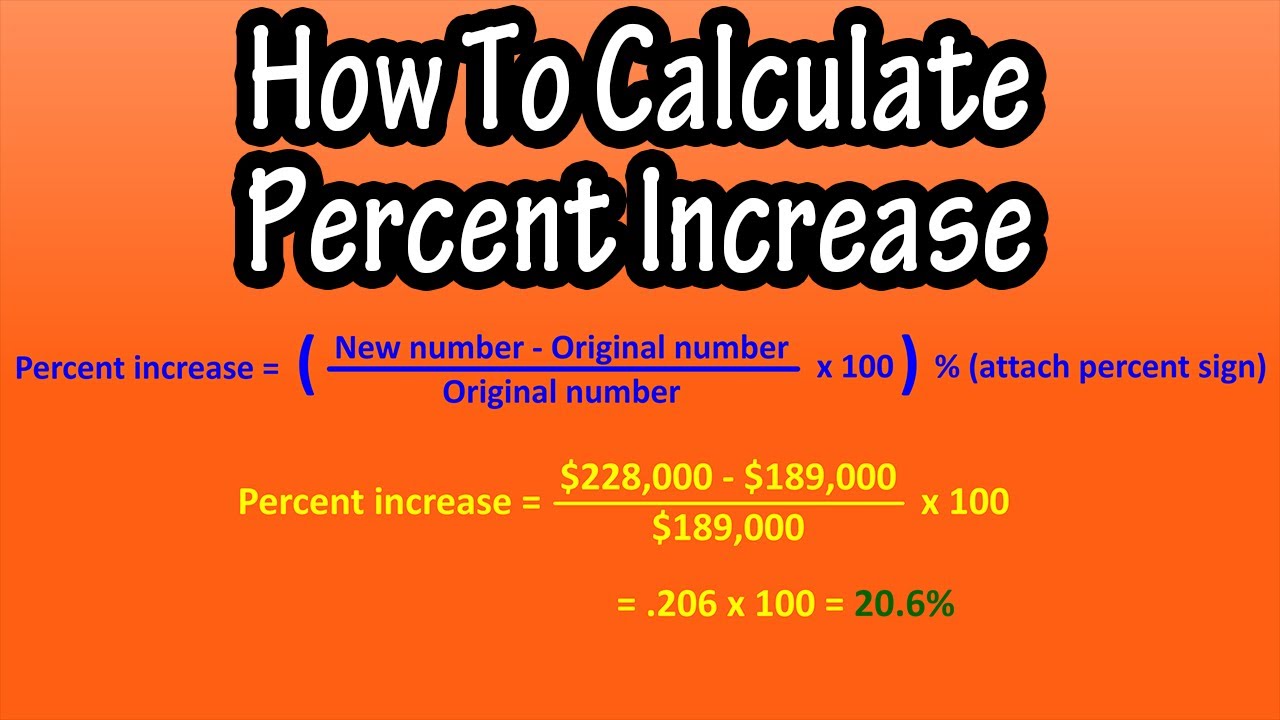

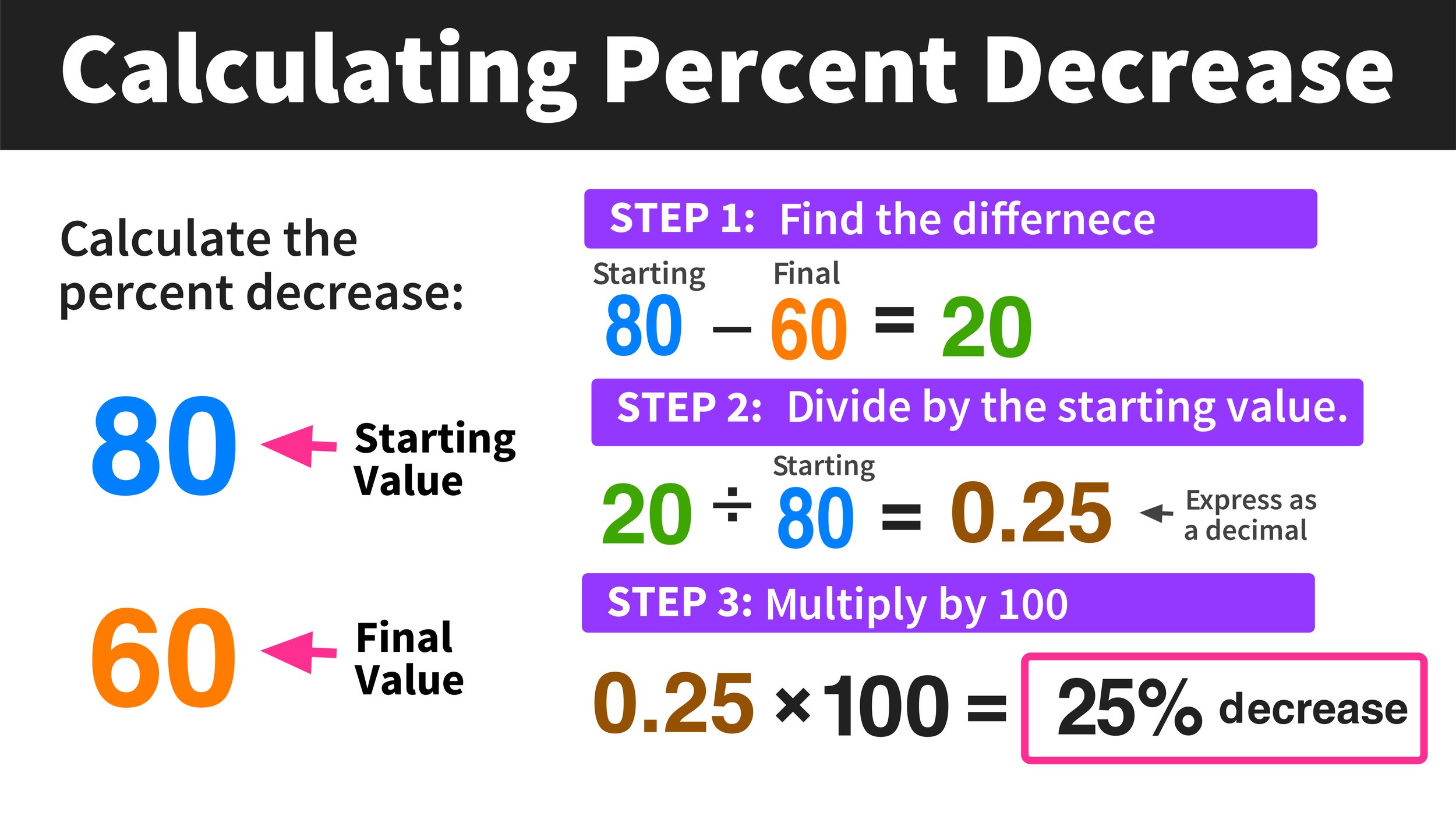

Whats 7 Percent Of 5000

Whats 7 Percent Of 5000

Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Form W 4 PDF Form 1040 ES Estimated Tax Texas State University staff can only answer general questions about Form W-4. It is recommended that employees use the IRS's Tax Withholding Estimator, (www.

Form IL W 4 Employee s and other Payee s Illinois Withholding

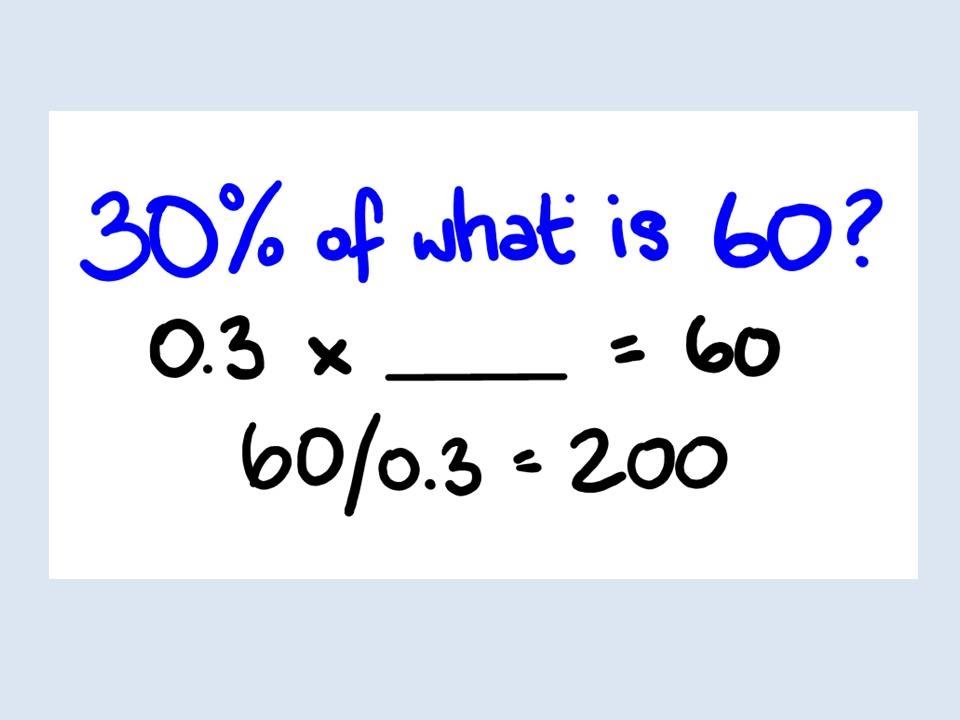

4 Is 5000 Of What Number Let s Solve The Percent Problem Step by

Whats 7 Percent Of 5000You must submit a Michigan withholding exemption certificate (form MI-W4) to your employer on or before the date that employment begins. If you fail or refuse. Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Consider completing a new Form W 4 each

Use lines 3, 4, and 5 below to have additional withholding per pay period under special agreement with your employer. 3 New York State amount ... Percent Worksheets Percentage Worksheets Percentages Math Pr What Is 20 Percent Of 5000 Solution With Free Steps

About Form W 4 Employee s Withholding Certificate

Lotha Neiipa

If you completed a 2024 Form W 4 you must complete Form W 4MN to determine your Minnesota withholding allowances What if I am exempt from Minnesota 3 Percent 5000

Give Form W 4 to your employer Your withholding is subject to review by the IRS OMB No 1545 0074 2023 Us Population 2024 Live Updates Gelya Joletta What Is 20 Percent Of 5000 1000 With 2 Solutions

Financial Data SC School Report Cards

Calculate

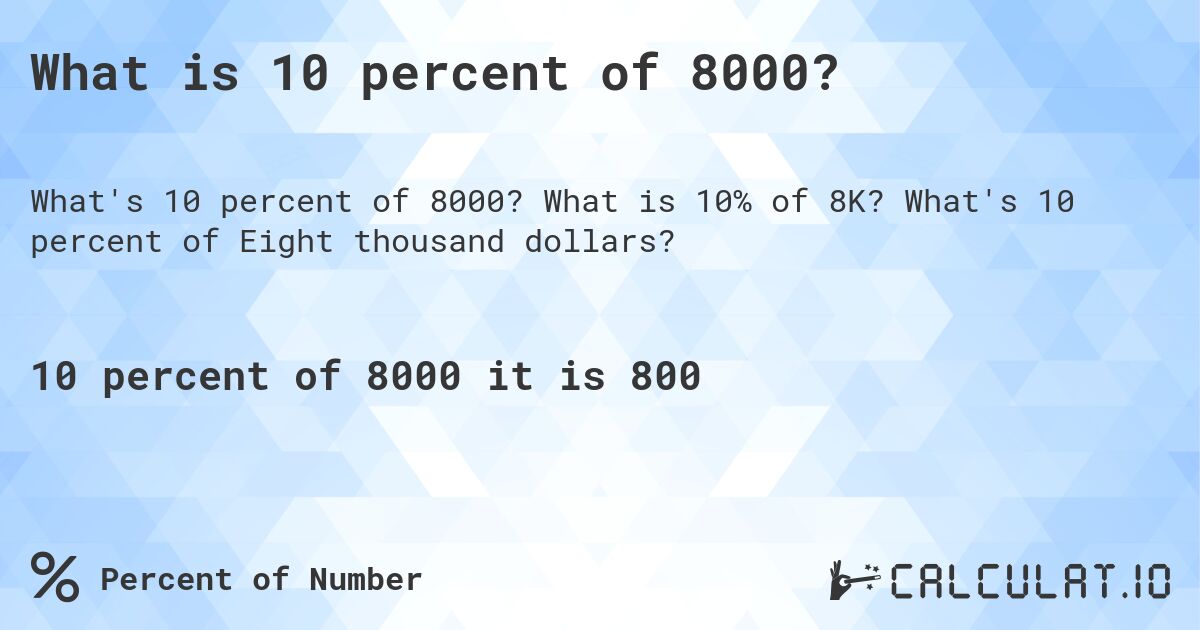

What Is 10 Percent Of 8000 Calculatio

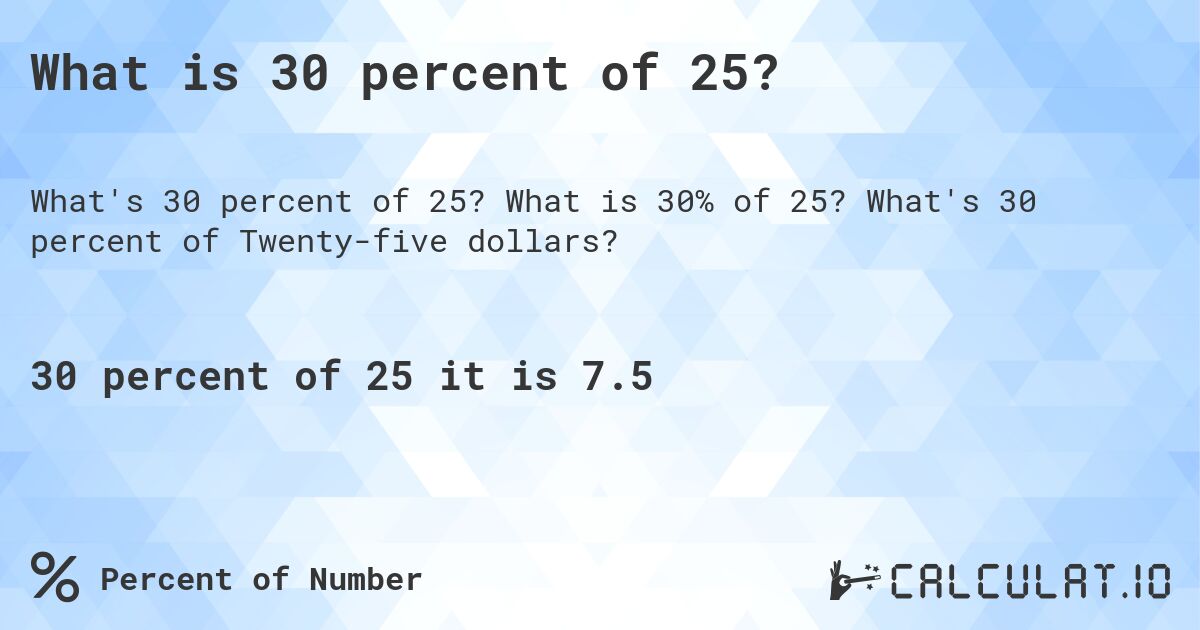

What Is 30 Percent Of 25 Calculatio

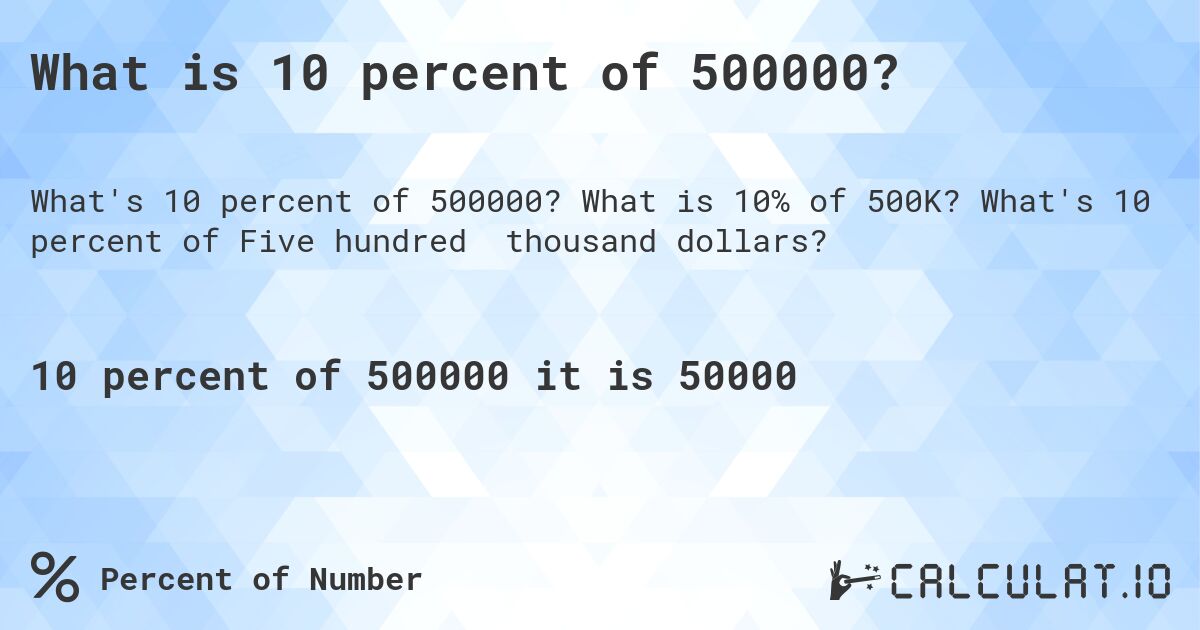

What Is 10 Percent Of 500000 Calculatio

What Is 4 Percent Of 1000 In Depth Explanation The Next Gen Business

Headlight Tint Levels

3 Percent 5000

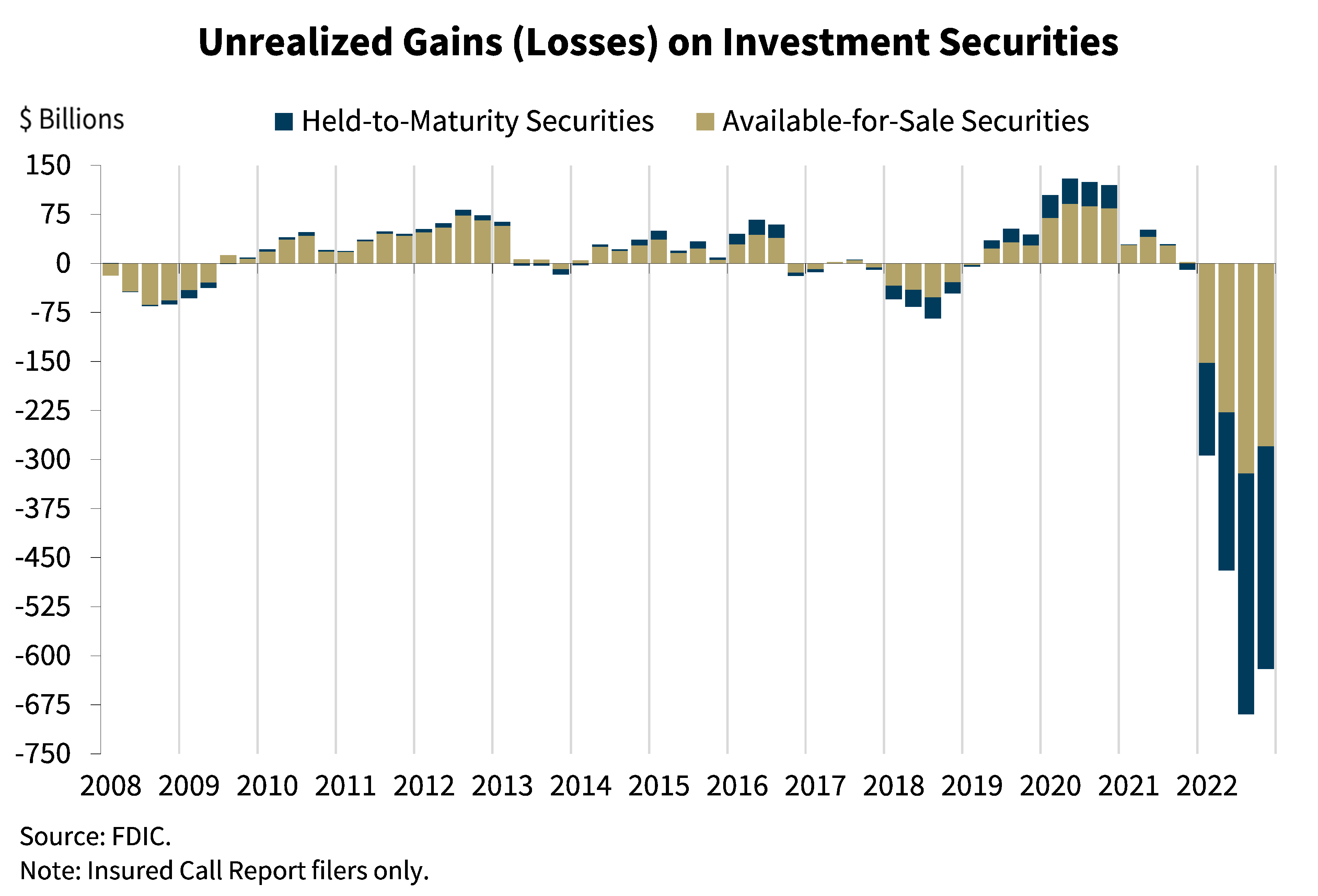

FDIC Speeches Testimony 2 28 2023 Remarks By FDIC Chairman

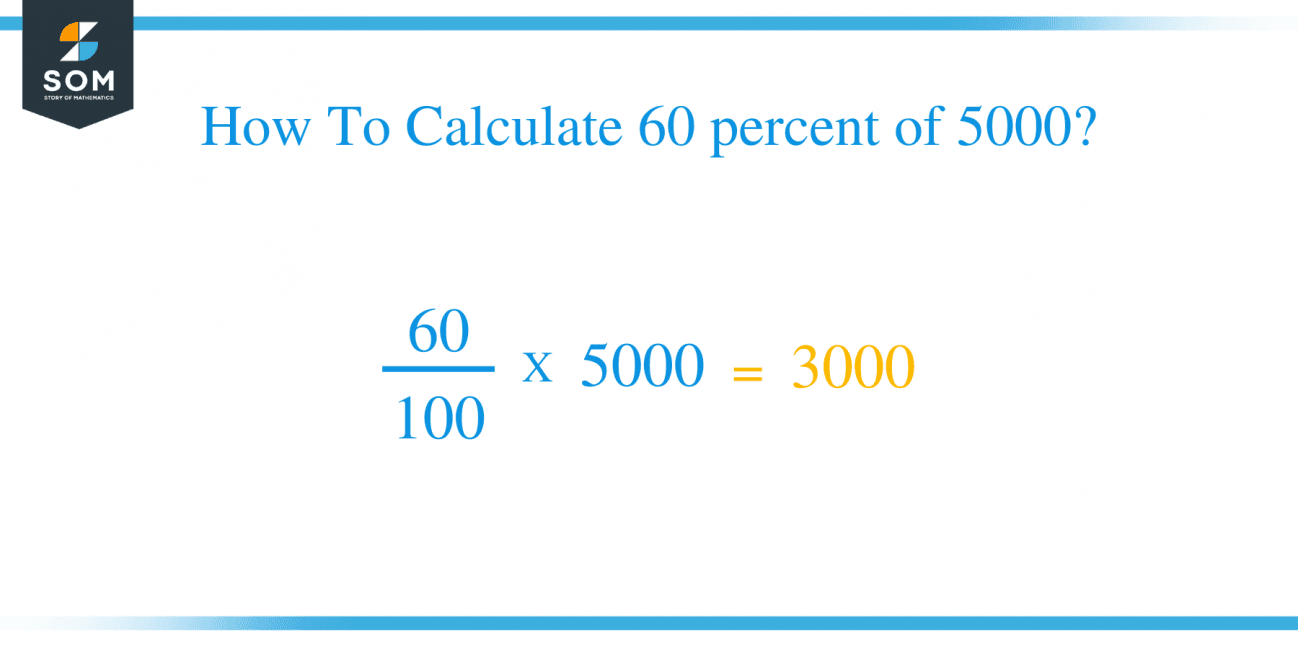

What Is 60 Percent Of 5000 Solution With Free Steps